Chinaâs great bond market opening leap forward

Beijing regulators are leaning into a seven-week rally in China’s sovereign bond market by widening access to onshore interest-rate swaps. Yet what sounds like a rather technical turn of the screw is a huge and timely reform win for institutional investors keen on trading Asia’s biggest economy.

“Timely,” because it coincides with Group of Seven (G7) members heading to Hiroshima, Japan to contain any number of financial troubles. They include runaway inflation, failing Western banks, the specter of a US default and desperate attempts to woo Global South countries.

In China, though, the vibe is more about opening a recovering financial system to global investors hungry for growth and higher-yielding assets as the post-Covid-19 trade gains momentum.

Here, the new “Swap Connect” program between China and Hong Kong is wisely timed. It opens the way for overseas funds to access derivatives vital to hedging bets in China’s bond market. The dearth of hedging tools has long turned off the biggest of the big money.

The swap scheme will enable punters to deal in key money-market rates tied closely to People’s Bank of China (PBoC) policies. This will likely deepen institutional investors’ involvement in China markets, building on the existing Bond Connect plan. The move dovetails with a powerful bond rally driven by expectations that the central bank will add more liquidity this year.

For Chinese leader Xi Jinping, Swap Connect helps fulfill a pledge to open mainland capital markets to international funds. It turns the page, to some extent, from the regulatory crackdowns of 2020 and 2021. It also reminds top investment banks that geopolitical turbulence between Beijing and Washington isn’t getting in the way of market reforms.

The program “will be a huge leap forward in developing the domestic derivatives and bond markets,” says Rose Zhu, chief China country officer at Deutsche Bank, which Beijing named as a key market maker for Swap Connect.

“Leveraging our cross-border strengths, we look forward to playing an active role in helping international investors get a head start via Swap Connect” and “helping accelerate the opening up of China’s financial markets and RMB internationalization.”

Monish Tahilramani, head of Asia Pacific markets at HSBC, says the hedging tool marks “an important complement to Bond Connect and a positive sign that onshore markets continue to open up.”

It’s not that simple, of course. Nicolas Aguzin, CEO of Hong Kong Exchanges and Clearing Limited, is absolutely right to call Swap Connect “the latest chapter in our ‘connect’ story.”

The reference here is to Xi’s habit of connecting markets to Hong Kong’s first-world system to increase China’s financial street cred. First it was Stock Connect, then Bond Connect. Now, Swap Connect rounds out Xi’s regional ambitions.

Yet the question is whether this time financial reforms will keep pace with rising investor optimism? Or will this be another episode of China over-promising and under-delivering?

New Premier Li Qiang has signaled the former. Since March, when he formally took over as Xi’s No 2, Li seems to have hit the brakes on the tech company crackdown that in recent years has sent foreign capital fleeing.

In March, for example, Li said that “for a period of time last year, there were some incorrect discussions and comments in the society, which made some private entrepreneurs feel worried.

“From a new starting point, we will create a market-oriented, legalized and internationalized business environment, treat enterprises of all types of ownership equally, protect the property rights of enterprises and the rights and interests of entrepreneurs.”

The plan, Li explained, is to “promote fair competition among various business entities and support the development and growth of private enterprises” and to “shore up” investor confidence.

Hence the importance of Swap Connect. It’s equally important, though, that Li’s reform team ensures that China follows through this time.

Earlier episodes of market opening saw Xi’s government putting the proverbial cart before the horse. In 2014, for example, the Stock Connect program lured tidal waves of capital but steps lagged to increase transparency, level playing fields and reduce limits on yuan convertibility.

The same with Bond Connect in 2017. Regulatory upgrades lagged as capital zoomed in. In between there, in 2016, China gained access to the International Monetary Fund’s “special drawing-rights” program.

That came after years of lobbying by former PBoC Governor Zhou Xiaochuan. The yuan’s inclusion in the IMF’s club of reserve currencies along with the dollar, euro, yen and the pound signaled China was achieving prime-time status.

Unfortunately, seven years on, the yuan still isn’t fully convertible. That’s limiting the yuan’s appeal as a rival to the dollar — even as the US government does its worst to damage the reserve currency’s credibility.

Part of the problem, though, is what this state of affairs says about Xi’s first 10 years in power: China doesn’t trust markets to decide the yuan’s value. If so, the thinking goes, why would investors trust Team Xi?

Still, the Swap Connect narrative is a powerful one if Li can reinvigorate the reform process as Xi’s third term heats up. It’s a “northbound” trading system enabling dealing in mainland yuan-denominated contracts with a net cap of 20 billion yuan (US$2.9 billion) per day. Next, a “southbound” channel might be added from China to Hong Kong.

As Hong Kong’s Chief Executive John Lee said this week: “The new scheme will strengthen Hong Kong’s role as an offshore yuan trading center and as a risk-management center.”

Julia Leung, CEO of the Securities and Futures Commission, added that Swap Connect “deepens connectivity between mainland and overseas capital markets and bolsters Hong Kong’s position as a risk-management hub.”

In a note to clients, HSBC argued that “compared to offshore interest-rate swaps, onshore interest-rate swaps are less volatile and correlate better with onshore bond yields. This makes onshore interest rate swaps more efficient interest rate hedges of onshore bonds. The other benefit of entering the onshore swap market is having access to SHIBOR interest rate swaps, which are rarely quoted in the offshore market.”

HSBC analyst Candy Ho notes that “Swap Connect has immediate value for global investors and is a timely move in China’s ongoing commitment to its markets opening up.” She adds it will make “participating in the world’s second-largest fixed-income market more attractive by introducing a central clearing model and providing better access to the deep onshore liquidity in financial derivatives markets.”

A deep and vibrant bond market is needed to finance everything from the growth of the private sector to adjust to an aging and shrinking population to funding bigger social safety nets so China can pivot to a consumption-led growth model. Beijing is expected to rack up a record 3.88 trillion yuan ($557 billion) deficit this year.

A more resilient debt market would help PBoC Governor Yi Gang’s team gain greater traction when it tweaks monetary policy. The odds of more assertive PBoC easing may have increased Tuesday with news that retail sales, industrial output and fixed investment expanded much less than hoped in April. The youth unemployment rate meanwhile hit a record high of 20.4%.

“China’s activity indicators missed expectations by a wide margin even with a favorable base,” says economist Xiangrong Yu at Citigroup. “With China now out of the sweet spot of reopening, hope of further sentiment repair could be diminishing in the absence of decisive government actions.”

Such trends may be more positive for Chinese bonds than stocks in the short-to-medium term. And here, news that Beijing is stepping up efforts to develop a more developed bond market to provide the economy with a bigger shock absorber if global markets go awry will bolster confidence. The ability to hedge is an important step in that direction.

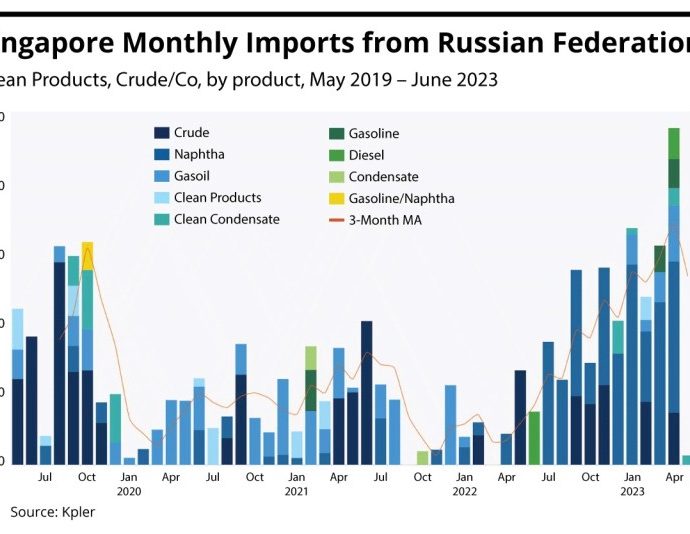

The new risk-hedging instrument is being introduced just as rising US interest rates put foreign outflow pressure on China’s bond market, with overseas funds cutting their holdings by $169 billion over the past five quarters. At the same time, global investors still own 10 times as many of the securities as they did a decade ago.

Before May 15, Beijing only allowed foreign funds to access onshore interest-rate swaps via the China Interbank Bond Market framework. Swap Connect vastly broadens access at a moment when G7 members are giving investors reasons to seek opportunities elsewhere – not least China.

Follow William Pesek on Twitter at @WilliamPesek