Nvidia to test Chinese markets with slower chips

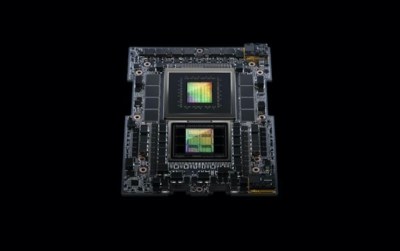

Nvidia has downgraded three graphic processing units (GPUs) for the Chinese markets after it was banned by the US government from shipping A800 and H800 chips to China last month.

The California-based chipmaker is expected on Thursday to launch at least three new artificial intelligence (AI), the H20 L20, and L2, and perhaps more, to replace the banned processors, media reported.

The performance density, or speed per die size, of the three chips is reduced to between 14.9% and 26.8% of that of the H100. Nvidia slowed their speeds with some hardware and software adjustments, according to technology experts.

The H100 is 6.68 times faster than the H20, technology analyst Dylan Petal says in an article published by SemiAnalysis on November 9. However, the H20 is 20% faster than the H100 in large language model (LLM) reasoning, he added.

LLMs are deep learning algorithms that can recognize, summarize, translate, predict and generate content using very large datasets, according to Nvidia’s website.

Some Chinese firms had given up ordering Nvidia’s AI chips as they did not know when and whether their orders would be canceled amid the United States’ tightening chip export controls.

Baidu, China’s search engine, had already ordered 1,600 Ascend 910B chips from Huawei for about 450 million yuan (US$61.83 million) in August and received about 1,000 of them, Reuters reported on November 7, citing two unnamed sources.

One of the sources said the Ascend processors are now the most sophisticated AI chips available in China, although they are not as fast as Nvidia’s.

“The H20’s overall computing power is only equivalent to 20% of that of the H100, meaning that there is room for price cut,” a Shanghai-based columnist writes in an article published on Monday. “However, using the H20 will still be more costly than using China’s AI chips, such as Huawei’s 910B.”

The writer says Nvidia will lose its competitiveness in China over the long run if it cannot sell its most cutting-edge products in the country.

New parameters

In August last year, the Biden administration ordered US chipmakers to stop exporting graphic processors that operate at interconnect bandwidths of 600 gigabytes per second or above to China and Russia. Nvidia’s A100 and H100 chips and AMD’s MI250 chip are in the category affected by this rule.

Nvidia later unveiled the A800 and H800 processors, which work at 400 and 300 gigabytes per second respectively, targeting the Chinese markets. Some analysts found that the A800 and H800 were actually reduced versions of the A100 and H100, respectively.

On October 17, the US Commerce Department’s Bureau of Industry and Security (BIS) said it will not categorize restricted chips by using “interconnect bandwidth” as a parameter. Instead, it will use “performance” and “performance density” as new parameters.

Under the new rules, a chip with a total processing performance of 4,800 or more or a performance density of 5.92 or more will be banned from being shipped to China. A800, H800, L40, L40S and RTX 4090 chips are in the category of this rule.

China’s orders involving US$5 billion worth of Nvidia chips have reportedly been canceled.

As of now, the H20, L20 and L2 can still be exported to China as they fulfill the performance and performance-density requirements. But they are becoming unattractive to Chinese firms.

A Beijing-based writer surnamed Huang in an article describes the H20, L20 and L2 as the “castrated versions” of the more advanced H100, AD102 and AD104 chips, respectively.

He says it’s worth pointing out that the H20 is even slower than the entry-level A30 chip, which was launched in April 2021.

The H100 is designed for graphics-intensive workloads while the A100 is designed for high-performance computing (HPC) and AI workloads. The H100 is two times faster than the A100, which is also two times faster than the A30.

Jiang Tao, a senior vice president of iFLYTEK, a Hefei-based AI solution provider, said on October 20 that the company uses Huawei’s Ascend 910B chips for computing. Without providing data, he claimed that the chip has reached the benchmark of Nvidia A100.

iFLYTEK has been unable to purchase American items since it was added to the entity list of the US in 2019. It was accused of supplying its surveillance equipment to Xinjiang camps that detain Uyghurs and other ethnic minority people.

Read: End to decoupling tops China’s pre-summit demands

Follow Jeff Pao on Twitter at @jeffpao3