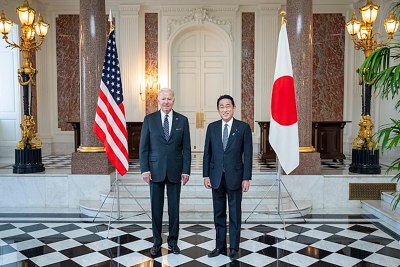

Japan & US at G7 can bask in multilateral momentum

The year 2023 is bringing a renewed focus on the US-Japan partnership as a fulcrum of global and regional diplomacy.

With an eye to this weekend’s G7 Summit in Hiroshima, Prime Minister Fumio Kishida began the year with visits to G7 counterparts in Europe and North America. Later in the spring, he toured Africa in an effort to gain understanding from countries of the Global South.

The Joe Biden administration looks ahead to a lively economic agenda, as it hosts the APEC Summit in November on the heels of the G20 Summit in New Delhi in September. National Security Advisor Jake Sullivan laid out in detail the economic ambitions of the Biden national strategy on April 27, giving further clarity to how the administration thinks its foreign policy will meet the needs of the American middle class.

Regional collaboration continues to expand. Both leaders will be present in Australia on May 24 as Prime Minister Anthony Albanese hosts the third in-person meeting of the leaders of the Quad.

Also noteworthy is the progress in ties between Japan and South Korea. Trilateral consultations began early in the Biden administration and, after the election of President Yoon Suk Yeol last spring, the groundwork for resolving the many difficulties in the bilateral relationship began. This spring, Yoon and Kishida revealed their progress in a set of visits to each other’s capitals. A trilateral summit is planned for the G7 Summit, which Yoon will attend as an observer.

Overshadowing this active multilateral calendar is the continuing war in Ukraine. Both Kishida and Biden have visited President Volodymyr Zelensky in his capital. The United States and Japan remain stalwart supporters of the Ukrainian defense effort as Ukrainians prepare for the spring counteroffensive against Russian forces. Yet questions have arisen within the US Congress over the scale and duration of military aide provided to Zelenskyy.

Interestingly, there remains little doubt about the Kishida cabinet’s support of Ukraine. While Japan does not provide lethal aid, it has joined in solidarity with European nations to contribute humanitarian relief.

Political choices will also shape the remainder of the year. President Biden on April 25 announced his run for a second term in the 2024 election.

In Tokyo, talk of a national snap election continues, with the latest rumors suggesting that Kishida, coming off his party’s good showing in local elections in April, might opt for a ballot after the G7 Summit.

Prepping for the G7 Summit

Early in the year, Kishida began consultations with other G7 partners for the summit to be held in Hiroshima from May 17-19. As host, Japan will set the agenda for the meeting, and the prime minister aimed to highlight his home constituency as a gathering place for global leaders. Traveling first to Europe and then to North America, Kishida met the French president and Italian, British, and Canadian prime ministers before his final stop at the White House for talks with Biden.

High on the agenda was rallying global support for Ukraine. Kishida then visited Ukraine in March, quietly traveling there from India, where he had met with Prime Minister Narendra Modi. While in Kyiv, Kishida pledged to provide additional aid and create a “special global partnership” between Japan and Ukraine. In addition, he invited President Zelensky to speak to the G7 leaders at the summit.

There are other aims as well. Notably, Japan intends to highlight the repercussions to the Global South of the war in Ukraine. Kishida traveled to Africa on a week-long trip beginning April 29 to offer assistance to those suffering from the global hike in food and energy prices caused by the war. Similarly, Tokyo will be looking to engage developing countries to ensure they avoid becoming overdependent on Chinese largesse. On May 1, during his meeting with Ghanaian President Nana Addo Dankwa Akufo-Addo, Kishida pledged $500 million in financial support to Africa.

The Japanese prime minister will have Indo-Pacific security balance on his mind as G7 leaders gather in Japan. As Kishida made clear throughout last year, a conflict similar to the Ukraine war is easily imaginable in the Indo-Pacific as cross-Strait tensions between China and Taiwan have intensified. Gaining deeper European understanding of the strategic challenges he sees being posed by China will be high on his priority list. Some European nations, such as France and Germany, see economic ties with China as indispensable, especially as sanctions on Russia have been costly.

Finally, Kishida will have the opportunity to remind the world of the nuclear risk. A visit by Biden and other G7 leaders to the Hiroshima Peace Park, and possibly to the Nagasaki Peace Park, will highlight the consequences of nuclear weapons and provide a platform for global condemnation of the threat to use them again.

US-Japan Regional Cooperation

The Biden and Kishida governments have continued to expand their regional agenda. Striking this spring was progress made in improving trilateral US-Japan-South Korea ties. Security cooperation began in the early months of the Biden administration in 2021 and gained momentum with the election of Yoon last year. This year consultations deepened. Foreign ministers met on the sidelines of the Munich Security Conference, where the three democracies restated their joint condemnation of recent North Korean missile tests. Further agreement is expected at a trilateral leaders’ meeting to be held during the Hiroshima G7 Summit.

Nonetheless, concerns over US extended deterrence in South Korea prompted a significant statement of reassurance during the state visit of President Yoon to Washington in April. Yoon gained a clear statement of the US commitment to South Korean defenses in the so-called “Washington Declaration.” Speaking during a joint press conference in the Rose Garden, Biden said that “a nuclear attack by North Korea against the United States or its allies or partners is unacceptable and will result in the end of whatever regime to take such an action.” In return, Biden received Yoon’s reassurance of South Korea’s commitment to the Nuclear Non-Proliferation Treaty.

Strategic stability on the Korean Peninsula has a significant impact on Japan as well, and North Korean missile tests continued to make it clear that a robust trilateral agenda of security cooperation was all the more necessary.

The new National Defense Plan put forward by Prime Minister Kishida suggests an early purchase of counterstrike capabilities, ensuring that Japan, like South Korea, will have its own conventional deterrent. But close coordination between Tokyo, Seoul, and Washington will be indispensable.

US Special Representative for the DPRK Sung Kim, Japanese Director-General of the Asian and Oceanian Affairs Bureau Takehiro Funakoshi and South Korean Special Representative for Korean Peninsula Peace and Security Affairs Kim Gunn met in Seoul on April 7 and called for joint efforts to block North Korea from sending workers abroad and engaging in malicious cyber activities to fund its nuclear program.

Most welcome have been the accompanying improvements in bilateral ties between Tokyo and Seoul. Washington has been supportive of the bilateral diplomacy that produced first Yoon’s visit to Tokyo on March 16 and then Kishida’s visit to Seoul on May 7. The former produced a Japanese commitment to improve favorable treatment of South Korean companies under the export control laws.

Progress made by the Yoon administration on ensuring compensation for the plaintiffs in the Supreme Court forced labor decision has also been a major signal of progress. On April 17, Japan and South Korea held their first bilateral security dialogue in five years. Finally, Kishida’s visit suggested far greater cooperation on strengthening supply chain resilience and advancing high-tech industries will be coming in the months ahead.

Yoon’s attendance at the G7 Summit will provide the opportunity for US-Japan-South Korea leaders to move their agenda forward, with Yoon hinting in press remarks that the leaders might use the meeting to form a new trilateral security forum. Media reports also suggest that the three countries hope to reach an agreement on linking radar systems, to better detect North Korean missiles, when their defense ministers meet in Singapore in early June.

The US and Japan have continued their cooperation in the Quad. The Quad foreign ministers met in New Delhi on March 3 in preparation for the leaders’ summit planned for May 24 in Australia. Already, Quad working groups have produced considerable progress across a host of issues. From April 10-14, the US, Japan, Australia, and India hosted the Quad Cyber Challenge, a coordinated campaign to promote responsible cyber habits across corporations, schools, and individuals in the four nations.

And, the US and Japan are joining with the Philippines to deepen security cooperation. On April 5, Chief Cabinet Secretary Hirokazu Matsuno announced that Japan would begin to offer bilateral Overseas Security Assistance to help smaller Indo-Pacific nations strengthen their defenses. One of the first candidates will be the Philippines.

A month earlier, the Japanese Self-Defense Force (SDF) participated in the annual US-Philippine Salaknib military exercises as an observer to encourage a more formal role for the Japanese SDF participation in contributing to stability in the South China Sea.

This pattern of inviting Japan to join bilateral military exercises with allies proved successful in expanding Japanese security cooperation with Australia and then India in the 2000s, and ultimately to a Quad dialogue on maritime and other regional security needs.

Already, media reports suggest that the US, Japan, and the Philippines are planning to create a trilateral consultative mechanism for their national security advisors.

Politics in the Air

Kishida faced a series of challenges toward the end of 2022. His decision to host a state funeral for former Prime Minister Shinzo Abe sparked controversy, while growing public discontent arose over Kishida’s management of the LDP’s connections with the Unification Church. The resignation of four Cabinet members due to their ties with the church and other scandals added to the mounting pressure on Kishida’s leadership.

Some polls even indicated that Kishida’s approval rating, which had already been on a declining trajectory, had fallen below 30%, entering the so-called “danger zone” where prime ministers face the risk of losing office.

But Kishida has seemingly bounced back since the start of 2023. His support rating has steadily climbed, with one Nikkei poll in late April finding that support for the prime minister surpassed 50% for the first time in eight months.

What factors contributed to this successful turnaround in public support? Some of it can likely be attributed to Kishida’s vigorous engagement in high-profile diplomacy in the leadup to G7.

Kishida has also benefitted from positive developments on the domestic front. His ruling coalition performed better than anticipated in the unified local elections and parliamentary by-elections held in April. While the LDP and its coalition partner Komeito experienced some setbacks in the two rounds of local elections on April 9 and 23, they managed to secure victories for most of their preferred candidates.

However, it was the LDP’s better-than expected performance in the five parliamentary by-elections on April 23 that was particularly significant for the Kishida government. Although Kishida had set a target of winning three out of five seats, LDP-backed candidates exceeded expectations by securing four victories.

Support for Kishida further increased after he survived an assassination attempt on April 15. While Kishida was delivering a stump speech at a fishing port in Wakayama, an assailant hurled an explosive device at him, but he managed to escape unharmed. The incident evoked memories of the assassination of former Prime Minister Abe, who was shot and killed less than a year ago on July 8, 2022, during an Upper House campaign event in Nara.

With the upswing in Kishida’s support rating, speculation has arisen about the possibility of a snap election for the Lower House. Kishida must call a new election by October 2025 at the latest when the term for the Lower House expires. While concerns exist that voters may experience election fatigue after the busy month of April, Kishida is likely contemplating the optimal timing to secure victory at the polls and strengthen his position before the LDP’s next party leadership election in September 2024.

Another crucial factor influencing Kishida’s decision on election timing is its impact on support for his policy proposals, particularly in terms of how he plans to pay for them. Kishida has made ambitious pledges to double Japan’s spending on defense and childcare, but specific details have been limited, causing some confusion about the prime minister’s plans for implementation. Opinion polls indicate that the public is not inclined toward new taxes, and Kishida himself has said that he would seek a public mandate through an election before considering any tax hikes.

While Kishida has recently dismissed the possibility of an imminent election, only time will reveal whether this stance changes. Meanwhile, observers will closely monitor the performance of the Kishida administration during the G7 Summit and parliamentary deliberations in June, as it is expected that the government will unveil more information regarding its spending priorities.

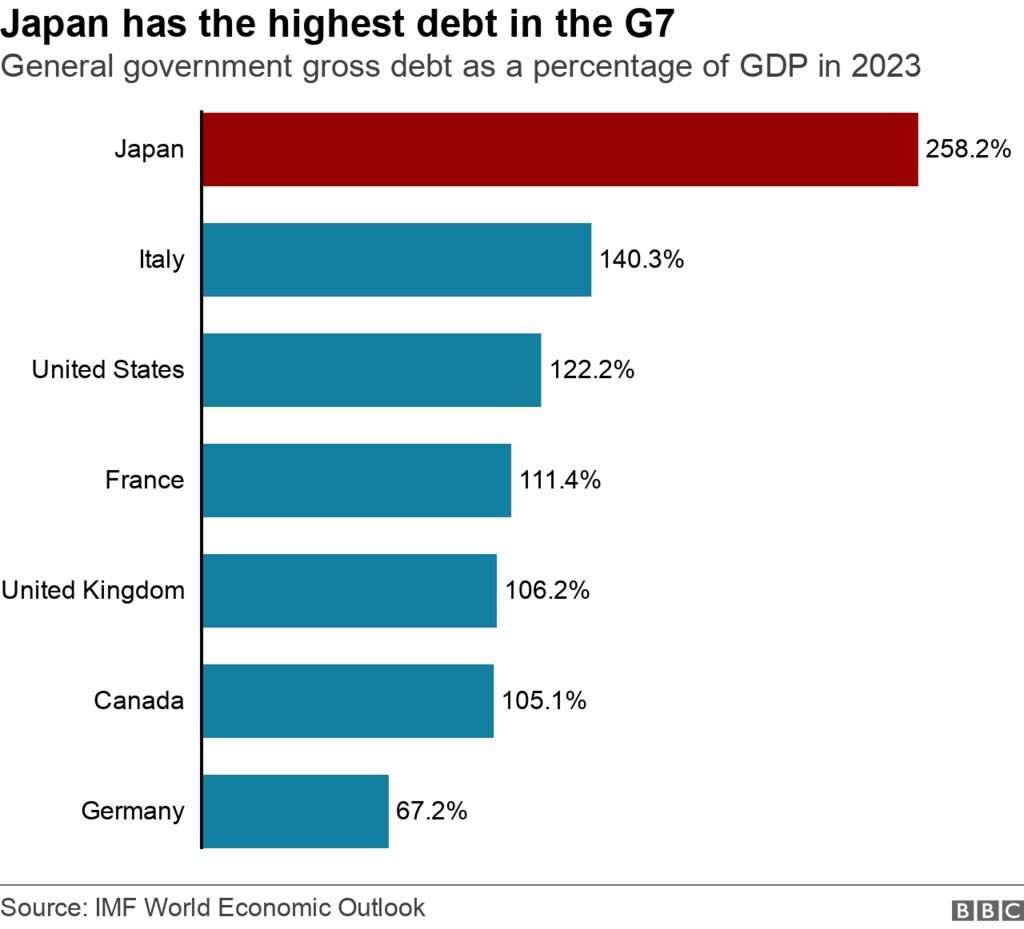

As for Biden, his support ratings have largely managed to hold steady at just over 40% through the first few months of the year, but significant challenges lie ahead. As Biden heads to Japan to meet Kishida and world leaders in Hiroshima, domestic concerns will likely be looming large on his mind as the US needs to raise the debt ceiling by June 1 or risk default.

The last time the US came within just days of default in 2011, Standard & Poor’s downgraded the country’s top-tier credit rating for the first time. How the Biden administration handles the issue will have substantial implications for the global economy and will also likely continue to be a point of contention as the president seeks reelection in 2024.

Sheila A. Smith is senior fellow for Japan studies at the Council on Foreign Relations. She is the author of Intimate Rivals: Japanese Domestic Politics and Rising China and Japan’s New Politics and the U.S.-Japan Alliance. Charles T. McClean is Japan Foundation CGP postdoctoral associate in East Asian Studies at the Yale MacMillan Center. Previously he was the Toyota visiting professor at the University of Michigan’s Center for Japanese Studies.

This article, abridged from one originally published by the Pacific Forum in Honolulu, is extracted from Comparative Connections: A Triannual E-Journal of Bilateral Relations in the Indo-Pacific, Volumw 25, Number 1, May 2023.