Trump’s tariff onslaught headed for self-defeating recession – Asia Times

It takes a truly incredible impact to drive the global market into crisis. Did Donald Trump’s bilateral tax strategy simply shove the earth into one?

Eastern policymakers can’t help but fear the worst as the area bears the overwhelming weight of the US president’s worldwide revenge tour.

Liberation Day? More like” Obliteration Day”, quips Neil Dutta, economist at Renaissance Macro Research, as about US$ 2.5 trillion was erased from the S&, P 500 Index on Thursday ( April 3 ) alone. Now, economists at JPMorgan worry a Trump downturn is likely.

” This affect alone could get the business perilously close to slipping into crisis”, says JPMorgan analyst Michael Feroli. ” And this is before accounting for the more visits to total imports and to purchase spending”.

Feroli thinks Trump’s tariffs will add as much as 1.5 % to already rising prices this year, using the core personal consumption expenditures (PCE ) index, the Federal Reserve’s preferred inflation gauge. The taxes also did bang individual wages and consumer investing in the US, he predicts.

Any large dispositions in the US would resonate Asia’s method almost instantaneously. But Trump’s about straight focus on Asia is because self-defeating as it is harmful.

Trump’s concerns are very much on screen. China, for example, now faces a 54 % tax on all supplies to the US. On April 2, Trump slapped an additional 34 % tariff on top of an earlier 20 %. Vietnam, however, faces a 46 % price.

Vietnam’s place in the line of flames stems from the mistakes of the Trump 1.0 time. Most of the work that Trump thought had tilt from China to the US went to Vietnam otherwise. It was the China solution of choice for firms from American Eagle to Deckers to Hasbro to Nike to Wayfair.

Trinh Nguyen, top analyst at Natixis, speaks for many when she calls the income “devastating for Vietnam”. As such, Trump may have just raised the prices of clothing, furniture and toys manufacturers everyday. Cost hikes for customers around the globe are all but certain.

Like some developing Asian economies, Vietnam is far more probable to communicate than fight. ” Vietnam is extremely unlikely to observe Canada or Europe in applying mutual taxes. At present, it imports to some US products to establish any real pain”, says Craig Martin, president of Dynam Capital.

Japan and South Korea got off easier with tariffs of 24 % and 25 %, respectively. But without moves by Tokyo and Seoul to placate Trump, it’s unclear how Asia’s No 2 and No. 4 economies avoid bigger levies.

The question now is whether Trump’s truly epic shock causes a catastrophic global downturn. There have been two such events since the 1990s: the 2008-09 global financial crisis and the Covid-19 pandemic. Though the 1997 Asian financial crisis came close, it didn’t send the West into a tailspin.

This Trump 2.0 assault on the global trading system could indeed be the third such economic earthquake in 17 years – and an inflection point for the global financial system.

If these actions are “implemented, the effective US tariff rate would be higher than the Smoot-Hawley Act rate”, says Priyanka Kishore, economist and founder of consultancy Asia Decoded. ” The estimates range between 26 %-29 % compared to around 20 % in the 1930s”.

This, she notes,” challenges our view of resilient US growth this year. While we expected the Trump administration to act swiftly on tariffs, the scale and scope have exceeded our expectations. With heightened policy uncertainty and rising downside risks to investments, we now anticipate US growth to falter in the coming months”.

Part of that problem – and the disorientation – is that the logic behind it is completely nonsensical.

” If a 9th grader in high school presented this tariff chart to a teacher in a basic economics class, the teacher would laugh and say sit down and work on the assignment”, says Dan Ives, an analyst at Wedbush Securities.

Jeffries analyst W Brad Bechtel adds that “our textbooks tell us that tariffs are inflationary if the currency market does not adjust to offset. The dollar dropping 2 % amid the addition of tariffs around the world on US imported goods is very inflationary“.

Kevin Thozet, an investment committee member at Carmignac, notes that” this is the US economy flirting with recession this year and inflation reaccelerating. And this is before we get the next wave of sectoral tariffs, which Trump mentioned again on chips, pharmaceuticals, copper, timber and shipping services”.

Analysts are counting the ways that Trump’s tariffs will backfire. In 2024, the US exported$ 2.1 trillion in goods and$ 1.1 trillion in services.

If his taxes on imports send other top economies into recession or even crisis, the fallout for US growth could be devastating. And that’s even before America’s biggest trading partners hit back with retaliatory tariffs.

” This is a game-changer for the global economy”, says Fitch Ratings economist Olu Sonola. ” Many countries will likely end up in a recession”.

Japan, for example, may seem to have gotten off easy relative to China. But the 25 % tax Trump slapped on all imports of automobiles and car parts already has economists upping the odds of Japanese stagflation.

It’s not just Japan facing a scenario where growth flatlines and inflation accelerates, though. Stagflation scenarios now stalk the US as well.

” An increasing probability of stagflation risk in the US may see further narrowing of the two-year sovereign yield premium spread between US Treasuries and Japanese government bonds”, says Kelvin Wong, senior market analyst at brokerage OANDA.

Wong adds that recent policy shifts” suggest a rising risk of stagflation in the US economy due to uncertainties in growth prospects and the cost of living, which are exacerbated by the current US White House’s erratic and aggressive trade tariff policy”.

China, though, is grappling with deflationary pressures. Trump turning the screws tighter on China could send mainland prices even lower.

The latest US tariffs “limit China’s ability to rely on stimulus and raise long-term export costs”, says Lauren Gloudeman, an analyst at Eurasia Group. ” The usual playbook of domestic stimulus will be constrained. More spending will risk inflating local government debt while deeper rate cuts could hurt banks. Beijing will opt for central government-led infrastructure investment”.

Beijing has been preparing exporters through low-cost financing and tax rebates. ” But”, Gloudeman says,” the removal of the de minimis rule will deal a heavy blow to employment, as it affects the labor-intensive segment of the export sector”.

Though China’s share of global trade is rising, headwinds bearing down on US households raise question marks on the$ 3.3 trillion the US imported last year. If US imports disappear under the weight of Trump’s tariffs, so would a key driver of global growth. That’s the last thing export-dependent economies from China to Germany want.

One concern is the so-called “wealth effect” kicking into reverse. Just as rising stocks make average households more confident, plunging shares often slam sentiment. UBS Group analyst Bhanu Baweja thinks the S&, P 500, which is now at 5, 396, could be headed even lower.

” We see 5, 300 as the near-term target for the S&, P 500, but if tariff uncertainty persists or negotiations with trading partners don’t go well, risks of downside through 5, 000 become real”, Baweja says. ” The probability of US stocks entering a bear market is going higher”.

The huge drop in shares of financial companies is ringing alarm bells of their own. They include Citibank ( down 12 % on Thursday alone ), Bank of America (-11 % ), Morgan Stanley (-9.5 % ) and JPMorgan (-7 % ).

” Although financials don’t have direct exposure to tariffs, the uncertainty and ensuing market volatility around the indirect impact of broad-based tariff increases on the economy and activity levels is likely to dominate bank stocks in the near term”, says Jim Mitchell, an analyst at Seaport Research Partners.

The violent stock selloff that shook the region on Thursday dramatized Asia’s place in Trump’s trade destruction. Japan’s benchmark Nikkei 225 Stock Index tumbled more than 4 % at one point yesterday, Korea’s Kospi index dropped 2.7 %.

Japan’s Chief Cabinet Secretary Yoshimasa Hayashi called the new levies “extremely regrettable”, warning they’re likely to have a” significant impact on the economic relationship between the US and Japan”.

Wishful thinking, perhaps, but Hayashi said Tokyo would “take all necessary measures” to ensure its economy isn’t hobbled by such tariffs.

Korea’s acting President Han Duck-soo called on the government to “exert all its capabilities to overcome the trade crisis” at an emergency meeting on Thursday, calling the related uncertainty “extremely serious”.

China’s Communist Party slammed Trump’s move as a “typical unilateral bullying practice” and said it would “resolutely take countermeasures to safeguard its own rights and interests”.

Beijing “urges the United States to immediately cancel its unilateral tariff measures and properly resolve differences with its trading partners through equal dialogue”, the Commerce Ministry said in a statement.

” As we had worried, Asian economies have been hit hard by the new tariff announcements”, said Decoded’s Kishore. Outside of China and Vietnam, Trump’s tariffs hit Taiwan ( 32 % ), Thailand ( 36 % ) and Indonesia ( 32 % ). Malaysia’s 24 % was in line with Japan and Korea, as was India at 26 %. The Philippines ( 17 % ), Singapore ( 10 % ) and Australia ( 10 % ) fared slightly better.

” Whatever be the outcome, the increased economic uncertainty is likely to take a toll on sentiments and spending in the foreseeable future”, Kishore says.

” We will be following up with a more detailed note on the channels through which the tariff shock will likely flow through Asian economies and to what degree. Several indirect and spillover impacts need to be considered”.

Former Treasury Secretary Lawrence Summers worries Trump’s latest tariff hikes could trigger an oil crisis-like shock to the globe’s biggest economy.

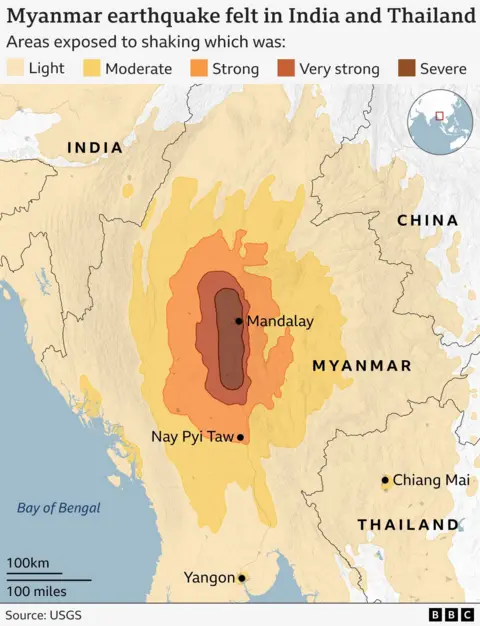

” This is the kind of thing you discuss in the way we would usually discuss an oil-price spike or earthquake or a drought, as a supply shock”, Summers tells Bloomberg. ” The question is mostly how much damage is going to be done”.

Follow William Pesek on X at @WilliamPesek