Analysis: Malaysiaâs anti-graft probes into former political elite Daim and Mahathirâs families sparks allegations of selective prosecution

SUSPECT TIMING OF INVESTIGATIONS?

Some politicians have questioned MACC’s explanation that the investigations into both Mr Daim and Mr Mirzan are part of the anti-graft agency’s probe into the Pandora and Panama Papers which began in August 2022.

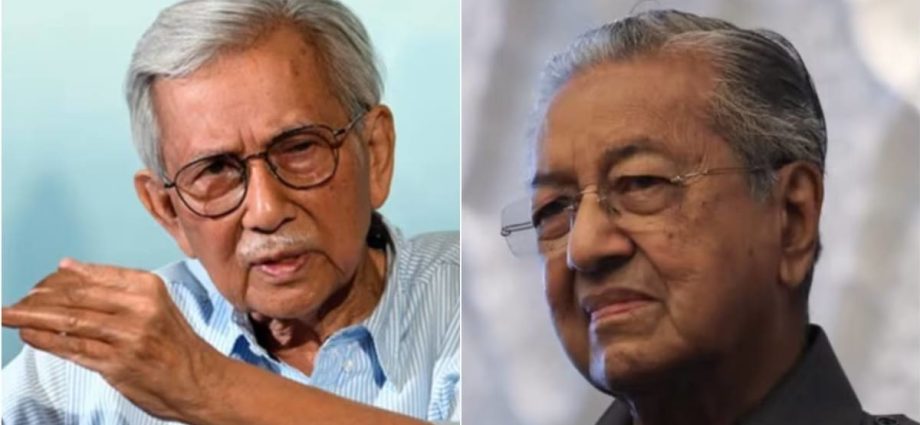

Senior lawyer and former minister in the prime minister’s department for legal affairs and judicial reforms Zaid Ibrahim told CNA that the time gap between when the documents were published and the fact that the investigations were only conducted recently triggers a legitimate perception that the probes are done selectively.

“It looks like (political persecution) to me because it has been so many years (since the allegedly illegal transactions were done),” said the former United Malay National Organisation (UMNO) member.

Mr Daim had said in the wake of the leak in 2021 that his business dealings, as revealed in the Pandora Papers, were legitimate. He added that he was a “successful and wealthy” businessman long before he entered politics and that taxes had been fully paid for his businesses and income.

Mr Daim who was finance minister from 1984 to 1991 has said that he would have accumulated over RM50 billion (US$ 10.58 billion) in liquid assets had he remained in business instead of taking up public office.

Founder of activist group Center to Combat Corruption and Cronyism (C4) Cynthia Gabriel also questioned the timing of the investigations.

“We ask for more transparency in investigations, and ask that MACC be above politics. They must also have the courage to investigate politicians currently in government, and not after they fall from power,” said Ms Gabriel.

Ms Gabriel also said that the fight against corruption should not be selective, giving the example of deputy prime minister Ahmad Zahid Hamidi whose graft charges in court were dropped back in September of last year.

“There is something fishy going on, and the prime minister must know the rakyat (the citizen population) is watching him very carefully,” she added.

However, some analysts defended the timing of MACC’s investigations, and its decision to focus the probe on Mr Daim and Mr Mirzan.

Politics expert Professor James Chin of the University of Tasmania told CNA: “The reason why Daim and Mahathir are being investigated now is because they are in the opposition (camp to PM Anwar). Previously when Mahathir was prime minister it was just not practical that he would investigate himself. Just not possible.”

Dr Mahathir served as prime minister for two terms. The first was between 2003-2018 when he was UMNO chief and the second term was between 2018-2020 as Pakatan Harapan chief.

In a press conference on Monday (Jan 22), Dr Mahathir claimed that Mr Mirzan was being investigated because he was his son.

“My son has to explain his business, his money, his property from 1981, the year I became Prime Minister until now. Not long. Only 42 years. I am quite sure all of you know what you did over the past 42 years,” he said sarcastically.

Mr Anwar had been fired from Cabinet in 1998 following a falling out with Dr Mahathir over the handling of the 1997 Asian financial crisis.

In 1999, Mr Anwar was sentenced to six years’ jail for corruption. A nine-year prison sentence was then added in 2000 for sodomy charges, a move he said was aimed to put an end to his political career.

Nusantara Academy for Strategic Research senior fellow Dr Azmi Hassan echoed similar sentiments, saying that he believed that the likes of Mr Daim and his family were being investigated now because they were considered “untouchable” by law enforcement during the era of Dr Mahathir.

“To me it doesn’t matter which one of these names are investigated, as long as there is merit to the case. Whether the infringement was done yesterday or two decades ago, if there is merit, it must be investigated,” said Dr Azmi.

Commenting on the MACC investigations, Mr Anwar had said on Jan 20 that the investigations into political elite was a difficult process and that the government needed to dedicate huge resources.

“We will go after the crooks, I don’t care… When we want to take action (against these individuals), the people get angry, saying that this Prime Minister is too harsh. For me, this is strange; you should support it (investigations). It’s not easy, you know, to investigate a Tun (the highest civilian honour that can be awarded to a Malaysian.)

“Investigating a village chief is easy. Investigating a school teacher is even easier. I want to investigate the big shots who steal big money. Do you think it’s easy? It’s not. We want to protect this country; don’t let them steal the people’s wealth,” he was quoted as saying by The Star.

Teen gangsters face murder, rape, assault charges

Two of the 5 are police sons, 11 criminal cases in total

PUBLISHED : 23 Jan 2024 at 17:26

Police will lay a folio of charges in 11 criminal cases against the young teen hoodlums accused of the murder of a mentally unstable woman, also alleging other rapes and assaults.

Two of the five accused juveniles, aged 13-16 years, are the sons of local police officers.

Sa Kaeo police chief Pol Maj Gen Ormsin Boonyanuson said at Aranyaprathet police station on Tuesday that detectives reported that the five boys were now suspects in 11 criminal cases.

They include a 14-year-old boy suspected in three cases of murder and rape.

Deputy national police chief Pol Gen Surachate Hakparn said police would press charges in all the cases this Friday. Adults were also involved in some cases.

The alleged offences included rape, murder, molestation and assault, he said.

The exposure of the youth gang’s depredations in Sa Kaeo province had prompted the launch of a police campaign against young criminals nationwide, Pol Gen Surachate said.

The battered body of a mentally unstable woman, Buaphan Tansu, was found in a pond in Aranyaprathet district on Jan 12. Initially, her 54-year-old husband Panya Khongsaenkham confessed to the crime. He later reversed his story, saying he was physically coerced by police into making the confession.

It was reported that the coercion included being restrained, a bag placed over his head and being left shirtless in a room with the air-conditioner turned down low.

CCTV footage uncovered and made public by a reporter showed five boys had attacked the victim in the early morning of Jan 12. They first harrassed the woman, who was drinking near a convenience store. She became annoyed and threw a bottle at one of the boys.

In response, the youths assaulted her and then took her away on one of their motorcycles to the pond where her body was found.

She fell off repeatedly on the way. Once at the pond they allegedly drowned her.

Analysis: Resurfaced Pandora and Panama papers cast doubt over Malaysiaâs anti-graft probe into Daim and Mahathirâs families

SUSPECT TIMING OF INVESTIGATIONS?

Some politicians have questioned MACC’s explanation that the investigations into both Mr Daim and Mr Mirzan are part of the anti-graft agency’s probe into the Pandora and Panama Papers which began in August 2022.

Senior lawyer and former minister in the prime minister’s department for legal affairs and judicial reforms Zaid Ibrahim told CNA that the time gap between when the documents were published and the fact that the investigations were only conducted recently triggers a legitimate perception that the probes are done selectively.

“It looks like (political persecution) to me because it has been so many years (since the allegedly illegal transactions were done),” said the former United Malay National Organisation (UMNO) member.

Mr Daim had said in the wake of the leak in 2021 that his business dealings, as revealed in the Pandora Papers, were legitimate. He added that he was a “successful and wealthy” businessman long before he entered politics and that taxes had been fully paid for his businesses and income.

Mr Daim who was finance minister from 1984 to 1991 has said that he would have accumulated over RM50 billion (US$ 10.58 billion) in liquid assets had he remained in business instead of taking up public office.

Founder of activist group Center to Combat Corruption and Cronyism (C4) Cynthia Gabriel also questioned the timing of the investigations.

“We ask for more transparency in investigations and ask that MACC be above politics. They must also have the courage to investigate politicians currently in government, and not after they fall from power,” said Ms Gabriel.

Ms Gabriel also said that the fight against corruption should not be selective, giving the example of Deputy Prime Minister Ahmad Zahid Hamidi whose graft charges in court were dropped back in September of last year.

“There is something fishy going on, and the prime minister must know the rakyat (the citizen population) is watching him very carefully,” she added.

However, some analysts defended the timing of MACC’s investigations, and its decision to focus the probe on Mr Daim and Mr Mirzan.

Politics expert Professor James Chin of the University of Tasmania told CNA: “The reason why Daim and Mahathir are being investigated now is because they are in the opposition (camp to PM Anwar). Previously when Mahathir was prime minister it was just not practical that he would investigate himself. Just not possible.”

Dr Mahathir served as prime minister for two terms. The first was between 2003-2018 when he was UMNO chief and the second term was between 2018-2020 as Pakatan Harapan chief.

In a press conference on Monday (Jan 22), Dr Mahathir claimed that Mr Mirzan was being investigated because he was his son.

“My son has to explain his business, his money, his property from 1981, the year I became Prime Minister until now. Not long. Only 42 years. I am quite sure all of you know what you did over the past 42 years,” he said sarcastically.

Mr Anwar had been fired from Cabinet in 1998 following a falling out with Dr Mahathir over the handling of the 1997 Asian financial crisis.

In 1999, Mr Anwar was sentenced to six years’ jail for corruption. A nine-year prison sentence was then added in 2000 for sodomy charges, a move he said was aimed to put an end to his political career.

Nusantara Academy for Strategic Research senior fellow Dr Azmi Hassan echoed similar sentiments, saying that he believed that the likes of Mr Daim and his family were being investigated now because they were considered “untouchable” by law enforcement during the era of Dr Mahathir.

“To me it doesn’t matter which one of these names are investigated, as long as there is merit to the case. Whether the infringement was done yesterday or two decades ago, if there is merit, it must be investigated,” said Dr Azmi.

Commenting on the MACC investigations, Mr Anwar had said on Jan 20 that the investigations into the political elite were a difficult process and that the government needed to dedicate huge resources.

“We will go after the crooks, I don’t care… When we want to take action (against these individuals), the people get angry, saying that this Prime Minister is too harsh. For me, this is strange; you should support it (investigations). It’s not easy, you know, to investigate a Tun (the highest civilian honour that can be awarded to a Malaysian.)

“Investigating a village chief is easy. Investigating a school teacher is even easier. I want to investigate the big shots who steal big money. Do you think it’s easy? It’s not. We want to protect this country; don’t let them steal the people’s wealth,” he was quoted as saying by The Star.

PM Lee to make 4-day working visit to New York City

SINGAPORE: Singapore Prime Minister Lee Hsien Loong will make a working visit to New York City from Wednesday (Jan 24) to Saturday. The Prime Minister’s Office (PMO) said in a statement on Tuesday that Mr Lee will be accompanied by Mrs Lee, as well as officials from PMO and the Ministry of ForeignContinue Reading

CNA Explains: What are the political implications of the new Ram temple in India?

Assoc Prof Singh said the temple’s inauguration undermined one of the founding constitutional principles of India, which is that it is a secular country with equal rights for citizens of all religions.

It sends “a very clear signal” to India’s Muslim minority, which has often been subject to violent discrimination under the BJP regime, she added.

The new temple also undermines institutions such as the judiciary, whose judgment actually cleared the path for the building of this temple, she noted.

The site represents how India has veered towards Hindu nationalism over the years, said Assoc Prof Singh.

“In 1992, it was very much a site of conflict and of this Hindu identity that was just being mobilised. What you’re seeing today is the ascendence, the hegemony (and) the triumph of this Hindu (identity) that has been so central to the ruling party and the Prime Minister,” she said.

Dr Sen said that unlike the 1992 incident, the new temple’s inauguration was unlikely to trigger a fresh wave of violence.

This is due to a high level of security around the country, and the current state of the Muslim minority which is “more fearful of the situation rather than prone to sort of take up acts of violence”, he said.

Several violent clashes erupted last year between Hindus and Muslims during Hindu processions in states like Haryana and Gujarat.

Lion cub in Bentley spooks Pattaya

Authorities looking into ownership of animal after video goes viral

PUBLISHED : 23 Jan 2024 at 16:53

PATTAYA: A video featuring a lion cub riding in a Bentley convertible driven by a foreigner along a crowded street in this beach town has sparked fear and criticism after it went viral online.

Residents living along Phra Tamnak Soi 5, where the video was taken, said they often spotted a foreign man driving his Bentley, accompanied by his lion cub sitting in the back seat. Their usual route takes them to Dong Tan beach and Yin Yom beach before the driver returns to his house in the evening.

The lion appears calm and domesticated and has a collar and leash.

The Department of National Parks, Wildlife and Plant Conservation has launched an investigation into the incident, according to local media reports.

Ownership of exotic lions like lions is legal in Thailand but officials will try to determine if the Bentley driver is the owner of the animal and has the proper permits.

In March last year, residents of a luxury housing estate in Pattaya went into a panic after they saw a white lion cub wandering around the community.

The animal’s Chinese owner, who had purchased it for 500,000 baht, had reported it missing but later informed officers that he found it hiding inside the house.

Authorities who visited the house discovered that the cub was not confined to a cage but allowed to roam freely.

Residents of Phra Tamnak Soi 5 in Pattaya say a lion cub is a frequent sight in the populated area.

Philippines will not ‘lift a finger’ to assist ICC’s drug war probe

In a statement, Vice President Sara Duterte echoed the position long held by her father that foreigners should not be allowed to meddle in the country’s affairs, adding she will refuse to be a part of a process that would put shame on the country’s courts and judicial system. “AllowingContinue Reading

MOH finds more lapses at Cordlife, sets May 31 deadline for rectifications

SINGAPORE: The Ministry of Health (MOH) has found more lapses at Cordlife amid ongoing investigations into the private blood bank. Cordlife, which is listed on the Singapore Exchange (SGX), said in December it would accept a six-month suspension given by MOH over the exposure of several cord blood tanks to irregular temperatures. TheContinue Reading

Moody’s reminds China’s pain will be widely shared – Asia Times

Moody’s Investors Service was something of a thorn in global policymakers’ sides in 2023. From Beijing to Washington, the ratings giant fired any number of shots across the bows of the biggest economies.

In mid-November, it lowered America’s credit outlook to “negative” from “stable”, pointing to political polarization in Congress as the US national debt topped US$34 trillion. Three weeks later, Moody’s cut its outlook for Chinese sovereign debt to “negative,” citing a slowing economy and a property sector crisis that Beijing has been slow to address.

Now, Moody’s is reminding Asia of the economic trauma 2024 may have in store as China’s slowdown imperils sovereign creditworthiness across the region.

Moody’s thinks the fallout from China’s property troubles on business and household confidence makes hopes for 5% economic growth in 2024 overly optimistic. It sees mainland gross domestic product (GDP) slowing to 4% this year and next.

For an economy at China’s level of development, such a downshift from the 6% growth averaged from 2014 to 2023 will set back living standards. And it will exacerbate the debt troubles Moody’s flagged last month, both among developers and local governments around the nation. It also may spark legitimacy problems for Xi Jinping’s Communist Party.

China’s slowdown “significantly influences” regional economic trajectories via supply chains, Moody’s says. “As these economies’ respective manufacturing bases are smaller in scale and less developed than China’s, the latter will remain at the center of many of the region’s supply chains and an important source of final demand in the near term.”

True, Moody’s argues that “against this backdrop, we expect companies to continue to diversify supply chains away from China to better manage risks around overarching geostrategic tensions, but also in response to longer-term structural trends.”

These “include population aging and policy risks in China – as illustrated in internet platforms and private education sector regulatory changes – as well as the rapid expansion of the middle class in India,” Moody’s says.

“The diversification trend,” Moody’s goes on, “has accelerated in recent years, boosting investment prospects in economies with large manufacturing bases and improving infrastructure such as India, Malaysia, Thailand and Vietnam.”

But such pivots take time to execute. Rerouting trade routes is complicated in the best of times and even more so in relatively tight global credit conditions.

In recent weeks, traders have dialed back expectations for US Federal Reserve interest rate cuts. The People’s Bank of China, meanwhile, has been far less generous about adding liquidity than most economists, analysts and investors expected.

In addition to the “lackluster situation in China,” says Moody’s analyst Christian De Guzman, tight credit conditions are an added headwind for the region.

“This,” De Guzman told CNBC, “is predicated on global liquidity conditions where we really don’t see the Fed easing until the middle of the year. And Asia-Pacific central banks – we don’t see much decoupling [from] global liquidity conditions there.”

It’s not just that China may be less of a global economic engine going forward. In 2023, Chinese imports contracted by 5.5% amid weak domestic demand. That means China’s 5.2% economic growth rate in 2023 didn’t generate much of a tailwind in Asia.

The bigger problem is how China’s financial risks may stress-test a region still dealing with the fallout from the Covid-19 era. In recent years, governments and companies borrowed aggressively to recover from the pandemic.

In its report, Moody’s warns that elevated global interest rates will worsen debt-servicing burdens. The upshot is that gaining access to international capital will become increasingly more difficult for lower-rated governments.

That will be a problem for China as much as anywhere, if not more. It’s sure to have a cooling effect on President Xi’s economy, notes Moody’s economist Harry Murphy Cruise.

“Real estate investment, dwelling prices and new dwelling sales are set to fall throughout 2024 before returning as a modest driver of growth in 2025,” he predicts.

Yet this could reflect wishful thinking if Xi’s team doesn’t act more forcefully this year to repair the property sector, including by creating a credible mechanism to get bad assets off balance sheets. A similar effort is needed to address the $9 trillion buildup of local government financing vehicle (LGFV) debt.

As these headwinds intensify, the Asia-Pacific region’s sovereign creditworthiness in general is deteriorating. These “tight international funding conditions will curb the region’s output,” Moody’s warns.

For its constellation of 25 sovereigns in the region, Moody’s sees GDP growth falling to an average 3.6% in 2024 from 4.2% last year. That, the rating agency’s analysts say, marks the “lowest rate of expansion in a non-pandemic year in at least two decades – reflecting a slowdown in China and broadly lackluster global economic conditions.”

Slower growth, Moody’s adds, will make it even harder for most governments to reduce Covid-era increases in public debt.

“Together with tight domestic labor markets, this will spur many APAC central banks to maintain tight monetary policy and mitigate currency depreciation risks,” Moody’s says. “International financing will remain difficult for lower-rated sovereigns, particularly frontier markets with large external payment needs.”

On Monday, China’s Premier Li Qiang called for more assertive steps to halt the plunge in mainland stocks, which are now at a five-year low. That’s easier said than done as global investors react to deepening deflationary pressures and a festering property crisis many economists compare to Japan’s banking debacle in the 1990s.

Even if the PBOC were to begin easing suddenly — something it’s avoided doing so far — the moves have already been priced in the market, says Eva Lee, head of Greater China equities at UBS Global Wealth Management. Only a much “punchier” monetary response might stabilize the situation, she adds.

Global “passive” funds are becoming far more assertive in hedging China risks. “Their recent selling did amplify the downside pressure,” says analyst Gilbert Wong at Morgan Stanley.

The reason is that “the Chinese government has not yet introduced effective measures to resolve the property turmoil and drive the economic recovery,” says strategist Ken Cheung at Mizuho Bank. This, he adds, has overseas investors continuing to “reduce their risk exposure” amid “bearish expectations” for China’s outlook.

Here, expectations versus reality are becoming a problem for investor sentiment. Generally, Premier Li has “doused” hopes for further support measures, notes Brian Martin, an analyst at ANZ Research.

As Li “trumpeted the nations’ ability to hit its 5% growth target without flooding the economy with massive stimulus,” investors were left fearing Beijing had lost the plot, he said.

Surely, Xi’s inner circle may have valid reasons to be confident about China’s 2024. It’s entirely possible that the economic dashboard Xi’s men are viewing suggests aggregate demand will bounce back sooner than most investors believe.

At the same time, Xi’s party is loath to squander progress made in financial system deleveraging. Beijing’s determination not to reward bad behavior and poor lending decisions is to be applauded. Still, if China’s trajectory is less dire than markets think, Xi’s team is doing a poor job spreading the news.

Even taking a glass-half-full approach to China’s 2023 performance requires an asterisk. “While the economy did beat the official target, it could have scored a higher grade through a more forceful response to the property meltdown and greater commitment to the private sector,” says Tianchen Xu, a senior economist at the Economist Intelligence Unit.

Downward pressure on the yuan also suggests the economy is less vibrant than Beijing’s spin would have investors believe. On Monday, Reuters reported that major state-owned banks are propping up the exchange rate. The rationale, Reuters notes, is to disincentivize traders from shorting China’s currency.

A deeper drop in the yuan might also add to default risks among distressed property developers and intensify selling of China’s A shares. So far this year, overseas funds have dumped upwards of $1.6 billion worth of Chinese equities.

“The PBOC has stepped up its efforts to restrain dollar-yuan through the daily fix lately, and this is keeping a lid on” the exchange rate “at the 7.20 level,” says Alvin Tan, head of Asia FX strategy at RBC Capital Markets. “But I think it should give way to the upside soon.”

In recent days, Tan notes, the PBOC and Beijing’s foreign exchange regulator stepped up to “strengthen market expectation guidance and take actions to correct pro-cyclical and one-way market behaviors when necessary.”

Julian Evans-Pritchard, head of China economics at Capital Economics, says the PBOC’s decision Monday to hold benchmark lending rates steady proves that policymakers “appear to harbor lingering concerns” about the yuan.

“A cut at this stage could trigger additional depreciation pressure, something the PBOC wants to avoid,” Evans-Pritchard says. “Therefore, it may stick to quantitative easing tools for now,” including supplementary lending efforts.

This, too, is part of Xi’s desire not to derail success in building trust in the yuan. A stable exchange rate remains key to making China Asia’s top financial power. As such, Xi appears to care more about a strong currency than rising stocks.

There are also geopolitical threats to consider as US voters choose a new president in November. As US President Joe Biden looks to outflank Republicans loyal to Donald Trump by being tough on China, new sanctions could emerge.

Tensions in the Red Sea and Russia intensifying its Ukraine war could boost energy prices and thus inflationary pressures in the year ahead.

All this puts sovereign ratings across Asia in harm’s way. A bigger trade war is a particular wildcard. As Washington and Beijing face off in the year ahead and related risks become “more prominent,” Moody’s warns, Asian governments will find it increasingly difficult to maintain financial balance.

Moody’s adds that “competition between China and the US is resulting in regionalization of trade and shifts in economic and financial influence” in the longer run. In the shorter run, though, such disruption is another reason for investors to worry about threats to sovereign ratings in 2024.

Follow William Pesek on X at @WilliamPesek

Mavcap invests in Vynn Capitalâs SEA focused mobility and supply chain fund

Reflects continuous commitment to back local funds, nurture pioneering startups

Sime Darby, AEI Capital earlier investors, enabling industry to invest into tech companies

Malaysia Venture Capital Management Bhd (MAVCAP), Malaysia’s largest venture capital firm, announced that it is investing as a limited partner (LP) in Vynn Capital’s latest Mobility and Supply Chain Fund….Continue Reading