Hong Kong exports rebound despite Sino-US trade war – Asia Times

After a considerable year-on-year reduction in the same period last year, Hong Kong’s exports and imports rebounded in the first third of this year.

The logistics hub saw its exports rise 11.9 % to HK$ 1.06 trillion ( US$ 135 billion ) in the first three months of this year from a year ago, according to the Census and Statistics Department. Its imports surged 8 % to HK$ 1.14 trillion for the same time.  ,

Neither figure has yet returned to the levels of 2021 and 2022 as the city’s exports and imports fell 17.7 % and 12.7 %, respectively, in the first quarter of last year.

A spokesperson for the Hong Kong government claimed that while exports to the United States and Europe remained on decline, a rise in exports to land China contributed to the rise in total imports.  ,

He claimed that despite improving physical desire, high global geopolitical tensions and limited cash in the financial market will continue to have a negative impact on Hong Kong’s imports.  ,

Michael Li, sin- chairman of the Hong Kong Chinese Importers ‘ &, Exporters ‘ Association, said the damaging factors seen in the first quarter of 2023, including the Ukrainian- Soviet war, the US- China social fight and the US rate hike, are fading out.

He claimed that, unless some fresh negative aspects arise, Hong Kong’s exports have returned to normal during the first quarter of this year and are likely to increase by 8 to 12 % for the entire year starting in 2023.  ,

He claimed that the West’s attempt to advance the so-called de-Sinization of the global supply chain failed. He claimed that there were many overseas buyers at this year’s Canton Fair, a trade show held annually in Guangzhou.  ,

According to Chinese press, there were more foreigners attending this year’s Canton Fair, particularly those from Russia, the Middle East, and South America.  ,

Some foreign buyers are drawn to China’s low prices of digital goods and electric vehicles, while some US importers prefer to purchase today because they worry that US-China trade relations will crumble ahead of the US national elections in November.

As Donald Trump threatens to increase tariffs on Chinese goods, according to Ryan Lam, head of research at Shanghai Commercial Bank, some companies are putting their China development plans on hold. However, Lam still anticipated that due to the country’s strong demand for phones and electronic components in foreign countries, its exports would increase by 8 to 9 % this year from 2023.  ,

Trade with Russia ,

The US and the European Union are increasingly concerned about Hong Kong’s package of northern chips and digital goods to Russia.

In a statement released in April 2023, Nikkei claimed that between February 24 and the close of the year, cards produced by Intel and Advanced Micro Devices from Hong Kong and Russia amounted to at least US$ 74 million. In 2021, it stated that the number would only be US$ 51 million.  ,

In December, the Washington-based analytical non-profit C4ADS reported that Hong Kong and Hong Kong were the main ports of high-end bits to Russia. According to the statement, Hong Kong has already become the world’s main port for cards entering Russia.  ,  ,

The US Commerce Department has previously slapped a number of Hong Kong and Foreign firms that had shipped US high-end technology and cards to Russia over the past two years.  ,

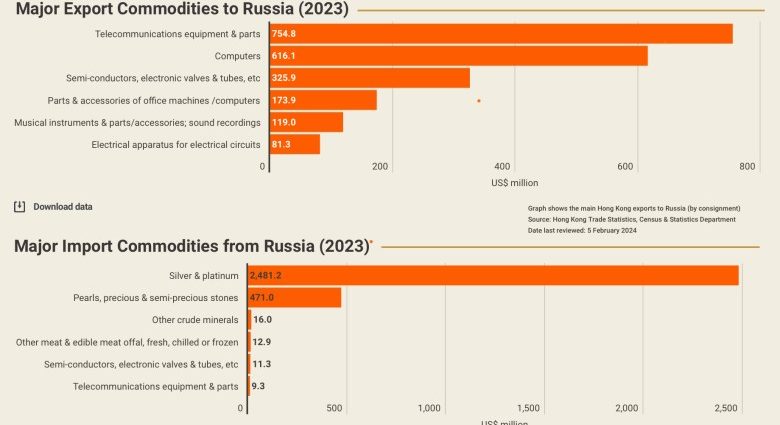

According to a study released by the Hong Kong Trade Development Council, Hong Kong’s exports to Russia increased 11.2 % to US$ 2.66 billion last year from$ 2.62 billion in 2022, accounting for about 2 % of the city’s total imports.  ,  ,  ,

The exported goods include communications equipment and parts, computers, semiconductors, electrical valve and tubes.  ,

For the same time, Hong Kong’s exports from Russia surged 118 % to US$ 3.06 billion, 96 % of which were imports of gold and silver items, gems and precious and big- precious stones.  ,

Financial atomic weapons

US Secretary of State Antony Blinken expressed concern about China’s aid for Russia’s military during a meet with Chinese President Xi Jinping on Friday in Beijing.  ,

He claimed that China was providing a range of products, including “dual-use items that Moscow is using to ramp up its defense business bottom,” including microelectronics, chemicals for munitions and jet propellants, and “dual-use items that Moscow is using to ramp up its defence industrial bottom.”

Normal trade between the two countries should n’t be halted or restricted, according to Chinese officials, as long as China does not provide any weapons to Russia.

Janet Yellen, the US Treasury Secretary, warned Beijing officials on April 8 that sanctions could be applied to Chinese banks that support Russia in the wake of its conflict in Ukraine. Because they can forcefully hit the sanctioned banks, these curbs are referred to by the media as “financial nuclear bombs.”  ,

Russian state newspaper Izvestia reported on April 12 that Chinese banks, including Bank of China and Great Wall West China Bank, have recently started preventing payments from Russia, particularly for crucial electronic components like laptops, storage, and servers.  ,

On April 22, a US official told Reuters that the country has no concrete plans to impose sanctions on Chinese banks.

New economic world order

Chinese exporters can only receive payment in renminbi from Russia through either underground banks or a cross-border payment system called Multilines Corp., according to a Chinese columnist by the name of Hong in an article published last month.

He asserts that Multilines is a trustworthy business capable of accepting payments from Russian companies that have been sanctioned.  ,

According to Multilines ‘ website, the company offers full- fledged services that cover the buying, selling, importing, exporting and hedging of precious metals. It has offices in China’s Chongqing and Hong Kong.  ,

Ali Hussnain, chairman and chief executive of Multilines, studied marketing at the Lahore University of Management Sciences in Pakistan. He is also the chairman of the Economic &, Business Advisory Council of the Pakistan House, a think tank based in Islamabad and Bronshoj, Denmark.  ,

Muhammad Athar Javed, the founder of Pakistan House, asked Russian President Vladimir Putin in a plenary session of the Valdai International Discussion Club in Moscow in October whether Russia could use its natural resources to create a new economic world order.  ,

Putin claimed that China’s Belt and Road Initiative and the Eurasian Economic Community can work together to overthrow the US dollar’s hold on the global stage.  ,

Read: Blinken to China to fuss about support for Russia

, Follow Jeff Pao on X:  , @jeffpao3