Inflation threat is worse than Larry Summers thinks

Former US Treasury secretary Larry Summers is right about an inflation threat he says is still plaguing the world economy. But his most recent warning is only half the story.

The half on which Summers is focused – the US Federal Reserve – is indeed an important part of the equation, given the vital role that inflation expectations play in investment trends and corporate pricing power where Fed chairman Jerome Powell’s policies are concerned.

“I’m glad that the Fed is not among those who are declaring victory,” Summers told Bloomberg on Friday.

“I don’t think we can yet be confident that we’re not going to see a real acceleration of inflation at some point down the road,” he said shortly after news the US economy added 187,000 jobs in July and unemployment slid to 3.5%.

Last month, average hourly earnings jumped a bigger-than-expected 0.4% from a month earlier. Such wage growth, Summers noted, is “not consistent” with the Fed’s preferred 2% inflation rate. Trouble is, after accounting for productivity dynamics, recent data point to “an underlying inflation rate in the 3.5% range – and it may not be decelerating.”

This gets at the second half of the story: what President Joe Biden is doing – and isn’t doing – to increase productivity and, in turn, US competitiveness.

For all the chatter about a “soft landing” in the US, Summers worries the combination of falling unemployment, increasing job vacancies and rising wages could send bond yields skyrocketing. This would be China’s worst nightmare as policymakers battle sliding growth and deflationary pressures.

“We have not just a tight labor market, but a tightening labor market,” Summers said. An added stress point in Summers’ view: The US population is growing by between 50,000 and 100,000 per month, slower than average job increases over the last several years.

Fed governor Michelle Bowman argues more taps of the monetary brakes might be needed to ensure price stability. “Additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2% target,” Bowman said, referring to the Federal Open Market Committee.

Bowman’s take contrasts with other top Fed officials favoring a wait-and-see stance depending on how data trends go in the weeks and months ahead. They include Raphael Bostic, president of the Fed Bank of Atlanta. The same goes for former White House economist Austan Goolsbee.

“The pace of underlying inflation is therefore more modest than the Fed expects,” says economist Robin Brooks at the Institute of International Finance.

Unforeseen factors

Either way, the last few years have challenged Milton Friedman’s edict that inflation is always and everywhere a monetary phenomenon. First came Covid-19-driven supply-chain disruptions, which created unprecedented mismatches when demand rebounded. Then came giant tidal waves of government stimulus.

Those titanically large transfer payments, coupled with a failure to incentivize productivity increases, left the US, Europe and other regions susceptible to the worst inflation in 30 years. In other words, this time solutions for elevated consumer prices must come from the supply side.

Over the last two years, the Biden White House has indeed put some productivity-enhancing reform wins on the scoreboard. The CHIPS and Science Act is aiming hundreds of billions of dollars at incentivizing innovation and strengthening supply chains. Biden is subsidizing electric-vehicle purchases and upping investments in American manufacturing.

At the same time, Biden rolled out the biggest investments in infrastructure in decades and imposed “Buy American” requirements for government procurement. These steps and others are playing a role in building up America’s economic muscle at home.

It’s only a start, though. Team Biden must pick up the pace on increasing efficiency to ensure that rising wages don’t exacerbate inflation pressures.

“If the US economy were a car, the engine has been sputtering for a while,” says economist Charles Atkins at McKinsey & Co. “In the past 15 years, productivity growth has averaged just 1.4%, even as [major] advances in digital technology put a supercomputer in every pocket. This state of affairs is well known.”

To be sure, Atkins adds, it’s not confined to the United States. Most OECD (Organization for Economic Cooperation and Development) countries have seen a drop in labor productivity growth since 2005. But “in the US economy, there’s also a problem with the transmission,” Atkins says. “The link between productivity growth and real incomes has weakened.”

In the postwar boom from 1948-70, Atkins notes, US incomes grew at 3.0% annually, while productivity growth averaged 2.8%. More recently, real incomes have grown at 0.7%, well below the 1.4% gains in productivity.

Worse, he says, “not everyone has shared equally in the relatively low gains in income, and labor participation rates have fallen from 67% in the 1990s to 63% in 2019, as millions have become discouraged about work.”

The good news is that 11 Fed interest-rate increases in 17 months and certain Biden policies helped lower inflation to a 3% rate of increase from 9%-plus a year ago. The bad news is that upward wage pressures could fuel another wave of consumer price spikes.

Lessons from Tokyo

Here, Tokyo’s experience of these last 25 years of government officials abdicating their responsibilities to the Bank of Japan warrants close study in Washington.

Granted, Japan is hardly the only major economy where the government abdicated its responsibility to a group of unelected economists. It happened in Washington in the mid-1990s, when US presidents and the Congress in effect outsourced economic management to then-Fed chairman Alan Greenspan.

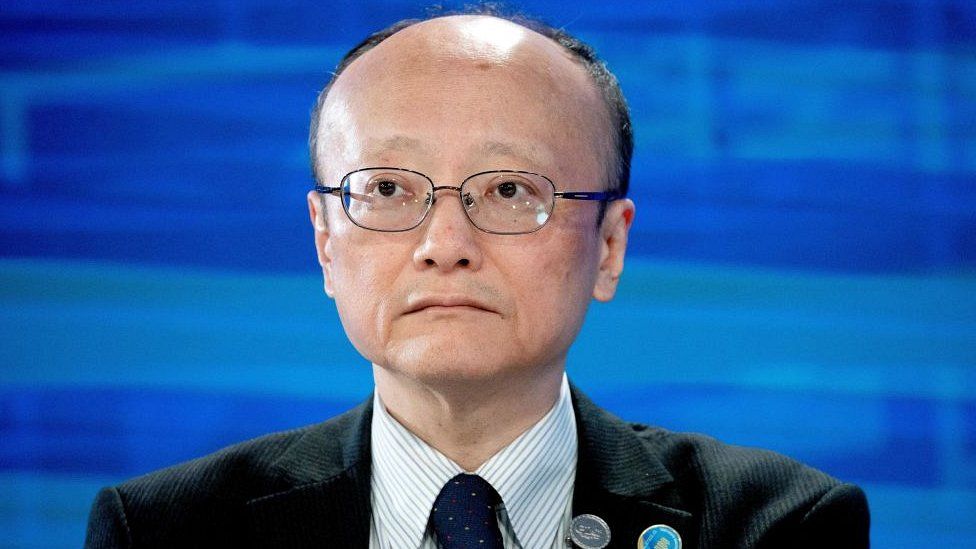

Yet Japan took that model to new heights. Since the late 1990s, a succession of governments let the BOJ take the lead. This strategy got supersized in 2013, when the prime minister at the time, the late Shinzo Abe, hired Haruhiko Kuroda to end deflation once and for all.

The lesson here concerns the “Bidenomics” reboot whereby US Democrats hope to ride plans to recalibrate growth drivers to re-election in November 2024. Yet this enterprise must be more than slogans. It mustn’t be an “Abenomics” redux.

In late 2012, Abe took office on the strength of bold pledges for a Japanese Big Bang. In his nearly eight years in power, Abe sidelined efforts to modernize labor markets, reduce bureaucracy, reinvigorate innovation, increase productivity, empower women and restore Tokyo’s place as a top financial center.

In 2013, just after Kuroda grabbed the reins at the BOJ, Abe took his reform extravaganza on the road to the floor of the New York Stock Exchange. He urged American punters to “buy my Abenomics.” And buy they did. In 2013 alone, the Nikkei Stock Average surged 57%.

Mostly, though, Abe’s Liberal Democratic Party prodded the BOJ to shift quantitative easing into even higher gears. Leaving matters to the central bank meant flooding world markets with yen. The hope was that the resulting boom in corporate profits would catalyze a virtuous cycle of consumption and wage gains.

In the US, Donald Trump’s administration was all too Abenomics-esque. Rather than do the heavy lifting to increase innovation, productivity and boost US competitiveness, all Trump’s massive $1.5 trillion tax cut in 2017 did was prove that 1980s-like trickle-down economics still does not work.

Rather than rekindle Detroit’s animal spirits, Trump reduced emissions standards, ceding the electric-vehicles advantage to Germany and China.

These and other Trump-era blunders played into Xi Jinping’s hands in Beijing. While Trump was busy making 1985 great again, Team Xi focused on its “Made in China 2025” strategy to dominate everything from EVs to semiconductors to renewable energy to artificial intelligence to biotechnology to aviation.

Biden needs to heed the lessons from both Japan and the 2017-21 Trump era. His administration should be going much bigger on investments in new innovation and productivity. Biden also needs to reduce America’s twin current-account and budget deficits, both of which are increasingly unsustainable.

This doesn’t mean Summers is wrong about US inflation being a more enduring problem than many investors think. But the other half of the price-trajectory equation deserves equal, if not more, attention.