SWIFT battling Russia, China’s crypto use to dodge sanctions – Asia Times

The Society for Worldwide Interbank Financial Telecommunications (SWIFT), the Western-led global financial transfer system, has implemented various control measures for banks to identify those who use cryptocurrencies to assist Russia and China bypass Western sanctions, including those imposed over the Ukraine war, according to a SWIFT executive.

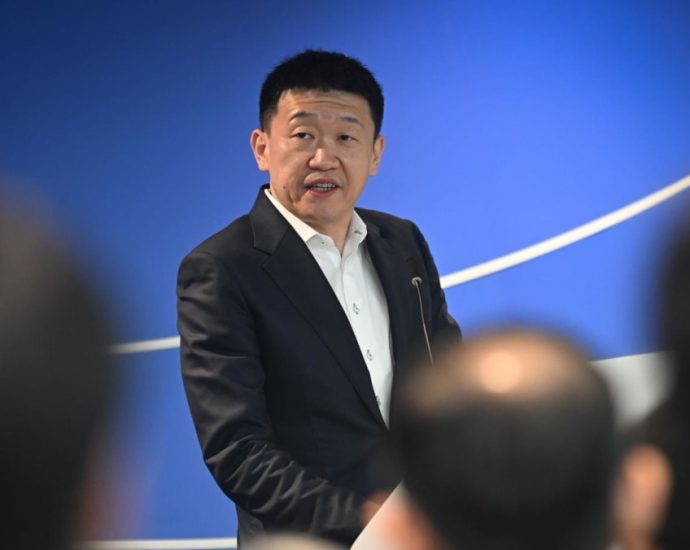

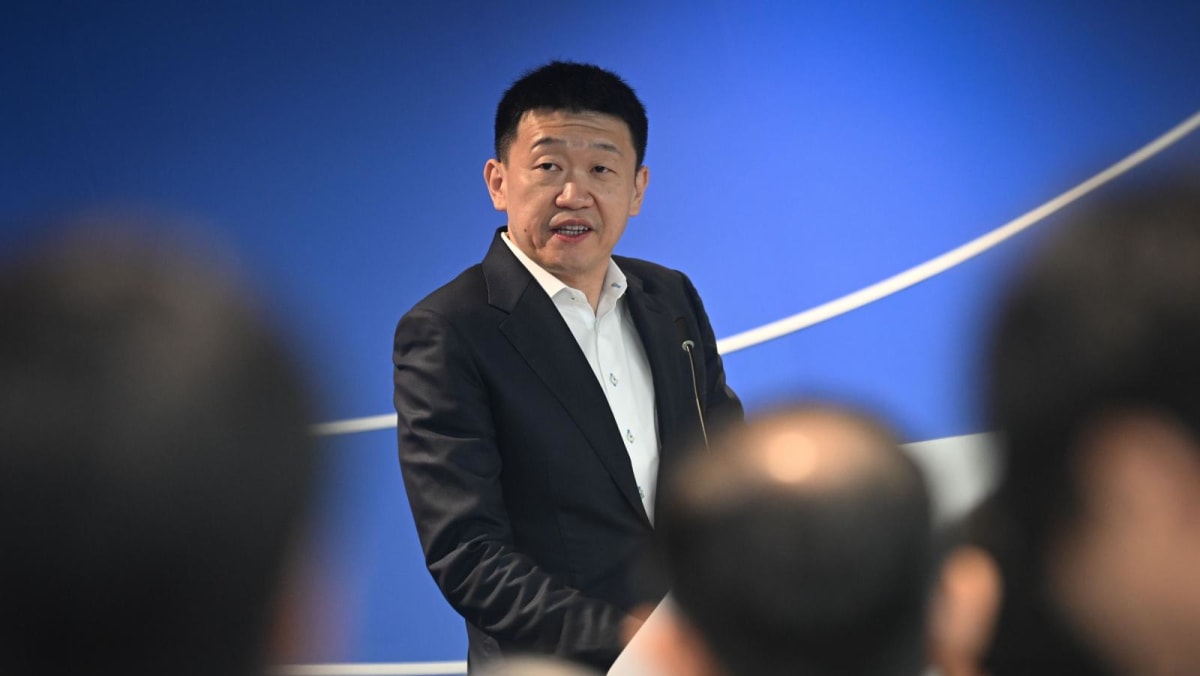

“There is a number of different controls that are built into the system, and things that financial institutions and banks can use to manage and permit the traffic that happens over the SWIFT network,” SWIFT’s Chief Innovation Officer Tom Zschach told Asia Times in the Q&A session at a London cryptocurrency event on May 6.

“It’s a pretty mature infrastructure that we have in place. It’s all driven by our banks, around the agreements they have in place to transact with any of the counterparties around the world,” he said. “It’s pretty robust. It’s been in place for quite some time, and it helps to support things, even in the future, with some of the ideas we see rolling out around automatic compliance.”

Currently, SWIFT offers the Customer Security Programme (CSP) and the Customer Security Controls Framework (CSCF) to help financial institutions monitor suspicious or sanctions-dodging transactions.

Zschach’s said his primary responsibility is to drive innovation across SWIFT and collaborate with the SWIFT community and partners to prevent the fragmentation of international payment markets amid the rise of cryptocurrencies.

However, at the Digital Assets Summit organized by the Financial Times on May 6, media members were more interested in SWIFT’s efforts to prevent Russia and China from evading sanctions and moving to a different payment system.

Zschach did not name Russia and China specifically but stressed SWIFT’s increasing role in ensuring the world stays connected in today’s geopolitical situation.

“The geopolitics impacts many different areas, including payments,” he said. “We could build ‘digital islands’ and start to create different networks that aren’t connected. But nobody wins from the fragmentation.”

“In the US, there’s a pullback from globalization…. Now, SWIFT plays an even more important role in ensuring the world stays connected and that we don’t lose the trust and the ability to scale.”

His comments came after Reuters reported in March that Russia has used cryptocurrencies such as bitcoin, ether and stablecoins such as Tether (USDT) to effectively bypass Western sanctions in its estimated US$192 billion oil trade with China and India.

Stablecoins are digital assets that use blockchain technology to peg to the US dollar. They allow “T+0” or same-day settlement for cross-border transactions, while a traditional wire transfer can take up to five working days.

Traditional cryptocurrencies such as Bitcoin have a limited supply and high volatility as they are made through time-consuming and heavy electricity-using “mining” activities. Stablecoins have an unlimited supply as long as they are backed by dollars.

Crypto trading, which does not involve the SWIFT system, creates an environment for money laundering, cybercrime, and sanctions evasions. Crypto exchanges and related banks are responsible for “knowing your customer” (KYC).

The US Treasury’s Office of Foreign Assets Control (OFAC) often sanctions companies and bourses in Russia, North Korea and Venezuela for suspicious crypto activities.

Sanctions against Russia

After Russia invaded Ukraine in February 2022, the US, European Union (EU), United Kingdom (UK) and Canada agreed to punitively purge seven Russian banks from the SWIFT system.

China had once settled trade transactions with Russia in renminbi but the US deterred that workaround with secondary sanctions.

Russia and China then settled their transactions in more complex, harder-to-decipher ways. For example, Russians bought Chinese electronic parts and paid in gold, precious metals or gemstones, which were sold to the Middle East for US dollars. Hong Kong is both a logistics and financial hub for such operations.

Last year, the US Treasury curbed these activities by sanctioning a group of Hong Kong and Chinese companies and threatened to sanction some small Chinese banks.

The Wall Street Journal reported in April last year that intermediaries and smugglers have turned to using Tether to buy weapons and equipment for Russia’s defense industry. Some quoted in the article estimated this “shadow trade” at $10 billion a month.

Last September, Russia reportedly opened two crypto exchanges in Moscow and St Petersburg to support external trade.

“Could crypto eventually provide a ‘workaround’ to sanctions enforcement and prohibitions on terrorist financing?” researchers at the Washington-based Brookings Institution weighed in a report last year. “The fundraising techniques of those seeking to evade sanctions and prohibitions could easily become more sophisticated.”

The report said stablecoins could also become a way for terrorists to launder funds.

Crypto bourses in Asia

On January 23, US President Donald Trump signed an executive order encouraging the growth and use of digital assets, blockchain technology and related technologies across all sectors of the US economy.

Steve Lee, co-founder of Neoclassic Capital, said at the Digital Assets Summit that many Asian countries are quickly building new crypto exchanges.

“Japan has been very progressive regarding crypto regulations since 2017. They are now aiming to lower the tax rate on crypto gains from 55% to 20%,” Lee said. “In South Korea, institutions might be able to start trading cryptos by the end of this year.”

“Singapore is easing its regulations to attract global crypto players, such as Robinhood Crypto (a US-based bitcoin trading platform),” he added.

It remains unclear whether these Asian crypto exchanges will become new platforms for Russian and Chinese companies to circumvent US sanctions.

In a crypto roadmap unveiled last November, the UK’s Financial Conduct Authority outlined its policy publications for regulating stablecoins, crypto firms, and exchanges. It will finalize the rules in 2026.

Multinational law firm Pinsent Masons said in March that crypto companies have begun self-reporting suspected breaches of sanctions against Russia to the UK government. Three out of 50 self-reports originated from crypto firms, while others were from financial institutions.