Pundits warn of Trump policy risks

According to experts in international affairs, Thailand should be wary of the violent trade practices of US President-elect Donald Trump, who will sworn in for his second term on January 20.

Governments around the world are concerned about the effects that Mr. Trump’s risks to raise taxes on US imports have had on their economies.

Mr. Trump said the high import duties would help reduce the country’s enormous trade deficit, budget deficit, and promote investment in the country under the” America First” theme of his election campaign, which pledged to levy tariffs of 10 to 20 % on all imported goods and 60 % or more on Chinese goods.

According to experts, the Thai government and the business sector should carefully check US trade and economic policies because they may have an impact on the country’s economy and business environment.

They are also worried Mr Trump’s monetary policies could reduce US funding in Thailand, particularly in manufacturing, and slow down technology transfers, putting limits on access to advanced technology.

The authorities in Thailand were speaking with The Bangkok Post to get their opinions on how the country should make.

Price war harms development

Sineenat Sermcheep, chairman of the Asean Studies Center, Faculty of Economics of Chulalongkorn University, said Mr Trump’s monetary policies may prioritise business protectionism by imposing big tariffs to protect local business.

These actions may hurt US business partners, increase worldwide confusion, and have a negative impact on the US economy, reducing global progress, she said.

High import taxes from China and other nations could cause trade wars, stifle global supply chains, and stifle international business. For National consumers and companies who rely on imported products for their production methods, these taxes are likely to raise expenses.

Mr. Trump’s economic policies and higher tariffs pose negative risks for the Thai economy by slowing exports and dissuading FDI because trade and US foreign direct investment ( FDI) are key drivers of Thailand’s economic growth.

On trade, Ms Sineenat said the US is a big Thai export market, especially for items such as computers, electronics, and electronic appliances, and these exports may be hit straight by higher tariffs.

” However, the flood of Chinese products may increase competition in the Thai business. Because of the great tariffs that China may impose on its exports to the US, they may look for new industry, including Thailand. This fierce competitors may have an impact on local producers and stymie the recovery, according to Ms Sineenat.

She claimed that Thailand’s economy may be sluggish as FDI and international funding decline. International investors may hold off on their investment decisions until more positive information is available.

” Also, Mr Trump’s reshoring method might increase funding in the US while decreasing international funding elsewhere. This makes it more likely that less investment may be made in Thailand.

” So Thailand needs to prepare by adjusting its profitability, growth and encouraging more local assistance,’ ‘ she said.

She said Thailand needs to increase its local production capacity to be more competitive in the global market by leveraging systems and sustainable development by investing in cutting-edge developing technologies, digitalization, natural industries, and solar power. Additionally, she recommended strengthening its business environment to draw in a wide range of FDI.

These would be particularly crucial as the Trump administration attempts to cut back on US climate action goals.

Thailand also needs to diversify its economic partnerships by strengthening trade ties with other major nations to lessen its dependence on any single market. It should also firm up economic ties with economies including the European Union, Japan, South Korea, Taiwan, and the Middle East, Ms Sineenat said.

Finally, Thailand needs to encourage Asean to enhance intra-Asean trade to deepen regional integration, which would enhance economic resilience.

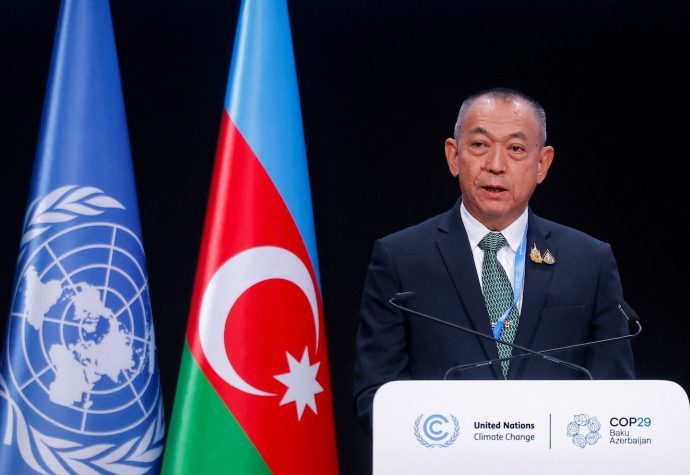

Panitan: More pressure to take regional responsibilities

More regional responsibility

Panitan Wattanayagorn, a former lecturer on international affairs at the Faculty of Political Sciences, Chulalongkorn University, says Thailand must brace for the economic impacts of a Trump-led administration, particularly regarding US-China trade tensions.

Any slowdown in China’s economy will inevitably affect Thailand, given their interconnected trade relationships, he said. Thailand may also face tougher negotiations on tariffs and trade balances, requiring strategic adaptability.

Thailand could be under more regional responsibilities under the second Trump administration, including addressing human rights issues, battling illegal fishing, and tackling human trafficking.

Such pressures might serve as leverage in trade talks, with Washington tying economic incentives to Thailand’s cooperation on these fronts, said Mr Panitan.

He thinks that the government might be able to solve some of these issues with former prime minister Thaksin Shinawatra’s influence and direct communication with US leadership.

However, Mr Panitan also cited risks related to transparency if the government relies on Mr Thaksin’s help, suggesting the former premier may benefit instead.

According to Mr. Panitan, transparency will be essential to preventing any public backlash and ensuring that any collaboration benefits Thailand as a whole.

Virot: Thailand risks losing out to neighbours

Thammasat University’s international relations professor Virot Ali emphasized the importance of Thailand’s adaptation to the rapidly-changing global economy.

He said Mr Trump’s policies, if consistent with his first term, may stimulate shifts in global trade and technology. Although stabilized oil prices and lessening strategic tensions can benefit the US, these changes could increase competition in global markets.

Thailand, with its outdated industrial framework, risks losing out to more dynamic economies like Vietnam, Malaysia, and Indonesia. He emphasized the necessity of embracing the” Fourth Industrial Revolution” by modernizing production processes and diversifying trade markets.

He warned that if Thailand didn’t adapt, it might struggle to attract investment and keep up with its regional peers.

Trump’s policies may stymie global trade, but they also offer the chance for Thailand to adjust its economic strategies. The country could reduce potential losses by boosting domestic consumption and opening new markets.

He adds that Mr. Thaksin’s prior business dealings with Mr. Trump could be a valuable diplomatic asset because they might help ease current tensions and open the door for further cooperation.

He stated that he anticipates the administration of Prime Minister Paetongtarn Shinawatra to make use of these ties to aid Thailand in overcoming economic difficulties.

Anekchai: China containment could hurt Thailand

Myanmar and Indo-Pacific

Given its close proximity to Thailand, Mr. Panitan continued to say that one area where the US might exert more pressure is Myanmar.

Although Thailand’s involvement in the South China Sea’s issues is likely to be limited, Mr. Panitan thinks Washington will anticipate greater Thai involvement in resolving the crisis there.

He predicts that the US will continue to rely on Asean alliances to counterbalance China’s influence, particularly in the South China Sea, with nations like the Philippines and Indonesia likely to be encouraged to take more active roles.

Anekchai Rueangrattanakorn, Silpakorn University’s adjunct lecturer in Political Sciences, said Mr Trump’s second victory may stem from his clear action on how to contain China’s global influence in a bid to retain America’s supremacy.

Southeast Asia may be impacted by the containment of China because the South China Sea and the Myanmar crisis have become a geopolitical hotspot.

Regarding the Myanmar crisis, Mr. Anekchai said that even though the United States hasn’t given it any priority or its strategic importance in relation to the Middle East, Washington can’t ignore it as it did in 1990-2010.

He claimed that this is because the US has finally recognized that Myanmar has not changed or given importance to democracy and human rights protection as expected since Washington imposed sanctions on the nation in response to the uprising there on August 8, 1988.

The so-called 8888 Uprising, also known as the People Power Uprising, was a series of nationwide protests, marches and riots in Myanmar ( then known as Burma ). The key events occurred on Aug 8, 1988.

According to Mr. Anekchai, this event caused Myanmar to forge strong ties with China, which affected America’s efforts to maintain its leadership and influence in Southeast Asia.

During Joe Biden’s soon-to-end administration, Washington announced a tough policy on Myanmar, which effectively cut its access to the Tatmadaw.

Mr. Anekchai said that even though the Trump administration may not be as concerned with democracy and human rights as the Biden administration, he believed Mr. Trump would need to support the anti-Tatmadaw movement while also backing the anti-Tatmadaw movement, saying that this would be the best way to keep American influence and leadership in the area.

In order to thwart Chinese influence in the region, he said, Washington may also have the impression that it wants to form a systematic alliance that promotes democracy and human rights while co-creating security and fair economic growth.

Because Myanmar has a strategic importance for China, he said,” President Trump would open the door for Myanmar and China to foster a closer bond.”