Ukraine harnesses spirit of Tuskegee Airmen in quest for victory

The spirit of the Tuskegee Airmen, the black American World War II fighter pilots who overcame racial discrimination to become the most lauded and decorated combat pilots in US aviation, has become more than inspirational for Ukraine’s own underdog battle against its Russian invaders.

Tuskegee Airmen of the US Army’s 332nd Fighter Group, whose heroism led Star Wars director George Lucas to produce the Hollywood film Red Tails, is connecting critical allies of Ukraine, from the incoming chairman of the Joint Chiefs of Staff, Air Force General Charles Q (CQ) Brown, to US President Joe Biden, Italian Prime Minister Giorgia Meloni, the American owner of AC Roma soccer club, Dan Friedkin, and South Korean President Yoon Suk Yeol.

The key man who will determine whether Ukraine will achieve an unambiguous victory over Russia is fighter pilot General CQ Brown, whose military mentor was Tuskegee Airmen commander and the first black American air-force general, Benjamin O Davis Jr, while Brown is the first black to head a US military service.

As the president’s military adviser, it will be up to Brown to cancel the “just not in time” policy of his predecessor, General Mark A Milley. Milley advised Biden to delay delivery of F-16s fighter jets and long-range ATACMS ballistic missiles, weapons Ukraine needs to put an end to the fratricidal Russo-Ukraine war.

CQ Brown, while head of the Aviano Air Forces in the Veneto region of Italy, personally rediscovered the Ramitelli Airfield at Campomarino in the economically depressed region of Molise, where the Tuskegee Airmen fighter escorts distinguished themselves with the lowest losses of US bombers during World War II, a feat recognized by 96 Distinguished Flying Crosses.

The historic importance of the Ramitelli Airfield was marked on July 16 by at a ceremony dedicating a monument and mural of a Tuskegee Airman, with the participation of Tuskegee descendants and the newly elected governor of Molise, Francesco Roberti.

Dan Friedkin, AC Roma owner, is also passionate about the Tuskegee Airmen, owning three functionining P-51 Mustangs and two original Tuskegee T6-G trainer planes, Italian aviation lawyer Claudio Tovaglieri said.

Just as Ukrainian President Volodymyr Zelensky makes no apologies for pushing reluctant Western allies for war materiel like Challenger/Leopold tanks and Shadow/Scalp cruise missiles, the private sector led by Boosteroid chief executive offcer and founder Ivan Shvaichenko, Kharkiv Regional Council Chairwoman Tetiana Yehorova-Lutsenko and Kharkiv Mayor Ihor Terekhov are coming to the United States to meet American CEOs.

Speaking to Capitol Intelligence during an intelligence and national-security summit this year, FBI Deputy Director Paul Abbate said he witnessed “unprecedented support” by US companies to Ukraine just prior to the Russian invasion on February 24, 2022, and specifically called out Microsoft for its work helping Ukraine defend itself.

The public-private initiative of Shvaichenko, Yehorova-Lutsenko and Mayor Terekov is part of Ukraine’s efforts to decentralize power to regional elected officials ahead of membership in the European Union.

Yehorova-Lutsenko is set to be elected as the next president of the Ukrainian Association of District and Regional Councils after forging partnership agreements with the prosperous Italian region of Emilia-Romagna and the US state of Ohio. The Kharkiv already has a sister-city partnership with Cincinnati, Ohio.

Shvaichenko, whose company is now the third-largest cloud gaming company in the world after Nvidia’s GEForce and Sony’s PlayStation Cloud Gaming, and strategic partner of Microsoft, is now headed to the United States to open an US headquarters in Gary, Indiana, as part of the company’s goal to list the $500 million to $1 trillion Kiev-based global company on Nasdaq.

Not only does Boosteroid want to be a force to reckoned with in the world’s largest economy, but Shvaichenko plans to use his US footprint to convince US CEOs such as Oracle founder Larry Ellison, Microsoft president Brad Smith, Advanced Micro Systems CEO Lina Su, Vista Equity Partners founder Robert F Smith and DRW Trading founder and CEO Don Wilson to look at Ukraine, especially his native city of Kharkiv, as the world’s new driver of economic growth and innovation.

For example, Boosteroid is launching a gaming/IT infrastructure developer academy/boot camp in Kharkiv and plans to launch the same initiative in Gary, thus creating centers of excellence between Ukraine’s second city and the American heartland.

US Commerce Secretary Gina Raimondo, who is leading the effort to create learning academies to train a new generation of IT developers and technicians lessen US dependence on Asian chip manufacturers and software developers, said she is very excited about Boosteroid’s plans for Gary, one of the most economically depressed and segregated cities in the United States.

Boosteroid’s plans for Gary follow the decision of South Korea’s Samkee Automotive to build a $200 million, 170-jobs auto part factory in Tuskegee, Alabama, to supply Hyundai and Kia manufacturing plants in nearby Montgomery.

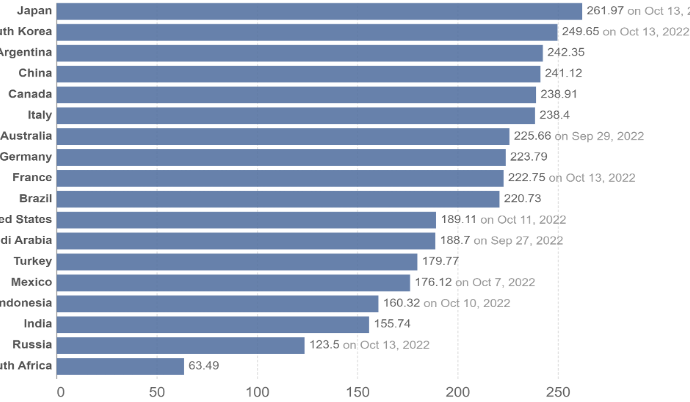

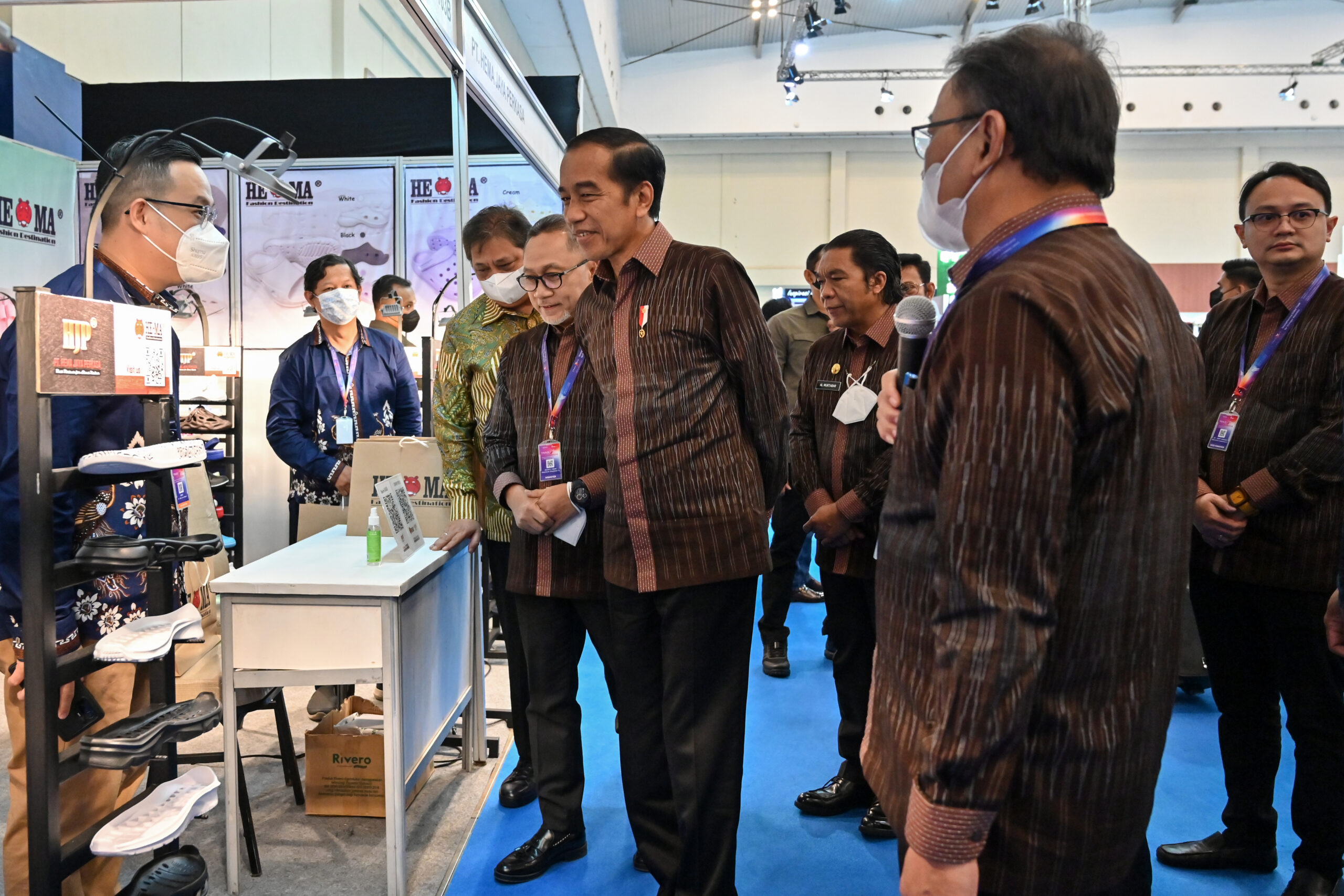

Korean President Yoon Suk Yeol made a high-level visit to Ukraine this month that followed his state visit to President Biden to further cement economic and military ties with the United States on April 26.

Not only is Tuskegee the home of the Tuskegee Airmen and Booker T Washington’s Tuskegee Institute, but also the congressional district of Mike Rogers, the chairman of the US House Armed Services Committee and a stone’s throw from Auburn University, where Alabama’s populist US Senator Tommy Tuberville coached college football.

Even while holding up the Senate confirmation of General CQ Brown, and all higher-rank military promotions because of his opposition to military funds used for abortions, Tuberville only had praise for Brown and the legacy of the Tuskegee Airmen.

The spirit of the Tuskegee Airmen helped to further consolidate the special relationship between the United States and Italy as Giorgia Meloni furnished her pro-US and pro-Ukraine credentials during her meeting with President Biden at the Oval Office on July 27.

Shortly after a purposely low key Oval Office meeting, Biden went off to make a speech marking the 75th anniversary of president Harry Truman’s executive order desegregating the military forces because of heroism of the Tuskegee Airmen in World War II and their even more courageous “mutiny” against Jim Crow laws in postwar America.

Peter K Semler is the chief executive editor and founder of Capitol Intelligence. Previously, he was the Washington, DC, bureau chief for Mergermarket (Dealreporter/Debtwire) of the Financial Times and headed political and economic coverage of the US House of Representatives and Senate.