US-China chip war: Washington announces new export curbs

shabby Pictures

shabby PicturesThey are made to stop China’s government from bringing in sophisticated electronics or machinery.

Firms like Advanced Micro Devices and Intel find it more difficult to buy new or used chips to China as a result of the move.

Following the announcement, the securities of all three businesses dropped on Wall Street.

The Chinese embassy’s spokesperson added that it” strongly opposes” the new restrictions, which will take effect in 30 days and even target Iran and Russia.

The world’s largest supplier of tungsten and gallium is by far China. According to the Critical Raw Materials Alliance( CRMA ), an industry group, it produces 60 % of germanium and 80 % of gallium worldwide.

The materials are” minor metals ,” which means they are frequently by-products of other processes and are not typically found in nature on their own.

China has been subject to import restrictions on chip systems in addition to the US, Japan, and the Netherlands, which is home to important device equipment manufacturer ASML.

Concerns about the rise of so-called” resource nationalism” when governments hoard crucial materials to wield influence over various countries have been raised by the constant tit-for-tat between the world’s two largest economies.

Related Subjects

More information on this tale

-

-

October 7, 2022

-

Country Garden default talk swirls as offshore debt deadline passes

An investigation into China Evergrande’s chair, a besieged gaze that has also defaulted and been at the center of the sector’S debts crisis, followed Country Garden’d missed payment. Shares in Country Garden have lost about 70 % of their value this year, but on Wednesday they gained some ground, risingContinue Reading

PM woos Chinese firms

Discussions with business leaders at the BRF platform

According to Prime Minister Srettha Thavisin, Chinese businesses are interested in funding projects for bio-circular and green( BCG ) economic development as well as renewable energy, electric vehicles( EV ), and transportation infrastructure.

The third Belt and Road Forum for International Cooperation ( BRF ), which ends tomorrow in Beijing, was just attended by Mr. Srettha and Chinese business leaders.

He spoke with Zhu Hexin, the president of Citic Group Corporation, which runs a variety of companies, including financial solutions, commercial banking and investment banking, asset management, resources and power, production, real estate, energy outsourcing, and equipment.

According to Mr. Srettha, Citic has previously invested in Thailand, and the two nations have a shared passion for renewable energy.

The largest manufacturer of aluminum alloy rims for the automotive industry worldwide, according to Mr. Srettha, is Citic Dicastal, a division of Citib Group.

He stated that he had invited Citic to establish a factory in Thailand to create alloy wheels, and the business can anticipate doing well given that four Chinese EV manufacturers have now established facilities there and two more are on the way.

According to federal official Chai Wacharonke, Citic has been listed among Fortune’s Global 500 companies for 15 years running since 2009 and was ranked 100th this year.

According to the spokesman, Citic has also expressed interest in significant public-private partnership ( PPP ) projects.

The prime minister, according to Mr. Chai, also invited Citic to participate in Thailand’s five proper industries, including the mechanical, electronics, online, and modern sectors, as well as crops, food, medicine, clean energy.

According to Mr. Chai, the PM also invited the company to establish its regional office in Thailand as part of a strategy to promote the country’s emerging economies. He also added that the business is eager to increase its investments, especially in sectors like industrial property development and clean energy.

The professionals of CRRC Group, which specializes in building, producing, and maintaining trains and rolling stock, were subsequently introduced to Mr. Srettha.

The company now exports locomotives to Thailand, but it also sees growing opportunities for export growth abroad. According to Mr. Srettha, the company is looking into ways to establish a factory in Thailand where it can produce energy rails and engines.

According to Mr. Srettha, Thailand does act as a hub for the agency’s global exports if it can set up shop there.

The southern area gate connecting Chumphon on the northeast coast of the Gulf of Thailand to Ranong along the Andaman Sea has just received approval from his case, he continued, adding to his information to the company’s professionals.

According to Mr. Srettha, if it is put into place, it will serve as a shipping hub for shipping to India, the Middle East, and Africa. He also said that the company is very interested in the land bridge job.

The PM claimed that he had also invited Xiaomi managers to establish a manufacturing facility in Thailand, the Chinese company that makes smartphones and consumer electronics. Although the company now has a regional office in Thailand, he said it has no production facilities as of yet.

Therefore, Mr. Srettha spoke with representatives of Alibaba International Digital Commerce Group and requested that they think about promoting more goods produced by Thai small and medium-sized business owners on Lazada, the company’s website financial system.

” Conversations with the businesses were successful.” We made an effort to entice them to invest in Thailand by providing them with income breaks. As Thailand is now available to funding, they expressed their happiness and desire to conduct more business, according to Mr. Srettha.

China’s position on Israel leading to a cold war

The indiscriminate attack by the Hamas criminal organization on Israel on October 7 was much more than that, as evidenced by Israel’s response as well as its ferocity and violence. This may alter the course of the world, just like the terrorist attacks of September 11, 2001, and Russia’s invasion of Ukraine. & nbsp,

China has had a significant impact on these three pivotal events in recent history, demonstrating how badly US-China relationships have deteriorated and where the universe is headed— into another cold war.

China’s answer to the terrorist attacks of September 11 was to help the US at the UN Security Council, just as Russia did. Given their personal domestic issues, such as Chechnya in Russia and the Uyghurs in China, both countries actually stood to gain greatly from the US’s resolve to put an end to Islamic extremism.

Despite the assurance that China would be a business sector after joining the World Trade Organization in 2001, it was still able to maintain its socioeconomic model of state-led socialism based on planning and business plan. China became the US’s primary trading partner, with a$ 400 billion trade surplus in just ten years, while the United States continued to be mired in its anti-terrorist campaign.

After a severe financial crisis that destroyed the American economic system in 2008, US President Barack Obama’s management started to realize that an open-door coverage with China could not last indefinitely.

Obama acknowledged that the US had squandered to much time in the Middle East without realizing that China, a new strength with ambitious global dominant goals, was emerging with his news of the hinge to Asia in 2012.

China’s fall is acknowledged.

Since then, the desire of an open-door relationship with China has been dashed by Donald Trump’s election to office in 2017 and his moves to quickly have China through tariffs and technology transfer restrictions, which have persisted under President Joe Biden rather than the opposite.

The fact that China became the largest trading partner of the majority of nations in the world while the US continued to be excluded from global and business agreements was significant in all these years that US looked the other way.

The US had now lost a significant amount of economic leadership by the time Russia decided to invade Ukraine in February 2022. This was due in large part to the 2008 financial crisis, the Covid-19 crisis, and politics, as evidenced by its withdrawal from Afghanistan.

The sovereign debt crisis of 2010, which prevented the European Union from sufficiently reacting to Russia’s annexation of Crimea in 2014, was another shock in its peak. & nbsp,

From that point on, both China’s confusing and nbsp position toward, if never comfortable with, Russia as well as its invasion of Ukraine astounded the rest of the world. One could even contend that, given Russia’s extreme dependence on China, the conflict might have already been resolved in Ukraine favour if China had not provided implicit support for Russia.

In general, the conflict in Ukraine has widened the divide between the West and China, not just because of its stance on Russia but also because it has inspired emerging and developing nations to join forces with the US in defense of their imperial history. & nbsp,

In this framework, China is not an exception to the seismic movements in the Middle East that the latest attack on Israel has sparked, in addition to being extremely unpleasant( as Israel’s response in Gaza is, regrettably).

Middle East and China

Second, it is difficult to accept that Hamas was able to strike Israel so unexpectedly, exactly, and murderously, without any assistance. All eyes are on Iran, whose foreign minister, Hossein Amir-Abdollahian, met with a Hamas leader in Qatar this trip and threatened Israel with the repercussions of its attacks on Palestine.

As if that weren’t enough, Saudi Arabia, which up until the time of the attack was in talks with the US to reach an agreement with Israel for the standardization of its political relations, appears to not want to continue with this approach and, in fact, seems to want the exact opposite, given the sudden recent visit between the rulers of Yemen and Iran.

A few years back, a Hamas attack of this magnitude would have raised concerns among Saudi officials about Iran’s aggression given the two countries’ long-standing rivalry. Yet Saudi Arabia appears comfortable in the face of like terrorist attacks, however, as a result of the recent mutual respect agreement that China brokered.

In that regard, it is abundantly clear that China is not on Israel’s area but rather on that of Palestine from the stance that the Ministry of Foreign Affairs of China made people in the aftermath of the strikes against Israel and, even more so, from Wang Yi, its foreign minister, most recently stated.

The key point here is that China, as it did in the aftermath of Russia’s war of Ukraine, uses language that opposes that of the US once more. In addition, & nbsp,

This fact is not at all unexpected. China has maintained a pro-Palestinian stance since the day of Mao Zedong. In response to the US energy void, China has recently transitioned from being just one of many trading companions for the Middle East to its primary proper mate.

Furthermore, before the Biden administration took office, China would have been more hesitant to show a pro-Palestinian bias because Israel had permitted the sale of dual-use companies to China for ten years, but lately, things have changed. The harsher approach taken by the Biden administration regarding Israel’s exchange of core technology to China likely gave China more latitude to initiate an Iran-Saudi agreement.

Israel, the US, and the European Union should not be at ease with this at this time, for sure. A planned reduction in fuel production as a means of economic coercion could result from an Iran-Saudi reconciliation, in addition to the clear risks to Israel and Russia’s familiar shadow behind Iran.

two beams

The most far-reaching implications of such a surprise is the unavoidable spread of the world splitting into two wires, in addition to the painful processes of disinflation that have occurred in the West over the past few years. & nbsp,

The US will be able to determine its friends yet more precisely than ever thanks to this new horror. These include, without a doubt, Israel and the European Union, but they also include Australia, Japan, the Philippines, and Taiwan.

The other shaft is focused on China’s conflict with the US and a winner-takes-all mentality on both sides. While others observe how events turn out, the Middle East may backslide into China’s rod.

Finally, it appears crucial that the West recognizes the historic era in which it is currently residing. Despite greater economic interdependence, what may appear to be a mere” flashback” of the Cold War, which we thought was over, is actually true.

In other words, the attacks on Israel will become remembered as one of three significant occurrences that, along with the terrorist attacks of September 11 and the invasion of Ukraine, preceded and defined the division of the world get into two main alliances, resulting in a new cold war with disastrous repercussions for our societies as well as investors and businesses.

Senior research fellow at Bruegel is Alicia Garcia Herrero. Keep up with her on X @ Aligarciaherrer.

Alleged state links will continue to hurt Chinese firms in Europe

According to Reuters, the European Commission began a 13-month regulation investigation into the goods of Chinese electric vehicles on September 13 and claimed that state grants allowed Chinese Vehicles to outperform European companies in terms of price.

According to a Reuters article, Chinese imports have increased their market share for EVs in Europe by 8 % over the past year, suggesting that competitive pricing has contributed to the local market’s success in China. & nbsp,

Taiwanese” enemy” companies

The EV industry is not the only target of anti-dumping studies by Europeans against Chinese companies. A quick search reveals that even this year, a variety of Chinese-made products, including material and plastics, have come under regulatory scrutiny in Europe, frequently with Chinese companies being subjected to anti-dumping duties.

However, given the ongoing political tensions resulting from the Russo-Ukranian war and perceptions among Europeans that the Chinese position is subtly favoring Russia in the fight, German investigations into Chinese firms have become more socially beneficial and draw less criticism from company leaders. & nbsp,

As a result, Europeans’ perceptions of Taiwanese businesses that are either state-owned or seen as having strong ties to the Chinese government are deteriorating. The possibility of a angry Chinese state using Taiwanese companies in Europe to manage the local market is the source of European skepticism toward Chinese businesses.

Some are more overt, like worries that Chinese governments will have access to Western data that violates privacy laws. Both Huawei and TikTok‘s operational limits can be included in this category.

Others are more subliminal, like the notion that Taiwanese businesses dominate Europe, which would disadvantage the latter in the event of conflicts. Such interpretations may apply to restrictions on EVs, metal, and plastics.

The presence of Chinese businesses in the Belt and Road Initiative by the Chinese government is the single most damaging example of how they are perceived as a tool of hostility toward Europe.

The BRI has grown to be a significant foreign policy action for the Foreign state since its 2013 build in an effort to improve China’s standing internationally by providing sizable funding for infrastructure projects. Due to political and financial differences surrounding several initiatives, including in Europe, the BRI has also been mired in considerable controversy.

destruction to Belt and Road company

China Ocean Shipping Company( COSCO ) is a good case study in Europe.

For 35 years, the Grecian port of Piraeus was largely leased to COSCO for€ 100 million annually. Since 2016, COSCO has owned the port in an illegal majority, with a full ownership stake of 67 % in 2021, at the cost of€ 368.5 million, making Piraeus an important port for the shipping of products between Europe and Asia.

As a result, the interface has grown significantly under COSCO’s leadership, with its power increasing and its position in the world rankings for pot transaction volumes rising from No. 77 in 2010 to No 24 in 2020. & nbsp,

However, the diminished support for the BRI among European nations has made it more and more challenging for COSCO to employ Piraeus to carry out its stated objective of managing German transshipments to Asia. Local Greek opposition to the port’s continued expansion has been one factor.

Citizens who live close to the port have been fighting in local courts over pollution from port operations that endangers native fisheries, as well as allegations that local government officials have purposefully sidestepped the problems in the name of economic expansion.

The planned rise of the harbor was halted in March 2022 by Greece’s highest administrative court, which did so because COSCO failed to submit an environmental assessment in accordance with EU and Grecian law.

As Piraeus becomes involved in another unhappy BRI projects, COSCO’s brand image will continue to decline even if it manages to reduce home opposition within Greece.

For example, the Budapest-Belgrade-Skopje-Athens railroad, which was intended to serve as a link between the dock and central Europe in 2013, has been suspended until 2019. During this time, EU regulators looked for indications of irregularities in the bidding procedure.

The Romanian government’s failure to make the terms of the US$ 1.9 billion payment for its section of rail public merely served to increase EU suspicions that China and COSCO are aiding in the alleged anti-democratic tendencies of Prime Minister Viktor Orban and the absence of pro-corruption reforms.

As a possible industry of both commercial and political conventions, the outcome will further damage COSCO’s reputation in Europe.

In retrenchment

The BRI and the Chinese government’s role in Europe is waning in response to political antagonism. The removal of the three Atlantic says by 2022 has weakened cooperation between China and Central and Eastern European nations, a assistance format that sponsors the Budapest-Belgrade rail.

Recent reports that Italy, the only G7 nation to formally join the BRI, is considering leaving the program raise the possibility that the Chinese state will quickly play a smaller role in investments in Europe. & nbsp,

However, as the Chinese government retreats, new options for Chinese businesses like COSCO to enhance their reputation through international cooperation are opening up.

Greek Prime Minister Kyriakos Mitsotakis stated in an interview from September 2022 that there are no significant new Taiwanese investments in Greece and that the Piraeus port funding from ten years ago was during a” various time” when” no one wanted to invest in Greek.” However, only a year later, Indian Prime Minister Narendra Modi’s state visit to Greece featured increased use of the dock at the top of his mission.

Foreign companies can also expand their industrial footprint in Europe after being cleared of suspicions of working with the Foreign state, as evidenced by India’s willingness to designate a majority Chinese-owned port as an important conduit to increase European exports.

Of course, it is still unclear whether any decrease in the Chinese state’s presence in Europe will result in a long-lasting reprieve for Taiwanese businesses operating there. The fact that Piraeus is no longer increasing in transaction volume and, as a result, losing its corporate significance, may contribute to the decreased attention to COSCO.

However, given that companies like COSCO, Huawei, and TikTok deliberately promote and advertise their presence in Europe, it is unlikely that they won’t encounter intense media scrutiny and aggression from the general public once more. And when that time comes, their purported connections to the Chinese government, both actual and imagined, might damage their reputation after more. & nbsp,

How should Uzbekistan develop its debt market?

President Shavkat Mirziyoyev has called for a significant economic transformation, as stated in Uzbekistan’s New Development Strategy 2022 – 2026. Uzbekistan is well on its way to achieving its socio-economic development goals, based on recent press coverage and on-the-ground images. & nbsp,

All of that is good information, but Uzbekistan is capable of more. & nbsp,

It is past time for Uzbekistan to begin creating a robust long-term loan funds market in ens, the nation’s official currency. A well-developed local debt market may benefit Uzbekistan’s lenders and borrowers more than the current structure of its debt markets, and over time it would also benefit foreign investors, to hasten the process of economic transformation. & nbsp,

Box 1 demonstrates why a portion of the som debt market isn’t appealing to borrowers under the current conditions. This is the main reason why the SOM-denominated bond market remains undeveloped. Loans in SOm are costly due to inflation. & nbsp,

Box 1: In Uzbekistan, who can afford a 16 % mortgage?

Consider the home loan industry in Uzbekistan to describe the purpose of this article. You can obtain a som mortgage loan at presently 16 % interest from the lender if you want to purchase real estate. A 20-year linear mortgage with a 5 % redemption rate implies that the borrower pays 21 % of the original amount in the first year. Who has the money for that?

This explains why the regular mortgage in Uzbekistan only accounts for 25 % of the property’s value. & nbsp, Banks seems to have poor vision. & nbsp,

An inflation-linked loan is a much better product for the lenders. Assume the bank wants to make a 4 % margin and that inflation will be 12 % the following year. The borrower would have to spend what? The loan would only need to consent to prices plus 4 % interest.

In general, the borrower will pay the 4 % interest plus 5 % redemption, which equals 9 %, plus inflation over this sum, or 1.12 times the 10 %, in the first year. Consequently. The bank only charges the borrower 10 % in the first year as opposed to the original 21 %. The cost of the mortgage is now double as low!

To put it another way, a person can use half as much with an inflation-linked loan. As a result, the average mortgage in Uzbekistan could now easily increase from 25 % to 50 % of the home’s market value.

The development of solely inflation-protected debt instruments is the answer to the comparative unaffordability of the sole loan industry. The creditor may now only give a chance premium of, say, 4 % annually after accounting for inflation, as opposed to the nominal rate, which would have been 16 %. In our example, the customer may spend half of the loan’s cash flow in the first year as opposed to the amount that is currently owed. & nbsp,

There is no magic in this situation because as a borrower’s payments rise in nominal terms over time due to inflation, you end up paying the same as you would under an old ( non-indexed ) contract. The money flows are, in actual words, better distributed over time, which is the difference. & nbsp,

The confusion of Uzbekistan’s potential inflation is taken into account when pricing inflation-indexed equipment. Also long-term maturities of 20 or 30 years ought to be feasible.

Due to the lower risks, it is anticipated that this type of debt will lower the cost of borrowing in Uzbekistan, which will benefit both the housing market( see Box 2 ) and the government’s budget. & nbsp,

Box 2: According to economic theory, an inflation-linked relationship offsets currency risk by ensuring that the native stock’s buying power at maturity is constant across all markets. In other words, the transfer rate between two nations is essentially balanced. & nbsp,

Because the purchasing power of principal and interest at any given time is supposed to be the same across industry, inflation-linked bonds are made to make costs and inflation useless. For instance, it makes no difference if an asset costs US$ 1, 000 or$ 10,000 in six months because you will always receive the appropriate number, regardless of its nominal charge. In addition, & nbsp,

Long-term ties in regional money

Consider Uzbekistan’s federal loans needs as stated by its Ministry of Investments, Industry, and Trade as another illustration of the value of developing a native bond market. & nbsp,

It is obvious that Uzbekistan needs long-term funding because there are numerous infrastructure projects with long shelf lives, including the ambitious Trans-Afghan Railway and its planned free economic zones and public private partnerships( PPPs ) across the nation.

It takes a while to repay these jobs because they require so much cash. Such words should not be used to finance a railroad’s borrowing costs because they cannot be” earned up” in just three years. & nbsp,

If Uzbekistan wants to fund its long-term agreements with debt tools that must be refinanced every three years, a debt crisis may be on the horizon. Borrowing foreign money over the long term has related limitations because exchange rates are outside of Uzbekistan’s control. & nbsp,

Additionally, because these jobs are in Uzbekistan, local currency is the best form of financing.

Treasury Inflation – Protected Securities ( TIPS ) of the Uzbek Republic

The Uzbekistan Treasury Inflation-Protested Securities ( U – TIPS ), inflation-linked local currency debt instruments, or the tip-protected securities market should all be developed in order to finance these projects.

U-tips, like US TIPS, may be indexed to a trustworthy inflation and nbsp measure to shield investors and investors from an increase in their money’s purchasing power. The primary value of a TIPS increases as inflation rises, which causes the discount payments to change proportionately. & nbsp,

Interestingly, Uzbek TIPS would enable owners to concentrate on the credit risk in the investment structure and, as a result, more closely align the ties with credit default swaps. Credit default swaps are tools that, in theory, ignore other dangers like prices and just charge the costs associated with default. In addition, & nbsp,

For instance, Turkey recently issued a 10-year bond at 27 % annually when its credit risk was only 7 %. Turkey should have been able to issue a TIPS in the range of just 7 %, which means investors receive an annual return of 3 %, each year adjusted for inflation, as opposed to issuing an interest-bearing bond of 27 %. & nbsp,

Additionally, an inflation-linked bond is preferable to a fixed-rate long-term bond for the reasons listed below: & nbsp,

- Lower risks: greater certainty regarding the actual income and cost of debt for both the lender and the borrower.

- Lower saving costs as a result of lower risk premiums due to walled prices risk.

- Due to inflation hedge, nearby currency risk was mostly avoided. This will be more accurate the longer the saving phrase( see Box 2 ) & nbsp,

- Risks involving foreign exchange were avoided, such as prices in the eu or imbalances on the EU single market. & nbsp,

- No risks associated with international politics, such as restrictions on dollar payments to second nations.

Other benefits that come with creating a strong local currency government bond market include the following: & nbsp,

- Companies can raise long-term funding from domestic sources thanks to a more secure financial system under Uzbekistan’s control( better allocation of saving ).

- Government finances should be better managed and planned to reduce the need for selling proper assets, increase taxes, or overstuff the balance sheet of the central bank. & nbsp,

- establishes a benchmark rate for home financial markets and government risk. & nbsp,

- provides opportunities for local pension funds and insurance firms to invest while fostering native private capital markets.

Mirziyoyev might think about asking his economic team to put together a plan to develop the mechanism to issue inflation-indexed local currency debt instruments with 10 year tenors, and perhaps longer. This mechanism would include dependable and independent methodologies to determine inflation. & nbsp,

In this way, Uzbekistan would become the only other Asian nation to challenge 10-year inflation-indexed ties, joining Japan, South Korea, and a select few people.

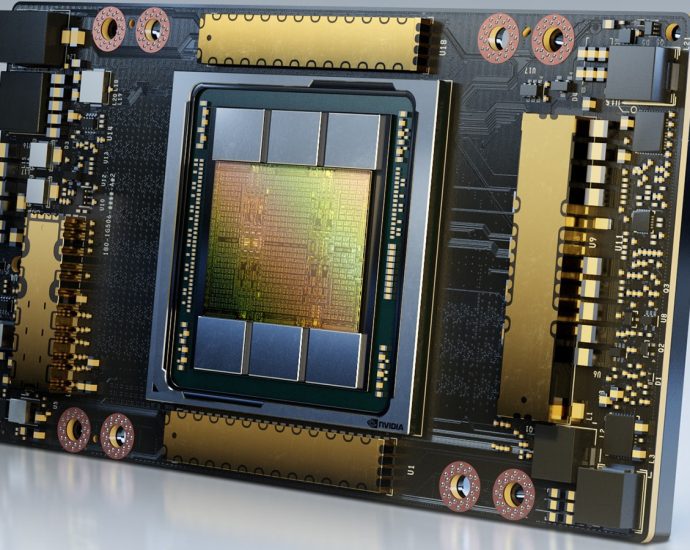

US to deepen chokehold on Chinaâs AI chip access

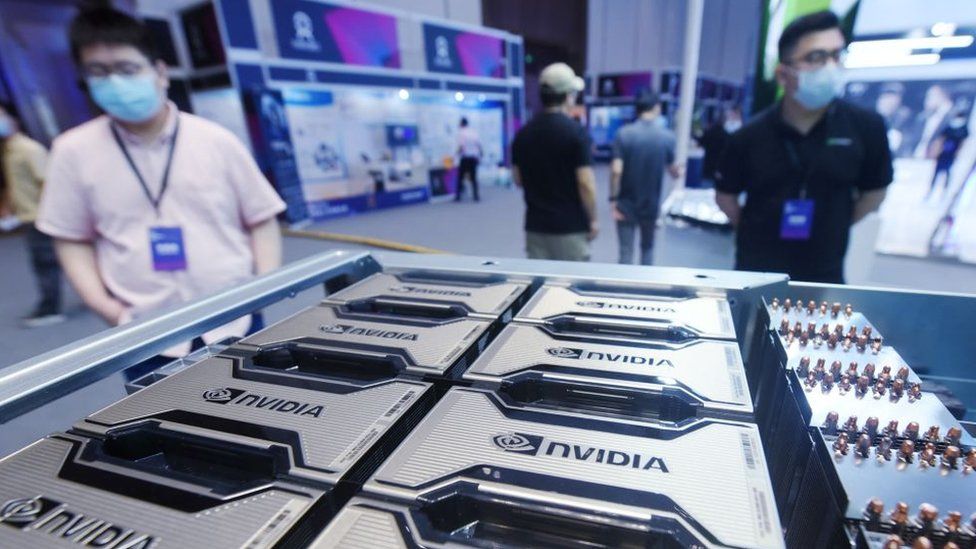

A new set of regulations that aim to stop Chinese businesses from sourcing American-made high-end artificial intelligence ( AI ) chips through various channels are expected to be announced by the United States.

Washington plans to introduce fresh regulations that may limit some superior AI cards to China, according to an unnamed US official who spoke with Reuters. According to the report, the US is considering whether to forbid exports of the H800 scrap from Nvidia to China. & nbsp,

According to Bloomberg, the US will step up its efforts to see if any Chinese companies are getting around export restrictions by sending shipments through various countries. Additionally, it will demand that foreign manufacturers obtain a US permit before placing orders with Taiwanese chip design companies. According to the information, the new regulations will be released early this year.

According to Wang Wenbin, a spokeswoman for the Chinese Foreign Ministry,” China opposes US politicizing, instrumentalizing, and weaponizing commerce and technology problems.“

The principles of marketplace economy and fair competition are violated by arbitrarily putting curbs in place or violently seeking decoupling to further social agenda, the global economic and trading order is undermined, global commercial and supply chains are disrupted and destabilized, and ultimately the interests of the entire world are harmed, he claimed. & nbsp,

China, according to Wang, did closely monitor advances and steadfastly protect its legal rights and interests.

Interchip data rates

The Biden administration ordered US chip manufacturers to stop sending 600 gigabytes per second interchip graphics chips to China and Russia in August of last year. This new law applies to AMD’s MI250 device as well as Nvidia and H100 chips.

Later, Nvidia unveiled the 400 and 300 gigabytes per second A800 and H800 computers, between, for Chinese areas. Both chips meet the export standards set forth by the US government.

Although it has not yet announced the regulations, press reports in June of this year claimed that the Biden presidency would soon forbid the import of the A800 and H800 to China.

A US official recently informed Reuters that a” performance density” factor will take the place of the bandwidth factor to help avoid further workarounds. & nbsp,

Just AI cards with performance criteria that fall within the export ban guidelines can be shipped to China. & nbsp,

Chinese tech behemoths BAT( Baidu, Alibaba, and Tencent) and ByteDance just ordered US$ 5 billion worth of A800 bits from Nvidia, according to a report by The Financial Times on August 9.

According to the report, 100 000 A800 chips worth$ 1 billion are expected to arrive this year, with the remaining ones arriving in 2024. & nbsp,

According to tech experts, the A800 now performs at 70 % of an A100. It’s unclear if the new regulations will forbid the delivery of the A800 and H800 to China.

A Beijing-based journalist claimed in an article published on Monday by the systems news website AI era that the H800 is now a slower version of H100 but that it may still be prohibited from being shipped to China. The upcoming US limits may hinder Chinese businesses’ ability to develop their Intelligence technologies, according to nbsp.

trade solutions

According to a Reuters report from June, some shops in Shenzhen’s Huaqiangbei area were discovered to have purchased small quantities of A100 cards at prices twice as high as usual, costing$ 20,000 each. & nbsp,

The Chinese People’s Liberation Army( PLA) frequently purchases commercial off-the-shelf AI systems from Chinese academic institutions and private companies, which are not easily blocked by US restrictions on military end-users, according to a research report published in June of last year by the Washington-based think tank Center for Security and Emerging Technology( CSET ). & nbsp,

The CSET stated that it would be difficult for US authorities to launch a targeted assault on the PLA’s intermediate device suppliers due to the challenges associated with tracking AI cards and the variety of potential vendors. & nbsp,

Nearly all of the 97 AI cards the CSET was able to identify from public Army acquire records were created by Nvidia, Xilinx( today AMD ), Intel, or Microsemi. The CSET added that the PLA is placing orders for AI cards created by US companies and produced in Taiwan and South Korea. & nbsp,

As the 7nm AI computer uses the company’s self-developed Da Vinci structures, sanctioned Chinese technology huge Huawei Technologies can also transfer the production of its Ascend 910 device to Taiwanese TSMC.

More than 20 Chinese towns have used Ascend cards in their AI services, according to a CITIC Securties studies document that was released in July, and Huawei currently holds the 79 % market share for AI technology centers in China. & nbsp,

Zhang Dixuan, CEO of Huawei’s Atlas Data Center Business, announced on July 6 that the company may increase the number of Ascend 910 tickets in its Altas 900 Supercluster from 4, 000 to 16, 000 after this month.

An That writer named Yao Yue claims that such a grouping is sufficient to teach an equal chatbot to GPT3.0.

Read: Shanghai’s plans to develop an AI hotspot may be derailed by the microprocessor war.

What’s behind Samsung and SK Hynix device war discounts, you ask?

@ jeffpao3 Follow Jeff Pao on Twitter at & nbsp.

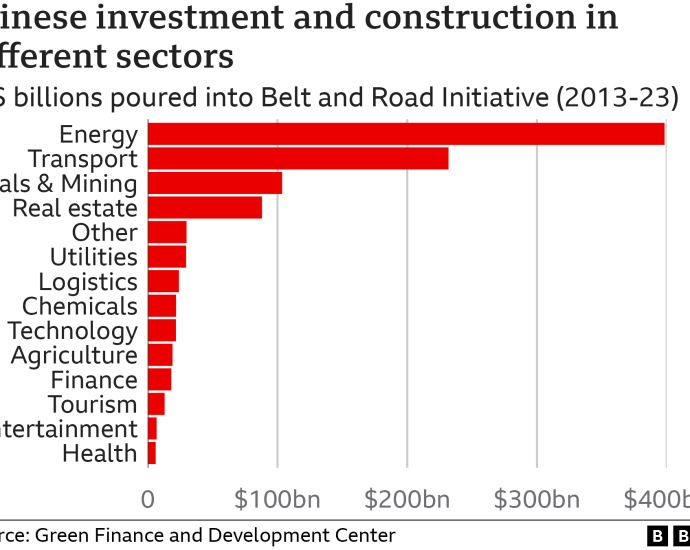

How China’s Belt and Road Initiative is changing after a decade of big projects and big debts

BEIJING: After ten years of significant projects that increased business but left significant debts and raised environmental concerns, China’s Belt and Road Initiative aims to be smaller and greener. The change occurs as officials from all over the developing world travel to Beijing this week for a government-organized community onContinue Reading

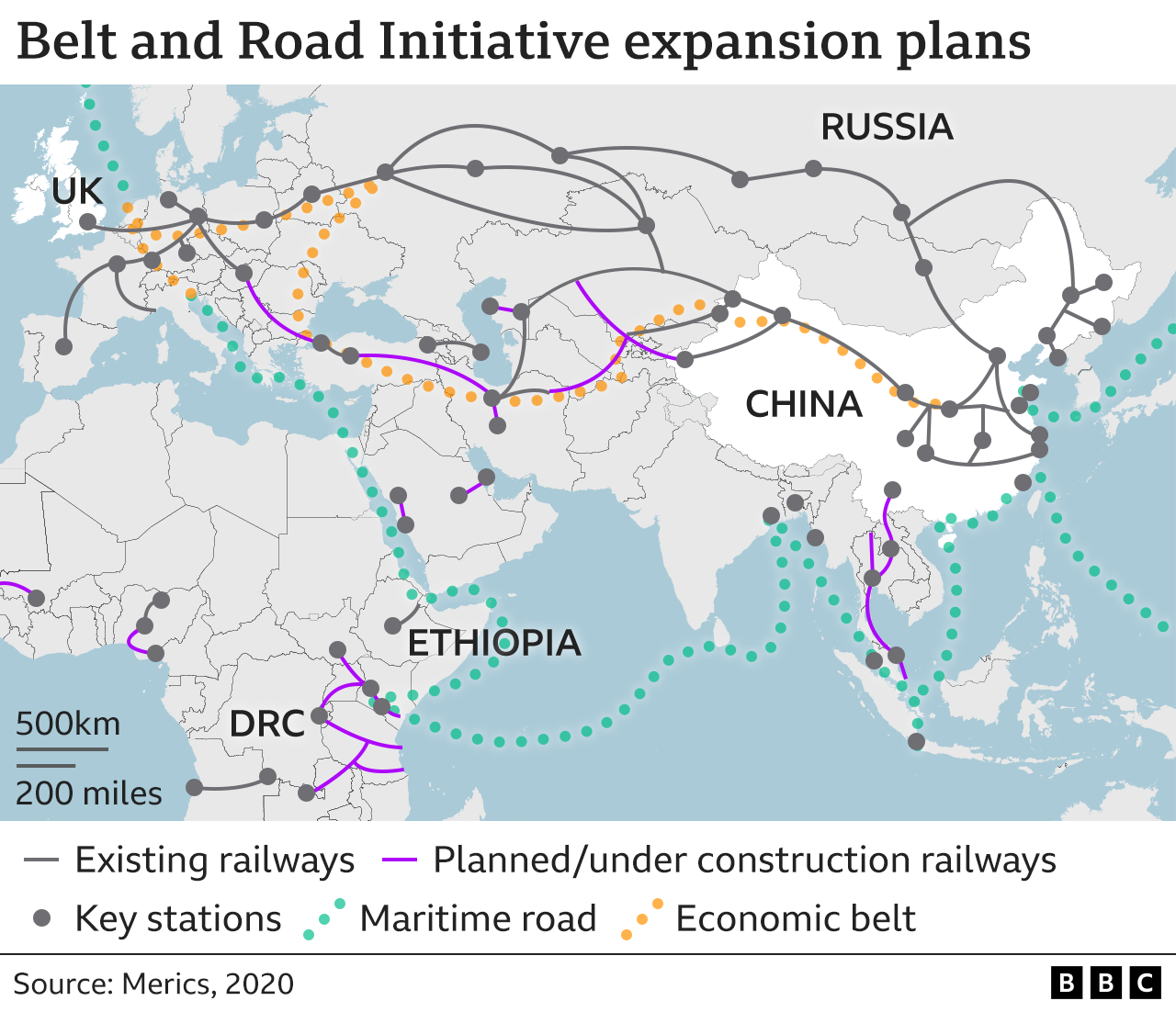

Belt and Road Initiative: Is China’s trillion-dollar gamble to transform the world working?

shabby graphics

shabby graphicsChina is hosting a sizable party this week to commemorate its Belt and Road Initiative( BRI ), one of its most significant global engagement initiatives.

In Beijing, authorities and influential people from all over the world will take part in a high-level conference honoring the 10th anniversary of the BRI. From Vladimir Putin to the Taliban, members are anticipated to attend. The BRI’s accomplishments are widely covered in Chinese media, including a six-part video on state television.

The BRI, President Xi Jinping’s personal initiative, aims to use investments and infrastructure projects to bring China closer to the rest of the world. China boasts that it has changed the world with an unprecedented abundance of cash pumped into roughly 150 countries, and it is not bad.

Beijing’s enormous spend, however, hasn’t exactly turned out the way it had hoped. Was it worthwhile?

A” win-win” in terms of financial success?

It was obvious that China had expansive interests from the moment the BRI was unveiled in 2013 and compared to the historic Silk Road.

While” Road” denotes a maritime network connecting China to significant ports through Asia to Africa and Europe,” Belt” refers to overland routes linking China with Europe through Central Asia, as well as to South Asia and South East Asia.

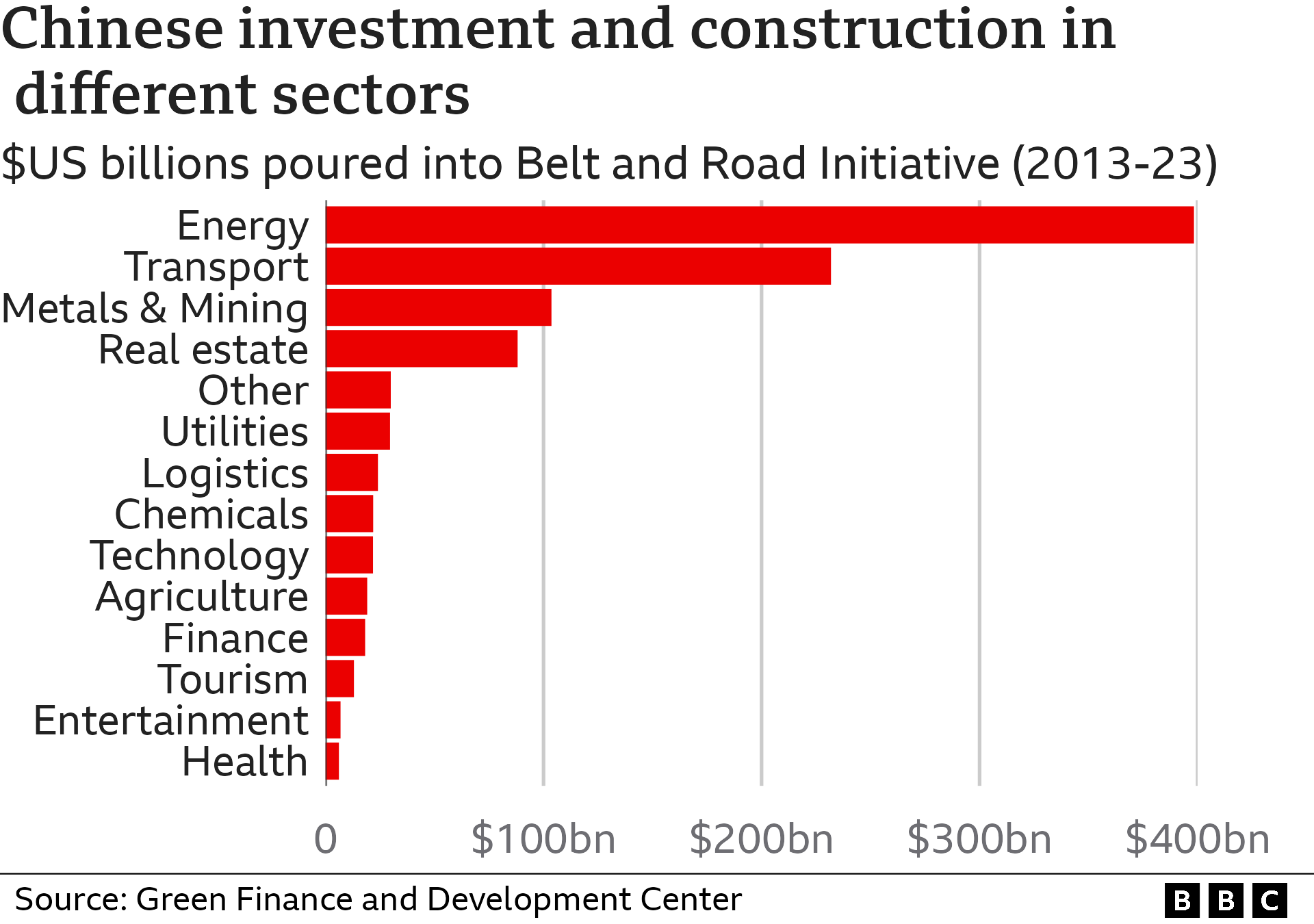

Large state-driven investment in challenging infrastructure abroad was the beginning of it. Energy and transportation projects like power plants and railroads have received the majority of the estimated$ 1tn($ 820 billion ).

Beijing hailed this as a win-win for the business and assured different nations that these investments would spur development, while at home it sold the BRI to support Chinese businesses, strengthen the local economy, and improve the reputation of the nation.

It had some success in achieving some objectives, like internationalizing the renminbi and addressing the overcapacity of Taiwanese businesses.

However, China benefited greatly economically from business. Access to more resources, including oil, gas, and vitamins, increased as a result of numerous agreements, particularly as the BRI’s concentrate expanded to include the Middle East, South America, or Africa. In the previous ten years, China and BRI nations traded about$ 19.1 trillion worth of goods.

According to senior scientist Jacob Gunter at the Mercator Institute for China Studies,” it’s about Chinese state-owned companies going internationally… to help promote the flow of tools that China needs.” ” As solutions to the progressive developed world, it’s also about growing and developing trade markets.”

At a time when China is more at odds with the West and its supporters, this growth has become essential.

According to the International Institute for Strategic Studies( IISS ), China’s dependence on Japan, South Korea, and the US has decreased as a result of gas pipelines from Central Asia and Russia, as well as imports of oil from countries like China, Iraq, Brazil and Oman.

Bill capture diplomacy

China is now the largest international bank in the world thanks to the BRI, which has made it the lender of last resort for some small – or middle-income nations.

Due to the fact that many of the loan contracts are shrouded in secrecy, it is unknown what the true scope of loan is, which is estimated to be at least hundreds of billions of dollars.

Countries are currently struggling with BRI debts, including Sri Lanka, the Maldives, Laos, and Kenya. The Taiwanese government is now in a precarious situation.

In order to assist consumers in making timely payments, China has restructured BRI loans, extended dates, and allocated an estimated$ 240 billion. However, it has declined to pay off the debt.

According to Christoph Nedopil, the founding director of the Green Finance and Development Center( GFDC ), which monitors BRI spending,” For China to simultaneously engage in debt write-downs abroad while domestic economic issues are not fully resolved- it will be politically challenging internally to promote that.”

Although there isn’t much evidence for this, some experts claim that Beijing is using the BRI to destroy other people’s independence.

China has also come under fire for its so-called” hidden debts”; governments are unaware of how exposed their loans institutions are, making it challenging for nations to weigh the advantages and disadvantages of the BRI.

BRI projects have also been charged with producing inefficient” white elephants ,” fostering local corruption, escalating environmental issues, exploiting staff, and breaking promises to create jobs and prosperity in nearby communities over the years.

According to a recent study by the study test Aid Data, these issues affect more than one-third of tasks. Some nations, including Malaysia and Tanzania, have been forced by a growing reaction to revoke BRI agreements.

Read more of the content in our line commemorating 10 years of BRI here:

According to the Council on Foreign Relations, Chinese lenders and businesses are partially to blame for” poor risk control and a lack of attention to detail and coherency.”

However, other observers point out that saving nations are also at fault, as in the Hambantota circumstance, which was partially brought on by Sri Lanka’s individual poor financial management.

Additionally, they claim that China offers solutions with fewer restrictions, making them less arduous than offers from foreign lenders or the West.

According to Mr. Gunter,” China exhibits a” one-stop shop” mentality.” These are our banks and companies, and we do everything from start to finish ,” and if you sign now, we will conclude that railroad and it will be finished in time just as you run for your next election ,” he said.

The fact that you can complete it in one to three times with minimal documents is a major selling point. Your railway may be finished, even if it’s a little dirty and there are labor rights violations.

a triumph in diplomacy

However, China has succeeded in achieving one of its main objectives — expanding its influence.

According to Pew Research, numerous middle-income nations, including Mexico, Argentina, South Africa, Kenya, and Nigeria, have developed more favorable sentiments toward China over the past ten years.

Mr. Gunter observed that more and more nations in the Global South do not want to take factors in their conflict with China. China hasn’t changed some nations from a Western perspective, but the fact that it has moved the needle to the middle ground has already resulted in significant diplomatic success for Beijing, he said.

However, observers have even raised worries about potential monetary coercion, wherein foreign governments feel compelled to support Beijing’s policies or run the risk of China ceasing to invest.

Deal clauses that” probably allow the lenders to control debtors’ domestic and foreign policies” were discovered in a One Aid Data study of loans made by Chinese state-owned entities to foreign governments.

According to the IISS, China has” corralled additional states into momentary partnerships” at the UN to oppose measures essential of Beijing, and participation in the BRI has prompted some EU members to obstruct or weaken China-critical plans.

The BRI, according to the think tank, has evolved into one of China’s” key tools” for isolating Taiwan diplomatically. It noted that BRI cash has been given to numerous countries that have switched their recognition from Taiwan to China over the past ten years.

While Laos and Thailand have drawn criticism for detaining or permitting the violence of Chinese activists sought by Beijing, Cambodia has consistently resisted conviction of China’s activities in the South China Sea.

” Minor and lovely.”

China then understands that some points must alter.

Beijing promotes the idea of” small and beautiful ,” and the BRI can be more relevant through low-investment, high-yield projects.

State media cite programs for bamboo and bamboo knitting in Liberia, gas technologies projects in Tonga and Samoan, and the promotion of mushroom-growing technology in Fiji, Papua New Guinea and Rwanda as examples.

China has also unveiled a brand-new” modern silk road” that focuses on connectivity and modern facilities. According to experts, this would lessen the effects of European bans on Chinese 5G products and provide Chinese businesses with a more stable stream of earnings.

China has reduced borrowing with this new approach. According to a GFDC analysis, it has placed restrictions on Chinese banks’ ability to lend money abroad, and investment deals are now almost 50 % smaller than they were five years ago. Additionally, it has established a program where other nations can contribute money rather than being the sole borrower in the BRI.

Beijing, which now claims that the BRI is the cornerstone of” the global community of shared future ,” has even grander plans for it.

Beijing claimed in two white papers published this month that its approach to globalization would be more equitable, inclusive, and less judgmental than the” hegemonic” Western powers’ pursuit of a” zero-sum game.”

It stated that the BRI is a common road that is accessible to everyone and not merely the secret journey owned by one party. China asserted that it is” helping people to achieve while seeking our own achievements ,” far from seeking dominance as critics claim.

China’s perspective is that” globalization is currently in risk.” According to Wang Yiwei, a professor who teaches the BRI at Renmin University of China, the West is actually” de-China – risking” in the name of” risking.” How can the BRI establish common connection and prevent a new Cold War is the main challenge.

The trillion dollars test in Beijing has produced a potent instrument for influencing people. But the real issue is whether the rest of the world wants a Chinese-led purchase.

Further information provided by BBC Monitoring.

Related Subjects

Tesla sideswipes Indonesia’s EV supply chain dream

Indonesia’s efforts to entice investments for creating an end-to-end EV supply chain ecosystem were hampered by Tesla ‘ decision to establish its electric vehicle ( EV ) car manufacturing in neighboring Malaysia. & nbsp,

By turning raw ore into higher-grade metal intermediates, Indonesia’s metal downstreaming policies aim to increase value by utilizing the huge nickel reserves and production of the nation. These higher-grade nickel intermediates are crucial parts that go into making EV batteries made of stainless steel and metal chrome manganese( NCM ).

Indonesia’s metal downstreaming policies andnbsp have been successful in luring investment. Indonesia outlawed the export of raw copper metal in 2020 in an effort to draw investment, primarily into nickel smelters. & nbsp,

A year later, the nation received downstream investments and commitments from Chinese companies totaling about$ 30 billion in the US. 43 metal boilers were already operating as of July 2023, 28 were under development, and 24 were in the planning stages.

Indonesia uses two smelting techniques to process its schist copper ore. One technique, which is suitable for Indonesia’s metal ore, produces metal swine iron, a crucial element in the production of stainless steel, using pyrometallurgical( class 2 ) treatment for lower-grade nickel grade. & nbsp,

Mixed hydroxide precipitate( MHP ), which is used in lithium-ion NCM battery cathodes, is produced during the other ( class 1 ) treatment for higher-grade nickel using a high-pressure acid leaching( HPAL ) process. Due to the rising demand for EV batteries, the majority of smelting opportunities have been made to produce group 1 high-grade metal NCM battery cathodes.

The recent trend of major EV manufacturers, including Tesla, to switch from using nickel to a mineral combination of lithium-iron-phosphate ( LFP ), however, is cause for concern. & nbsp,

These materials are more accessible and economical. If this change spreads widely, it might have a disastrous effect on Indonesia’s optimistic downstream plans.

It is helpful to compare these two cell types in order to evaluate the effect of EV suppliers switching from NCM to LFP batteries on Indonesia’s metal industry. According to a recent report, LFP batteries are approximately US$ 12 per kWh less expensive because the materials used are more accessible and rich.

However, compared to their NCM competition, LFP batteries do have a some drawbacks. Their lower driving selection( estimated to be about one-third less ), which is particularly noticeable in cold conditions due to LFP’s lower energy density, is one of their drawbacks. & nbsp,

Their lower disposal price is another disadvantage. The cost difference between NCM and LFP batteries is taken into account when calculating the price, which may result in a lower demand than originally anticipated.

The metal downstream business in Indonesia faces significant obstacles. & nbsp,

Second, it is necessary to properly mitigate economic harm caused by deforestation at mining sites, disruptions to nearby communities, and unsafe toxic mining waste management. For the great power power required by smelting plants, the business also heavily relies on fuel.

Next, it’s worrying that the nation relies too heavily on China for investment and business exposure. The majority of the copper processing facilities in the nation are run by Chinese businesses. & nbsp,

Tsingshan Holding Group, Zhejiang Huayou Cobalt, Ningbo Lygend( a CATL Group member ), Wuling Motors, and China Molybdenum Company are notable people. However, the dominance of China has been somewhat restrained by the expansion of huge South Korean companies like Hyundai Motors, LG Energy, and SK, as well as Taiwan’s Foxconn.

Finally, there is confusion as a result of the industry’s dual oversight by two ministers. The Ministry of Industry is in charge of keeping an eye on the upstream metal processing phase, while the country’s Minister of Energy oversees mining operations. & nbsp,

These two ministers often have different ways of interpreting and enforcing related laws. For Indonesia’s downstreaming plan to be effective, close cooperation and understanding between these two departments are necessary, which is difficult due to different historical goals.

There will be a number of coverage issues for the fresh 2024 administration. Indonesia may think about recalibrating the balance between its power and investment in class 1 and class 2 nickel processing if the anticipated switch to more cost-effective LFP batteries occurs. This entails concentrating more on creating and funding lower-grade metal pig iron for the production of stainless steel.

Indonesia should think about switching from an aggressive nickel export ban to a more adaptable Domestic Market Obligation ( DMO ) scheme, similar to those used for coal and palm oil. & nbsp,

This plan is well-known to the state and business people, making it perhaps simpler to put into practice. As state institutions develop over time, some sort of assurance for long-term investors regarding the source and a price range of organic ore may be taken into consideration.

Indonesia is the world’s largest copper supplier with the largest reserves, which contributes to the success of the nickel downstreaming policy. This might not be the case for other metals and commodities, necessitating more cautious implementation across various industries.

Indonesia needs to give inland plans in industries that have a greater influence on small businesses and job creation priority. If the nation wants to take advantage of its socioeconomic income, which will expire by 2040, this is essential.

Manggi Habir is a visiting fellow at Singapore’s ISEAS-Yusof Ishak Institute.

This post, which was originally published by the East Asia Forum, has been republished with a Creative Commons license.