US tech war opens fire on China’s cloud computing

US Commerce Secretary Gina Raimondo stated that she and the Biden administration would not be portrayed as bad on China in response to Republican senators’ pressure to censure Chinese cloud computing business:

She told the Senate Appropriations Committee,” I’ve put more than 200 Chinese businesses on the institution list during my tenure, and we’re constantly looking into new threats. If and when we decide that companies should be added to the list, I won’t bother.”

Eight Republican senators, including Senator Bill Hagerty( R-TN ), a ranking member of the Senate Banking Subcommittee on National Security and International Trade and Finance, wrote to Raimondo, Treasury Secretary Janet Yellen, and Secretary of State Antony Blinken on April 25 requesting that they take decisive action against Chinese cloud service providers like Baidu and Tencent, as well as Alibaba Cloud and Huawei Cloud.

According to” Open-source information ,” Huawei Cloud and PRC-based cloud computing services are directly undermining the interests of the US and our allies and partners in terms of national security and economic security. They are also increasingly interacting with foreign entities, some of which are sanctioned. & nbsp, We implore you to take decisive action against these companies through sanctions, export restrictions, investment bans, and further research into PRC cloud computing service companies.

The following payment is listed on Senator Hagerty’s site:

” The example we give in the text demonstrate the viability of China’s military-civil integration strategy.” It does make sense to refuse US exports of these nations given China’s laws, which require every Chinese citizen and company to participate in regional security or intelligence work, according to Hagerty. & nbsp,” Yet businesses like Alibaba Cloud that are not on the Entity List now have access to US technology, imports, and even activities here in the United States.”

Do you recognize that the PRC cloud service providers operating in the United States pose a danger to our national and our financial security, given the scope of China’s military legal fusion strategy and regional security-related laws? Hagerty questioned.

According to Secretary Raimondo,” I’m in wide agreement with you.”

The email continues by citing specific but well-known instances of the companies’ play with China’s military, security, and intelligence services, such as satellite imagery and regional monitoring. They do, however, mainly serve financial markets, much like US military legal fusion company Boeing.

For instance,” military civil fusion” is not a sinister Chinese plot; rather, it is based on common practice. Boeing declared in February that it had been” selected by the US Air Force as the prime contractor for the country’s intercontinental ballistic missile ( ICBM ) guidance subsystems support.” Over the course of 16 years, the contract could be worth up to$ 1.6 billion.

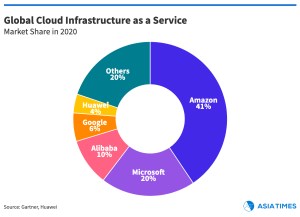

Alibaba Cloud is the biggest cloud service provider in China and the fourth-largest in the world. It offers services to the banking, e-commerce, logistics, and many industries around the world in the areas of repository, storage, data analytics, networking, application, security, etc.

The employment website indeed.com currently lists 30 positions at Alibaba in Sunnyvale, California, including software engineer, photonics expert, research scientist, and business manager, with annual pay ranging from$ 110,000 to$ 240,000.

According to Crunchbase, US technology providers have eliminated more than 135, 000 projects so far this year. Senator Hagerty and his associates likely want to do away with internships at Alibaba as well as the modern know-how they stand for.

The level of knowledge is very deep. For instance, a Ph.D. is required for applicants for the placement of optics professional. have in the construction, development, and production of golden optics chips for visual interconnects, as well as a d. degree in electrical engineering, applied science, or another related field.

Although Huawei Cloud is basically roughly half as big as Alibaba Cloud, it has been developing quickly. Huawei Cloud, as reported on its website, has received a number of qualifications and awards since being added to the Entity List in August 2020, including:

The initial cloud service provider in Asia-Pacific to receive PCI 3DS accreditation for regional transactions account information security as of August 2020.

The second cloud service provider to achieve information security management Standard 27799 certification in September 2020.

The British Standards Institution has awarded both the CSA STAR 2021 Gold Certification and the ISO / IEC 27034 application security standard certification.

Forrester Research has named him a president in predictive analytics and machine learning as of November 2020.

For its GaussDB registry products, which assist businesses in migrating data to the sky, Gartner has included it in its Magic Quadrant for Cloud Database Management Systems for December 2020.

One of the best four and the fastest-growing cloud service provider in Latin America, Canalys named it in March 2021.

May 2021- No. Ranked 1 in the IDC market for commercial cloud infrastructure in China.

Ranked No. December 2021 IDC ranks machine learning at number one in China’s public cloud system market.

More than 1,000 public staff, clientele, and business experts attended the Huawei Cloud Summit Middle East and Africa in Dubai in March 2022.

The meeting looked at how cloud computing can help with public services, financing, carriers, media, e-commerce, and gaming.

The second Huawei Cloud Indonesia Summit was held in Jakarta in September 2022 to discuss the electronic economy with local business leaders and scholars, business partners, and the internet.

With more than 60 products to be launched in areas like e-commerce, shorter video platforms, online gambling security, and finance, Indonesia became a new area for Huawei Cloud in November.

In order to create good town ideas, Huawei Cloud and BCB Blockchain of Singapore joined forces in November 2020.

The Huawei Cloud Accelerator, a system intended to support the growth of start-ups with the aid of venture entrepreneurs, was unveiled in September 2022 at the summit held by the Huang Cloud Global Startup Founders Summit. This program aims to empower businesses in Shenzhen.

According to the company, Huawei Cloud is now used by more than 800 public clouds in China. The bank’s” One City, One Cloud” approach has been put into practice in over 150 settlements, and it also powers over 300 financial institutions, including six major institutions.

E-commerce, financing, power, manufacturing, medicine, and gaming are a few other user industries. Huawei Cloud is present outside of China in the Asia-Pacific, Middle East, Africa, Latin America, and Europe. Being on the Entity List does not appear to be a serious issue, aside from not being able to work in the US.

May US politicians be able to punish some Chinese cloud service providers for their actions? Maybe. Even as they forced Oracle to cut its ties with Huawei, they may compel US businesses like Salesforce, IBM, VMware, and Fortinet to do the same with Alibaba Cloud.

Huawei created its own ERP application as a result, which it unveiled in April. If Alibaba Cloud were added to the Entity List, which is overseen by the Bureau of Industry and Security ( BIS ) of the Commerce Department, something similar would likely occur.

Being placed on the list can be a significant issue, but it also motivates the targeted business to exert more effort. It may be referred to as the BIS Certificate of Quality in the Global South and some regions of the world where US sanctions are truly recognized.

@ ScottFo83517667 is the author’s Twitter account.