Yuan is internationalizing more than meets the eye

China has made clear its discontent with the role of the US dollar in the international economy and its intention to internationalize the RMB as an alternative international currency.

A popular narrative tells us that as China is now the world’s second-largest economy, the largest trading nation and the largest trade partner to 120 countries, it is inevitable that the RMB will play a larger role in the international economy. A side effect of the move to a more RMB-centric international economy will be the loss of US economic power.

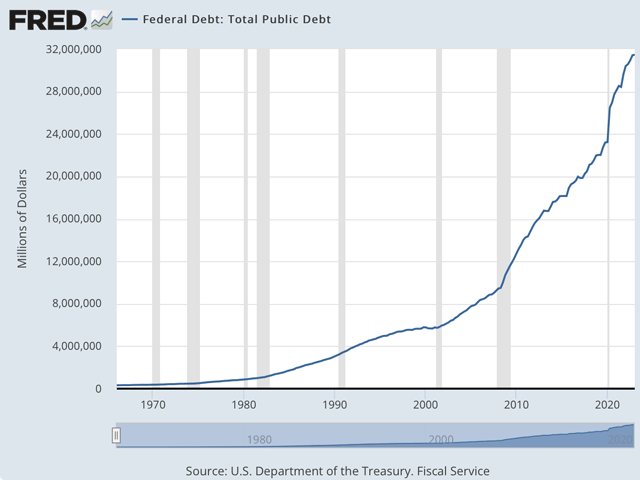

If the United States continues to weaponize its dollar hegemony, this is only bound to accelerate the diminishment of the dollar. The United States would be best served by refraining from using economic statecraft to pressure countries to adhere to its wishes.

China has already developed the “financial plumbing” required to facilitate the internationalization of the RMB. The country has developed an alternative cross-border payments system (CIPS) to rival Fedwire and the Clearing House Interbank Payments System. China’s Alipay and Tencent pay have also now been widely adopted abroad.

And since 2020 China has been trialling its Digital Currency Electronic Payment network, which has the potential to accelerate international use of the RMB.

Perhaps more telling than what China has done to facilitate the international use of the RMB is what it has not done. As China has internationalized its own balance sheet, it has remained decidedly dollar-centric.

China is still wedded to a policy of exchange rate targeting and requires large dollar reserves of its own — in part because of the high propensity for domestic capital flight — which is problematic when it’s promoting the greater international use of the RMB. China is yet to liberalize its capital account to make the RMB freely exchangeable — a prerequisite for reserve currency status.

China’s capital markets remain underdeveloped with both regulated and limited foreign participation. Foreign issuances denominated in RMB remain small.

Nor has China shown a willingness to become a net supplier of RMB to the world by running current account deficits, preferring instead to lend RMB to other central banks through swap arrangements.

While China has facilitated the use of the RMB in trade, it remains a long way from having the overarching macroeconomic structure that would make it a contender for reserve currency status.

This is important because it is through trade that countries earn the foreign exchange required to service their foreign currency-denominated liabilities. Earning RMB through trade is a risky way to earn income to service a dollar-denominated debt.

There is no sustainable dichotomy between the currency denomination of trade and the currency denomination of a country’s foreign assets and liabilities. The majority of the world’s foreign currency debt is denominated in US dollars and very little is denominated in RMB.

These observations strongly challenge the narrative that the dollar is in decline and the RMB will replace it in the international economy. Many of China’s largest trading partners, such as Hong Kong and Saudi Arabia, continue to operate on a de facto dollar standard. The RMB has gained the greatest traction among countries, such as Iran, that have strong geopolitical reasons for abandoning the dollar.

With the ratcheting up of Western sanctions against Russia, many countries in the southern hemisphere have expressed a desire to reduce their dollar dependency. Not least among these has been the disclosure that Saudi Arabia and Brazil will use the RMB for bilateral trade with China. In both cases, China enjoys considerable monopsony power, being the largest importer of hydrocarbons, soy products and iron ore.

Despite the speculation, China’s progress appears limited. According to SWIFT data, transactions denominated in RMB accounted for less than 1.5% in December 2022 — slightly more than those denominated in Australian dollars and less than those denominated in Swiss francs. This puts RMB in a distant 7th place. The US dollar accounts for nearly 48% of the total.

There are two reasons why the RMB’s diminutive market share in cross-border payments using SWIFT might not be a fair reflection of the RMB’s use in trade. First, not all cross-border transactions use SWIFT. Estimates by ANZ’s China research team suggest that about 20% of transactions settled using China’s own CIPS system do not use SWIFT.

Second, the total size of the cross-border payments market — around US$170 trillion per year — is about eight times larger than world merchandise exports at $22 trillion.

If one assumes the vast majority of international RMB usage is trade-related and not asset related — which seems reasonable given the low foreign participation rate in RMB-denominated asset markets and China’s dollar-centricity when it comes to their foreign assets — it might be that about 5-7% of world trade is already denominated in RMB, though such estimates need to be treated with caution. CIPS itself saw a 75% growth in settlement volume in 2021 to about 80 trillion RMB or US$13 trillion.

Some might interpret this level of RMB usage as disappointing. But if a collateral purpose of RMB internationalization is to immunize China from potential Western sanctions while providing sanctioned countries with a workaround and to provide efficiency gains in bilateral trade, then it is highly satisfactory from a Chinese perspective.

The return of Russian oil exports to above 2019 pre-war levels demonstrates that sanctions, though supported by countries representing more than half the world’s GDP, have lost some of their efficacy even while the US dollar remains hegemonic.

The ability to cut selected institutions out of the SWIFT system is a powerful tool of economic statecraft. But it must be remembered that trade took place before SWIFT was established and it is still possible — albeit more inconvenient and expensive — to conduct trade without SWIFT today.

If China is outside the sanctions, an RMB-based financial ecosystem helps facilitate and reduce the costs of sanction circumvention — as it was, in part, designed to do.

Stewart Paterson is Research Fellow at the Hinrich Foundation and Head of Economic Risk at Evenstar. This article was originally published by East Asia Forum and is republished under a Creative Commons license.