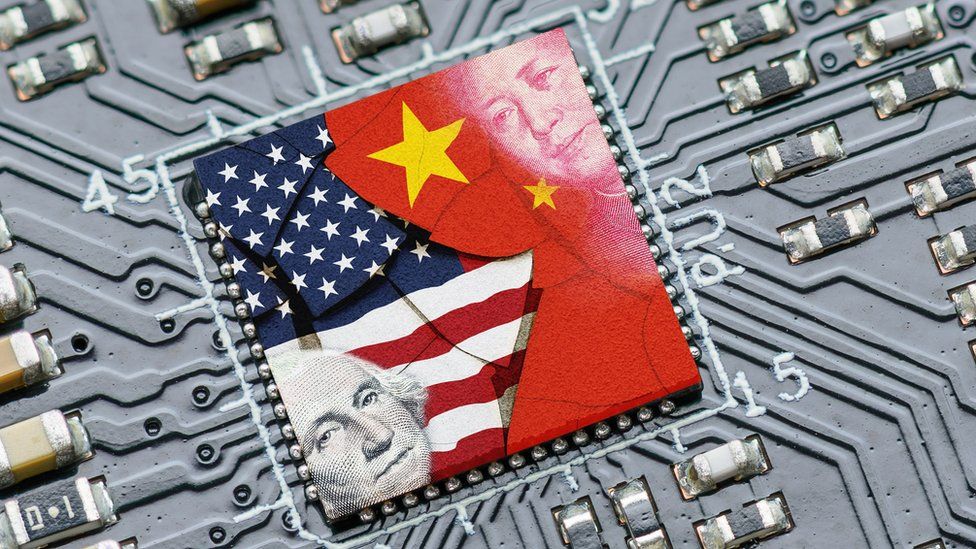

Asian stocks fall as China’s property pains weigh on sentiment

HONG KONG: Asian stocks fell on Thursday (Nov 16) pausing the heavy gains made this week, as fresh Chinese data showed prolonged weakness in the property sector and dented some of the recent optimism about a recovery in the world’s second-largest economy. While data released this week showed China’s industrialContinue Reading