- JACCS ‘ experience, solutions may be combined with Carsome Capital’s habitat

- US$ 225m <strong>given since 2018 </strong>to help 45<strong>k</strong> deals for traders, end-customers

Carsome Group Inc, Southeast Asia’s ( SEA ) largest integrated car e-commerce platform, and JACCS Co, Ltd ( Japan Consumer Credit Service ), a consumer finance company, announced a strategic partnership where JACCS has taken a 49 % stake in Carsome Capital Sdn Bhd with Carsome Group holding 51 %. The acquisition cost was never revealed.

JACCS is a member of Mitsubishi UFJ Financial Group, while Carsome Capital is Carsome’s financing shoulder. Since its inception in 2018 Carsome Capital has disbursed more than US$ 225 million ( RM1 billion ) of financing to support close to 45, 000 transactions for Carsome’s dealers and end-customers.

Since its entry into Vietnam in 2010, JACCS has expanded to the second SEA market.

According to Carsome, the purchase will incorporate JACCS ‘ knowledge and international sources with Carsome Capital’s habitat and regional know-how, in order to offer tailored financing options in Malaysia, with an emphasis on under-served segments.

Additionally, the partnership will accomplish knowledge transfer to improve credit governance, improve risk assessments, and implement best practices that improve portfolio performance and financial sustainability.

.jpg) Eric Cheng ( pic ), Carsome Group’s co-founder and CEO, said,” Carsome is honored to partner with JACCS, a global consumer finance company, as they mark their entry into Malaysia. By combining JACCS’s considerable experience with Carsome’s ecosystem, we aim to redefine the mobility financing experience, empowering communities and leading financial growth across the region”.

Eric Cheng ( pic ), Carsome Group’s co-founder and CEO, said,” Carsome is honored to partner with JACCS, a global consumer finance company, as they mark their entry into Malaysia. By combining JACCS’s considerable experience with Carsome’s ecosystem, we aim to redefine the mobility financing experience, empowering communities and leading financial growth across the region”.

Ryo Murakami ( pic ), the president and representative director of JACCS, stated:” We have carefully evaluated the automotive and financing landscape across Southeast Asia, and are excited to share our findings.” about the long-term growth potential in this region. We think Carsome has the potential to spur regional growth and change as an ideal partner for us.

about the long-term growth potential in this region. We think Carsome has the potential to spur regional growth and change as an ideal partner for us.

This collaboration allows us to continue serving unserved and underserved markets here in Malaysia, a segment that has always been at the center of what we do, said Nicholas Wong, Managing Director of Carsome Capital. To expand access to financing for dealers who purchase wholesale inventory from us to support their business as well as for end-customers who put their trust in our vehicles, we are excited to work with JACCS to introduce additional capabilities and technologies, such as AI-driven credit assessments.

Founded in Hakodate, Japan, in 1954, JACCS is a trusted name in consumer finance offering solutions ranging from credit cards to auto and housing loans. The business collaborates with more than 20 automakers.

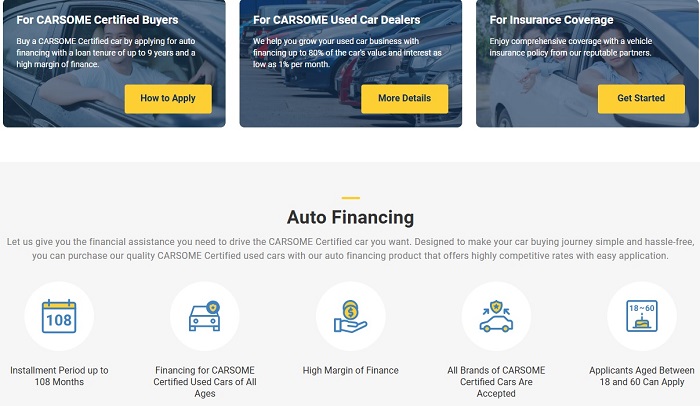

Established in 2018, Carsome Capital provides a comprehensive range of auto financing services, including retail financing for individual buyers, floor stock financing for dealerships, and automotive insurance solutions. It improves risk assessments to better assist unserved and underserved communities by utilizing advanced data analytics and machine learning to optimize vehicle pricing, inventory management, and credit evaluations.