Ex-minister urges Beijing to lead in setting global EV battery standards

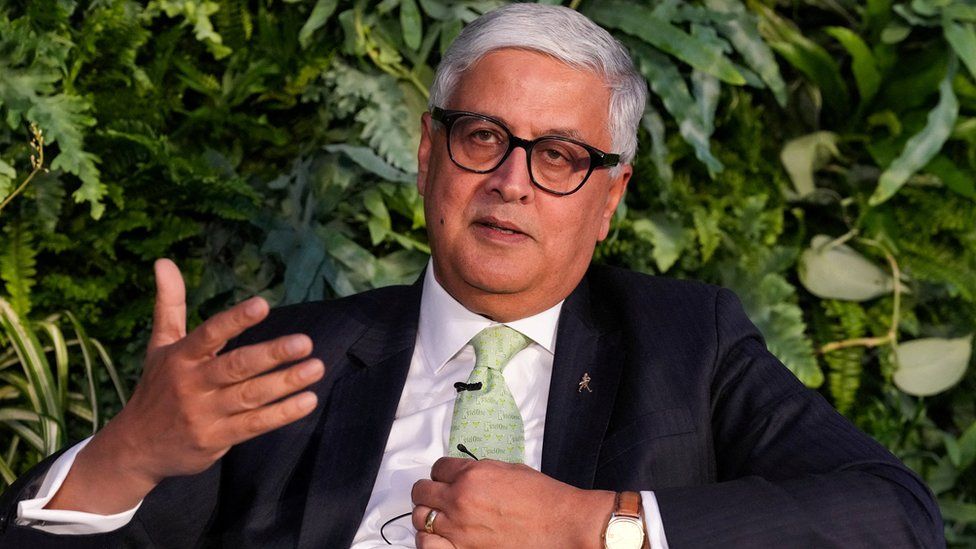

BEIJING: China should standardise requirements for electric vehicle (EV) batteries in order to keep its edge over other markets such as the US and Europe in the rapidly growing industry, the country’s former industry minister said on Friday (Jun 9). “Europe and the United States are ramping up efforts toContinue Reading