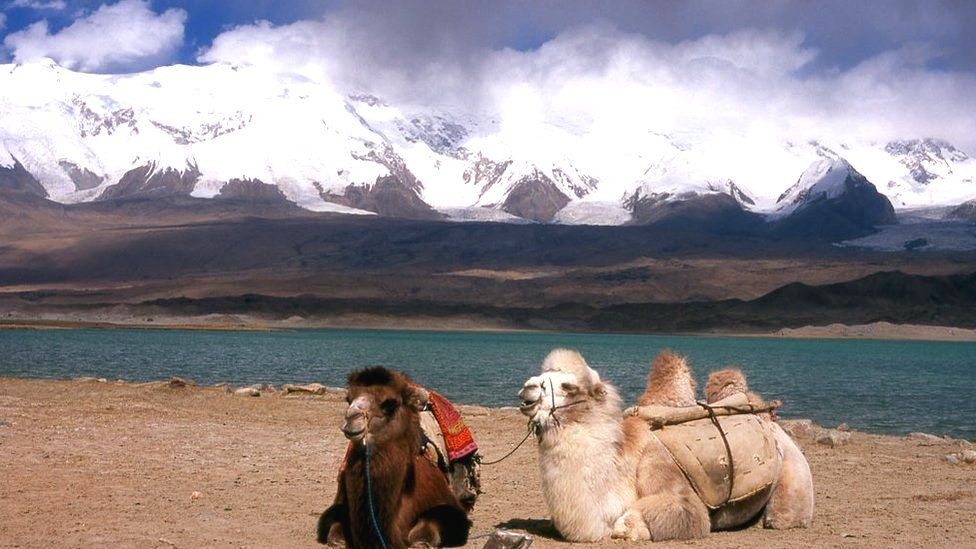

Pakistan’s Khunjerab is a high-altitude desert that is both clean and cool. Some of the highest peaks in the world can be found in this rough landscape, which is surrounded by towering mountains, immaculate glaciers, and snowy meadows.

A very proper road that runs through it connects China to Gwadar slot on Pakistan’s south-west coast.

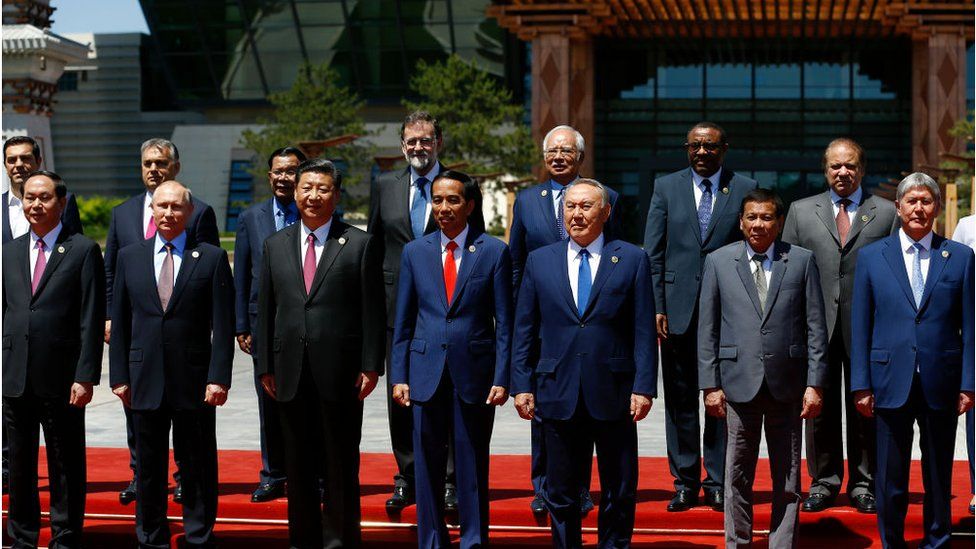

Since it was first used for trade and travel, the Silk Road has played a crucial role in Beijing’s Belt and Road Initiative ( BRI ) over the past ten years.

President Xi Jinping’s vision to rebuild the ancient way heralded the development of transport links across South Asia, in the process developing poorer nations and helping Beijing win friends abroad. It was described as” one of the most ambitious infrastructure projects ever conceived.”

The West has long been watchful of Beijing’s actions because it believes that these purchases will enable China to build a network of slots for its army to use in Africa, the South China Sea, and the Arabian Sea. China has refuted this.

More than 145 nations, representing nearly 75 % of the world’s population and more than half of its GDP, have joined the BRI as of today.

The China Pakistan Economic Corridor ( CPEC )-$ 60 billion(£ 49 billion ) is the largest project to date. Its initial funding was set aside for the construction of roads, railways, and pipelines through this isolated and difficult region of Pakistan.

In the end, it was intended to eliminate the need for extensive sea routes around South and South East Asia by connecting to oil and gas pipelines from northern Asia and the Middle East straight into eastern China.

China made a lot of perception by expanding this part of Pakistan. It provided a gate to Afghanistan and the rare earths that might be buried there, as well as the chance to secure the porous borders with its own restless Xinjiang region, and it could serve as counterweight to long-time rival India.

disruptions and corruption

Although progress has been made, problem, difficulties, and other problems, such as economic and security concerns, have plagued CPEC, like so many other BRI tasks. The Gwadar interface, which was intended to serve as a premier service, is still deserted and shows no signs of arriving or departing cargo.

Ten years after Xi Jinping unveiled the Belt and Road Initiative, this is the next in a series of articles that examine Chinese investment worldwide.

A large portion of that has to do with Pakistan’s personal financial issues. It was plagued by higher inflation, reduced growth, and a weak dollar earlier this year and was on the verge of default. Authorities were struggling to pay for the goods required to build CPEC system while material workers were being laid off and companies were closing because businesses couldn’t afford raw materials or power.

In the end, a$ 3 billion bailout program was approved by the International Monetary Fund ( IMF ) in July. However, Pakistan also owes$ 100 billion in additional debt, with China owing one-third of it.

And Pakistan is not the only nation that is in this situation.

Since the BRI’s origination, China has grown to be the biggest bank and a key source of investment for many developing nations, and as this relationship develops, many South Asian neighbors of Pakistan are now at odds with one another.

According to Constantino Xavier, a brother in international policy and safety studies at the Centre for Social and Economic Progress in Delhi, Nepal, Sri Lanka, and Bangladesh saw the BRI after 2013 as an opportunity to expand options and draw much-needed exports and opportunities to modernize their markets.

Now, however, the grass appears less natural. In Sri Lanka, China has turned unsustainable infrastructure investments into long-term leases that threaten independence, and in Bangladesh, it is becoming clear that China’s promised grants are actually expensive loans.

adhering to the rules

In the end, Beijing is attempting to save its own institutions. According to Carmen Reinhart, a former World Bank chief economist and one of the survey’s artists, that is why it has entered the difficult enterprise of global loan financing.

China is secretive about the amount and terms of its loans and often pardons debt. When more than one global provider is involved, experts claim that makes it challenging to reorganize debt.

What can happen in situations like Sri Lanka, which experienced significant societal upheaval and social upheaval after running out of international resources, is that nations enter a period of trying to pay back attention, restricting the economic growth that may help them pay off the debt in the first place. Individuals start losing their jobs, inflation spikes, and essential goods like food and fuel become unaffordable when the money stops coming in.

China has extended payment dates and offered emergency money.

However, experts claim that this is untrue despite criticism that it is using” debt trap diplomacy ,” a term popularized by the Trump administration and in which debtor nations offer significant assets as collateral.

They continue by saying that because China’s banks are dangerously exposed to internally indebted real estate companies, these unusual money have no benefit for the country.

China frequently contributes to these nations’ financial woes, but its loans are undoubtedly not the only problem, according to Ana Hirogashi, an analyst at the study test Aid Data. She adds that transparency regarding the funding is a problem, but like in Sri Lanka, Beijing later enters the picture.

As part of an effort to rebuild its debts and open the door for the acceptance of the IMF’s$ 2.9 billion loan deal, Sri Lanka has reached agreements with bondholders China and India.

The next question is: Why has China allied itself with nations with like subpar financial foundations? For instance, analysts point out that rather than investing in Gwadar, China may include expanded Karachi slot if it really wanted to develop Pakistan.

” Opportunism and politicians are present in Chinese investments. Meia Nouwens, head of the China Programme at the International Institute for Strategic Studies ( IISS ), says that bilateral political ties with the recipient countries’ governments could be strengthened.

” China uses this as an example to support its own claim that it is the Global South’s head, supporting developing nations and being aware of and responsive to their wants.”

In comparison to commercial lenders, China’s talks are renowned for having fewer problems and finishing in less time. Additionally, multilateral organizations like the World Bank and International Monetary Fund ( IMF) take their time and frequently include environmental and social riders in their aid pledges.

According to Ms. Hirogashi,” many leaders in the Global South are dealing with poll cycles and need tasks to be finished quickly with little plan conditions.”

The path back

Analysts note that despite both successes and failures, some developing countries’ financial prospects, including those in South Asia, will continue to improve thanks to infrastructure that was otherwise not built.

” China’s BRI has accelerated South Asian growth and development, compel India and other nations to get better and quicker ways to deliver choices.” Beyond China and India, there are now several more players in the region, such as Japan or the European Union, making it an open area for geo-economic competition, according to Mr. Xavier.

For example, the G7 unveiled a strategy to increase infrastructure investment in low – and middle-income nations last month. The India-Middle East-European Economic Corridor ( IMEC ), which aims to establish a trade corridor between India and several Gulf nations as well as other Middle Eastern and European nations, was also announced this month in conjunction with the G20 summit. President Joe Biden stated that there would be more like passageways in the future, and the US is involved.

According to Mr. Xavier, China has” entrenched, native economic and political professional across South Asian places.”

However, as China’s economy slows down, another change in the international order might get imminent.

Countries in the region are then rebalancing towards India, Japan, the United States, European Union, and additional traditional companions as China shifts its development model towards domestic consumption and there is less money available to be deployed to South Asia. This is evident in Sri Lanka, where China hasn’t done much since the nation’s economic proxy, according to Mr. Xavier.

On this account, more

-

-

two days ago

-