Early in the year, concerns about the international banking system were sparked by the US banking crises. Silicon Valley Bank, Silvergate, and Signature, three mid-sized US businesses, all experienced sharp declines in rapid succession, lowering cant share prices all over the world.

The Federal Reserve, the nation’s central bank, made sizeable sums of money available to failed businesses and established a financing program for other struggling organizations. With only one more US local banks, First Republic, collapsing a few weeks later, buyers were calmed and an instant disease was avoided.

However, it’s not entirely clear if the issue is truly over. How are things likely to turn out as investors return from their summer vacations to a time typically associated with market revolution?

slender margins and decreasing debris

In recent months, central bankers have kept raising interest rates to combat persistent prices. The Fed increased its key interest rate in July to 5.5 %, the highest level in 20 years. As late as February 2022, the charge was close to zero.

Although the increases have slowed this year, a sudden change like this can be very bad for banks, especially in light of the U-shaped rate movement that has been present since the global financial crisis of 2007 – 2009.

US forecast interest rate from 2007 to 23

Raising interest rates lowers the value of banks’ assets, raises what they must pay to use, limits their profitability, and usually makes them more vulnerable to bad things happening. Lenders have struggled with minimal product development and high payment fees, which refer to the amount they must pay out in relation to customer deposits, particularly in the first half of 2023.

This increased price is partially due to the fact that many consumers have been withdrawing their cash and depositing them in money market funds, where they can earn more interest. In order to make sure they had enough money, it forced businesses to acquire more from the Fed at prices that were significantly higher than they used to be.

The banks falls in the flower, which destabilized them at a time when the value of the debt on their balance sheets had likewise sharply decreased, were caused in part by this. As a result, more customers at different banks stopped making deposits out of concern that their wealth wasn’t secure either.

In conclusion, US banks observed a nearly 4 % decline in deposits between June 2022 and July 2023. This is usually bad information for the banking industry, along with higher interest rates.

By examining overall net interest margins ( NIMs ), you can see how this affects banks’ profitability. These represent the interest money that businesses receive less than what they pay out to lenders and other donors.

Online interest margins(%) for US banks

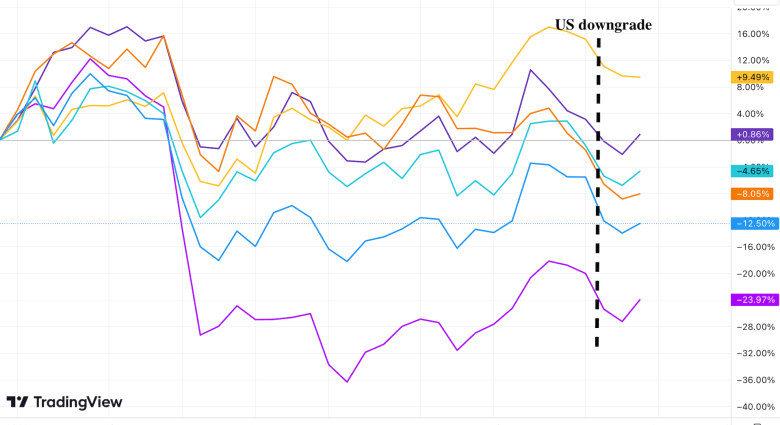

Credit grade declines

The rating companies have put more strain on people. Fitch downgraded its assessment of US government debt from AAA to AA at the beginning of August. It mentioned a potential decline in the public finances over the following three years as well as constant lobbying regarding the loan ceiling, the highest amount the government can use.

Devaluations by sovereigns frequently reflect issues in the larger market. Lenders may become unstable as a result of appearing less legitimate, which may cause their credit ratings to decline as well.

They may find it more difficult as a result to use funds from the Fed or even the industry. This may then have a negative impact on banks’ ability to lend money, capital buffers for handling poor bills, overall profitability, and share prices.

Share prices for US businesses in 2023

Sure enough, Moody’s downgraded the credit scores of ten US mid-sized banks a week after the Fitch news, citing mounting economic challenges and strains that might reduce their success. Additionally, it forewarned that bigger institutions, such as State Street and the Bank of New York Mellon, might experience a potential drop.

Since then, S & amp, P Global Ratings, another significant ratings agency, has done the same, and Fitch has threatened to follow suit. According to our research, bank downgrades are linked to making them riskier and more fragile, especially when they are accompanied by a royal downgrad.

Despite all of that, there are advantages for US businesses. In the upcoming months, it is at least anticipated that both interest rates and bank deposits will stabilize, which may benefit the sector.

Bigger bankers are reporting improved profits from charging higher interest on loans despite the overall reduction in banks’ revenue. Later in the year, some of these businesses anticipate a increase from things like increased deal-making. Such indicators might contribute to greater balance across the board.

Credit Suisse needed to be saved by other European banks UBS in March because banks in Europe have recently seen lower payments and net attention profits.

However, in the most recent couple of rooms, German payments and gain profits have been rising. Additionally, new stress tests conducted by the European Banking Authority revealed that huge EU banks are strong.

UK businesses seem to be in somewhat worse shape than businesses in the EU. Although their payments have not recovered to the same degree as in Europe, they are still tenacious on their stability plates. In anticipation of additional price increases by the Bank of England, they have also been reducing their revenue projections.

Governmental action

The regulators intend to further raise the minimum cash levels that must be held by big US banks( with assets for more than US$ 100 billion ) in order to strengthen the US field.

Although they will get more than four years to fully implement, these plans to improve banks’ ability to absorb costs are stimulating. Similar changes were made to the Basel II international banking regulations in 2004, but they were not put into effect in time to stop the world monetary problems.

For the time being, the US banking system is still open to both economic system surprises and more widespread disasters. Before we can say with certainty that the worst is around, it will still be a few months.

George Kladakis teaches financial services at Edinburgh Napier University, and Alexandros Skouralis works as a research associate at the University of London’s Bayes Business School.

Under a Creative Commons license, this essay has been republished from The Conversation. Read the article in its entirety.