Japan breaks with Trump in a South African embrace – Asia Times

Last year, South African Deputy President Paul Mashatile met with Prime Minister Shigeru Ishiba, Cabinet Secretary Yoshimasa Hayashi, and various government and private sector officials in Tokyo.

Their discussions were intended to promote bilateral trade, expense, and cooperation, strengthening a relationship that does help Japan offset some of US President Donald Trump’s tariffs and give South Africa some breathing room following Trump’s most recent decision to halt financial aid to the nation.

Minister of Trade, Industry, and Competition Parks Tau, Minister of Agriculture John Steenhuisen, Deputy Minister of International Relations and Cooperation Thandi Moraka, Deputy Minister of Science, Technology, and Innovation Nomalungelo Gina, Minister of Higher Education Nobuhle Nkabane, and Minister of Game, Arts, and Culture Gayton McKenzie were all present in Mashatile’s group.

Members of the South African delegation met with representatives from the Association of the African Economy and Development in Japan Committee ( AFRECO ), the Japan Business Federation ( Keidanren ), the Japan External Trade Organization ( JETRO ), the Japan International Cooperation Agency ( JICA ), and the Japan Organization for Metals and Energy Security ( JOGMEC ).

Japan is one of South Africa’s larger trading and investment colleagues, and it ranks sixth on the list of countries where West African products can trade. Additionally, Tokyo provides the African nation with significant amounts of overseas development assistance ( ODA ) and foreign direct investment ( FDI).

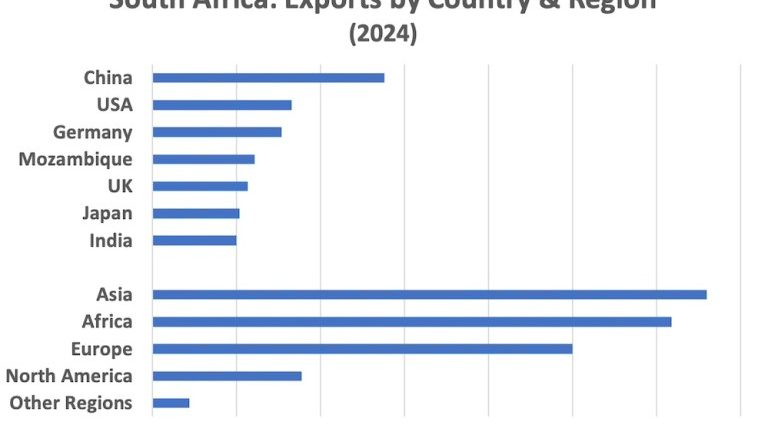

According to the Japanese Ministry of Foreign Affairs, South Africa’s exports to Japan totaled 790.9 billion yen ($ 5.3 billion ), while its imports totaled 288.5 billion yen ($ 1.9 billion ). Japan accounted for 5.2 % of South Africa’s total exports, followed by China ( including Hong Kong ) for 13.8 % and the US for 8.3 %.

In 2024, 31 % of South Africa’s exports went to other African nations, 25 % to Europe, 9 % to North America, and 2 % to other regions, for reference.

South Africa imports technology, electric, visual, medical equipment, medicine, iron and steel, gold, silver, various metals, ores, and agricultural products from Japan, as well as other metals and ores.

With 273 businesses operating in the country, Japan is a major investment in the South African economy, according to Deputy President Mashatile in his presentation speech at United Nations University in Tokyo on March 18. This provides over 200, 000 local job opportunities for some South Africans.

Toyota, Toyota’s party trading partner Toyota Tsusho, Sumitomo Corporation, Fujitsu, NEC and Fujitsu, machine manufacturer Fanuc, Mitsubishi UFJ Financial Group, and Fujifilm, a company that specializes in digital cameras, visual artists, and medical imaging, are just a few examples.

In Durban, Toyota South Africa Motors builds rider and truck vehicles. From its bases in Durban and Pretoria, Toyota Tsusho Africa provides logistics, material processing, parts assembly, and materials and parts purchasing to the South American auto industry.

Mashatile remarked to the audience that” the two nations improved their relationships in 2010 to a strategic cooperation partnership,” with particular strong relationships “in the areas of trade and investment, science and technology, and support for education and skills creation.”

The total amount of Japan’s ODA loans, grants, and technical assistance to South Africa is estimated to be worth 47 billion yen ($ 350 million at the time ). This is according to data from the Japanese Foreign Ministry’s 2022 ( the most recent available ).

Global Trade Portal also has data for 2022, which places Japan 9th in total FDI to South Africa at$ 3 billion, far behind former colonial powers the Netherlands and the UK ($ 63.7 billion ), which account for about a quarter of the investments made by Belgium and the US ($ 11.8 billion ), and about half the amount for China ($ 5.9 billion ). However, Japanese investment in South Africa has increased significantly since then: according to Statista and JETRO data, it is currently worth about$ 5 billion.

The Trump government’s proposed steel and aluminum taxes would have an impact on both South Africa and Japan. According to Busisiwe Mavuso, CEO of the business organization Business Leadership SA ( BLSA ),” steel and aluminum account for about 8.5 % of what we export to the US,  , so the 25 % tariff will put pressure on those volumes.”

In response to what his administration says are human rights violations against the majority light Afrikaners and their allies in its foreign policy stance regarding Israel, the Palestinians, and Iran, Trump has also cancelled US financial support to South Africa. The US has even expressed its disapproval of South Africa’s close ties with Russia and China.

Four Republican lawmakers wrote to Trump in February pleading for more severe action, saying:” We urge you to withdraw South Africa’s taste benefits under the African Growth and Opportunity Act [AGOA]; we also advise that you think about suspending diplomatic relationships unless that state is willing to engage constructively with our own.”

In this context, Mavuso of BLSA points out that” The deal balance favors SA and supports many jobs, particularly through great value-added manufactured products.” Our respected private sectors have close ties to over 600 American businesses operating in this country. However, we must also maintain our wider global relations in perception, which include many of our rapidly expanding industry, which offer opportunities for our businesses.

Deputy President Mashatile stated at the Foreign Correspondents ‘ Club of Japan on March 19 that” we are focusing on stabilizing our relationship with the United States of America,” but that the state is even working to expand its imports, mentioning Japan, China, Russia, Europe, and the Africa Free Trade Area in this regard. Mashatile questioned how tiny nations could handle the US, citing self-reliance.

According to him, the removal of US economic assistance results in an 8 billion rand ($ 437 million ) shortfall in the budget for TB and HIV healthcare programs, which have a particularly severe impact on the rural poor. That is reasonable, yet. The expenditure is being revised, and other nations are also offering help. For more than 20 times, JICA has been making a difference in Africa through the identification, prevention, and treatment of HIV and TB.

Akihiko Tanaka and Mashatile discussed a range of topics at their two-day meeting, including participation in science and technology research, and solar power. Tanaka expressed his hope that South Africa would take its traditional leadership position during the upcoming August 9th Tokyo International Conference on African Development ( TICAD ).

Since 1993, the Asian government has been organizing the TICAD meeting that is hosted by the UN, the World Bank, and the African Union Commission.

Mashatile concluded by saying that” this trip for us was really successful” and that frank discussions of issues affecting West African buyers, such as the security and stability of the power source, were on hand. Given the criticisms made against South Africa in the US, he said it was good to be able to speak directly.

According to Mashatile,” South Africa and Africa have a trusted and reputable ally in Japan,” the company plans to have a “huge impact” in the coming years as more Chinese companies come to South Africa to produce goods, improve the energy grid, and employ and train native workers.

He added that “protectionism is not going to help anybody,” and that tariffs must be reasonable and not in the way of sustainable development.

Follow this writer on , X: @ScottFo83517667