Why stock markets are no longer reflecting the economy – Asia Times

Lately, economists have been making a reasonably convincing case as to why stock markets are supposed to be suffering a setback, and yet continue to rise.

Even in Japan, a country mired in recession, stocks are trading at levels not seen for a long time.

Some would say that it is all due to a super-optimistic outlook; for example in the case of the US, the uptrends in the S&P 500, Nasdaq etc are due to an expected cut in interest rates.

Meanwhile, in Japan, the good momentum is explained by the conitunity of ultra-loose monetary policy and the regulator’s reluctance to end Abenomics.

But here’s the catch: Everyone seems to be turning a blind eye to the mountain of problems piling up. And we’re not just talking about regional banks and commercial real estate.

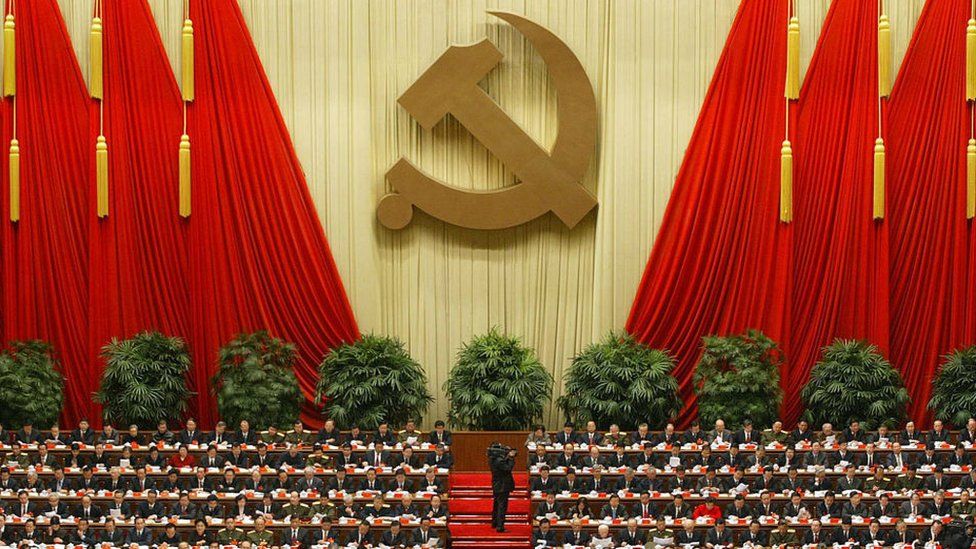

We’re talking about colossal debt bubbles that will never be paid off. Another risk is rising tensions, not only in armed conflicts but also in trade disputes.

For instance, US presidential hopeful Donald Trump is waving the tariff stick against European and Chinese products. Obviously, such protectionism will not be conducive to economic growth.

Why else are stocks skyrocketing?

First, investors are afraid they’ll miss out on this historic rally. It’s all going well now, so why not keep the party going?

Then there’s the feeling that, for many, stocks aren’t just about making money; they’re a kind of shield against geopolitical uncertainties and inflation.

And the bigger the company, the more trust folks seem to have in it. That has made everyone forget about things like fair value.

The third factor is in the head: Thanks to the US Federal Reserve bailing out regional banks last year, many people are convinced that Big Brother will come to the rescue if things go wrong.

But here is the risky part: Spending all the ammunition now means that regulators will not have much left to intervene later (one only has to look at public debt and its servicing costs to understand why).

So when will a market crash become a reality?

For the tide to turn, one of two things has to happen: Either the money flooding the market dries up (which seems rather unlikely given the $6 trillion in money markets), or curveballs start coming our way.

For example, if US regional banks fail left and right, it will create a domino effect that will eventually spill over to Europe and even Asia. But for that to happen, government support would have to disappear.

What we see in the market does not reflect the state of the economy. And the worst thing is that the positivity is based not so much on hopes for a bright future as on believing in the help of regulators.

But this is a slowly ticking time bomb that will eventually explode, and the longer we wait, the greater the damage will be.