How Trump’s ‘drill, baby, drill’ pledge is affecting other countries

Environment Correspondent, BBC World Service

Getty Images

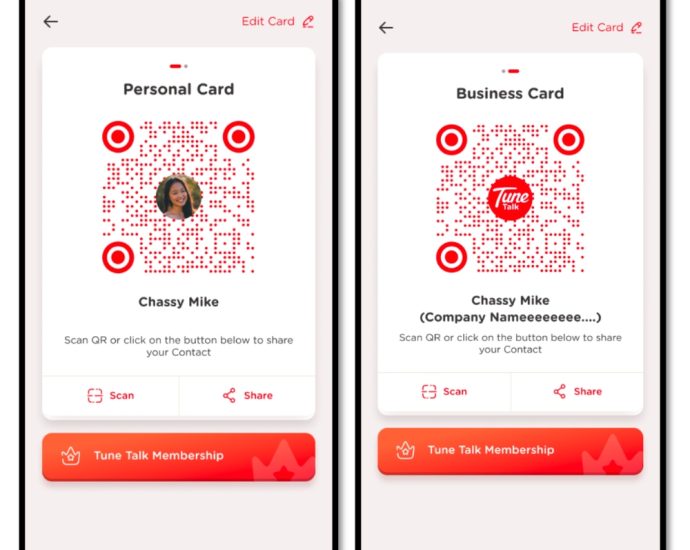

Getty ImagesThe UN climate summit in the United Arab Emirates in 2023 called for” shift away from fossil fuels.” It received praise as a significant achievement in global climate change.

Barely a year later, however, there are fears that the global commitment may be losing momentum, as the growth of clean energy transition is slowing down while burning of fossil fuels continues to rise.

And now there is US President Donald Trump’s “national energy emergency”, embracing fossil fuels and ditching clean energy policies – that has also begun to influence some countries and energy companies already.

In response to Trump’s “drill, baby, drill” slogan aimed at ramping up fossil fuel extraction, and the US notifying the UN of its withdrawal from the Paris climate agreement, Indonesia, for instance, has hinted that it may follow suit.

Getty Images

Getty Images‘ If US is not doing it, why does we?’

“If the United States does not want to comply with the international agreement, why should a country like Indonesia comply with it?” asked Hashim Djojohadikusumo, special envoy for climate change and energy of Indonesia, as reported by the country’s government-run news agency Antara.

Indonesia has remained among the world’s top ten emitters for many years.

” Indonesia produces three lots of carbon]per people a year ] while the US produces 13 plenty”, he asked at the ESG Sustainable Forum 2025 in Jakarta on 31 January.

” Yes, we are the people being ordered to shut down our energy plants,” we are told. But, where is the sense of justice around”?

Nithi Nesadurai, chairman with Climate Action Network Southeast Asia, said the impulses from her place were concerning.

She claimed that increasing the “richest nation and the largest oil producer in the world” gives another states” an easy reason to increase their personal- which they are already doing” by increasing its production.

In South Africa, Africa’s biggest sector and a big carbon emitter, a$ 8.5bn foreign-aided change initiative from the coal industry was already moving at a snail’s pace, and now there are concerns that it may obtain derailed more.

Wikus Kruger, director of Power Futures Lab at the University of Cape Town, said there was a “possibility” that decommissioning of old coal-fired power stations would be “further delayed”.

However, he claimed that the clean energy sector was expected to grow even though there was some “walk back” from the transition to renewables.

Getty Images

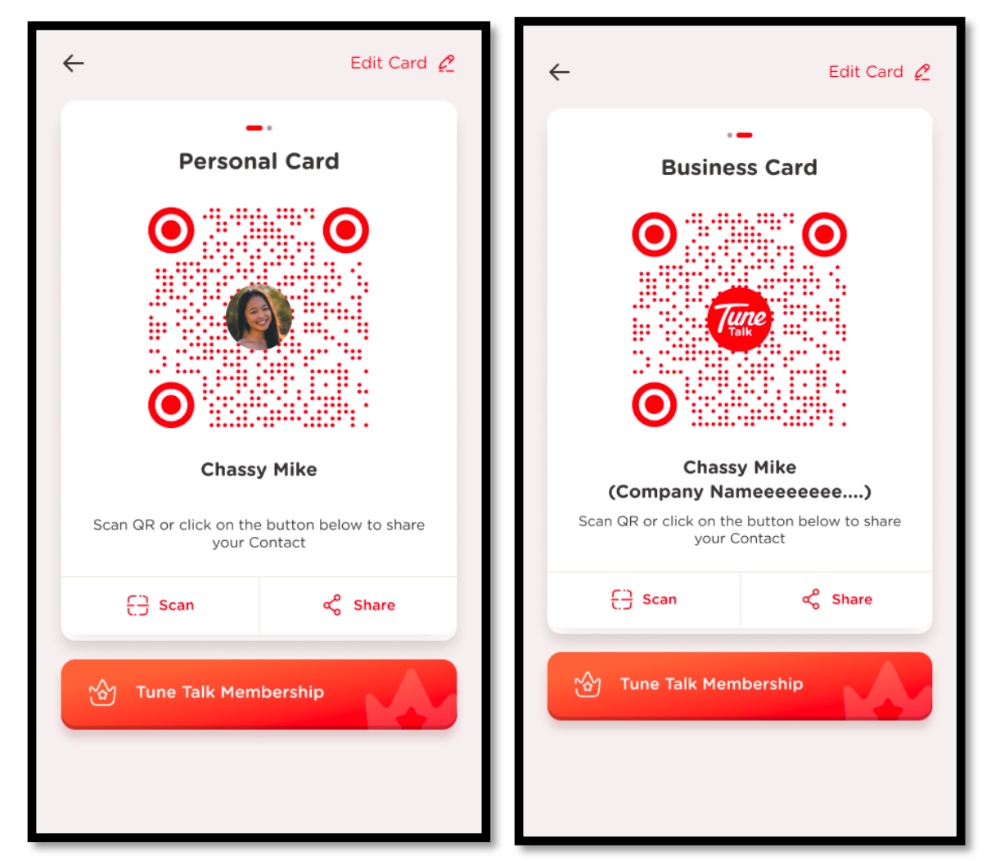

Getty ImagesArgentina withdrew its negotiators from the COP29 climate meeting in Baku last November, days after Trump won the US presidency. Since Trump’s announcement to withdraw from the Paris Agreement of 2015, which supports global efforts to combat climate change, has since followed suit.

The Argentine Association of Environmental Lawyers ‘ president, Enrique Viale, told the BBC,” We now anticipate that our oil and gas production will increase.”

” President Milei has indicated that he intends to withdraw from the Paris Agreement and that environmental protection is a part of the woke agenda,” Milei said.

Meanwhile, energy giant Equinor has just announced it is halving investment in renewable energy over the next two years while increasing oil and gas production, and another oil major, BP, is expected to make a similar announcement soon.

Getty Images

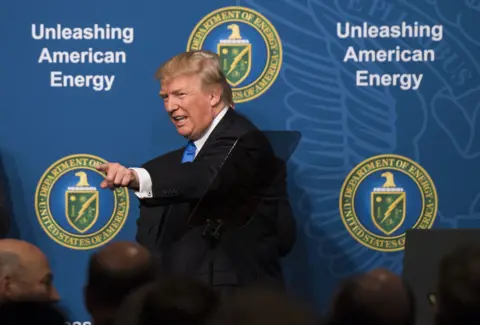

Getty Images” American energy all over the world”

Trump has not just said “drill, baby, drill” but also:” We will export American energy all over the world”.

Potential buyers from abroad are already lining up.

India and the US have agreed to significantly increase the supply of American oil and gas to the Indian market.

At the end of Indian Prime Minister Narendra Modi’s US visit on 14 February, the two countries issued a joint statement that “reaffirmed” the US would be “a leading supplier of crude oil and petroleum products and liquified natural gas to India”.

A few days after Trump’s inauguration, South Korea, the world’s third largest liquified natural gas importer, has hinted its intention to buy more American oil and gas aimed at reducing a trade surplus with the US and improving energy security, international media have reported from Seoul.

Officials with Japan’s largest power generator, JERA, have told Reuters they too want to increase purchases of liquified natural gas from the US to diversify supply, as it currently imports half of it from the Asia-Pacific region.

The global energy transition may be slowed, according to Lorne Stockman, research director with Oil Change International, a research and advocacy organization for transition to clean energy.” There is definitely a threat that if the US seeks to flood markets with cheap fossil fuels, or to bully countries into buying more of its fossil fuels, or both, the world energy transition may be slowed.

Getty Images

Getty ImagesAccording to scientists, there can’t be any new fossil fuel extraction and there needs to be a quick reduction of carbon emissions ( roughly 45 % by 2030 from the 2019 level ) if the world is to experience a 1.5 Celsius warming increase compared to the pre-industrial era.

” The economics of energy supply are a key driver of decarbonisation”, said David Brown, director of energy transition practice at Wood Mackenzie, a global energy think-tank.

Natural gas and liquids production are supported by the US energy sector’s abundance of resources. By contrast, import-dependent economies such as China, India, and those in Southeast Asia have a dramatic economic incentive to decarbonise sources of energy”.

Global energy transition investment surpassed $2tn for the first time last year but studies have also shown that the growth of clean energy transition has markedly slowed in recent years, while many major banks continue to finance fossil fuels.