On a China-built train from Mombasa to Nairobi

Having spent the last five weeks in East Africa after a long hiatus, I sensed that Kenyans are more confident than at any time since achieving independence in 1963 of their ability to attract reliable partners as the country moves ahead in its quest for long-term economic growth. In this connection, the development of infrastructure has been a top priority for successive Kenyan governments.

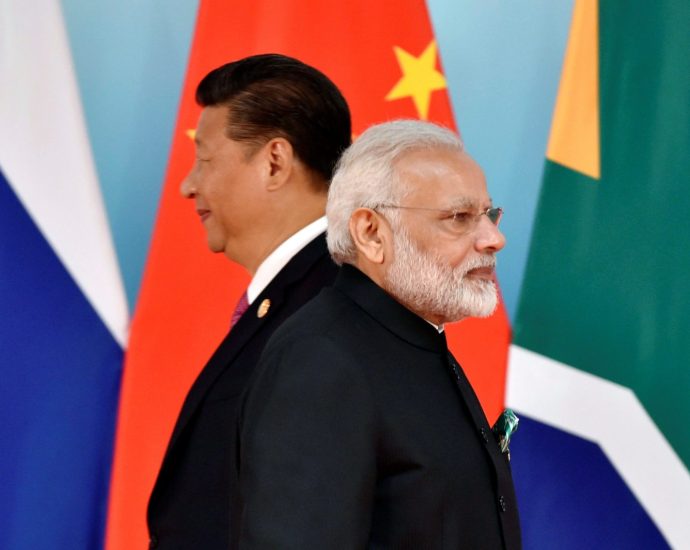

Among Kenya’s potential international development partners are its traditional ones – the United Kingdom, the European Union, and the United States – and/or the newcomers – BRICS members Brazil, China, India, Russia and South Africa, among others.

In Nairobi and Mombasa, a sense of strategic autonomy is palpable.

If any of Kenya’s traditional development partners were to offer Nairobi a deal that is economically uncompetitive, vulnerable to extraterritorial sanctions or unacceptable for ideological reasons, or because it would offend the cultural sensibilities of the people, then Kenya would likely get up from the negotiating table and go elsewhere. It has options.

Across Africa, the picture is much the same.

What’s more, more and more African leaders recognize the predatory, velociraptor-like nature of neoliberal economic theory, which functions as a highly sophisticated wealth transfer mechanism disguised as the false god of perpetual progress and prosperity for all.

Africa’s new strategic autonomy is evidenced not only by the growing number of projects funded by non-Western sources but by increasing calls for more of the same across the continent.

Africans’ emerging ability to pick and choose their development partners is driving some Western leaders bonkers. Witness this remark uttered this month in Nigeria by UK Foreign Secretary James Cleverly: “We are living through an era when the tectonic plates of world politics are shifting decisively. And a battle of ideas is taking place once again. This time, its focus is on the nature and the future of the international order.”

These words are no mere “talking points.” They come from the gut and evince an undertone of something like panic.

Clean, comfortable and on time

These thoughts about Africa’s emerging strategic autonomy raced through my head as Kenya’s crack, Chinese-built Standard Gauge Railway sent me hurtling from Mombasa, East Africa’s largest port, to the bustling capital Nairobi. Coach class, with ingratiating, uniformed waiters beckoning from their food-laden trollies, surpassed Amtrak’s equivalent from Washington to New York.

The train was clean, comfortable, air-conditioned and on time.

In Nairobi, I spoke at length with several highly accomplished civil engineers with decades of professional experience in Kenya about the Nairobi-Mombasa express. They unequivocally stated that the China Road and Bridge Corporation, the principal Chinese contractor, had done a “very good job” from an engineering, planning, design, and construction perspective.

For its part, the Wilson Center recently noted: “The [Kenyan Standard Gauge Railway] has had some important successes. Trains run faster than the former [British-built] railway or road traffic, and its passenger services are popular. The amount of freight carried by the SGR has risen significantly since commercial operations began, and it has helped to decongest port operations, speed freight transportation, and enhance cargo security.”

While there have been concerns about the railway’s cost-effectiveness, it appears to be on the verge of profitability. According to Dhahabu Kenya, as of year-end 2022, its revenues increased 6.4% to 15.3 billion Kenyan shillings (US$116.4 million), which compares to costs of “about 18 billion shillings ($136.98 million) to operate the passenger and cargo trains.”

If accurate, the SGR has almost broken even, which is remarkable, as many mega-projects across the globe – according to the Cato Institute (“Megaprojects: Over Budget, Over Times, Over and Over”) – are money-losing propositions.

Caesar Mwangi, the dean of Strathmore University Business School in Nairobi, told me: “if London, Paris or Brussels wants to compete successfully against China, or any of the BRICS, in Africa, then Western governments must get serious about public-private partnerships.

“Western governments need to tone down their claims of exceptionality on technical matters, stop blaming others for shoddy work when it’s not, put forth reasonable proposals, and gin up money on acceptable terms with realistic timetables. Otherwise, China, Turkey and India will continue to take the lion’s share of projects.”

This helps explain why The Taipei Times, citing the Center for Global Development’s 2022 study, reported that “China’s development banks provided $23 billion in financing for infrastructure projects in sub-Saharan Africa from 2007 to 2020, more than double the amount lent by such banks in the US, Germany, Japan and France combined.”

Lamentably, the West has failed to advance its strategic interests in Africa because most African countries have had enough of Western specialists and academics spouting off about “best practices,” “human rights,” “future prosperity” and “equity.”

Some African leaders may buy into the West’s ideological agenda out of conviction or because they are simply corrupt, but the majority will not sign up for overpriced projects with unrealistic timelines and unacceptable conditions no matter how slick the PR presentation.

Deeper problem afflicts Western interests in Africa

Over the past 20 years, neoliberal economic theory – the belief that financial markets are (and should be) the driving force in socio-economic decision-making, and that they will, at some undisclosed point in the future, bring about equitable development – has devastated the poor and much of the middle class across the globe.

Neoliberalism has helped undermine societal cohesion and pitted one community against another, wiping out traditions, degrading the environment, and ruining cultural identities in the process.

Mwangi emphasizes that “neoliberalism as an economic model has not served the common good of societies across Africa. Rather, it has delivered greater inequality and social insecurity. Its claim of reducing poverty is not supported by the evidence.”

In the case of Kenya, The Daily Nation reported in June that “nationally, about 30% of [Kenyans] are unable to meet their food needs, with more rural than urban dwellers living in hunger.” In 2016, 16.8 million Kenyans were living in a state of poverty versus 19.2 million in 2022, an increase of more than 14%.

Other African states have experienced a similar deterioration of living standards over the same period, and the blame cannot be pinned strictly on Covid.

The United States also has geopolitical headaches of its own making.

Many of the businessmen I met in East Africa (though certainly not all) expressed deep frustration with US diplomatic outreach over the past several years. One described it as “little more than a sales pitch delivered by a failing commercial enterprise selling third-rate products and overpriced ideas that smack of a disguised form of neocolonialism.”

What’s more, Africans increasingly understand that just as the June 2021 US-led “Build Back Better World” (B3W) infrastructure initiative turned out to be a flop, so, in all likelihood, will the Partnership for Global Infrastructure and Investment as codified in the G7 Hiroshima Leaders’ Communiqué (May 20, 2023). The failure of the domestic version of B3W in the United States is well known in Africa.

For this and other reasons, the West’s claim to be Africa’s development partner of choice has worn thin. Across Africa, leaders are increasingly holding Britain and France at arm’s length. Pretoria, Algiers and Bamako, for example, are in no mood to be lectured by their former colonial overlords.

The countries of the Sahel have all but booted the French out.

At the 15th BRICS Summit in South Africa (August 22-24), heads of state are discussing new membership criteria, new funding mechanisms, new infrastructure projects and a new currency – as the West looks on in horror as multipolarity gains momentum.

More than 20 countries have formally applied to join BRICS, including Argentina, Egypt, Ethiopia, Indonesia, Iran, Saudi Arabia and United Arab Emirates. Many more have expressed an interest.

The Nairobi-Mombasa express and other infrastructure projects across the continent show that Africans have options. They are no longer dependent on their former colonial patrons for technical or financial support because they are increasingly able to look elsewhere.

If the West wants to remain relevant in Africa, it must compete for African business and find new ways to peddle its influence in a world growing rapidly more multipolar. It must deal with Africans as equals, ditch any lingering colonial attitudes of superiority, and delink programming for economic development from dogmas and doctrines of an ideological nature.

The countries assembling at the 15th BRICS Summit in Africa this month are not bluffing about gaining strategic autonomy in international relations. When in East Africa, I recommend taking the Nairobi-Mombasa express to understand that Kenya’s self-confidence in development matters is real.