CPF Board warns companies against scam emails asking for employee wage information

SINGAPORE: The Central Provident Fund (CPF) board on Wednesday (Nov 1) warned companies against scam emails asking for employee wage information.

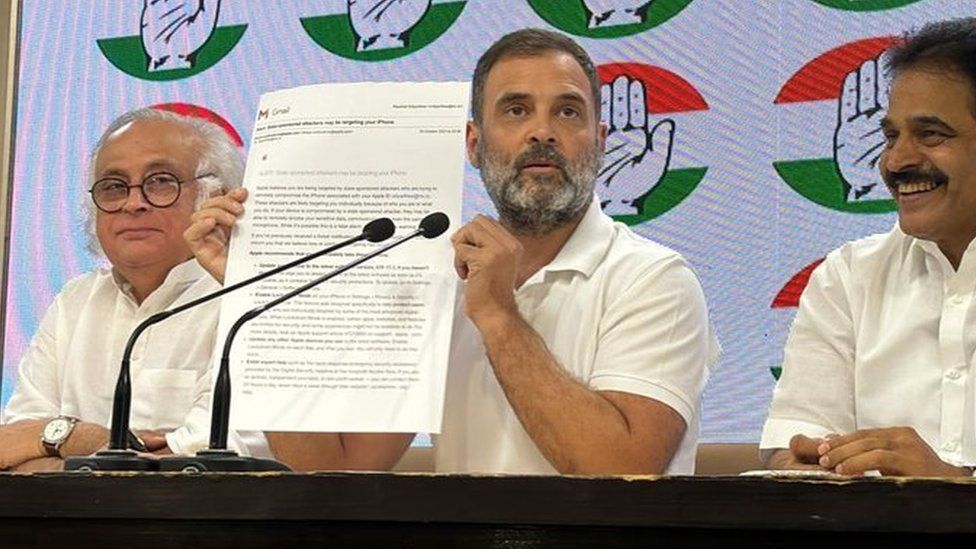

The email mimics CPF Board’s authorised email address in the sender description, it said in a Facebook post on Wednesday.

The scam email has the subject “Reminder: Requirement to declare wage information” and contains an attachment asking employers for employee wage information, CPF Board added.

CPF Board has advised employers not to open the attachment and to delete the email immediately.

It also assured the public that its system is not compromised.

The public is encouraged to review and update their email security settings to block malicious or spoofed emails, or seek assistance from their email service provider, said CPF Board.

An advisory published by the Cyber Security Agency of Singapore (CSA) in 2020 and updated in 2022 said that the most common method used by attackers is the impersonation of a company’s CEO, business partner or a known contact of the victim, using a spoofed email account to send the request.

It added that phishing campaigns’ emails will sound urgent and list dire consequences if the recipient does not act promptly and advised against clicking any links or opening any attachments from the emails.

CSA also advised business owners to promote a culture of cyber vigilance among employees and to implement additional verification processes for finance-related requests.