Japan police arrest woman, parents in beheading of man at hotel in Hokkaido entertainment district

TOKYO: Japanese police said they have arrested a woman and her parents in a bizarre beheading case in a popular night entertainment district in Japan’s northern city of Sapporo, where a headless man was found in a hotel room three weeks ago. Hokkaido police on Japan’s northern main island saidContinue Reading

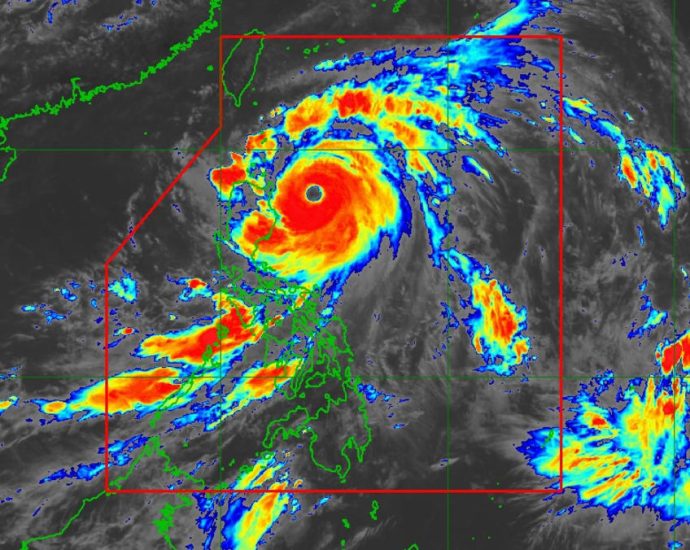

Typhoon Doksuri: Taiwan cancels Han Kuang military drills

Reuters

ReutersTaiwan has cancelled parts of its largest military drills as it braces for what could be the strongest typhoon to hit the island in four years.

Doksuri has roared to super typhoon strength with winds of 240km/h (149mph) and is headed to waters that separate Taiwan and the Philippines.

The annual Han Kuang drills that started Monday tests Taiwan’s defence in case of an attack from China.

It is unclear if the rest of the five-day-long exercise will be disrupted.

Typhoons are common in the western Pacific at this time of the year, but none have hit the island directly since 2019. Taiwan is projected to feel the impact of the super storm on Wednesday and Thursday.

Taiwan’s weather bureau has issued warnings for strong winds and heavy rains. In the southern port city of Kaohsiung, authorities had made haste to round up containers on the sea.

“I’d like to remind citizens not to underestimate the typhoon threats,” Taiwan’s premier Chen Chien-jen said in a statement posted online.

In the Philippines, schools and offices have shut in the northern province of Cagayan as Doksuri moved closer. The flood-prone province is home to 1.2m people.

Climates scientists have long warned that global warming will increase the intensity and frequency of storms.

Later this week, Doksuri is expected to head to southern China, which is still reeling from typhoon Talim earlier this month.

This year’s Han Kuang will see Taiwan simulating its response to an attack on its main airport and a China-led blockade. It is one of the biggest yet since the drills started in 1984.

Taiwan regards itself as a self-ruled island, distinct from mainland China, with its own laws and democratically elected leader.

However, China sees island as a breakaway province that will eventually be brought back under Beijing’s control, by force if necessary.

Related Topics

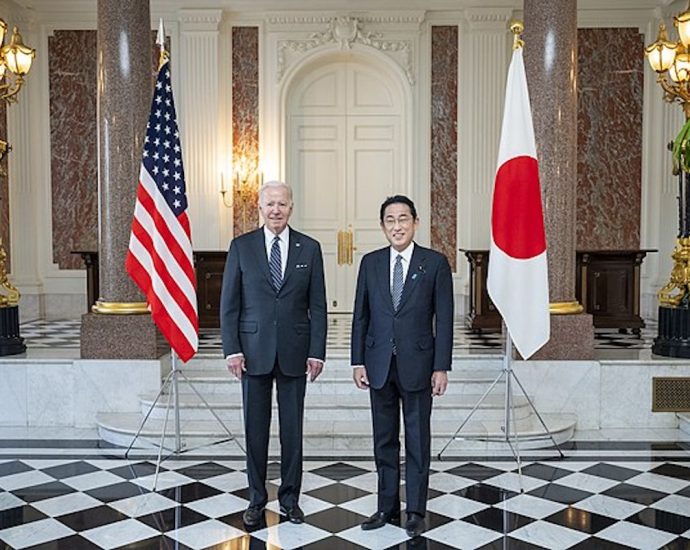

Japan enacts chip export controls at US behest

Japan’s new restrictions on exports of advanced semiconductor production equipment went into effect on Sunday. Drawn up at the instigation of the United States and formally announced three months ago, they are couched in broad terms but are aimed primarily at China.

At this stage, it is difficult to predict their impact on Japanese equipment makers or Japan-China relations, but a group of Japanese politicians are already questioning the wisdom of Prime Minister Fumio Kishida’s seeming eagerness to side with the US in a trade war with China.

These politicians are followers of Ishibashi Tanzan, a journalist-turned-politician who advocated for an independent foreign policy and good relations with the People’s Republic of China in the years after World War II.

Individual export licenses are now required to export 23 specific types of semiconductor production equipment, including cleaning (three items), deposition (11 items), annealing (one item), lithography (four items), etching (three items) and inspection (one item).

Cleaning: Tokyo Electron, Screen Holdings

Deposition: Tokyo Electron, Kokusai

Annealing: Screen Holdings

Lithography: Nikon, Canon

Etching: Tokyo Electron, Hitachi

Inspection: Hitachi, Lasertec

Extreme ultraviolet (EUV) lithography, nanoimprint lithography, photomasks, epitaxial wafers and high-speed valves are specifically mentioned, indicating that restrictions may also affect a few other companies such as Hoya, Toppan and Horiba.

This equipment now falls into the category of items that can be used for military purposes, the export of which is regulated under Japan’s Foreign Exchange and Foreign Trade Control Law.

In a broad sense, they do (through the use of semiconductors in weapons systems, computing and artificial intelligence), but so do other types of semiconductor production equipment that are not on the list.

The vagueness appears to be deliberate, giving the government a free hand to grant or deny export licenses while supporting the US.

In theory, equipment used at process nodes as large as 45 nanometers might be affected. In practice, the controls might be quite limited. Optimistic and pessimistic views of the restrictions compete, but their actual impact won’t be known until quarterly sales trends emerge and the companies involved provide commentary.

In a worst-case scenario, the impact could be quite severe, putting billions of dollars’ worth of sales at risk and inviting retaliation in the form of Chinese restrictions on exports of critical materials such as gallium nitride, germanium and rare-earth metals.

According to the International Trade Center of the Ministry of Foreign Affairs, Japan accounted for 30% of China’s imports of semiconductor production equipment in 2022. In the fiscal year ending March 2023, 23% of Tokyo Electron’s sales were made in China. Japan’s total trade with China in 2022 was 61% greater than its total trade with the US. There is a lot to lose.

This has not escaped the attention of the Ishibashi Tanzan Study Group, a cross-party association of Diet members founded to discuss policies that promote Japan’s interests as a trading nation and do not simply follow those of the US.

The group is led by Iwaya Takeshi, a former minister of defense from the ruling Liberal Democratic Party (LDP), Shinohara Takashi from the main opposition Constitutional Democratic Party, and Furukawa Motohisa from the Democratic Party for the People.

Furukawa Yoshihisa, a former minister of justice from the LDP, serves as chief secretary. He was quoted by Toyo Keizai (The Oriental Economist) as saying, “Tanzan emphasized that ‘just following America is not good for either Japan or America. We will partner with America, but we will not subordinate ourselves to America.’”

Group’s inspiration

Ishibashi Tanzan was born in Tokyo in 1884. The son of a Buddhist priest named Sugita, he took his mother’s surname, Ishibashi, but later became a priest himself.

After graduating from Waseda University, where he studied philosophy, he went to work as a journalist, first for the Mainichi newspaper and then for the Toyo Keizai magazine, rising to the positions of chief editor and, in 1941, president of the company. Waseda is one of the top two private universities in Japan.

Ishibashi opposed Japanese militarism and colonialism and, after the war, the policies of the US occupation. He was appointed minister of finance by prime minister Yoshida Shigeru in May 1946. Elected to the Diet in April 1947, he was purged a month later for his independent views.

After returning to politics in 1951, he supported the revision of Article 9 of the Japanese constitution, which renounces war as a sovereign right of the nation, and the rebuilding of Japan’s armed forces.

Ishibashi was appointed minister of international trade and industry by prime minister Yukio Hatoyama in 1954 and succeeded him as prime minister in 1956. Forced to resign for health reasons after only two months in office, he remained in politics, visiting the People’s Republic of China in 1959 and opposing the revision of the US-Japan Security Treaty in 1960.

The revised Security Treaty formalized the right of the US to maintain military bases in Japan in return for a commitment by the US to defend Japan from attack. It remains the cornerstone of US-Japan relations today.

In China, Ishibashi met with premier Zhou Enlai. The joint communiqué they issued after the meeting stated:

“Both sides believed that the peoples of China and Japan should hold hands and contribute to peace in [the] Far East and the world.… Mr Ishibashi stated that the Chinese and Japanese peoples should make efforts, based on their actual situations, for exchanges and developments in the political, economic and cultural spheres.

“Premier Zhou concurred with his statement, and pointed out the development of political and economic relations between the two countries should be integrated rather than separated. Mr Ishibashi concurred with this.”

Ishibashi died in 1973, but his ideas lived on as an alternative to the US-centric policies of successive LDP governments. They are enjoying a resurgence now due to concerns about the reliability of the US generated by former president Donald Trump, and the rise of protectionism and escalation of tensions with China under President Joe Biden.

Even if there is no outward change in Kishida’s foreign policy, the Ishibashi Tanzan Study Group can be regarded as an exercise in contingency planning and a signal to China that Japan is not pursuing a single-minded policy – that is, risk hedging from the standpoint of a nation dependent on international trade as opposed to the “de-risking” now touted by the US, which interferes with that trade.

In an opinion piece carried by the Nikkei newspaper under a pseudonym this month, the author wrote that the link between the formation of economic blocs and war is one of the lessons of history and that if Japan is to live as a trading nation, it should not worry about choosing between the US and China but be more focused on taking the market.

A delegation from the study group is reportedly planning to visit China in August.

Follow this writer on Twitter @ScottFo83517667.

Caretaker PM Prayut against 10 month wait for new govt

PUBLISHED : 25 Jul 2023 at 11:54

Caretaker Prime Minister Prayut Chan-o-cha has spoken against a proposal by some allies of the Move Forward Party (MFP) to wait 10 months for an end to senators’ tenure before forming a new government.

“I don’t think it’s appropriate,” Gen Prayut said in response to reporters’ questions about the idea.

He gave his brief answer only after reporters repeated the question a second time when he arrived at Government House on Tuesday morning.

Gen Prayut announced his retirement from politics earlier this month.

The Thai Sang Thai and Fair parties have proposed the eight coalition allies wait for the five-year term of the military-appointed Senate to end in May next year, so the MFP alliance could conveniently have its prime ministerial candidate elected by the House of Representatives alone.

The MFP won the most seats in the May 14 general election, with 151. The Pheu Thai Party came second with 141 MP seats. They are the core of the alliance, which has a 312 majority in the 500 seat elected House.

The current 249 senators (one recently resigned) are entitled to take part in the vote for the new prime minister, together with the elected representatives. The new prime minister needs a majority of the two chambers, at least 375 votes.

On July 13 Mr Pita, the then sole candidate for prime minister, was rejected by the joint sitting, receiving only 324 supporting votes including only 13 from senators, most of whom abstained.

Philippines orders evacuations ahead of super typhoon Doksuri

MANILA: A super typhoon swept towards the northern Philippines on Tuesday (Jul 25), the country’s weather agency said, triggering evacuation orders for coastal communities expected to bear the brunt of the powerful storm. Super Typhoon Doksuri was packing maximum sustained winds of 185kmh as it headed towards a group ofContinue Reading

‘Era of mass closures’: The Japan businesses without successors

BATONZ connected her with Miyaji, who pledged to keep the firm’s employees, clients and trucks. “I’m more relieved than sad,” she said. “I didn’t think our company had any value.” The glut of affordable small businesses can be a boon for young people looking to break into a sector. AmongContinue Reading

UAE Regulation Lab signs MoU with Malaysia’s Futurise to accelerate regulatory innovation

Fast-track emerging solutions through regulatory sandboxes and other initiatives

Agreement lets both sides explore cross-border collaboration and R&D initiatives

The UAE Regulation Lab (RegLab), under the General Secretariat of the UAE Cabinet, has joined forces with Futurise, a Malaysian company under the purview of the Ministry of Finance, to create a legislative environment for regulation…Continue Reading

China to review appointments, dismissals of officials at Tuesday meeting: State media

BEIJING: China’s National People’s Congress (NPC) Standing Committee, a powerful body that enacts and amends laws when parliament is not in session, will review appointments and dismissals of officials at a meeting on Tuesday (Jul 25), state media reported. The announcement comes one month since Chinese foreign minister Qin GangContinue Reading

Will AI make carbon emissions tradable?

Trading carbon emissions is the El Dorado of climate-change management, a new market that will allow corporations to offset their presumed contribution to global warming and give governments a mechanism to balance economic and environmental interests. But carbon emissions are notoriously hard to measure, and the existing scorekeepers for emissions have run into withering criticism by scientific referees.

Carbon-emitting businesses are supposed to purchase credits from entities that reduce carbon emissions, including reforestation, reducing emissions from landfills, and man-made removal of carbon dioxide from the atmosphere. Measurement is the main problem.

The carbon market has a long way to go to catch up with the hype. The global consulting firm McKinsey claims that “demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030,” and presumably US$350 billion by 2050.

Other estimates project a $22 trillion market by 2050 as artificial intelligence produces more reliable data.

An improvement in measurement techniques could make the difference between a stillborn project and one of the world’s largest markets. One startup claims to have made a radical improvement in measurement accuracy by applying AI to a suite of existing models of carbon emissions. If AI succeeds in creating a globally accepted measurement standard, the carbon trading market could become one of the world’s largest.

Jizhaojia GCN says it has developed an algorithm that incorporates several of the most widely accepted models of carbon emissions, drawing data from a wide range of industrial enterprises and joint ventures. The firm was founded by the Chinese-American entrepreneur Bruno Wu, a shareholder in Asia Times’ holding company.

Stillborn attempts to trade carbon

The Chicago Mercantile Exchange began trading carbon offset futures two years ago, but investor interest has been minimal. An exchange-traded fund (ETF) that tracks carbon offset futures contracts, KraneShares Global Carbon Offset Strategy, has attracted just $1.2 million in investments – a microscopic amount by ETF standards – and trades just 7,000 shares a day on average. The carbon ETF topped Yahoo Finance’s list of 2023 ETF flops.

The CBL GEO (Global Emissions Offset) futures trade carbon emissions for aviation under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), a small market in which emissions are easy to measure. But only 202 contracts were traded on July 21, out of 16.3 million contracts that changed hands on the Chicago Mercantile Exchange.

Carbon emissions from passenger cars, let alone factories and farms, entail measurement problems far greater than aviation, which involves a limited number of vehicles whose fuel use is easy to calculate.

Credits for reducing carbon emissions are generated by activities like rainforest reforestation. Verra, a non-profit organization that sets global standards for measuring emissions, has been under fire from investigative journalists and scientific critics.

A joint investigation by the UK newspaper The Guardian, the German weekly Die Zeit, and SourceMaterial “has found that, based on analysis of a significant percentage of the projects, more than 90% of their rainforest offset credits – among the most commonly used by companies – are likely to be ‘phantom credits’ and do not represent genuine carbon reductions,” The Guardian reported on January 18. Verra has certified nearly $3 billion of carbon credits.

SourceMaterial wrote that the investigation “raises questions for the organizations that many of the world’s biggest companies, and the consumers who buy their products, rely on to set the standard for effective carbon offsetting – in particular the biggest of them, Verra.”

Verra is one of four carbon offset registries that measure the carbon reduction due to the reforestation of rainforests and allow carbon-emitting businesses to purchase credits from rainforest nations as an offset.

The trading volume and price of carbon offset credits have both fallen this year in response to challenges to the integrity of the system.

A recent World Bank report notes, “The voluntary carbon market is difficult to measure. The cost of carbon credits varies, particularly for carbon offsets, since the value is linked closely to the perceived quality of the issuing company.

“Third-party validators add a level of control to the process, guaranteeing that each carbon offset actually results from real-world emissions reductions, but even so, there’s often disparities between different types of carbon offsets.”

World Bank added, “A measure of skepticism attends the use of credits in decarbonization. Some observers question whether companies will extensively reduce their emissions if they have the option to offset emissions instead. Companies would benefit from clear guidance on what would constitute an environmentally sound offsetting program as part of an overall push toward net-zero emissions.

“Principles for the use of carbon credits would help ensure that carbon offsetting does not preclude other efforts to mitigate emissions and does result in more carbon reductions than would take place otherwise.”

A World Bank official familiar with the institution’s activity in carbon trading says the Bank offered its own system of carbon emissions measurement as a global standard but failed to persuade constituent governments to adopt it.

Despite the glowing forecasts, carbon trading markets are stagnating or shrinking due to the poor quality of data.

Jizhaojia GCN says it can generate higher-quality carbon emissions data using a proprietary algorithm that links three technologies.

The first is Enabling Satellite-based Crop Analytics At Scale, or ECAAS. This analyzes satellite imagery and remote sensing to create large datasets for agriculture and forestry. ECAAS promises to dramatically reduce the cost of collecting on-the-ground data and generate artificial-intelligence training sets for machine learning.

According to a Jizhaojia GCN release, “The ECAAS platform is compatible with various devices in the fields of energy, transportation, industry and agriculture. Through the application of technology, the speed of market development and the efficiency of data capture and utilization are greatly improved.

“ECAAS can create a network effect similar to Microsoft or the SWIFT funds transfer system to integrate digital technology into carbon emissions management.”

Second, Jizhaojia GCN applies the EPC (Engineering, Procurement and Construction) system for energy management, deriving its own data from more than 210 gigawatts of clean energy projects now under contract.

Third, Jizhaojia employs cloud-based energy management systems using Virtual Power Plant technology, which aggregates the output of different energy sources, trading electricity in order to maximize efficiency.

Jizhoajia’s AI algorithm integrates data learning sets from all three technologies to assign a digital identity to carbon products, making it possible to settle trades across the full range of emissions products, according to a company release.

Catcha Digital raises US$6.5 mil for growth and expansion

Final step in its regularisation plan, GN2 status expected to be lifted

Launched i-Gov to develop solutions for Malaysian government

Catcha Digital announced that it had raised US$6.5 million (RM29.7 million) from the Rights Issue exercise to grow and expand its business. This is the final step in its regularisation plan, and its…Continue Reading