What would a US-China trade war do to the world economy?

BBC Verify

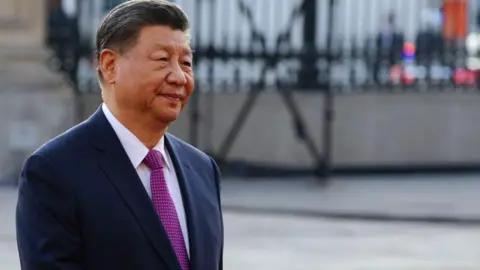

Getty Images

Getty ImagesAfter President Donald Trump threatened to impose levies of more than 100 % on Chinese goods starting on April 9th, a full-fledged trade war with China and the US is in view.

China has already raised its personal trade barriers in response to what it perceives as US force, and has said it did “fight to the close” rather than” adhere to it.”

What does the global economy’s growing business fight mean?

How many business are they engaged in?

Last year, the trade between the two economic powers increased to about$ 585 billion ( £429 billion ).

Although the US imported far more from China ($ 440 billion ) than China imported ($ 145 billion ) ).

That resulted in a trade imbalance between the US and China of$ 295 billion in 2024, which is the difference between what it imports and exports. That’s a significant trade deficit, which accounts for about 1 % of the US market.

But it’s less than the $1tn figure that Trump has repeatedly claimed this week.

In his first year in office, Trump now imposed considerable tariffs on China. His son Joe Biden continued to add to and keep those taxes in position.

Collectively, these trade barriers helped lower the amount of products the US imported from China from a 21 % share of the country’s total goods in 2016 to 13 % last year.

So over the past ten years, the US has become less dependent on China for business.

However, experts claim that some Chinese products that are exported to the US have been routed through South-east Asian nations.

For example, the Trump administration imposed 30% tariffs on Chinese imported solar panels in 2018.

But the US Commerce Department presented evidence in 2023 that Chinese solar panel manufacturers had shifted their assembly operations to states such as Malaysia, Thailand, Cambodia and Vietnam and then sent the finished products to the US from those countries, effectively evading the tariffs.

Due to the new “reciprocal” taxes that will be imposed on those nations, the US price of a variety of products that will eventually come from China will rise.

What do the US and China transfer from one another?

Beans, whose main imports from the US to China were beans in 2024, made up of 440 million pigs, were the most popular product class there.

Additionally, the US delivered medicine and gas to China.

From China to the US, there were significant amounts of devices, computers, and games going the other way. Additionally, a sizable number of batteries that are essential for electric cars was exported.

Phones make up 9 % of the total goods from the US, making up the largest category of imports from China. For Apple, a US-based foreign, a large proportion of these phones are produced in China.

One of the main factors in the decline in the market value of Apple in recent weeks has been the US tariffs on China, with its share price falling by 20 % over the past month.

Due to the 20 % tax the Trump presidency has already imposed on Beijing, all these imported goods to the US from China were already going to be significantly more expensive for Americans.

The impact may be five times worse if the price were to increase to 100 % for all items.

Additionally, US imports into China will increase in price as a result of China’s hostile tariffs, which will eventually harm Foreign consumers in a similar way.

Beyond levies, these two countries may also try to aggravate one another through trade.

China plays a significant role in refining a variety of essential metal, including copper and lithium to exceptional rocks.

Beijing might put obstacles in the way of these metal reaching the US.

This is something it has already done in the case of two materials called germanium and gallium, which are used by the military in thermal imaging and radar.

In terms of US policy, it might try to enact a tighter legal framework that Joe Biden initiated by preventing China from importing the kind of advanced microchips it doesn’t still develop itself.

Peter Navarro, Donald Trump’s business consultant, suggested this week that the US had put pressure on other nations like Cambodia, Mexico, and Vietnam to stop trading with China if they want to keep exporting to the US.

How does this impact another nations?

According to the International Monetary Fund, the US and China jointly account for approximately 43 % of the global market this season.

If they decided to start a trade war that would slow their growth, or even cause them to go into crisis, other nations ‘ economy would suffer as a result of slower global growth.

World investment would probably suffer as well.

There are additional possible effects.

China produces far more than its domestic people does, making it the largest country in the world.

It already has a surplus of almost$ 1 billion worth of goods, which indicates that it exports more products than it imports.

And it frequently produces those goods for less than the actual cost of production as a result of local subsidies and state financial support, such as low loans, for the wealthy.

Steel is a good illustration of this.

Foreign companies may try to “dump” these products abroad if they were unwilling to enter the US.

That may be advantageous for some consumers, but it might even hurt manufacturers in nations that are putting jobs and wages at risk.

The hall party UK Steel has been informing about the danger of too much steel being redirected to the UK marketplace.

The global effects of a comprehensive China-US trade war may be felt, and the majority of economists believe the impact would be very damaging.

” Tech is changing the way people consume it. Cinch is leading the movement toward round software due to rising costs, funding gaps, and growing regulatory strain on e-waste. Beyond a system, we’re tying the dots between Asia’s facilities for a green tech economy, according to Mahir Hamid, CEO and co-founder of Cinch.

” Tech is changing the way people consume it. Cinch is leading the movement toward round software due to rising costs, funding gaps, and growing regulatory strain on e-waste. Beyond a system, we’re tying the dots between Asia’s facilities for a green tech economy, according to Mahir Hamid, CEO and co-founder of Cinch.