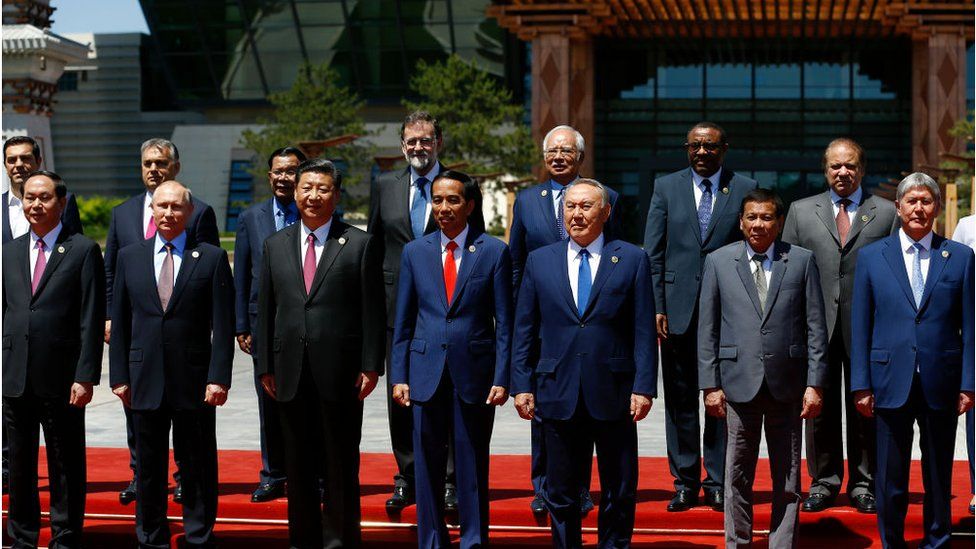

Is Chinaâs Belt and Road Initiative running out of steam?

China built the US$ 4.5 billion Addis Ababa-Djibouti rail line in Ethiopia, and it also invested heavily in the country’s ships and free trade zones in Dubai, where it established its first international military center close to the Bab el-Mandeb Strait, which connects the Gulf of Aden and the RedContinue Reading