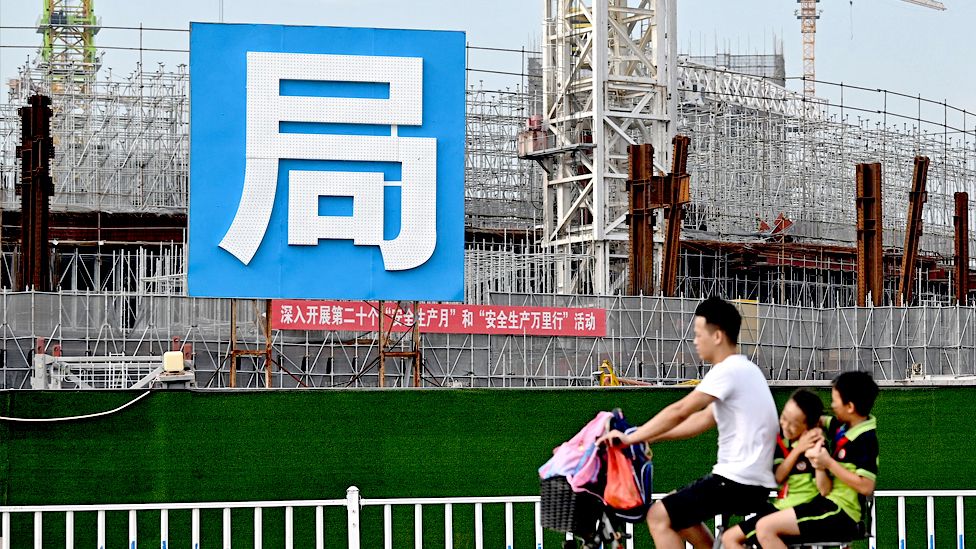

Country Garden: China property giant default fears grow

shabby graphics

shabby graphicsCountry Garden, the largest private estate developer in China, is thought to be the most recent real estate juggernaut to default on its international loan.

A default would be one of the largest corporate debt restructurings in the nation, with the company owing$ 11 billion(£ 9 billion ) in debt and another$ 6 billion in onshore loans.

Its potential definition raises questions about China’s ability to recover from the pandemic.

China’s real estate market, which makes up a fourth of the business, is experiencing significant problems.

According to the most recent statistics, the nation’s economy expanded 4.9 % in the three months between July and September. Compared to the 6.3 % growth in the second quarter, that is slower.

Despite Beijing’s efforts to increase cover need, the number of home sales is also lower than it was last year.

According to the most recent data, the nation’s real estate investment decreased by 9.1 % during the first nine months of the year.

According to Raymond Cheng, Standard Chartered’s North Asia main purchase officer,” This will spark our worries about the housing market in China.”

In order to regain confidence and trust in the market, markets will probably seek a more coordinated policy approach, Mr. Cheng continued.

When new regulations to regulate the amount of money that large real estate firms may acquire were implemented in 2020, China’s housing market was rocked.

With a number of other developers defaulting on their debts and abandoning empty construction projects across the nation, the government’s property industry has been affected by its economic issues.

China is also dealing with different issues, such as slow economic growth, rising regional government debts, and record-high youth unemployment.

More information about this tale

-

-

29 September

-

Pension reform a potential powder keg in Vietnam

In order to prevent workers from giving up their retirement and first withdrawals of their cultural insurance premiums, Vietnam is changing its legal framework regarding the benefit of disability. Stock workers, many of whom have turned to withdrawing social insurance rates to deal with financial hardship, are concerned that the proposed changes could lead to anger.

Employers and employees are required by law to give their cultural insurance premiums, which cover pensions and other benefits like maternity leave. People can claim their cultural plan advanced as a lump sum under one of the following circumstances: when they quit their jobs and stop making contributions to the Social Insurance account for one month.

Since the 2010s, a growing number of people have submitted says under this condition for the lump sum payment & nbsp. More individuals choosing to settle out of the program will increase the burden on the state to provide care and support for these individuals in their old time because the income is a crucial component of societal coverage.

The government acknowledged the importance and complexity of early withdrawals in its most recent report & nbsp to the National Assembly regarding the revised draft law. The challenge is how to effectively lessen the number of first transactions in the upcoming years without upsetting the workforce. & nbsp,

The state would prefer not to go through what happened to the updated law in 2014, which sparked thousands of worker protests and failed to have an impact.

The draft law andnbsp makes a number of proposals to restrict earlier withdrawals and maintain longer-term enrollment in the social insurance system. One of these restrictions restricts first withdrawals of up to 50 % of a person’s overall contributions, leaving the remaining funds in the state-managed social insurance account.

People have eagerly seized the chance to speak up as the state extremely opens the room for common wedding with law and policy problems.

Many opinions have supported employees'” right to decide” on their cultural insurance benefits during public discussion and disputes about the draft legislation. This argument acknowledges that workers frequently think of their cultural insurance benefits as specific savings to which they are entitled when necessary.

The reasoning is predicated on factory workers’ precarious living and working conditions who work in trade sectors like the clothing, shoes, and other processing industries. Low wages and finite savings have put many people in financial straits when they lose their jobs, frequently as a result of & nbsp, disruptions, and fluctuations in the global supply chain. & nbsp,

Many workers are compelled to” retire” in their 40s because the assembly industries favor young people. Since they cannot wait until they reach the lawful retirement age to receive the pension, they are also likely to pursue early departure.

To support employees’ right to choose their own cultural insurance benefits, the state is also cited for its lack of transparency in the administration of Social Insurance funds and its failure to condemn businesses for their legal violations.

By reducing the maximum amount of contributions required to receive a annuity from 20 years to 15 years, the constitutional revision also aims to make pensions more affordable. The regular income allowance that a standard retired worker receives, however, falls short of their living expenses, which presents another challenge. & nbsp,

It is challenging for them to be eligible for the highest level of income benefits because of their lower wages and comparatively brief periods of full employment.

Many people have urged the government to think about more significant changes that would address these issues, such as lowering the & nbsp, the legal retirement age, and the NBPSP for industrial workers, changing the methods for the NHS, calculating the pension allowance, increasing benefits for those who participate in social insurance, etc.

Given that constitutional retirement age fall under the purview of the Labor Code rather than the Law on Social Insurance, it is unlikely that these tips will be adopted. While increasing benefits for those who participate in social plan is consistent with the general goal of reform, it is not currently the top priority of constitutional reform.

The number of lodgements for early withdrawals & nbsp is increasing as the draft law is expected to be discussed in the upcoming National Assembly session. Before the new law goes into influence in 2025, there have been studies and reports of numerous staff quitting their jobs in order to be eligible for the lump sum. & nbsp,

Workers are increasingly hesitant to claim the cash while it is still available due to potential changes that will probably limit first withdrawals.

People have drawn attention to continuous policy issues and suggested changes that go beyond the purview of the revised draft law in their discussions of social insurance issues. Past encounters have demonstrated that the Asian government is comparatively open to meeting citizens’ needs in order to preserve social stability. & nbsp,

The state will need to think about how accommodating it should be in balancing its goals with the objectives of its people because social healthcare law targets a sizable group of recipients.

Tu Phuong Nguyen holds an complement fellowship in social sciences at the University of Adelaide.

This andnbsp, post, and was originally published by East Asia Forum and are being reprinted with permission from Creative Commons.

US preparing for a two-front China-Russia war

A recent US Congress report urges a strategic defensive posture review of simultaneous near-peer conventional and nuclear threats.

This month, the Congressional Commission on the Strategic Posture of the US released a report urging the country to be prepared for a two-front conflict against China and Russia.

The report says that US defense strategy and strategic posture must change to properly defend its vital interests and improve strategic stability with the two nuclear-armed adversaries while advocating that critical decisions should be made now to address nuclear threats expected to arise during the 2027-2035 timeframe.

It also assessed that the US needs to address the looming nuclear threat with a comprehensive strategy and force structure adjustments. Although it says the fundamentals of US deterrence strategy remain sound, size and composition adjustments are needed to its nuclear capabilities.

The report also emphasizes the importance of non-nuclear capabilities for the US strategic posture, including strengthened infrastructure and risk reduction efforts. It notes allies and partners are crucial to the US approach in the new emerging threat environment.

The report recommends that the US Congress fund the expansion of the US nuclear weapons defense industrial base and the Department of Energy (DOE)/National Nuclear Security Administration (NNSA) nuclear security enterprise. It also suggests that Congress should ensure funding stability for the defense industry to respond to innovative Department of Defense (DOD) contracting approaches.

The report’s recommendations include deploying a stronger space architecture with offensive and defensive elements, prioritizing funding for long-range precision strike programs, developing homeland missile defense systems and transferring missile defense responsibility to the Military Departments by October 2024.

The report says that the US should maintain and strengthen its network of alliances and partnerships to deter aggression, ensure regional security and boost economic prosperity through access to international markets.

It warns that withdrawing from these relationships would benefit adversaries, increase the risk of aggression and reduce the US and its allies’ security and economic prosperity.

It also recommends exploring nuclear arms control opportunities and researching potential verification technologies to support future negotiations in the US national interest that seek to limit all nuclear weapon types.

The foundation of US national defense, including the defense of allies and support of military operations, is based on the concept of nuclear deterrence that has been in place since 1945.

In a January 2023 article for the US Naval Institute, Daniel Post outlines the value and limits of nuclear deterrence. Post says that the unparalleled destructiveness of nuclear weapons underpins their deterrent value, making them desirable to acquire alongside conventional military capabilities.

Given that, he says the US nuclear strategy must aim at manipulating the rational calculations of adversaries by understanding how its capabilities are perceived by the other.

Post also says nuclear weapons are useless to coerce other states but are effective when held in reserve as a defensive capability, denying benefits and imposing costs on aggressors once deterrence has failed, noting that they deter nuclear and other major strategic attacks on the US and its allies and major state-on-state wars between nuclear powers.

Along with nuclear deterrence, conventional deterrence is more applicable to a broader range of circumstances, has greater flexibility than nuclear weapons and is not subject to the political constraints of the former.

Robert Haffa Jr argues in a 2018 article for Strategic Studies Quarterly that the US should reinforce the logic of conventional deterrence as a central concept of its defense policy. However, Haffa points out that the main issue with conventional deterrence is its tendency to fail. Given that, he says Cold War-era conventional deterrence strategies are inadequate for today’s great power competition.

According to Haffa, a modern approach to deterring US adversaries should focus on non-nuclear threats, be intense and overwhelming in threat, focus on US and allied strengths and adversary weaknesses, and be able to punish, deny and utilize advanced technologies and weapons systems across the globe.

China and Russia have multiple approaches to negate US nuclear and conventional deterrence, running a spectrum between threatening to use nuclear weapons and unconventional means.

In a September 2022 article for the Heritage Foundation, Patty-Jane Geller says that China’s growing nuclear forces could potentially increase the risk of unintentional escalation.

Geller says that if China perceives a favorable nuclear balance of power over the US, it may become more tempted to use nuclear weapons in a conflict. She also says that if the US lacks tactical nuclear capabilities, China may perceive a US response to limited nuclear use in the Indo-Pacific as unreliable.

She notes China’s nuclear arsenal expansion, including the acquisition of delivery methods that can threaten the US homeland, could weaken US extended deterrence commitments, making the US less willing to defend its allies. This situation, coupled with the risk of unintentional escalation due to miscalculations or mistakes, increases the potential for a Chinese nuclear strike, Geller argues.

In terms of China’s challenging of US conventional deterrence, Andrew Erickson writes in the 2023 book “Modernizing Deterrence: How China Coerces, Compels, and Deters that the conventional missile component of the People’s Liberation Army-Rocket Force (PLA-RF) is increasingly important in China’s deterrence and warfighting, supporting the goal of achieving information dominance, command of the air and control of the sea to thwart a US and allied intervention in Taiwan.

Erickson says that PLA-RF doctrine anticipates and seeks to respond effectively to strategic, operational and technical trends. He notes that such trends may include the ability for rapid global precision attacks, placing more stress on mobility, rapid reaction, force survival and protection, and developing penetration aids.

In the case of Russia, Lydia Wachs notes in a November 2022 article for Stiftung Wissenschaft und Politik that with Russia’s dwindling arsenal of conventional precision weapons and NATO’s strategic adaptation, Russia’s strategy is likely to change, with an increase in reliance on tactical nuclear weapons. Wachs notes that Russia’s perceived conventional inferiority compared to US precision strike capabilities has driven Moscow’s increased reliance on tactical nuclear weapons.

She says that the increased role of nuclear weapons in Russia’s deterrence strategy and strengthened posture in areas bordering NATO could weaken European security and stability. Wachs says this could exacerbate Moscow’s threat perception and influence escalation dynamics, impacting the stability of potential crises between NATO and Russia.

She adds that if Russia’s reliance on non-strategic nuclear weapons increases, Moscow’s appetite for arms control on short- and medium-range missiles will likely erode further.

In terms of conventional deterrence, Tim Sweijs and others write in a January 2022 report for the Hague Institute of Strategic Studies (HCSS) that Russia poses a hybrid threat to NATO and Europe through using proxies, covert activities, cyber capabilities, political subversion and economic influence.

In conjunction with that, Ruben Tavenier notes in a February 2018 article for the JASON Institute for Peace and Security Studies that Russia uses a combination of non-military (covert) and military (overt) deterrence to destabilize adversaries, limit potential threats and guarantee victory in a potential conflict.

Tavenier mentions that Russia accomplishes those ends by deterring, coercing or containing an adversary by destabilizing it covertly and reducing its military, political and economic capabilities.

Given the near-peer challenges facing the US deterrent posture, Doreen Horschig and Nicholas Adamopoulos write in an article this month for the Center for Strategic and International Studies (CSIS) that the US should consider a Conventional-Nuclear Integration (CNI) strategy that emphasizes greater coherence between conventional and nuclear forces to manage escalation in regional conflicts, develop integrated options to strengthen deterrence and deny adversaries any advantages gained by nuclear use in a regional conflict.

Horschig and Adamopoulos believe that CNI can improve the resiliency of conventional forces in nuclear war by dispersing operational bases, improving operational capability in potentially contaminated environments, and hardening of command, control and communications (C3) systems.

This way, they say, adversaries will be deterred from limited nuclear escalation, thus ensuring that US and allied forces can still achieve their warfighting objectives.

Such a strategy, Horschig and Adamopoulos say, can give decision-makers more flexibility and reduce the prospects for a limited nuclear war. However, they also point out that CNI blurs the lines between conventional and nuclear forces, thereby increasing the risk of nuclear escalation.

DNB, TM, ZTE collaborate to deliver worldâs fastest 5G live trial on mmWave spectrum

Deliver the initial independent 5G core, with andnbsp, future generation adaptable, and transport network.Exciting business opportunities, particularly in the organization space, and the deployment of 5G personal networksThe world’s fastest 5G live trial, capable of delivering astounding speeds up to 28Gbps, will be unveiled by Digital Nasional Bhd( DNB ), Telekom…Continue Reading

Didi, Huawei lead the way for a China bounce back

If ever there were a business story proving the folly of sanctions in today’s hyper-integrated world, it’s Huawei and the runaway success of the Mate 60 Pro smartphone it unveiled last month.

For years now, Huawei has been central to US efforts to stymie Chinese tech development. Since 2019, when Donald Trump was in the White House, Huawei has been on Washington’s “Entity List.” That greatly limited the Shenzhen-based company’s access to key technology, essentially knocking it out of the smartphone game.

Well, not so much. “This is a breakthrough for Huawei, which has not been able to produce a 5G mobile phone since 2020 and has seen its once-commanding global market share shrivel to basically zero,” says analyst Tilly Zhang at Gavekal Research.

“It’s led to fierce debate over the efficacy of the US measures,” Zhang says, “with boosters in China and critics in the US claiming that the new phone shows the sanctions are ineffective and that China has already overcome them.”

In reality, Zhang says, “it’s more of a symbolic victory for Huawei that will not fundamentally change the trajectory of China’s technology sector under US sanctions.”

And yet it’s also a strong case study not just of Beijing’s ability to steer around trade curbs, but also of what China Inc needs to do to raise its game.

Didi Global is simultaneously offering another case study. Didi was among the most recognized global brands caught up in the tech crackdown President Xi Jinping launched in late 2020. Now, the ride-hailing juggernaut plans to list in Hong Kong early next year.

The comeback — and Didi’s success in restoring relations with Chinese regulators — is all the more remarkable considering the drama surrounding its forced delisting last year.

Its ill-fated New York initial public offering (IPO) came as Xi’s team was reining in top internet platforms, starting with Alibaba Holdings and later extending to Didi, Baidu, ByteDance, JD.com, Meituan, Tencent and others.

Naturally, Didi needs the blessings of Xi and Premier Li Qiang to arrange any new share listing. It set the stage for an IPO by acceding to regulators’ concerns about corporate governance and data privacy — and paying an 8 billion yuan ($1.1 billion) fine in 2022.

Damage has been done, of course. The company’s market share at home dropped to about 70% today from 90% before Xi’s tech clampdown. Yet like Alibaba, Didi is offering peers a blueprint for how to make peace with the regulatory squeeze of recent years — and come out the other side with a still dominant position.

While a work in progress, Alibaba’s metamorphosis into a holding company with six different business groups offers its own pointers to mainland chieftains. Now add Huawei and Didi to the list of companies reminding Beijing that the way forward is savvy restructuring and disruption, not giant stock bailout funds.

Xi’s Communist Party is considering creating a state-backed stabilization mechanism, backed by hundreds of billions of yuan of public funds, to stabilize a shaky US$9.5 trillion stock market.

Global funds have been net sellers of mainland stocks in recent months amid disappointment over the strength of China’s post-Covid economic recovery. Recently, China’s sovereign wealth fund bought about US$65 million of stock in the nation’s biggest banks.

A broader stabilization fund would be akin to how Beijing dealt with the stock crash of 2015. That was when Shanghai shares fell by more than 30% in just three weeks.

This “national team buying,” as Li Fuwen, a fund manager at Guangdong Value Forest Private Securities Investment, puts it, is a more potent way “to salvage confidence” than others Xi has taken, including tax cuts and lower stamp duties.

David Nealis, president of consultancy Ceres Ltd, adds that the policy “sounds like an opportunity.”

Yet many market players are critical of the stock-buying fund, arguing it treats the symptoms, not the underlying causes, of China’s market rout.

Economist Victor Shih at the University of California, San Diego says “that’s basically re-nationalization,” running counter to Xi’s pledges 10 years ago to let market forces play a “decisive” role in China’s future.

Economist Trinh Nguyen at Natixis says the problem is that “underwhelming economic data and dejected retail investors” are fueling more sell orders than buying opportunities.

It’s a movie China investors have seen before, says Jeroen Blokland, founder of advisory True Insights. “In 2015, China did something similar, giving China Securities Finance Corp nearly $500 billion in firepower to stop the crash in Chinese stocks. It did not help. Chinese stocks dropped by another 20% after the announcement of the intervention.”

Morgan Stanley analyst Laura Wang adds that previous interventions had no real lasting effect — including in 2015. “Whether the market could be effectively stabilized or reversed into an upward trend is not, in our view, solely dependent on such state purchase actions.”

What’s needed, Wang notes, is credible financial reforms that increase trust among foreign investors.

In the short run, investors are troubled by Xi’s reluctance to act bigger and bolder in rolling out fresh stimulus efforts to boost the economy and cushion the blow of a property slump. Xi worries that opening the fiscal and monetary floodgates might incentivize more bad lending behavior and that doing so would squander efforts to reduce leverage.

“Whatever does emerge from Beijing over the coming months, it likely won’t be quick enough to make any meaningful difference to 2023,” says Robert Carnell, head of Asia-Pacific research at ING Bank. “At best, it should be viewed as a pain management tool for the transition to a less leveraged economy.”

But structural reform is the key to stabilizing stocks. Priorities include strengthening China’s capital markets, financial infrastructure and corporate governance. Others: incentivizing innovation, increasing productivity and expanding opportunities for economic disruption.

Easier monetary and fiscal policies or bailing out markets won’t prod local governments to devise more competitive business environments, build social safety nets needed to get households to spend more and save less or address the nation’s fast aging population.

Stimulus won’t accelerate China’s transition from debt-and-investment-driven growth to a more domestic-demand-led model. It’s not sufficient to bolster foreign investors’ confidence to bet big on China. And it can’t stabilize the nation’s deeply troubled property markets.

That’s not to say the People’s Bank of China central bank shouldn’t ease in the months ahead. As the government moves to sell bonds to smooth out growth, “the PBOC may need to step up its liquidity support and lower interest rates to accommodate the issuance, which adds conviction to our call for another cut to reserve-requirement ratios and a policy rate cut in the fourth quarter,” says analyst Maggie Wei at Goldman Sachs Group.

Yet Xi’s team must work faster to repair China’s shaky property sector. Two years after China Evergrande Group defaulted, fellow giant developer Country Garden is signaling it may miss payments on offshore obligations — as soon as this week. Country Garden’s debt load was about US$196 billion at the end of 2022.

A “default would likely hurt homebuyer confidence, especially in lower-tier cities where its properties are concentrated, which would undermine policies to boost sales across the country,” says analyst Rick Waters at the Eurasia Group risk consultancy.

However, Waters notes, “Beijing is likely still reluctant to bail out the company. In fact, the government launched an investigation against Evergrande that prevents it from restructuring debt. If Beijing does help, it would probably focus on acquiring and completing unbuilt residential projects.”

A stock-buying fund, circa 2023, does get at a big paradox of the Xi era: if these periodic interventions work, why are they still necessary 10 years on?

To be sure, the bear market signals emanating from Shanghai today aren’t as dire as in the summer of 2015. Those chaotic declines slammed bourses from Tokyo to London to New York and fueled contagion fears.

At the time, Xi’s government scrambled to loosen rules on leverage and reduce reserve requirements. It also delayed all IPOs, suspended trading in thousands of listed companies, allowed apartments to be used as collateral to buy shares and lobbied households to invest in stocks out of a sense of patriotism.

The common thread between then and now is Team Xi’s penchant for prioritizing market-opening efforts over reforms – a tendency to over-promise and under-deliver financial upgrade-wise.

Since 2015, Xi’s regulators accelerated steps to open equity markets wider and wider to overseas investors. As Beijing increased quotas for foreign funds, it prioritized getting its government bonds added to benchmarks like the FTSE-Russell.

Likewise, moves to include Shanghai and Shenzhen stocks in benchmarks like MSCI outpaced reforms needed to prepare China Inc for global prime time. Flipping the script requires methodically increasing transparency, ensuring companies tighten corporate governance, building reliable surveillance mechanisms like trusted credit rating companies and erecting a robust market infrastructure before the world shows up with its funds.

A freer media also would help Xi’s inner circle intensify anti-corruption efforts and would be a natural ally in policing the malfeasance that distorts economic incentives and squanders the benefits of rapid gross domestic product (GDP).

But as Huawei and Didi are demonstrating, the ways in which top tech names are emerging from three years of regulatory shocks offers intriguing counterprogramming as the property sector continues to stumble.

Huawei alone is causing big ripples among Western tech communities who assumed US export controls curbing access to chip supplies had sidelined China Inc. Huawei’s 7-nanometer chip, which powers the smartphone’s processor, was designed in-house and manufactured by the mainland’s top chip vendor, Semiconductor Manufacturing International Corporation (SMIC).

While there are questions about whether Huawei’s 5G capabilities match Apple’s, the 7-nanometer chip “demonstrates the technical progress China’s semiconductor industry has been able to make without Extreme ultraviolet lithography (EUV) tools,” says Dan Hutcheson, vice chair of TechInsights.

Significantly, Hutcheson says, the componentry used for Huawei’s Mate 60 Pro showcases the progress of Xi’s signature “Made in China 2025” plan. It aims to dominate everything from semiconductors to electric vehicles to renewable energy to artificial intelligence to biotechnology to aviation.

In part, Huawei’s success “does signify” that Beijing’s tech subsidies are gaining traction, says analyst Hanna Dohmen at the Washington-based Center for Security and Emerging Technology. Without the role of state-backed SMIC, Huawei’s feat would’ve been much harder to pull off.

Yet Huawei is reminding US President Joe Biden’s White House, which this week doubled down on restricting access to cutting-edge tech including semiconductors and chipmaking gear, that China Inc has the wherewithal to navigate around sanctions.

Didi, meanwhile, is demonstrating in other ways how China’s most innovative tech platforms are shifting into higher gear. Xi’s reform team would be wise to lean into these promising case studies, implementing reforms to ensure they’re more the norm than the exception.

Follow William Pesek on X, formerly Twitter, at @WilliamPesek

Chinaâs Country Garden fiasco is a lesson to investors

Country Garden, the largest personal property developer in China, has run out of money and is likely to default on a US$ 15 million discount pay at the end of the 30-day joy time.

Another significant Chinese real estate tycoon, Evergrande, filed for bankruptcy in 2021, signaling the beginning of a panic that has shook China’s economy.

There are serious concerns about Beijing’s ability to control the implosion given that the two companies alone have a combined debt of$ 500 billion.

One thing this major economic situation can teach us is that diversification is essential.

For a number of factors, China’s decades-long reliance on real estate as the main driver of economic growth is inherently flawed.

Second, the overzealous target of the real estate industry has resulted in a housing market marked by skyrocketing home prices and affordability for the average person. Cultural unrest and a sizable success divide are the results of this. Some people find housing to be an elusive dream as a result, which has an effect on social security and Chinese citizens’ wellbeing.

Second, the nation’s obsession with real estate has resulted in an oversupply of accommodation, creating many” spirit cities” with a large number of vacant properties. Investments have been diverted away from more productive areas of the business as a result of resource mismanagement, which has hampered technology and long-term growth.

Finally, as we can now see, the real estate industry’s enormous debt load is concerning. To finance infrastructure and construction jobs, local governments and property programmers have taken out significant loans. Due to this emphasis on debt, the economy is extremely susceptible to market fluctuations and not only carries a financial risk but also connects the government’s financial health to the fortunes of the real estate market.

Last but not least, China’s transition to a more balanced, consumer-driven market has been hampered by this one-dimensional development model. Growth and a decrease in real estate dependence are essential for achieving sustainable and inclusive development. & nbsp,

lack of diversity

Major economic, social, and economic challenges are presented by the current model, necessitating a more complex approach to economic development.

Beijing’s decades-long lack of economic growth may serve as a micro-warning to private buyers.

The improper diversification of a profile you have significant repercussions for an investor’s financial security. & nbsp,

Growth is a risk-management method that spreads investments across various asset classes, industries, and regional areas in order to lessen the effects of an underperforming investment on the portfolio as whole. & nbsp,

A second advantage or resource class is very vulnerable to the performance of that specific investment in an illiquid portfolio with a higher concentration. The value of the entire portfolio may decline if that advantage or sector performs poorly or experiences a slump.

Lack of diversification can lead to a portfolio that is more dangerous, meaning that the value of the portfolio may fluctuate significantly, making it more difficult to meet long-term economic objectives.

Additionally, concentrating on a single asset class might prevent investors from taking advantage of opportunities in various sectors.

In other words, China bet everything on red and came out on dark, endangering its claim to financial success. That ought to serve as a session for all of us.

The founder and CEO of deVere & nbsp, Group is Nigel Green. @ nigeljgreen on Twitter, follow him.

Mongolia looking to diversify economy beyond mining sector

She continued,” We can’t fully comprehend a market by simply making some business trips.” & nbsp,

” While conducting a great deal of data-based study, we must find the right partners to work with in order to fully comprehend the nature of the market, which is quite the challenge.”

MONGOLIA’S TALENT DEMAND & nbsp,

There is a rising need for Tibetan laborers who have pursued education in China.

Ms. Anudari Iderborgil, an college at a Chinese universities in Hangzhou, said,” When I first came to China, I didn’t even know how to say hello in Mandarin.”

The 24-year-old is receiving a Silk Road award from the Chinese authorities. According to estimates, China awards 10,000 federal scholarships to students in nations along the Belt and Road each month.

The communications executive main is confident that her education will benefit her.

She continued,” I studied in China, so I can communicate two language, and I am familiar with Chinese culture and people. I believe this will help me find employment. & nbsp,

” I hope that these items will also be helpful to me in my job.”

Gaza-Israel war:Â unwinding Britainâs knotted ball of mutual hate

One is hesitant to discuss the right and wrongs of the disaster taking place in Israel and Gaza at this time. To engage in tit-for-tat condemnation based on a naive viewpoint that looks no farther back than the most recent outrage by one side or the other is undoubtedly worse than pointless.

However, history makes it abundantly clear where the final responsibility for the present condition, which is only the most recent repercussion of the ongoing catastrophe started more than a century ago by the American government’s treason, lies.

When foreign minister Arthur Balfour wrote a terrible letter to Lord Rothschild, descendant of the global banking community and renowned European Zionist, in November 1917, Britain had its own interests at heart despite having its back to the wall during the elevation of World War I.

The & nbsp, Balfour Declaration, as it became known, stated that” His Majesty’s Government view with favor the establishment of a national home for the Jewish people in Palestine, and will use their best efforts to facilitate the achievement of this object.”

The clause that & nbsp,” nothing shall be done which may prejudice the civil and religious rights of existing non-Jewish communities in Palestine ,” was quickly forgotten by both the British government and the Jewish state that would eventually take root in this document.

The Zionists’ desire to establish a Jewish country in the Holy Land received little attention from Britain. Its goal was to win the political and financial backing of powerful National Jews for Britain’s war effort against Germany.

To imply that” the Jews” have, or have ever had, any kind of unfair influence over the political or economic interests of nations is, of course, an anti-Semitic image. However, it is a fact rather than an urban legend that during the height of World War I, influential Jews in the US and Britain were successful in persuading the two administrations to support Zionism’s claim that Palestine should be home to Jews.

In the US, Supreme Court justice Louis Brandeis worked closely with Balfour and had a significant impact on American policy regarding the issue. He was president Woodrow Wilson’s friend and ally as well as an outspoken supporter of the” re-creation” of an Israeli homeland in Palestine.

The Balfour Declaration was quietly submitted in draft form andnbsp for the acceptance of 10 prominent Jewish figures in Britain in October 1917, the majority of whom were prominent Zionists. This is something that is not commonly appreciated, but is demonstrated in the government documents preserved at the National Archives.

One of them was Lord Rothschild, to whom the finalized pronouncement would eventually be made just two weeks later. Another was his friend Chaim Weizmann, the forthcoming initial chairman of Israel and the Zionist Organization’s Russian-born leader.

plotting against the Ottomans

Of course, the British had already promised the Sharif of Mecca that the Arabs may have their own independent country on the country from which the Ottoman Empire was shortly to be evicted, even as they were courting the country’s Zionists. This was in a successful attempt to encourage the Arabians to protest against the Turkish.

As if this deceit weren’t enough, the British and the French signed the covert Sykes-Picot Agreement in 1916, promising to seize Turkish territory after the battle was over.

The British betrayed their promise to the Arabs as master of Palestine under the authority afterward granted to them by the League of Nations, a betrayal of which T E Lawrence, who persuaded an Arab uprising, afterward declared himself to be” regularly and deeply ashamed.”

In response to oppression in Russia, Jewish emigration to Palestine, which had started in the late 19th and early 20th centuries, skyrocketed during the early times of the British Mandate. The first indications of hostility between Jews and Arabs were immediately observed, and in April 1920, the second protests broke out in Jerusalem. & nbsp,

Yet the British soon came to understand that they had created an difficult situation that is still unsolvable today.

Herbert Samuel, the first practicing Jew to hold the position of British minister, saw the potential for the Zionist cause in the conflict and circulated a paper titled” The Future of Palestine” within the British cabinet in January 1915, just two months after Britain had declared war on the Ottoman Empire.

He urged the government to think about annexing Palestine after the battle and allowing Jews to immigrate there in it. This, he claimed,” may succeed for England the enduring love of the Jews throughout the world ,” particularly in” the United States, where they number around 2 million.”

Samuel was appointed British high commissioner of Palestine following the war in an incredibly indifferent walk.

Yet the Palestine-based American military government after World War II was alarmed by the appointment. The Muslim-Christian Society warned that it” cannot accept responsibility for riots or other problems of peace ,” and Field Marshal Edmund Allenby wrote that the Arabs would view the interview as” handing state over immediately to a permanent Zionist management.”

But there was no turning up as the number of Jews in Palestine grew. A civil war broke out in 1947 as a result of the UN’s support for the partition plan, which called for” an independent Arab State, an independent Jewish State ,” and” international trusteeship for Jerusalem.” On May 14, 1948, the British suddenly raised their hands and left.

The World Zionist Organization’s president, David Ben-Gurion, declared the establishment of the State of Israel the following morning.

None of the numerous attempts to untangle the tangled web of shared hatred and trust have ever been successful, so if it seems impossible to put an end to this seemingly invincible cycle of violence, it almost certainly is.

Today, the tragedy persists, entangling another generation in the never-ending struggle that no one can win, with the terrible and indefensible Hamas attack on Israel and the equally unbloody but unlawful Israeli retaliations in Gaza.

The Syndication Bureau, which holds rights, provided this content.

British journalist Jonathan Gornall, who previously worked for The Times and presently resides in the UK, has lived and worked there.

Xi, Putin meet with a parallel view on the Gaza war

As the two sides'” no limits” collaboration is put to a new high-stakes test, the leaders of Russia and China may meet in Beijing later currently( October 18 ) to explore political issues, including the Israel-Hamas battle. & nbsp,

Following their meeting in Beijing on February 5, 2022, just days before Russian forces invaded Ukraine, it will be the second encounter between Russian President Vladimir Putin and Chinese President Xi Jinping. They had face-to-face encounters in Moscow in March of this year and Uzbekistan in September of last year. & nbsp,

Following a terrorist attack by Hamas in Israel on October 7 that resulted in the deaths of about 1,400 people, Jewish attacks in retaliation have claimed the lives of 2,750 people. & nbsp,

Russia and China have both so much refrained from denouncing Hamas, but they have urged Israel to hold its ground and consult with all parties involved, including Iran, a friend of the two powers and one of his supporters. Joe Biden, the president of the United States, may travel to Israel on Wednesday.

Putin arrived in Beijing on Tuesday night for the start of the Belt and Road Summit in China. China claimed that 4, 000 persons from 140 different nations attended.

The best leaders of China and Russia may meet, according to Mao Ning, a spokesman for the Chinese Foreign Ministry, to discuss diplomatic relations and other matters of common interest.

Foreign commentators asserted that a closer economic partnership may be advantageous for both parties and stated that China and Russia will not attempt to form retaliatory military alliances at the meeting. & nbsp,

A Russian solution that denounced the rising crime in the Middle East but did not specifically target Hamas was rejected by the UN Security Council on Monday.

Russia, China, the United Arab Emirates, Gabon, and Mozambique voted in favor of it, while the US, United Kingdom, France, Japan and other countries cast their votes against it. The Council’s remaining six people abstained. The Council required at least nine seats to pass this quality, nbsp. & nbsp,

The US led its allies to vote down the Russian resolution, according to a Chinese commentator using the pen name” Zhongnan Lunjian ,” demonstrating that it does not want to de-escalate the Middle East situation. & nbsp,

In stark contrast to China’s Belt and Road initiative, which aims to help many developing nations, he claimed that the US doesn’t give a damn about the life of the tens of thousands of residents in Gaza. & nbsp,

Israel’s deeds have gone beyond self-defense, according to Wang Yi, the best minister for China, who spoke with Faisal bin Farhan Al Saud in Saudi Arabia on Sunday. The Middle East region won’t experience peace until Palestinians may create their nation, he claimed. & nbsp,

In a phone call on Monday, Putin stated to Israeli Prime Minister Benjamin Netanyahu that Moscow is ready to operate toward” ending the Palestinian-Israeli conflict and achieving peace through political and diplomatic implies.”

According to Hamas, Russia has” indefatigable initiatives aimed at stopping Israel’s anger” against it.

The US has increase its regular troops, fortify alliances, and improve its nuclear weapons development program in order to prepare for potential simultaneous wars with Russia and China, according to a report released on October 12 by the US Congressional Commission on Strategic Posture.

Putin declared on Sunday that while suggestions that the US does get ready for war with China and Russia were absurd, Russia and China were no forming a military alliance.

Zhang Hong, a scientist at the Chinese Academy of Social Sciences’ Institute of Russian, Eastern European, and Central Asian Studies, said in an interview to iFeng.com that the rumor that China and Russia may forge an alliance is merely” a smear campaign of the European countries that want to advertise their China risk idea.”

” China and Russia’s cooperation is open and transparent, with the goal of achieving common rewards.” According to Zhang, it serves as a role model for international relationships based on mutual respect. The two sides also work well together as China diversifies its energy sources and Russia explores electricity markets in the Asia-Pacific.

According to him, as the United States seeks to polarize the earth with its definitions of philosophy, politicians, and security, the global situation has gotten more complex.

He claimed that in order to find global cooperation for both itself and the Eurasian Economic Union, Russia must turn to the East as a result of sanctions imposed by the West. He claimed that by taking part in China’s Belt and Road Initiative, Russia may accomplish its objective.

The US has been using a fantastic strength game strategy to keep its hegemony. But according to Chinese martial reviewer Song Zhongping, this approach actually results in a world conflict. Such a tactic revealed the evil purposes of the US.

The US cannot combat two war at once, particularly when it does so against powerful countries like China and Russia, he claimed. ” It will keep treating China and Russia as its main competitors and devote more military sources to fighting them.”

He claimed that the US Congress’s anti-China and Russia views met the political requirements of the Biden administration. & nbsp,

Read: Power prices punctuated the” no-limit” agreement between China and Russia.

At & nbsp, @ jeffpao3 is Jeff Pao’s Twitter account.

China’s Q3 GDP growth, September activity show economic recovery gaining traction

Retail sales growth, a key indicator of consumption, also exceeded expectations, increasing by 5.5 % last month and picking up from an increase of 4.6 % in August. Economists had anticipated a 4.9 % increase in retail revenue. In contrast to aspirations for a 3.2 percent increase, fixed asset investmentContinue Reading