CelcomDigi, U Mobile and ZTE deploy 360° cameras with remote virtual reality broadcast at SUKMA 2024

- 360° devices in sports arenas offer Multimedia sets for enhanced gaming experiences.

- By expanding the range of electronic fact, 5G-Advanced enhances the XR knowledge.

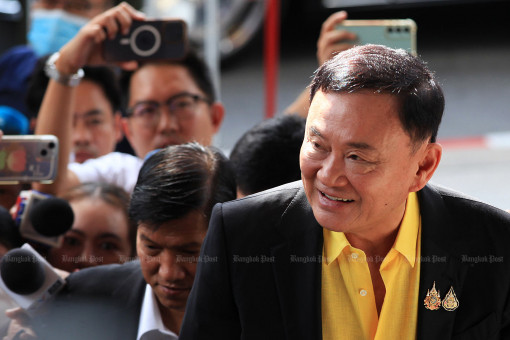

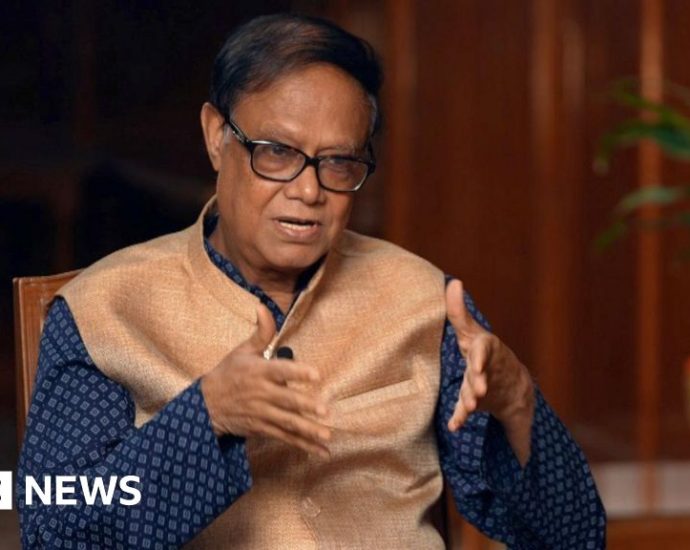

From Petra Jaya to Putrajaya. While SUKMA 2024 kicked off in Sarawak on Aug 17 and will end today Aug 24, Minister of Communications, Fahmi Fadzil had the opportunity to immerse himself in the atmosphere of Stadium Sarawak, from the comfort of his office in Putrajaya on 20th Aug, via a Virtual Reality (VR ) headset, powered by 5G-Advanced (5G-A ).

This was made possible as a result of a partnership between CelcomDigi and U Mobile, in order to show the viability of 5G-A in enabling modern innovations.  ,  ,

The sports arena has a number of 360° cameras installed to enable VR headset users to experience Extended Reality (XR ). Viewers can experience a 360-degree interactive view of the stadium’s live wearing action in real-time. By extending the range of virtual reality, immersive virtual reality applications, and fog gaming experiences, the 5G-A enhances the XR encounter. It offers consumers a better Er have while on the move, enabling a high-data-rate knowledge.

The couple’s strategic partnership likewise employed 5G-A systems to transmit the world’s first-ever 5G-A live transmit from the Opening Ceremony of SUKMA 2024 to viewers across the country via Radio Televisyen Malaysia (RTM).

For broadcasters like RTM, this is the first day they can get the best video, all of which can be done wirelessly, giving them more flexibility and the ability to provide real-time protection. The Malaysia Book of Records also praised the business relationship for achieving the fastest cellular frequencies at 30.8Gbps with 5G-A during a life test conducted in Kuching, Sarawak.  ,