Regulatory squeeze to kill a third of Chinaâs hedge funds

One-third of all Chinese hedge funds likely face liquidation next month when new minimum net asset values come into force. The measures mark Beijing’s latest regulatory squeeze on a key, fast-growing industry.

Hedge funds must maintain a net asset value of at least 10 million yuan (US$1.2 million) for 60 consecutive trading days or face liquidation, according to the Regulations on the Supervision and Administration of Private Equity Investment Funds.

The new minimum capital requirements were unveiled by the China Securities Regulatory Commission (CSRC) and Ministry of Justice on July 9 and will take effect on September 1. The new regulations will cap leverage levels at 200% and the size of investments hedge funds can make in single securities at 25% of total assets under management.

Beijing seeks to weed out the smaller and often less professional players responsible for extreme volatility in a sector that has grown sevenfold over the last decade.

Around 93,000 hedge funds valued at 5.6 trillion yuan were in operation across China at the end of 2022, according to the Asset Management Association of China (AMAC), a self-regulatory fund management industry group.

Shanghai Suntime Information Technology Co, a financial data provider, says that nearly 35,000 products, or 37% of the total hedge fund industry, have less than 5 million yuan of assets under management.

The new regulations will also require hedge fund managers to maintain at least 10 million yuan of paid-in capital. Analysts estimate that thousands of hedge funds will have to be shut down within this year, resulting in a “historic” shake-up of the massive industry.

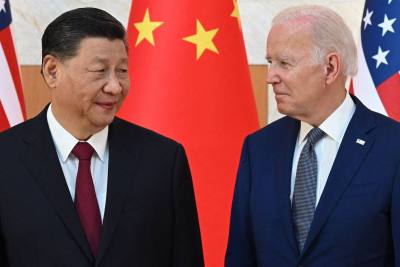

New Premier Li Qiang toughened industry curbs in July by approving a broad regulation on private funds that raised penalties for violations. The first State Council-level legislation on the industry will allow for criminal investigations into alleged irregularities including insider trading and can invalidate contracts that breach rules, news reports said.

On December 30 last year, the AMAC issued a consultation draft of the Measures for Registration and Filing of Private Investment Funds requiring hedge fund firms to have at least 10 million yuan of assets. In January this year, a total of 1,564 private equity firms were de-registered. On February 24, the AMAC officially launched the measures, which took effect on May 1.

As of mid-July, 1,959 private equity firms had been de-registered this year, compared with the dissolution of 2,210 firms for the whole year of 2022. There are about 22,000 private equity firms in China, which are managing more than 15,300 funds worth a total of 21 trillion yuan.

Zhou Chenghan, a solicitor at Beijing Zhongwen Lawyer Office, said the measures that took effect on May 1 are “self-regulatory” rules for the fund management sector while those that will take effect on September 1 are CSRC regulations.

The China Securities Journal said the new rules will act to remove “fake” private equity firms and shell companies from Chinese markets.

Big to get bigger

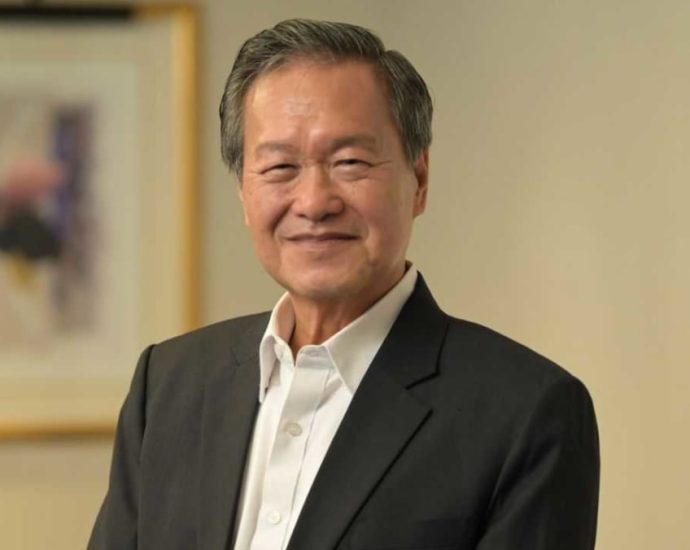

Zhou Yiqin, president of GuanShao Information Consulting Center, a financial regulations specialist, told Bloomberg that small hedge funds in China are facing growing compliance pressures while a large number of them will exit the markets.

The same Bloomberg report said smaller funds often outperform the larger ones as they deploy high levels of leverage and experience extreme volatility. It said larger firms such as Perseverance Asset Management and Bridgewater Associates LP are set to benefit from the new regulations, which will drive out smaller players from the market.

China’s hedge fund sector is much more concentrated than the US industry. The AMAC said in a report in 2021 that the largest 500 hedge funds managed about 57% of industry assets in the US while the top 500 firms held about 84% of assets in China.

Jiao Jinhong, chief lawyer of the CSRC, said the regulator had spent a decade working to improve its rules, which aim to standardize private equity investment activities and improve supervision.

He said the new rules will cover different activities from fund-raising to liquidations, support the healthy development of venture capital funds and effectively consolidate the legal foundation of private equity investment funds.

“The new rules will definitely benefit private equity investment funds and the overall asset management industry’s high-quality development,” Jiao said.

He added that the CSRC already reformed the stock listing system earlier this year and that it is high time to improve Chinese capital markets from the investor-side, which refers to hedge funds and their managers.

“Asset management products are one of the main sources of medium and long-term funds in the capital market,” he said. “Strengthening the market supervision and guiding fund managers to earnestly fulfill their obligations are the only way to achieve high-quality development of the asset management industry.”

Read: Country Garden’s cash crunch worries homebuyers

Follow Jeff Pao on Twitter at @jeffpao3