7-Eleven: Japan convenience store giant targeted by rival chain

Getty Images

Getty ImagesWhen the owner of 7-Eleven announced this week that it had received a buyout offer from a Canadian rival it triggered shockwaves in Japan.

A foreign company has previously purchased a Chinese business this size.

Generally, companies from Japan were more likely to purchase international organizations.

7-Eleven is the world’s biggest pleasure keep chain, with 85, 000 stores across 20 countries and territories.

And it’s been particularly successful in promoting itself as a fast, affordable, and delicious meals option in places like Japan and Thailand where there is already a lot of that.

” We have more outlets than McDonald’s or Starbucks”, the chief executive of Seven &, i Holdings, Ryuichi Isaka, told BBC News before the company received the merger present.

Around a third of those 85, 000 retailers are in Japan, while there are almost 10, 000 in the US.

A major player

In contrast, Quebec-based Alimentation Couche-Tard, which operates the Circle K ring, has nearly 17, 000 shops in 31 countries and territories. More than half of its stores are located in North America.

The approach valued Seven &, i at more than$ 30bn ( £23bn ) before news of the preliminary offer emerged.

7-Eleven’s stock jumped by over 20 % on Monday, before giving up some of those increases the following morning.

Analysts credit the Chinese currency’s relative weakness in relation to the US dollar and other main currencies for making Seven &, i more affordable.

According to Manoj Jain from Hong Kong-based wall account Maso Capital, efforts by the Chinese government to promote mergers and acquisitions appear to be working in addition to the yen’s failure.

Getty Images

Getty Images7-Eleven has been willing to capitalise on the reputation of the meal it sells- a wide range, including wheat balls, hamburgers, cooked pasta, cooked chicken and dumplings.

In Japan, stores like 7-Eleven are well-known with tourists looking for cooking comforts, while comfort businesses are where people go to get a bar of chocolate or a bag of biscuits in an emergency in much of the world.

The ring has become a social media hit in Asia thanks to these 7-Eleven food.

One of the best things to do in Thailand is to visit a 7-Eleven, where the ham and cheese toastie has become a TikTok reach has even been promoted.

American singer Ed Sheeran is one of the stars who has helped raise the profile of 7-Eleven. A picture of him attempting snacks from a Thai shop went viral.

Allow TikTok content?

As the business was pressured to buy some of its assets and concentrate on the 7-Eleven product, Mr. Isaka has been aiming to replicate that success in the US and European areas.

The company has been updating its method to allow for more locations to follow the Japanese retailers ‘ practices.

According to Mr. Isaka,” we discovered that stores that sell new food are attracting numerous more shoppers.”

” We want to grow with great value, not only increase the quantity. We want to ensure that customers are satisfied, boost the profits of each shop, and expand the number of locations, he continued.

National stems

Seven &, i has also been on a shopping spree. In January, it bought more than 200 stores in the US from petrol station chain Sunoco for around$ 1bn ( £770m ).

In April, it bought again more than 750 businesses from a operator in Australia.

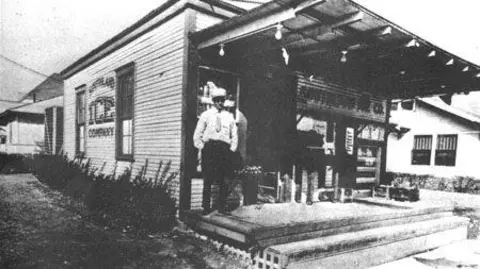

For most of its nearly century-long past 7-Eleven was an American company.

It launched in 1927 with the sale of ice blocks to keep refrigerators nice before stocking essentials like eggs, milk, and bread.

At the time, the shops were empty between 07: 00 and 23: 00- hence the name.

Seven &, i Holdings

Seven &, i HoldingsAs the company expanded, 7-Eleven started offering companies outside the United States.

In 1974, Asian financial firm Ito-Yokado struck a deal to start the country’s earliest 7-Eleven. In 1991, it bought a 70 % stake in the chain’s US parent company.

The founder of Ito-Yokado, Masatoshi Ito, who died in 2023 at the age of 98, is often credited with transforming 7-Eleven into a global empire.

Ito-Yokado was renamed Seven &, i Holdings in 2005 with the “i” in its name being a nod to Ito-Yokado and Mr Ito, who was by then the company’s honorary chairman.

Now, as the the company decides whether it will remain under Japanese ownership or return to its North National stems, experts are wondering whether more of Japan’s big firms could become takeover targets.

According to Mr. Jain, there is now a “greater determination of Asian boards and management teams to accept international approaches and be sympathetic to international approaches.”

More foreign investors may now be urged to follow their interests in Chinese businesses, he continued.

Gary Loh ( pic ), founder and CEO of DiMuto, remarked,” In a year marked by global economic challenges, this influx of capital validates the company’s growth trajectory and will enable us to leverage our momentum in the Latin American and US markets, bringing us closer to our mission of redefining global Agritrade”.

Gary Loh ( pic ), founder and CEO of DiMuto, remarked,” In a year marked by global economic challenges, this influx of capital validates the company’s growth trajectory and will enable us to leverage our momentum in the Latin American and US markets, bringing us closer to our mission of redefining global Agritrade”.

sation for Sustainable Development Goal 11 and the United Nations ‘ Centre of Excellence for United for Smart Sustainable Cities program. Through its 3D visualisation platform, Graffiquo’s global commitment to smart and sustainable urban development is highlighted in this partnership.

sation for Sustainable Development Goal 11 and the United Nations ‘ Centre of Excellence for United for Smart Sustainable Cities program. Through its 3D visualisation platform, Graffiquo’s global commitment to smart and sustainable urban development is highlighted in this partnership.