- Access to finance is critical to agriculture’s future, said SC chairman

- Capital market could help Malaysia achieve its food security agenda

The Securities Commission Malaysia (SC) encourages the broader adoption of financial technology (fintech) in agriculture to help achieve the country’s food security agenda.

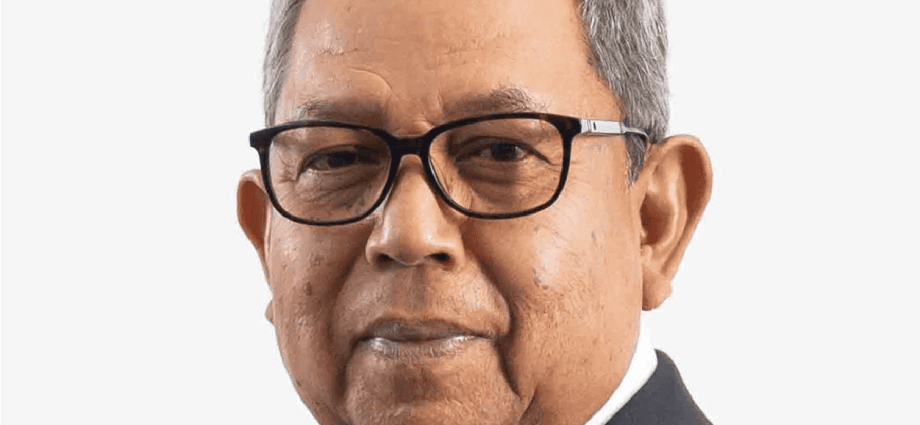

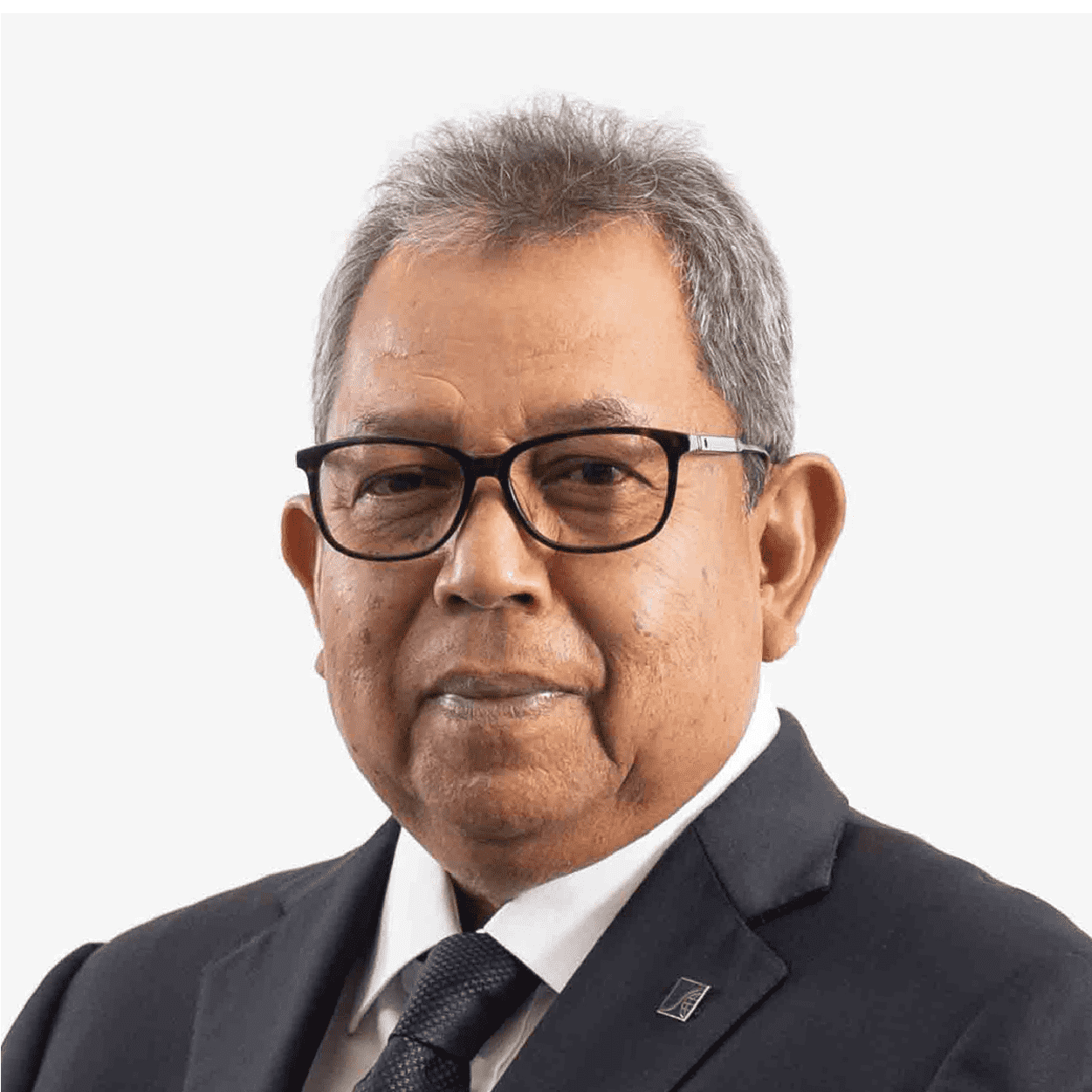

SC Chairman Awang Adek Hussin (pic) said access to finance is critical to agriculture’s future. This is especially important for smallholders and agritech-preneurs seeking to modernise agriculture and strengthen research and development, he said in his opening address at the SCxSC Grow Fintech Conference.

SC Chairman Awang Adek Hussin (pic) said access to finance is critical to agriculture’s future. This is especially important for smallholders and agritech-preneurs seeking to modernise agriculture and strengthen research and development, he said in his opening address at the SCxSC Grow Fintech Conference.

This marks the 10th iteration of the SCxSC conference, held in person again after the Covid-19 pandemic.

SCxSC GROW is a new collaborative programme under SC’s fintech flagship initiative, “Synergistic Collaboration by the SC” (SCxSC). The SCxSC GROW embodies a collaborative effort with partners in the fintech ecosystem to harness the potential of alternative financing digital platforms to meet the needs of micro, small, and medium-sized enterprises (MSME) in strategic sectors.

Recognising the challenges MSMEs face in the agriculture sector, Awang Adek said that leveraging fintech solutions will help improve access to financing and increase efficiency.

To achieve this goal, the SC has been working closely with ecosystem players to develop innovative solutions catering to farmers’ and agribusinesses’ unique financing needs. This is in tandem with the national agenda to support the agriculture sector’s transition into a dynamic and progressive industry.

Awang Adek said the capital market could be an enabler and accelerator to help Malaysia achieve its food security agenda.

“Alternative financing avenues such as equity crowdfunding (ECF) and peer-to-peer (P2P) financing allow investors with the right risk appetite to mobilise capital directly for agri-preneurs,” he said.

This provides more options for younger and high-growth companies to access capital relevant to their business risk profiles,” he added.

Over 7,000 MSMEs have benefited from SC-registered ECF and P2P financing since their introduction in 2015, raising more than US$954 million (RM4.4 billion), with only 600 agri-related MSMEs across the entire value chain raising close to US$65.01 million (RM300 million). This presents a significant opportunity for agricultural growth and investment.

Awang Adek said, “Malaysia was also the first country in this region to adopt a co-investment model, MyCIF, specifically for alternative finance platforms.” MyCIF was instrumental in providing MSMEs with financing during the pandemic.

“MyCIF implemented a special allocation ratio of 1:2 (MyCIF contributing RM1 for every RM2 raised) for the agriculture sector in 2022, which is more appealing than the normal ratio of 1:4. We’ve seen increased interest as four times as many agri-businesses have raised funds through ECF and P2P platforms,” he added.

The SCxSC GROW Fintech Conference, themed “Fostering Innovative Finance in Agriculture” aims to be a game-changer for the agriculture industry. With the world facing increasingly complex challenges, the conference brought agriculture and fintech players together to explore innovative solutions to food security, sustainability, and supply chain resilience.

The conference showcased new cutting-edge solutions, highlighting the latest advancements in these fields. The various panel also featured local fintech players in the agriculture sector.

SC Malaysia is confident that these fintech solutions have the potential to revolutionise the way farmers access financing and manage their operations, enabling them to make better use of resources and increase yields.