- Expects the PC Market in Singapore to Fall 17% in 2023

- Inventory corrections, dwindling private demand, and drop in public projects possible reasons

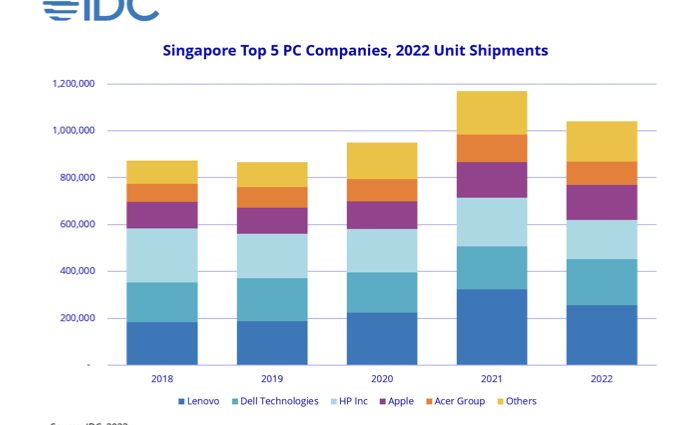

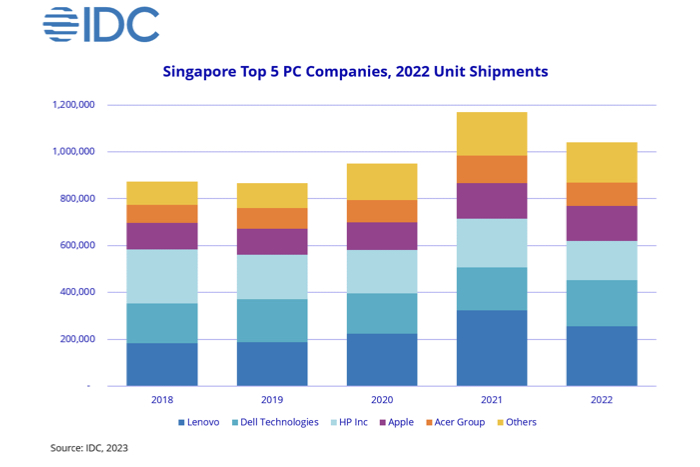

Singapore’s PC market declined 11% in 2022, totalling 1 million units shipped to the country, according to the recent IDC Worldwide Quarterly Personal Computing Device Tracker. This decrease can be attributed to weakening demand across different segments.

Following a two-year sales boom during the COVID-19 pandemic when demand was fuelled by work from home, online learning, and gaming, PC sales in Singapore finally slowed as post-pandemic life returned to normal and spending habits shifted back to leisure activities such as travelling. Inflation is a headwind in the market now, and a lot of demand was fulfilled during the pandemic, making PC purchases no longer a priority.

Lenovo remained the market leader in 2022, while HP Inc. dropped to third place as public sector shipments subsided. This allowed Dell Technologies to climb to the second spot, as the company capitalised on growth in the business segment.

Based on the graph released by IDC, Apple remains steadfast in third place followed by Acer and other brands.

While demand from the very large business segment continued to be strong, small and medium-sized businesses (SMBs) purchased PCs on a much smaller scale, and with the macroeconomic situation becoming more and more unstable globally, many companies cut down on spending.

“It is unlikely that we will see another major refresh from SMBs soon as most of them completed their PC refresh during the pandemic,” said Phang Hoon Yik, Associate Market Analyst, Devices Research, IDC Asia/Pacific.

Shipments for Personal Learning Device (PLD), a programme from the Ministry of Education which aims to equip every secondary school student with a school-prescribed device to enhance digital literacy, were already deployed during the pandemic. Demand from the Government Technology Agency (GovTech) also slowed due to bulk deployments made over the past two years. Instead, the government is now focusing on infrastructure investments.

“While the market experienced two great years of robust demand, it will face some headwinds in the short term. However, it is expected to remain resilient and stable in the long term as technology remains a critical part of consumers’ life and business operations,” Phang concluded.

Putting all the factors together, the PC market in Singapore is expected to remain soft in 2023, falling 17% because of inventory corrections, dwindling private-sector demand, and a drop in public-sector projects.