Imran Khan: How Pakistan ex-PM plans to win an election from jail

Khan Imran and his party had considerably deteriorated from social sophistication, going from prime minister to jail in less than two decades.

Despite the fact that the PTI’s founder was imprisoned in cases he claims were politically motivated and barred from running for office, the group claims it has n’t given up on its hope of winning this week of general elections in Pakistan.

With the aid of a social media fightback and new, frequently unknown candidates, the group hopes to get past the authorities ‘ onslaught.

Rehena Dar is being dragged along Sialkot’s back streets past the banners of her mouth that are affixed to the confined road corners of this city in Punjab state. As rose flowers wash her from below, the sound of beating drums clears her path.

If becoming a politician in her 70s caught her off guard, she does n’t even hint at it. The worries that have kept many of her fellow applicants out of politics or beneath appear to have been dismissed.

She exclaims with the assurance of someone who has worked the public for years,” It is very good that the happy sons and daughters, brothers and mother of my capital Sialkot are standing with me.”

” I’m here with Khan Imran, and I’ll be there.” I will continue to carry Khan Imran’s emblem and walk the streets if I am left alone in common.

That is unquestionably genuine based on a quick look around. Khan Imran’s graphic is held upright by the little group that has gathered around Mrs. Dar as flags for his PTI fly overhead.

However, Mrs. Dar is never a PTI member. She is essentially an separate, like all of their candidates, because the electoral commission decided to remove the PTI’s cricket bat symbol.

The PTI claims that numerous obstacles have been put in its path as it prepares for the election on February 8 and that the choice is just one of them.

But the battle has n’t stopped. It is demonstrating its willingness to put everything it has into this war, whether it be candidates pounding the streets like Mrs. Dar or systems that can move a chief from incarceration to the front of savages.

Usman, Mrs. Dar’s brother, led the group through Sialkot during the previous election. He was a freshman PTI president who worked for former Prime Minister Khan Imran as the special adviser on children matters.

However, his household claims that Khan Imran was the “mastermind of the 9 May protests” when he made an appearance on television in earlier October after going missing for three months.

On that day last month, after Khan Imran was detained, nationwide protests broke out, some of which turned violent. Numerous Khan adherents were detained on suspicion of attacking military structures, including the home of Lahore’s most senior military official.

Khan was freed, but his group was still under attack.

Officials in his party announced their resignations from the PTI or from politics altogether in the weeks and months following the demonstrations. According to the authorities, the fact that many of Khan’s senior leaders were among them was a sign that his former supporters did n’t want to be connected to any party that was responsible for the unrest.

The PTI claimed that the defections were coerced.

Regardless, Mrs. Dar did n’t seem impressed.

I did not concur with Usman Dar’s speech when he made it, according to Mrs. Dar. I informed him that my son’s death would have been preferable. You have lied in your speech.

But, Mrs. Dar’s explicit campaigning style is certainly a possibility for all of the PTI candidates.

As long as they have not been found guilty of a crime, some applicants who have continued their campaigning while incarcerated are eligible to run for office from behind bars.

Others are waging their activities while hiding and have completely avoided the authorities.

In the northern part of Pakistan, in Khyber Pakhtunkhwa, Atif Khan served as a provincial secretary. His team then drives around his piece, parking up in town squares to tackle PTI followers, as part of his battle, and he appears on video channels on three-meter windows.

He claims that because he has been in concealing since May, this is the only way for him to deliver his message to citizens. According to the authorities, he is a required person. He thinks a fair trial would n’t be given to him.

We are trying to control it, Mr. Khan told the BBC.” It’s a completely unique experience, not among the masses, nor on stage, but among people.”

The young vote is PTI’s largest support center. They use electronic media, such as cellular phones, so we reasoned that we ought to interact with them more through it. The only thing we can do is run a campaign using online media.

The PTI’s plan has relied heavily on technology.

More people follow the group’s standard X, Instagram, and TikTok sites than the other two main parties, the PPP and PML- N, combined. Khan Imran is the only one of the three parties ‘ leaders with a personal profile on each of those three systems, indicating that their information is reaching the general public.

Additionally, there have been initiatives to use technology to try and inform citizens of which candidate is PTI-backed. Without the unifying symbol of the baseball bat, the PTI has created a website where voters may enter their district and find the candidate’s symbol who is supported by the party.

Another problem arose when it came to planning protests. Politicians and character are closely related in Pakistan. Khan Imran, the adored cricketer who later became a legislator, was probably one of the biggest, attracting thousands to his gatherings.

But after receiving two and a half words this month, he is currently incarcerated and has been there since August and appears likely to remain for the next 14 years.

The group claims that planning demonstrations has been difficult for it. Authorities in Karachi used tear gas to disperse a crowd of tens of PTI followers in late January. The authorities claimed that they lacked the necessary authorization to obtain.

This is just the most recent instance, according to the PTI, of how they have been prevented from running for office. The BBC spoke with every candidate’s campaign crew, and they all mentioned intimidating their followers. The PTI has claimed that in order to prevent them from running, there has been a battle of harassment, kidnapping, prison, and violence against them.

Murtaza Solangi, the caregiver minister of information, told the BBC,” We find these allegation false and absurd.” Sure, people have been detained; however, some of these detentions were related to the events of May 9 and others to additional criminal cases.

But, even if their claims are unfounded, the PTI is free to voice their disapproval. They are reported in the media. They also have different legal options, such as the highest authorities in the nation, at the same time.

What is the answer to these issues? online demonstrations.

Jibran Ilyas, the head of the PTI cultural advertising, told the BBC over the phone that it was” affordable, safe, and quick.” Perhaps the actual rallies had a little less of an impact, but we were still trying to get our point across.

Mr. Ilyas remarked,” We’ve always had a political protest without Imran before.” Without him, had one still function? They were n’t entirely certain.

People are yearning for Khan Imran’s concept, he claims, which is the issue.

So how do you spread the word?

Only about 30 % of people in Pakistan use social media regularly. According to Michael Kugelman, chairman of the South Asia Institute at the Wilson Centre think tank in Washington, this suggests that as effective as the PTI is at spreading the word on social advertising, there will be natural restrictions on their approach with their virtual campaigning.

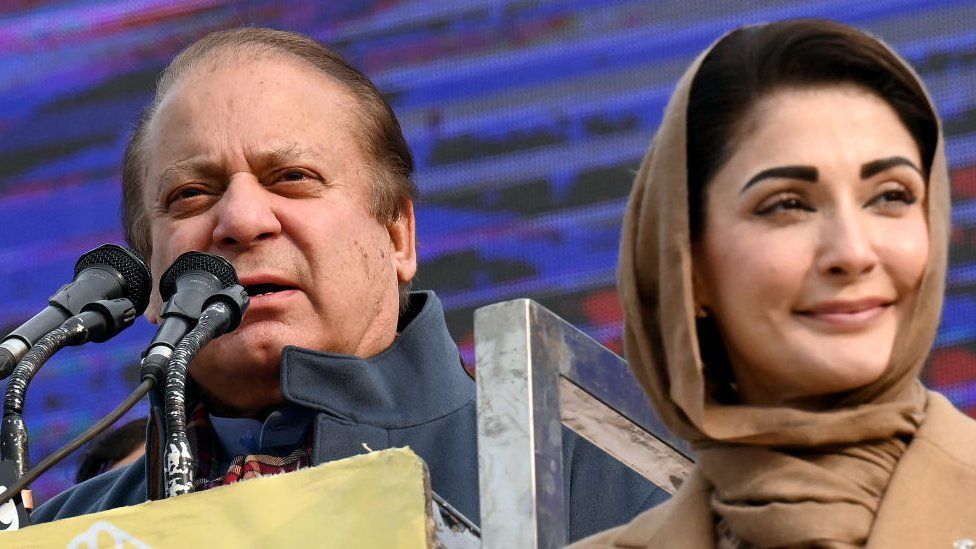

Of course, this has been observed before; most importantly, when Nawaz Sharif was imprisoned during the previous vote.

According to Mr. Kugelman,” If everything sounds the similar, that’s because it is; the players have really changed.”

He, like the majority of social analysts, believes that Pakistan’s potent military—the similar military that many believe to be the first ticket to power—is to blame for this turn of events.

The PTI received electoral support in 2018, but it is obvious that electoral engineering, even if it was n’t done directly by the military, benefited them.

There were numerous instances of exploitation and suppression. Users of the PML-N group were detained, and prison sentences were announced shortly before the election, including Nawaz Sharif’s 10 year prison sentence.

However, Mr. Kugelman believes that this is distinct from current times.

The handbook is the same, I would contend, but the depth is higher this time. More leaders and supporters have been detained and imprisoned than in subsequent votes.

Family people have been involved in this this day. Although it is not unusual, what we have observed in more new votes makes that stand out.

The PTI has made an effort to use each setback against Khan Imran or its plan as fuel, but will it be successful?

Nawaz Sharif and Bilawal Bhutto, two of Khan’s competitors for the PML-N and the PPP, are frequently covered at election rallies on Pakistani television programs. The PTI has received the majority of the media attention in the week leading up to the election regarding their president’s prison terms.

Mr. Kugelman contends that many voters might believe there is no place in election because they believe the PTI has no chance of winning.

How to motivate a sizable help base to turn out and voting in spite of everything that is happening to Khan is the challenge facing the PTI management. Some members of the PTI believe they could pull off a magic and win if they do get out there and vote attendance is large enough.

Related Subjects

On this account, more

-

-

ten days earlier

-

-

-

three days ago

-

Marilyn Manson completes community service sentence for blowing nose on videographer

According to court documents, Marilyn Manson just finished his time at an organization that provides meeting place for Alcoholics Anonymous and Al-Anon after being sentenced to community service for sneezing a videographer at the 2019 music in New Hampshire. According to the group’s site, the impact chair, 55, spent 20Continue Reading

4k US navy personnel join ‘Cobra Gold’

PUBLISHED: 4 February 2024 at 7:12

Cobra Gold 2024, a mutual defense training to be held in Thailand from February 26 to March 8, does feature the deployment of the USS Somerset and USD Miguel Keith with more than 4, 000 employees.

During a presentation for the occasion, Gen Thitichai Tiantong, Chief of Joint Staff of the Royal Thai Armed Forces, announced that 9,590 men from 30 different nations will participate in the yearly training.

The USS Somerset is a US Navy transport dock of the San Antonio course, whereas the USM Miguel Keith is an American B. Puller school mobile base.

According to Col. Kurtis A. Leffler, head of the Joint US Military Advisory Group Thailand, the US will concentrate more on marine training this time.

According to the US embassy, the Thai and American fleets may also work during Cobra Gold to recover HTMS Sukhothai‘s shipwreck. On December 18, 2022, HMS Sukhothai was caught in a surprise and sank about 35 kilometers off the beach of Prachuap Khiri Khan.

Seven nations will take part in all key aspects of this year’s practice over the course of the training. Thailand, the US, Singapore, Indonesia, Japan, South Korea, and Malaysia are among them.

Australia will only participate in the command-post exercise, while China and India will take part in just the philanthropic political assistance training.

In a group known as the global planning augmentation team, an additional 10 nations will alternately participate in the exercise. Bangladesh, Canada, France, Mongolia, Nepal, New Zealand, the Philippines, Fiji, Britain, and Brunei make up the staff.

The other party, known as the combined observer liaison group, will have the other 10 participants take part in the exercise. Cambodia, Laos, Brazil, Pakistan, Vietnam, Germany, Sweden, Greece, Kuwait, and Sri Lanka are among them.

âI gave up on parentingâ: This mother suffered from parental burnout â hereâs how she beat it

I gave up on parenting three years ago, in the midst of the COVID-19 crisis. Or, more accurately, I stopped and let go of my expectations of what it meant to be a” great Mum.”

My older daughter was in key six, as I clearly recall. I became stressed out from having to coach her for the PSLE regional test. Due to the increased notifications put in place for the Delta stress, in-person actions were decreased, particularly in the weeks leading up to examination, with no fee, lowered activities, and additional restrictions on social activities.

The strain of controlling my kids under the constantly evolving COVID- 19 practices took a burden. Additionally, I had lost my job a month before and was currently working part-time on various projects. I stayed away worrying about money.

I experienced anger and a lack of attention from the area results when we were able to receive our COVID- 19 immunisation.

To make matters worse, I was involved in a car accident that made me angrier and displayed mood swings that my home did not like. Although I was in good physical shape, my mental heath was unquestionably deteriorating.

The 10 best Chinese New Year pineapple tart brands to try in 2024

Since the pre-COVID days, prices of goods have skyrocketed, and the 9 % Tax adds to the burden on our wallets. Times have changed. Chinese New Year’s ( CNY ) treats like cookies and pastries have never been inexpensive, but they are now more expensive than ever.

Pineapple pies are a well-liked CNY meal that is oh so delectable but also very expensive. This is due to the fact that making the jam from scratch requires grating hard pineapples, which makes it extremely labor-intensive.

Finding out which fruit pastries are truly worth your money is something we think is worthwhile. So, over the course of eight days, we methodically purchased 30 different pineapple tart brands. department of Sg on the campus of Mediacorp.

We then munched our approach through the top 10 brands andnbsp that we would spend money on. It’s a difficult task, but someone has to complete it, best?

Significant statement: We bought each of these companies on our own and have no affiliation with any of them. Therefore, each fruit tart has a place of its own.

THE SELECTION OF THESE 30 Companies

It would be impossible to try this CNY address in every variation given that there are simply more than 100 brands selling fruit tarts in Singapore. Therefore, we have decided on 30 companies, which is still a decently large selection.

First and foremost, we chose to include the majority of these businesses based on how easily accessible and well-known they were after 8 days. Readers, gs.

These F&, B brands do n’t require you to sacrifice 10 goats or your firstborn in order to purchase them. The pineapple tarts can be purchased either physically at stores like bakeries and pop-up CNY fairs ( like Takashimaya’s atrium fair ), or online ( the most well-liked and practical method these days ).

We also conducted an open call for our readers to suggest their favorite brands, and some of the information we received from you was added to our list to ensure that we did n’t miss any potential gems.

We excluded fruit tarts from resorts, charities, and home-based businesses to ensure that we judge each one pretty. We want to compare them as uniformly as we can because their home procedures are typically quite different from those of CNY goodies specialists.

Just the traditional fruit dessert was chosen for this taste test in order to further ensure consistency. Therefore, if offered one, almost everyone will have it—no ka or other outré flavors—just the good ol ‘ traditional crowd favorite.

We also purchased the open-faced pineapple dessert that many people are comfortable with as much as we could. However, we did include buzzy brands that do n’t offer the open-faced variety in closed tarts.

Thai-China ties to hit new high

Mutual visa-free program a hospitality increase

PUBLISHED: 4 February 2024 at 6:56

The mutual visa exemption program for citizens of the two nations will encourage outbound tourism and further strengthen bilateral ties, according to the Thai-Chinese Cultural Relationship Council (TCCRC ) and the Chinese ambassador to Thailand.

According to TCCRC leader Pinit Jarusombat,” This Chinese New Year is unique because it ushers in a new era for Sino-Taiwan relationships.”

He continued by saying that Wang Yi, the foreign minister of China, visiting Thailand on January 24 to sign the contract and staying for three days, was also a remarkable mark.

The mutual visa-free program, which goes into effect on March 1, entirely waives visa requirements for citizens of each other.

The cancellation program aims to encourage more Chinese people to visit Thailand while easing travel restrictions for Thai and Chinese tourists.

Because Thailand shares a lifestyle with China, it is the travel destination that powerful Chinese tourists prefer.

According to Mr. Pinit, Thailand is also regarded as a center for funding and knowledge in the Asean region.

Thai visitors to China also gain from the waiver because they are no longer required to wait weeks for a card, he continued. In the next two times,” I believe it will enhance the travel consistency between the two nations tenfold,” Mr. Pinit stated.

According to him, Chinese visitors typically spend at least 20,000 yuan, or 100, 000 ringgit per person, while visiting Thailand. This tourism income will help organizations at all levels.

According to Chinese ambassador to Thailand Han Zhiqiang, the visa exemption may strengthen ties between the two nations.

According to him, “more associations will result in stronger bonds and create the adage that Chinese and Thais are never far but brothers and sisters even more true.”

After attending a meeting with the Chinese government, Mr. Han even emphasized China’s contribution to the fight for earth peace.

China has a strategy for working with its neighbors and different countries around the world. There have been a number of policies put in place to stretch such cooperation, he said.

According to Mr. Han,” Cooperation with Thailand did get much better in the future.”

According to TCCRC President Mr. Pinit, bilateral trade between China and Thailand could reach US$ 200 billion ( 7.1 trillion baht ) in 2024.

Govt may cut alcohol sale ban

Proposal ‘in line’ with tourism plan

The government could scrap the afternoon ban on alcohol sales to further boost its tourism promotion policy.

Public Health Minister Cholnan Srikaew will ask the government’s alcoholic beverage control committee to consider a call by an alcoholic beverage business association to get rid of the rule prohibiting the sale of alcohol between 2pm and 5pm.

In his capacity as chair of the panel, Dr Cholnan said he plans to request a discussion on the Thai Alcohol Beverage Business Association (Tabba)’s petition.

The afternoon ban isn’t actually part of the Alcoholic Beverage Control Act, but an announcement put in place by a coupmaker in 1972, he said. “The committee would have to find out what to do if it agrees the 2pm–5pm alcohol sale ban has to go for the sake of the government’s tourism promotion policy,” he said.

A source on the committee said a conclusion is expected to be reached at the next meeting on Feb 15.

And even though Tabba’s proposal appears consistent with the government’s tourism promotion policy, stricter measures to protect the public, especially minors, from the possible dangers of cancelling the ban will need to be implemented, the source said.

In the event the alcohol beverage control panel approves Tabba’s call, the committee will forward the decision to the national alcoholic beverage policy committee for a final endorsement, the source said.

The national committee is generally chaired by the prime minister or a deputy, the source said.

If the national committee endorses the cancellation plan, a new announcement by the Ministry of Health will be published and the sale of alcoholic beverages between 2pm and 5pm will be allowed, the source said.

The cancellation may be rushed so the new rule can come into force by early April, in time for the annual Songkran festival, said the source.

Last Thursday, Tabba adviser Thanakorn Kuptajit said a new regulation by the Ministry of Interior to allow entertainment businesses in Bangkok, Phuket and Chon Buri to extend opening hours until 4am, which took effect on Dec 15, had yet to fully benefit these businesses due to the afternoon ban.

The regulation imposing the ban is seen by Tabba as a setback, Mr Thanakorn said. The government must take care of this to fully support its tourism promotion efforts, he added.

Along with the cancellation of the 2pm–5pm alcohol sale ban, Tabba is also urging the government to step up enforcement of legal measures aimed at preventing alcohol-fuelled road accidents and illegal alcohol sales to people under 20 years old, he said.

The Thai-Chinese visa-free scheme, due to come into force on March 1, has increased the interest of Chinese people who want to visit the kingdom. The government’s decision to relax alcohol controls should help further boost tourism-related income, he said.

“Regulations that set back tourism or aren’t really necessary should be adjusted to bring them in line with the government’s tourism promotion. This alcohol sale ban is one of those regulations,” he said.

Aside from Chinese tourists, visitors from many other countries are used to sipping alcoholic beverages during meals, particularly dinner, he said.

Tabba has submitted its petition asking for the lifting of the 2pm–5pm alcohol sale ban to PM Srettha Thavisin, DPM Somsak Thepsutin and Dr Cholnan, he said.

Halting the student violence cycle

Although schools are intended to be secure learning environments, abuse and violence are known to occur frequently.

The latest incident at a Bangkok school, in which an alleged bullied 14-year-old boy was stabbed and killed, speaks volumes about the emotional harm that bullying can cause and how it unfortunately prompts victims to take drastic measures.

The perpetrator had been harassed by the target for two weeks before resorting to violence as a last resort, according to an original police investigation into the Jan 29 assault at Matthayom Naknawaupatham class on Soi Pattanakan 26 in the Suan Luang area.

Bullying at schools has been common for years; according to a study conducted by the Public Health Ministry last year, 44.2 % of 37,271 young respondents experienced either emotional or physical harassment, of which 86.9 % occurred in schools.

As part of a program to monitor students ‘ health and wellbeing, the Department of Health Service Support and Education headquarters in Bangkok and the regions conducted the survey.

Thailand had the second-highest level of abuse in the world, with 600,000 schoolchildren being victims, according to a survey conducted by the Department of Mental Health in 2020.

The stabbing on January 29 emphasizes the urgent need for educators, parents, and policymakers to prevent harassment and assault in the classroom.

Participants were questioned by The Bangkok Post to learn more about how to combat bullying in schools. Babies need to be reminded by their teachers and parents that bullying is unacceptable in schools and that it will result in negative effects.

enhancing school safety

The government supports a cooperative strategy to create safer schools, according to Siripong Angkasakulkiat, Pol Gen Permpoon Chidchob’s helper.

Due to the incident, more work needs to be done to address class crime and protect students ‘ personal well-being.

According to Mr. Siripong, Pol Gen Permpoon aims to make educators more personable in order to foster a friendly atmosphere where students can feel comfortable confiding in them about difficult incidents.

It’s crucial for instructors to get along with their kids well so that kids can feel at ease talking to them and asking for advice. The education secretary is concentrating on that strategy, he said.

The secretary also has a committee responsible for ensuring students ‘ emotional well-being, and one of its goals, according to him, is to improve the abilities of teacher-counsellors known as young naeh-neew, giving them the skills they need to help students.

He continued by saying that the government would reveal this month the steps it has taken to improve the wellbeing of learners.

Bullying is a difficult problem that is challenging to control, but Mr. Siripong acknowledged that it can be solved by working with partners.

Families, schools, and neighborhoods must take social action in this matter, just like the proverb” It takes a village to raise the child,” he said.

He responded that student happiness levels and the level of public involvement can serve as indicators to determine the effect of these initiatives when asked about the criteria used to assess interventions in reducing bullying.

And there needs to be a decrease in violent situations, he continued.

He claimed that surveillance systems have been set up by the government to assess the actions. Directors of the education zones and statewide education offices monitor their implementation and provide reports on their findings, he said.

Stepping up safety measures to make schools free of limited items like weapons is an immediate step taken after the stabbing incident, he said.

Although some students might be able to avoid recognition, he said that adequate measures are required because they can lessen violent incidents.

Siripong: A town is necessary to raise a child.

People have a part.

Bullying patients frequently experience sadness, experts say.

According to Pol Col. Krerkkamol Yamprayoon, head of the psychiatric and drug division at the Police General Hospital, a study conducted by the Department of Health in 2021 revealed that 28 % of children had high levels of stress, and 32 % of these children were at risk of developing depression.

According to studies, abused children are three times more likely than unbullied children to experience depression.

However, exposure to the media may drastically change children’s mental health and how they respond to various situations, he said. The household plays a vital role in protecting children from depression and anxiety and lowering the risk of violence.

In order for families to comprehend the issues their kids might encounter, Pol Col Krerkkamol urged them to have opened communication with them.

But, he added, parents must approach their children with purpose rather than emotion and give them the time and space they need to discuss their problems.

” Spending quality time together enables parents to carefully monitor their children’s behavior.” And parents may think about changing their activities if they seem angry, he said.

Bullying victims might exhibit melancholy and annoyance. They might even show a diminished sense of self-worth and lack of focus, he said.

They frequently act indifferently toward past pastimes, shift their eating habits (either eating more or less ), and speak in a variety of ways.

Before their kids start thinking about hurting themselves and other people, parents are advised to seek counseling for them, he said.

Krerkkamol: Kids need to talk.

tones of parents

Following the death of a pupil at Matthayom Naknawaupatham class, parents and students have expressed worries about bullying.

Panupong, 10 ( surname withheld ), claimed that his mother had informed him not to engage in bullying at school.

I’ve always abused my classmates at school. We simply enjoy, and that’s it. I believe that instead of bullying, we should concentrate on our reports.

Bullying is unacceptable and no one deserves it, according to 44-year-old Parichat ( surname withheld ).

” I speak with my brother about his day-to-day activities. Anyone wants their kids to be bullied or bullying each other, so as a family, I’m worried about that information.

Because students are still developing and also children, teachers should watch how they behave in order to prevent fights between students, according to Parichat.

calling for more effective measures

Violence against children is a major issue, according to Suriyadeo Tripathi, producer of the Centre for Morality Promotion.

According to Dr. Suriyadeo, a delicate society may give rise to children who imitate violent behavior, experience social problems, and lack empathy.

Yet words can cause a emotionally unstable child to lash out when they are under pressure from their family or school, he claimed. Even worse would be a world rife with murder that might have an impact on him.

He added that parents should be held responsible for their children’s behavior and that “tackling the problem at its origins may begin with families, schools, and areas.”

In the meantime, he said, the Ministry of Social Development and Human Security really assist in providing care for kids whose parents have a history of violence. It’s a crucial step to help safeguard kids, he said.

By avoiding demanding scientific assessments, schools can help students feel less stressed, he said. To develop their skills, students should concentrate on life-skills courses.

Communities if, in the meantime, set up a system for monitoring, transferring cases, and consulting with violently inclined children.

He claimed that after receiving favorable opinions, a House panel had invited him to reveal his opinions on youth violence. The state will receive a proposal to tackle child violence.

Suriyadeo: Concentrate on life knowledge

PM presses on with digital wallet despite NACC corruption warning

PUBLISHED: 05 :08 on February 4, 2024.

On Saturday, Prime Minister Srettha Thavisin announced that he would expedite discussions with Deputy Finance Minister Julapun Amornvivat about how to proceed with the electric pocket plan worth 10,000 baht.

The handout, which was initially set to go on sale in May, seemed to run into a roadblock in the wake of an investigation by the National Anti-Corruption Commission ( NACC ) that warned the program was potentially in legal jeopardy.

The finance minister, Mr. Srettha, stated that the government is still awaiting the NACC’s tips while even thinking about a backup program in the interim.

The consumer is looking forward to the plan rollout, so I will speak with Mr. Julapun about how to proceed, he said.

The prime minister said the government would need to speak with the NACC primary and declined to say how delayed the flyer may be.

The premier policy is still on trail, according to Prommin Lertsuridej, the prime minister’s secretary-general, and the government will move forward with a bill to request an interest loan of 500 billion baht to finance it.

After the NACC’s record is forwarded to the state and the modern budget committee reconvenes the following year, he said the administration is getting ready to respond to questions about the program.

He claimed that the country’s latest statistics indicate an economic crisis has occurred, highlighting the need for such a measure.

The Fiscal Policy Office ( FPO ) reported that GDP did not grow by 2.7 % as expected in 2023, only by 1.8 %. The FPO anticipates a 2.8 % increase in the economy this year.

The state will determine whether there is a problems or not. The president’s responsibility is to develop plans that will improve the situation of the populace and act in accordance with the actual circumstances. According to Dr. Prommin, this is what it hopes to accomplish with the online budget.

Phumtham Wechayachai, the deputy prime minister and minister of commerce, emphasized once more the importance of the digital wallet scheme in addressing financial issues.

Mr. Phumtham cited a group of academics who cautioned that Thailand might find itself struggling to deal with an economic crisis resembling the collapse of 1997 unless the government boosts purchasing power and increases the fiscal multiplier effect.

Is de-risking the beginning of the end for made-in-China goods?

According to Julio Bello, the company’s vice president and general manager in Hermosillo area, its earnings growth has doubled in five years as a result of many of those clients moving some of their manufacturing businesses from China to Mexico.

We’re going to add some lines and increase our ability over the next six months. That will help our growth plans for 2024 and 2025.

Collectron International Management, which aids foreign businesses in moving to Mexico, is another benefactor. According to Maria Elena Gallego, president and chief executive officer of Collectron Group, the team head matter has increased from 8, 000 to 10, 000.

European investment is pouring into her nation in addition to the 2018 start of the US-China business war. Another is the crisis. She added,” And of course, it has gotten worse ( as a result of the fight between Russia and Ukraine ).

It helps that Mexico’s labor force is experienced and prices are competitive. Bello remarked,” We’re lucky to be in a region with many institutions nearby and an extremely talented and skilled workforce.”

-sureanot.com-