Getty Images

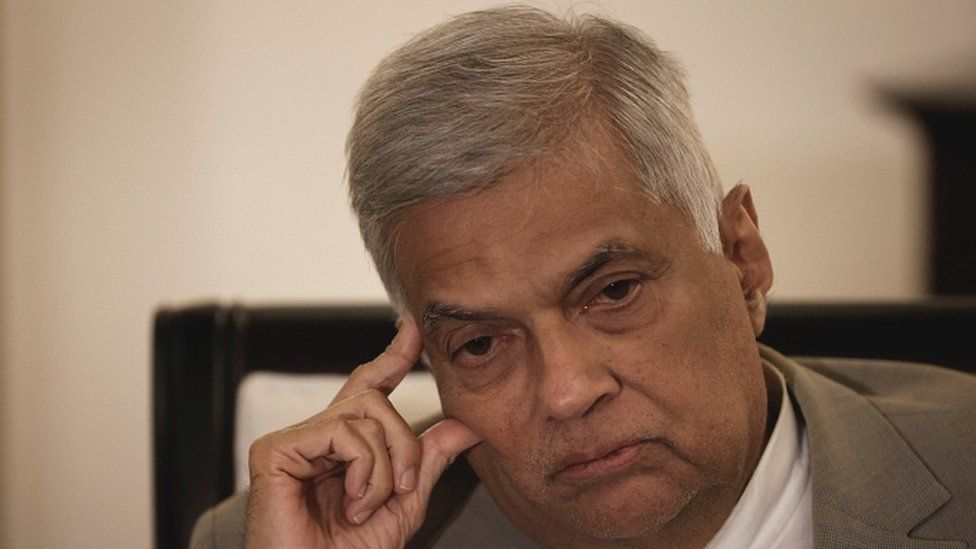

Getty Images Sri Lanka is in the midst of a deep and unparalleled economic crisis that has started huge protests and seen its president quit after fleeing the country – but other countries could be at risk of similar troubles, according to the head of the International Monetary Finance (IMF).

“Countries with high financial debt levels and restricted policy space will face additional stresses. Look no further than Sri Lanka as being a warning sign, ” said IMF Managing Movie director Kristalina Georgieva on Saturday.

She stated developing nations had also been experiencing suffered capital outflows intended for four months in a row, putting their dreams of catching plan advanced economies in danger.

Sri Lanka is fighting to pay for crucial imports like food, gas and medicine for its 22 million individuals, as it battles the foreign exchange crisis. Inflation has soared about 50%, with food prices 80% more than a year ago. The Sri Lankan rupee offers slumped in value against the US buck and other major global currencies this year.

Many blame ex-president Gotabaya Rajapaksa regarding mishandling the economy with disastrous plans whose impact was only exacerbated by pandemic.

Through the years, Sri Lanka had developed a huge amount of debt — last month, it became the first country in the Asia Pacific region in 20 years to default on foreign debt.

Officials had been negotiating with the IMF for a $3bn (£2. 5bn) bailout. But those talks are currently stalled among the political damage.

But the same worldwide headwinds – rising inflation and interest rate hikes, depreciating currencies, high levels of financial debt and dwindling foreign currency reserves – furthermore affect other economies in the region.

China has been a dominant lender to some several of these developing countries and therefore could control their destinies in crucial ways. Purchase it’s largely unclear what Beijing’s lending conditions have been, or how it may restructure the debt.

Where Customer at fault is, according to Alan Keenan from International Crisis Group, is encouraging plus supporting expensive facilities projects that have not produced major financial returns.

“Equally important has been their active political assistance for the ruling Rajapaksa family and its guidelines… These political problems are at the heart associated with Sri Lanka’s financial collapse, and till they are remedied via constitutional change plus a more democratic political culture, Sri Lanka is definitely unlikely to escape the current nightmare. ”

Worryingly, other nations appear to be on a similar trajectory.

Laos

The particular landlocked East Oriental nation of more than 7. 5 million people has been facing the chance of defaulting on the foreign loans for many months.

Now, a rise in oil prices because of the Russian invasion of Ukraine has put further stress on fuel supplies, pushing up the cost of food in a nation where an estimated third of people live in low income.

Local media stores have reported lengthy lines for gas, and said some households have been unable to pay their bills.

Laos’ currency, the kip, has been falling and is down by more than a third contrary to the US dollar this season.

Higher interest rates in america have strengthen the dollar, and weakened local currencies, increasing their debt problem and making imports costlier.

Laos, that is already heavily in debt , is struggling to repay those loans or pay for imports like fuel. The World Bank says the nation had $1. 3bn of reserves as of December last year.

Nevertheless total annual external debt obligations are around the same amount until 2025 – equivalent to about 50 % of the country’s overall domestic revenue.

As a result, Moody’s Investor Providers downgraded the communist-ruled nation to “junk” grade last month, a category in which debt is considered high-risk.

China has borrowed Laos huge amounts pounds in recent years to fund huge projects like a hydropower plant and a railway. According to Laotian officials speaking to Chinese state media Xinhua, Beijing has undertaken 813 projects worth a lot more than $16bn last year by yourself.

Getty Images

Laos’ public debt amounted to 88% of its Gross Domestic Item (GDP) in 2021, according to the World Bank, with nearly half of that find owed to Cina.

Experts point to many years of economic mismanagement in the nation, where one party – the Lao People’s Revolutionary Celebration – has held power since 1975.

But Moody’s Analytics has flagged improved trade with The far east and the export of hydroelectricity as optimistic developments: “Laos has a fighting chance of avoiding the danger zone as well as the need for a bailout, ” economist Heron Lim said in the recent report.

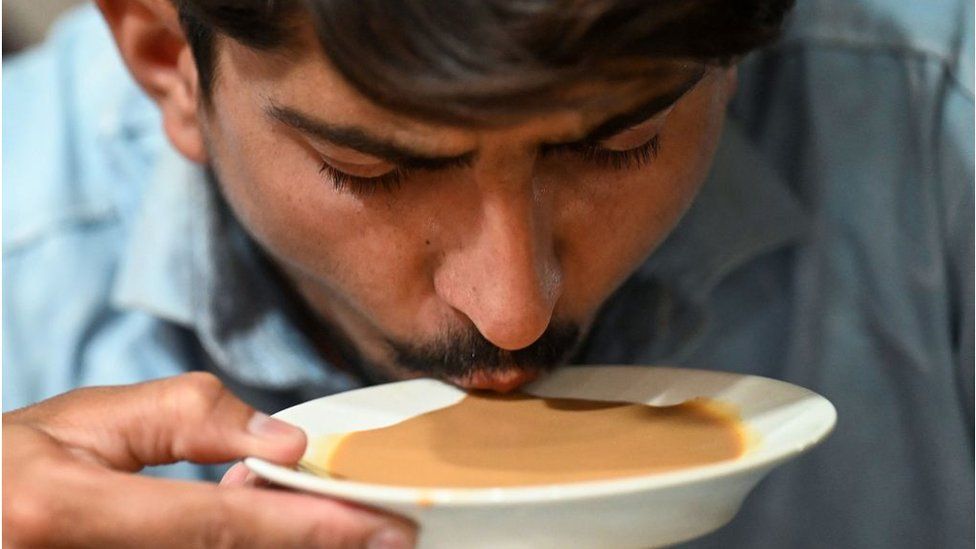

Pakistan

Fuel prices in Pakistan are up simply by around 90% because the end of May, after the government finished fuel subsidies. It’s trying to rein within spending as it works out with the IMF in order to resume a bailout programme.

The particular economy is experiencing the rising price of goods. In 06, the annual inflation rate hit twenty one. 3%, highest it is often in 13 yrs.

Like Ceylon (veraltet) and Laos, Pakistan also faces lower foreign currency reserves, that have nearly halved since Aug last year .

It offers imposed a 10% tax on big scale industry for just one year to raise $1. 93bn as it attempts to reduce the gap between government revenue plus spending – among the IMF’s key demands.

“If they are able to unlock these funds, some other financial lenders like Saudi Arabia and the UAE [United Arab Emirates] may be prepared to extend credit, ” Andrew Wood, sovereign analyst at S& P Global Rankings told the BBC.

Former prime minister Imran Khan who promised to fix some of these difficulties was ousted from power , although the faltering economy is not the only reason for that will.

Last 30 days, the senior minister within Pakistan’s government questioned citizens to reduce the amount of tea they drink to slice the country’s import bills.

Getty Images

Again The far east plays a role here, with Pakistan reportedly owing more than a quarter of its debt in order to Beijing.

“Pakistan appears to have renewed a commercial loan service vis-a-vis China which has added to the foreign exchange reserves and there are indications they are going to reach out to China for your second half of this season, ” Mr Wooden added.

Maldives

The Maldives has seen the open public debt swell in recent years and it’s now well above 100% of its GDP.

Like Sri Lanka, the particular pandemic hammered an economy that was greatly reliant on travel and leisure.

Countries that rely so much on travel and leisure tend to have higher community debt ratios, however the World Bank states the island country is particularly vulnerable to increased fuel costs due to the fact its economy is not really diversified.

US investment bank JPMorgan has said the holiday location is at risk associated with defaulting on the debt by the end of 2023.

Bangladesh

Inflation strike an 8-year rich in May in Bangladesh, touching 7. 42%.

With reserves dwindling, the government has acted fast to control non-essential imports, comforting rules to appeal to remittances from a lot of migrants living overseas and reducing foreign trips for authorities.

“For economies running current account deficits : such as Bangladesh, Pakistan and Sri Lanka : governments face severe headwinds in raising subsidies. Pakistan and Sri Lanka have turned to the IMF as well as other governments for monetary assistance, ” Betty Eng Tan, a sovereign analyst in S& P Worldwide Ratings told the BBC.

“Bangladesh has had to re-prioritise government spending and impose restrictions on customer activities, ” he or she said.

Rising food and energy prices are usually threatening the pandemic-battered world economy. Today developing nations which have borrowed heavily for years are finding that their own weak foundations get them to particularly vulnerable to worldwide shockwaves.

This video can not be performed

To play this video you should enable JavaScript within your browser.

More on this particular story

-

-

3 or more days ago

-

-

-

two days ago

-

-

-

three or more days ago

-