As customer development nears breakeven on an operating cash flow base in 2024, Japan’s ambitious mobile telecommunication system operator, sees light at the end of the hole.

Breakeven will mark the completion of the Open RAN ( Radio Access Network ) standard, which enables various businesses to supply various components of a telecommunications network.

Open RAN gives telecom service providers more mobility and freedom from big suppliers of perfect proprietary systems such as China’s Huawei, Sweden’s Ericsson and Finland’s Nokia, and smaller regional champions like South Korea’s Samsung and Japan’s NEC and Fujitsu.

According to US telecoms software provider Mavenir, a cloud-based Open RAN system can reduce deployment and operating costs by 37 % over the course of five years when compared to custom architectures.

This comes amid accusations that Open RAN is being carbon- opted by the powerful telecoms gear makers, especially Ericsson, and its available promotion as a” Huawei killer” in Washington, DC. However, it is important for Rakuten and another Open RAN business supporters to establish the technology as a viable business.

Rakuten Mobile, which is solely dedicated to Available RAN, had almost 6.5 million users by the end of December 2023. If the development price reported so far in 2024 is maintained, the company really hit its target of 8- 10 million subscribers by month’s end.

That lags Japanese market leaders NTT Docomo, KDDI ( au ) and Softbank, which had 89.2 million, 66.9 million and 40.1 million subscribers respectively at the end of 2023. However, it does demonstrate that customers can get better deals with the low-cost Open RAN business model and discount pricing.

Cheaper mobile phone service was in fact the government’s intention back in 2018, when the leader said” We want competition to accelerate and the three companies ‘ market dominance needs to be eliminated.”

A year after Rakuten Mobile was established in January 2018, it was granted a license to develop and run a fourth generation ( 4G ) mobile telecom network. In September 2020, it launched its 5G service. By February 2022, it had extended its coverage to 96 % of Japan’s population. Now it covers almost 100 % of the population and 99 % of the nation’s territory.

Although service plans vary, most comparisons show that after they reduced their fees in response to Rakuten, Rakuten is significantly less expensive than Japan’s major three carriers and as cheap or less expensive than discount stores UQ mobile Y! mobile, J: COM and BIGLOBE.

For the most part, Rakuten has also matched the others in quality. Rakuten Mobile is the top carrier in Japan in terms of 5G download and upload speeds, second only to Softbank, and ahead of NTT Docomo and KDDI in terms of consistency and live video experience.

Hiroshi Mikitani, the founder and CEO of the Japanese e-commerce company Rakuten, has been working on Rakuten Mobile as his pet project. He has taken a long-term commitment and endured losses that the majority of CEOs would not tolerate.

Rakuten has lost a total of 993.5 billion yen ( US$ 6.6 billion ) over the past five years and is on track to add more red ink in 2024.

Investors fell out of love with the stock, which dropped by about 70 % from March 2021 to June 2023. However, it has since made up more than a third of that loss as Rakuten Mobile’s operating losses have declined. Mobile telecom is one of Rakuten’s three main product divisions, the others being online shopping and finance.

Operating cash flow from Rakuten Mobile’s ( operating profit plus depreciation and amortization ) decreased from a previous low of 70.6 billion yen in the fourth quarter of 2022 to a new low of 29.5 billion yen in the fourth quarter of 2023. By the end of this year, it should be at zero in management’s eyes and reach a positive level in 2025.

While quarterly data shows that subscribers are growing at an accelerating rate in 2023, Rakuten Mobile’s domestic network has been largely finished and capital expenditures are declining, despite the fact that quarterly data indicates that the number of subscribers is increasing at an accelerating rate. But even if the company hits management’s targets, it is likely to be a drag on Rakuten’s consolidated profitability for another two years.

In March 2020, Rakuten Mobile and NEC, Japan’s top maker of telecommunications equipment, announced that production of jointly developed 5G radio units had begun at NEC’s factory in Fukushima. The radio units are equipped with compact, lightweight antennas, and do not use a lot of electric power, as NEC pointed out at the time.

The development of 5G base stations for Rakuten Mobile’s fully virtualized, cloud-based Open RAN mobile network followed this. Mavenir, a US-based company that claims to be the only end-to-end cloud-native network software provider for telecom service providers, contributed its most recent voice and messaging technology.

Red Hat, an American software company, states that” Virtualized radio access networks (vRANs ) are a way for telecommunications operators to run their baseband functions as software. One of the main advantages is that RAN functions can now be performed on standard servers instead of using special, proprietary hardware.

According to ACG Research, virtual RANs that are run through cloud computing can reduce network operators’ total cost of ownership by 44 %. In comparison to some single-vendor proprietary mobile networks, Rohuten Mobile claims its network is 40 % less expensive to build and 30 % less expensive to run.

To Rakuten Mobile’s Open RAN, a number of other equipment suppliers and software developers also contribute. Airspan of the US, which also works with Rakuten Mobile to promote its vRAN (virtualized radio access networks ) platform, and Airspan of the US, jointly promotes the Rakuten communications platform.

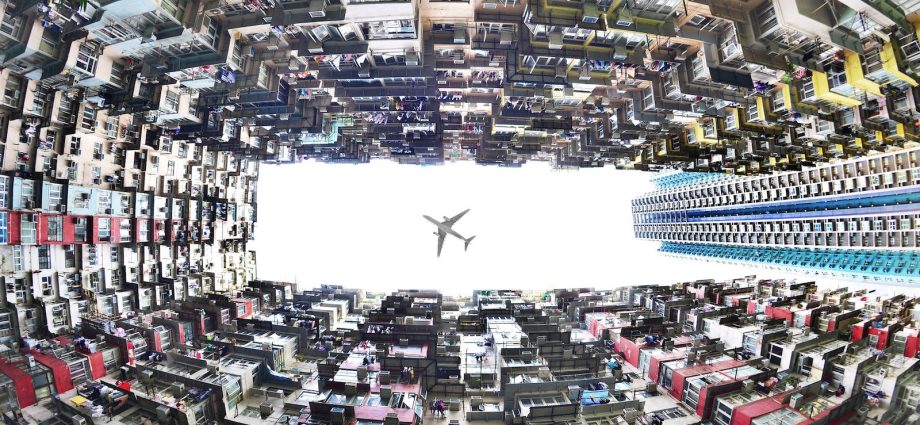

Korea Microwave ( KMW) and Taiwan’s Microelectronics Technology Inc ( MTI ) provide radio units. South Korea’s Qucell and Taiwan’s Sercomm provide small cell technology. Small cells are miniature radio access points that increase the use of cellular networks in densely populated cities and other high-end locations.

Prose Technologies, based in Ireland, manufactures and supports radio components, distributed antenna systems, and other components. Druid Software, also based in Ireland, has deployed its private cellular network software on Rakuten’s cloud platform, which is based on Intel technology.

Supermicro, based in San Jose, provides servers and works with Rakuten on the deployment of automated cloud- native network solutions. Dell, Google, Nokia, and Tata Communications of India also collaborate with Rakuten Mobile.

In August 2021, Rakuten and German telecom service provider 1&, 1 formed a partnership to build Europe’s first virtualized Open RAN mobile network. In December 2023, 1&, 1 began operations with a core network from Mavenir, Rakuten responsible for end- to- end integration of the network and participation of some 80 other vendors.

Wherever the 1&, 1 network is not yet complete, coverage is provided by nationwide roaming on the Telefonica network. Starting this summer, roaming will also be available on the Vodafone network.

Open RAN has high hopes, but there are also deep doubts about its viability and whether Rakuten Mobile will survive. However, it is gradually capturing market share in Japan and expanding its reach in Europe after several years of effort and great expense. And if Rakuten or 1&, 1 do eventually fail, their operations will probably be taken over by larger telecom carriers.

Follow this writer on , X: @ScottFo83517667