Damoh: Man posing as UK doctor held in India after fatal surgeries

BBC Hindi

BBC News

Narendra Ahirwar

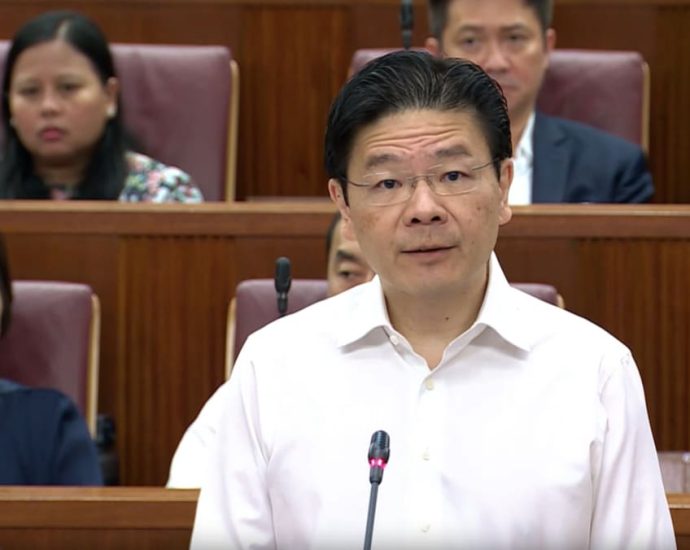

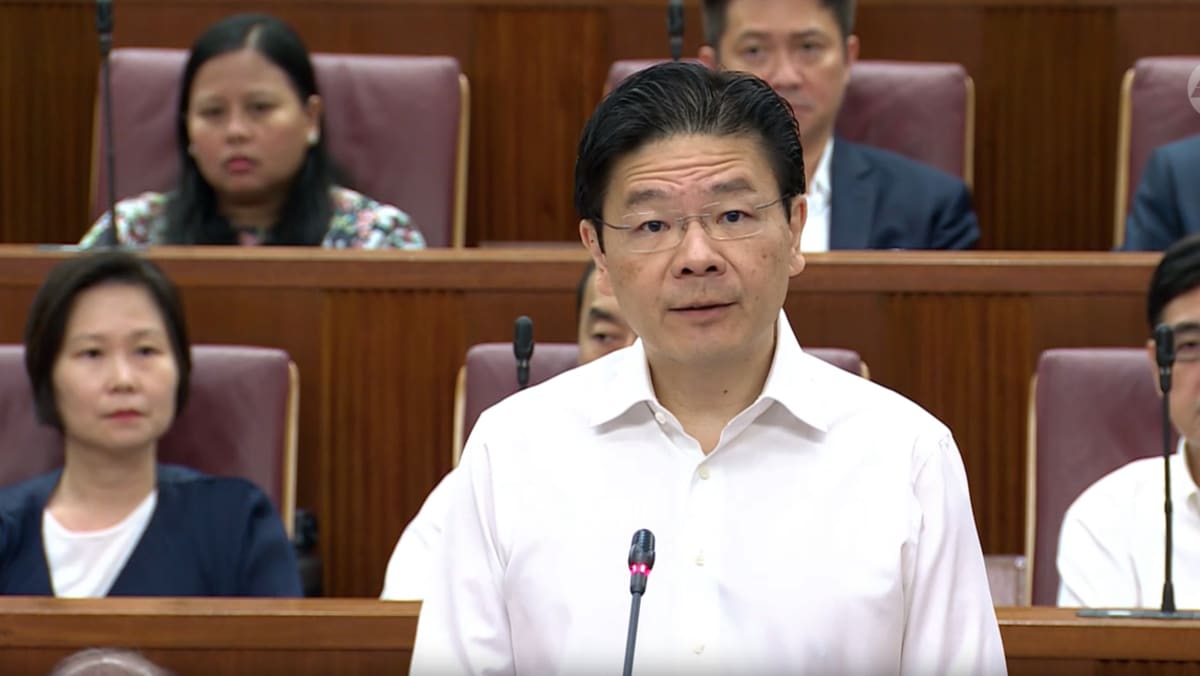

Narendra AhirwarPolice in India have arrested a man, who is accused of impersonating a British doctor, for performing surgeries that allegedly led to the death of seven patients.

Narendra Vikramaditya Yadav – also known as Dr N John Camm – worked as a cardiologist at a missionary hospital in Madhya Pradesh state.

Police accuse him of fraud, cheating and forgery and allege that the 53-year-old, who has worked as a doctor for almost two decades, faked his medical degrees.

They are also investigating allegations that he added the name of Prof John Camm, a leading cardiologist at UK’s St George Hospital, to his own to gain credibility. Mr Yadav has denied the allegations against him.

On Monday, just hours before he was arrested, he sent a legal notice of 50m rupees ($5,82,985; £4,54,969) to two dozen individuals and publishers for claiming he impersonated “some other cardiologist”.

The Mission Hospital in Damoh city, where Mr Yadav worked for a few weeks, has denied having any knowledge of his alleged fake credentials.

“Nobody suspected him of being a fake doctor. He was good at his job and acted like a big-time professor,” a hospital official told The Indian Express newspaper.

The case first came to light in February, when a child welfare committee in Damoh flagged the deaths to district officials.

“We got suspicious about his expertise and checked his credentials online and found that he had cases against him in at least three states,” claimed Deepak Tiwari, president of the district Child Welfare Committee.

An investigation found that Mr Yadav had quit his job at the hospital earlier that month and “gone missing” without explanation.

He was arrested in the city of Prayagraj in Uttar Pradesh state on Monday evening.

“The accused doctor had worked on a total of 64 cases, including 45 cases of angioplasty, which led to seven patient deaths,” the district’s police chief Shrut Kirti Somvanshi told BBC Hindi.

It’s not yet clear whether his degrees are genuine or fake, but police believe they were likely to be forged as the documents lack key details, such as a unique registration number given to each student.

BBC Hindi

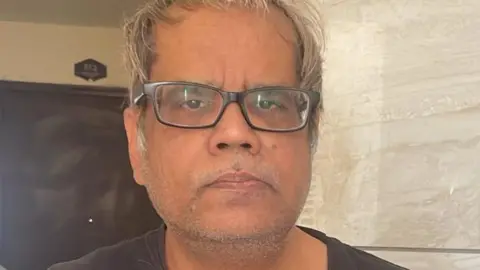

BBC HindiThis is not the first time that questions have been raised about Mr Yadav’s identity.

In a 2019 blog post, he claimed that he trained in the UK under Prof A John Camm and joined St George’s hospital in 2002 as an “Interventional Cardiologist”.

He claimed he first returned to India in 2003 to work at a leading heart hospital in Delhi and had worked in the US, Germany and Spain since then.

In one post shared in 2021, Mr Yadav wrote that he was developing a 5,000-bed John Camm Institute of Medical Sciences and Research in the western state of Rajasthan.

“The hospital is being developed under [the] leadership of Dr N John Camm, renowned Interventional Cardiologist from Germany, and will [be] spread over 100 acres of land and will have world class research and tissue labs,” he claimed.

But public records show that he registered four companies in the UK in 2018 under the name of Dr Narendra Vikramaditya Yadav, which he later got changed to Dr Narendra John Camm.

In 2023, a well-known fact-checker in India too had raised questions about his credentials after he allegedly created an X (formerly Twitter) account under the name of “Prof N John Camm”.

After some of his posts went viral, the real Prof Camm put out a statement clarifying that it was not his account and that he was being impersonated.

Police say Mr Yadav has also been at the centre of several other investigations.

In 2019, he was arrested for allegedly abducting a British doctor he had invited to work with him at a hospital in Hyderabad city.

And in 2014, India’s medical regulators had banned him for five years for “professional misconduct”, parliamentary records show.

Records show that he was also charged with fraud and cheating in 2013 in Uttar Pradesh. However, a court stayed the complaint against him.