Remittance to China through non-specified channels remain suspended for six more months

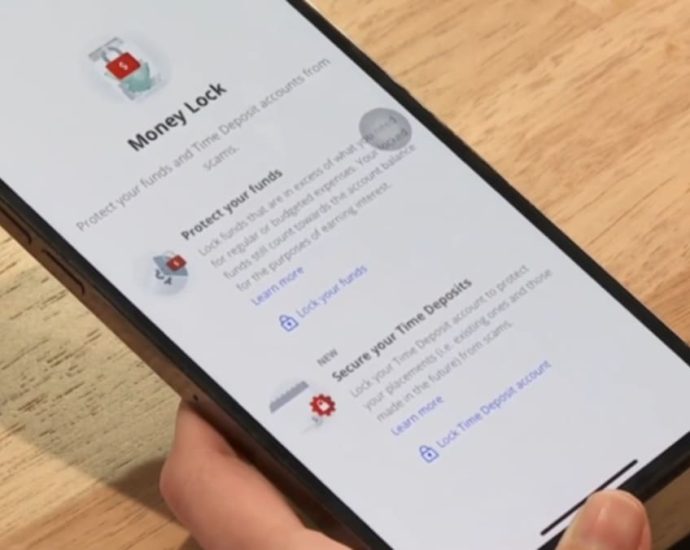

Remittance companies occasionally use outside third-party officials to complete the transfer from Singapore to China in order to keep transaction prices low for consumers, according to MAS in a media release last December.

The majority of the day, the funds sent through these programs are safely deposited in the recipients ‘ Chinese bank accounts.

” But, in recent months, for a very small percentage of such payments, the monies received in recipients ‘ bank accounts have been frozen by the PRC law enforcement agencies”, said MAS, adding that it was unclear , why those funds were frozen.

However, the Chinese Embassy did point out that a notice was posted on October 24th, last season, advising Chinese nationals in Singapore to employ formal banking channels to send money to China.

Singapore’s Foreign Affairs Ministry has also engaged the Chinese ambassador in Singapore on numerous occasions to discuss the situation, raising concerns about the impact it might have on remitters there and how remitters might be able to persuade Chinese authorities to restart their funds and accounts.

The Singapore authorities also raised the issue with the Chinese international affairs department, and the Singapore embassy in Beijing even raised the issue with its Chinese rivals there.

MAS and the officers held a consultation period for those whose money was impacted in December. Additionally, three payment companies, as well as representatives from the Chinese Embassy in Singapore, were present.