Why it’s China’s turn now – Asia Times

In the next half of the 20th centuries, macrohistorians like Paul Kennedy, Francis Fukuyama, and Alvin Toffler created’grand stories’ to forecast changes in the coming decades. They covered various aspects of society including philosophy, technologies, religion and culture.

These models were used by macrohistorians to forecast significant historic changes in geopolitics, strength relations, and economics. Interestingly, none of them predicted that China may come as a opponent to US international preeminence.

In the late 20th centuries, fantastic stories fell out of favor. Intellectuals claimed that fantastic or meta-theories neglected the differences between civilizations. Microhistories tended to elicit a Eurocentric view of the world by never acknowledging diverse cultural ideas.

When viewed in a historic context, China’s rise as a global power is less unexpected. For much of recorded history, including the colonial time, China was the world’s largest business, rivaled only by India. The US did not take the top spot until the close of the 19th centuries.

However, some researchers may have predicted the pace at which China’s modernization was quick. The West took two decades to modernize, China did it in less than 50 years. China acted as the world’s stock and a tarantula in the website of the global supply chain as a result. China had come to a halt if it were to be shut down, and the rest of the world do.

China has recently changed from a low-cost consumer goods manufacturer to a cutting-edge producer of electronics and natural tech. Robots and AI have taken the place of cheap labour. A new stock for Xiaomi, formerly a smartphone manufacturer, produces a new electric vehicles every 76 hours, or 40 per minute, without being touched by human hands.

In his international bestseller When China Rules the World: The End of the Western World and the Birth of a New Global Order, American artist Martin Jacques chronicled China’s development. The second significant change to the world’s political and cultural environment in 500 years, according to Jacques, will result from China’s future economic strength.

Jacques argued that China ’s arrival as a significant economic, social, and cultural energy is a traditional inevitability, requiring a adjustment in the American view of the world. He writes:

“There has been an notion by the American popular that there is only one way of being present, especially by adopting Western-style institutions, values, customs and beliefs, such as the rule of law, the free marketplace and political norms.

This, one might add, is a view that is normally held by people and cultures who view themselves as more developed and ‘civilized ’ than others: that those who are lower down on the evolutionary scale must become more like those who are higher up in order to advance. ”

Jaques brought up Fukuyama, who predicted that a new idealism that may embodie the American concepts of the free business and democracy would be the foundation of the post-Cold War world.

Fukuyama, in his 1992 report “The End of History”, argued that Western liberal democracy had won and that all countries in the world, including China, did eventually accept American liberal democracy.

Fukuyama did not anticipate the burgeoning crisis in Western democracies, the West’s partial deindustrialization, the rise in wealth concentrations, or Donald Trump’s election as president of “America First ” in his 1992 writing.

Trump sparked a trade war with China that his successor, Joe Biden, has gotten worse. The cost of the expensive products from China had been a boon for American consumers, but they also came with a price: the deindustrialization of major cities in the country and the loss of millions of jobs.

The trading conflict between the West and China is a repeat of the trading conflict with Japan on a larger scale. Japan decimated the Western automotive and consumer electronics industries in the 1980s. The West realized that Japan had eaten its lunch when it was too late. The Chinese are now ready to eat dinner.

Workers and Merchants

In 2001, US president Bill Clinton gave the green light for China ’s membership of the World Trade Organization ( WTO ), the American-led body that regulates global trade.

China agreed to lower tariffs on non-agricultural goods and take several steps to expand China’s financial sector, including those involving the life insurance and securities sectors.

According to the US government, China would become more politically liberal if its economy were liberalized. Fukuyama’s “End of History ” appeared to give credence to this theory. As it turned out, China liberalized economically but not politically. The Chinese government wished to maintain a tarn between government and business.

The American futurist Larry Taub, author of “The Spiritual Imperative”, framed the conflict between China and the West in terms of Worker and Merchant, archetypes he adapted from Indian philosophy. Worker and Merchant, together with Scholar and Protector, are four generic categories that form the basis of societies.

The Indian “social-psychological” archetypes emerged after humans transitioned from nomadic, hunter-gatherer life to form communities and cities. Each archetype covers a vital role in a community – teaching, producing, trading, and protecting.

Different psychological profiles and worldviews are present in each of the four archetypes. Workers, in Taub’s model all those who work for a wage or salary, value safety, stability, and solidarity. They are followers, not leaders. Merchants value opportunity, innovation, and freedom. The main concern is generating wealth.

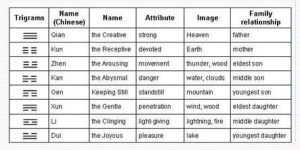

The four archetypes Taub adapted from Indian philosophy

In Indian philosophy, the four archetypes are in a cyclical struggle, one trying to overcome the other. The Indians used astronomical timescales that spanned millions of years, but Taub contends that the four archetypes can account for both the present and the future.

The current conflict between the West and China is a battle between the Worker and Merchant worldview, according to Taub’s model. China ’s psychological profile most closely resembles the Worker archetype, and the West, especially the US, most closely correlates with the Merchant archetype.

Neoliberalism

According to Taub, the Industrial Revolution’s conflict between the Worker and the Merchant began in the 19th century. The Merchants were demanding better working conditions from the workers. Socialism and communism merged to bring together workers to fight for their rights.

By the 1960s, the Workers had made massive gains, among them a five-day workweek and a social safety net, including healthcare and pensions. Employee unions had developed into powerful structures that could influence government decisions.

A backlash came in the 1970s, with the emergence of neo-liberalism. This reactionary hybrid ideology advocated market-oriented reform such as deregulating capital markets, and privatization of state-owned industries. It was an anachronistic plea for a partial return to the free-for-all environment that persisted in the 19th century.

With support from Merchants, the neoliberal agenda gradually spread into politics. In the 1980s, the neo-conservatives Ronald Reagan and Margaret Thatcher embraced the neoliberal agenda, followed in the 1990s by the “leftist ” Bill Clinton and Tony Blair. They marketed neoliberalism as” The Third Way” to their ignorant supporters. ”

Soon it became clear that neoliberalism did n’t benefit the US as a nation. Millions of Americans left the middle class, and wealth concentration reached levels of the 19th century. In 1970, the US was the world’s largest creditor nation. It is currently the most debated country, while China has grown to be its most popular creditor.

The legacy of Neoliberalism

The US and China’s decision to reverse their roles suggests that traditional Western ideologies are no longer a useful tool for understanding global changes.

ideologies were created in response to social and economic changes. Communism ( like fascism ) was a Worker response to the imperialist Merchant-dominated colonial era. It resembled a liberation theology in terms of secularism.

Ironically, orthodox communism became untenable because it sidelined the Merchants. Neoliberalism fails because it restricts the worker. All of the four archetypes are necessary for a fully functioning society, as the Indian sages pointed out centuries earlier.

Reciprocity

China reintegrated the Merchants into society with the reforms led by Deng Xiaoping in the 1970s, without allowing them to break into the political system. When celebrated billionaire Jack Ma, founder of Alibaba, became too big for his boots, the government put him in his place.

China’s leaders continue to liaise only superficially to communist ideology, but the nation has entered a post-ideological era. Pragmatism has returned as a guiding principle. As Deng famously remarked, it does n’t matter if a cat is black or white, as long as it catches the mouse.

China is currently looking at its own rich cultural and social history to find a way to advance beyond political ideology.

That does not imply that China has ever ceased to be Chinese. China remained a Confucian nation throughout the revolutionary era of communism and even through the Cultural Revolution’s ideology-driven vandalism.

Confucianism is foundational to Chinese consciousness. It is what distinguishes India from the nation. Confucianism, in turn, was based on the notion of Tao and inspired the development of a key feature of Chinese society: the notion of reciprocity.

Confucius based his social construct on the I Ching, the “bible ” of the yin-yang system. The I Ching is based on the Eight Trigrams, compounded yin-yang symbols denoting eight natural phenomena. The interaction of the Eight Trigrams in Chinese cosmology affected the natural world.

Confucius “appropriated ” the Eight Trigrams for his social construct.

Consucius enlarged the qualities of the Eight Trigrams by including the eight members of a nuclear family. This linked China ’s social structure to the yin-yang principle of nature. The children are a mix of yin and yang, the father is yang, and the mother is yin.

The yin-yang system has a hierarchical dimension, but in the social context, this hierarchy is situational. A man is yang to his wife, but yin to his boss, even if the boss is female. A woman is yin to her husband but yang to her children, both boys and girls. In a social context, let alone in an international context, determining what is yin and yang in any given situation is an art, not a science.

The Yin-Yang system operates on the principle of reciprocity. It implies that everyone has a shared vision and values. Unlike altruism, which is based on unequal relationships, reciprocity is based on mutual dependencies.

Reciprocity is a core component of Chinese society’s social fabric and interpersonal relationships, as well as social and family life. It maintains harmony within families, communities, and business life and fosters a sense of solidarity, cooperation, and teamwork.

China ’s traditional, primarily collectivist culture partly explains its rapid modernization. Chinese civil engineers pioneered industrial methods like prefabrication, standardization, and modularization. The city of Daxing, a metropolis of 84 square kilometers built in the 6th century, was completed in one year.

A new story

China learned from the West to become the world’s top industrial nation. Like Japan before, it avoided and took what it thought was valuable from the West in opposition to its values and worldview.

In barely one generation, China became an industrial superpower. It dominates 75 % of the technologies currently considered necessary for the Fourth Industrial Revolution globally.

The US has not been sure-footed in its response to the Chinese challenge. Given the influence of neoliberalism and the polarization in US politics, it would be necessary to significantly alter the government’s priorities in order to outperform China economically.

The dilemma facing the West is brought up by cultural communication expert Bill Kelly, author of” A New World Arising.” “Neoliberalism, ” according to Kelly, “led to community breakdown, the alienation of the individual, and the loss of an overriding aspiration that a majority can embrace. In terms of socially mobilizing its citizens to support government leadership, this puts the West at a significant disadvantage. ”

Neoliberalism is a remnant of colonial times and the ugly manifestation of the Merchants ‘ mindset. It tries to perpetuate Western military and financial hegemony at all costs because it is aware it ca n’t compete with China’s industrial giants. It wages foreign wars under the pretext of defending democracy and freedom in its own country, a ruse intended to divert attention from the workers.

The neoliberals should have heeded the advice of historian Paul Kennedy rather than copying Francis Fukuyama. Kennedy explained that the relative decline of great powers frequently comes from overstretching in his book” The Rise and Fall of the Great Powers.” Declining powers go beyond what their economic resources allow them to sustain with their military engagements.

The US is overstretched, has a small industrial base, and has one of its biggest trading partners, which is also one of its biggest creditors. It also has a very high level of debt. When something does, the US and its Western allies will need a new story that is contemporary with the twenty-first century.