- Indonesian exports are anticipated to grow as the electrical cycle bottoms out.

- In the second quarter of 2024, Malaysia is anticipated to take advantage of the electronics treatment.

The electronics sector is a positive force for Southeast Asia’s economy, according to a report from Oxford Economics that was commissioned by the Institute of Chartered Accountants in England and Wales ( ICAEW). The region is projected to grow by 4.0 % in 2024 and 2025. Nevertheless, this is below the pre-pandemic average of 5 % in the previous five years, mostly as a result of anticipated difficulties in private use as interest rates rise more.

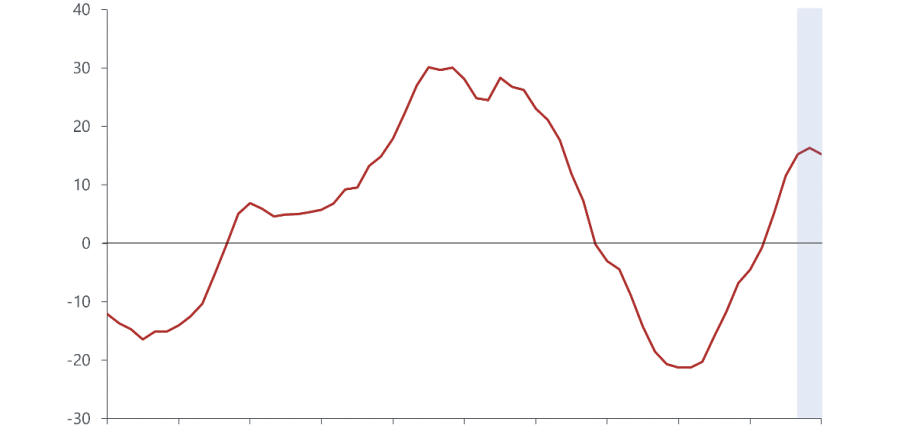

The report argues that Southeast Asian electronics-focused exporters gained a better grip in Q1 2024, in large part as a result of the technology sector’s bottoming out. It said the treatment in global silicon sales, which saw a 15.3 % year- on- yr increase in Q1 2024, has mainly benefited Vietnam, where export growth soared to an estimated 16.8 % year- on- year. Singapore also experienced a rise in non-oil home exports in April with an estimated 9.4 % month-on-month growth, which is a good turn after two consecutive weeks of collapse, intermittently adjusted.

Given its position farther down the electrical value chain, Malaysia is anticipated to benefit from the gadgets healing in the second half of the season. However, Southeast Asia’s electronics industry’s enhance is still less encouraging than those of Taiwan and South Korea, two other major Asian silicon players.

International tight monetary policies are likely to measure down additional need for the region’s exports, making recovery reasonable, the report stated, adding that the global growth forecast of 2.6 % for 2024, lower than pre- pandemic levels, did likewise lessen local export growth.

On the positive side, Southeast Asia’s tourism sector has experienced steady visitor growth since November 2023, partially as a result of various visa-free travel arrangements with China. This has resulted in more frequent intraregional travel within Southeast Asia. However, supply- side constraints, such as limited flight capacity and a shortage of hotel rooms, could hinder the region’s ability to fully meet resurgent tourist demand. As a result, the recent rapid growth in tourist arrivals is likely to decelerate.

Domestic consumption faces near- term challenges

In the report, domestic consumption in Southeast Asia was stronger than anticipated in Q1 2024. However, it is unlikely to spur economic growth in the upcoming quarter because regional tight monetary policy is anticipated to restrain consumer spending.

Southeast Asian central banks ‘ options for easing monetary policy are likely limited by the persistent weakness of local currencies in relation to the US dollar. The strong US dollar, driven by the Federal Reserve’s high interest rates, prevents local central banks from cutting rates without risking further currency depreciation. In Q1 2024, Bank Indonesia was even forced to raise rates to arrest the rupiah’s decline.

Due to the tight monetary policy in place, debt servicing and borrowing costs will continue to be high, likely limiting private consumption. Additionally, the research found that many consumers and businesses are continuing to consolidate as they are recovering from the pandemic and are likely to concentrate on quickly rebuilding their savings or refining their balance sheets.

Governments are coordinating at the same time to reduce spending and raise taxes in order to offset pandemic-related fiscal payouts. Indonesia is planning to raise taxes in 2025 after Singapore and Thailand both raised taxes this year. Malaysia intends to change the second half of the year’s RON95 subsidies from a blanket policy to a more judiciously targeted approach.

With the US Federal Reserve’s forecast for rate reductions in Q3 2024, there is still a glimmer of hope. This could lessen regional currency pressure, allowing Southeast Asian central banks to ease their monetary policies.

Malaysia: Q1 2024 economic growth buoyed by electronics exports but cautious outlook remains

In Q1 2024, Malaysia experienced a notable economic upturn, with GDP expanding from a revised 2.9 % year- on- year in Q4 2023 to a robust 4.2 %, coupled with a remarkable 1.4 % quarter- on- quarter growth in seasonally adjusted terms, effectively reversing the 1.0 % contraction observed in the previous quarter. This positive momentum, however, faces challenges in sustainability.

The remarkable rise of 9.7 % quarter over quarter in exports, primarily fueled by the resurgence of Chinese tourists during the Chinese New Year holiday in February, was a significant driver of growth. This resurgence can be attributed, in part, to the bilateral visa- free arrangement initiated in December 2023. Nonetheless, there are doubts regarding the longevity of this surge, as initial boosts tend to fade over time.

Retail sales volumes also experienced a notable recovery, rising 4.4 % month over month in February after four consecutive months of decline. However, this resurgence appeared to lose steam in March, with retail sales growing only by 0.7 %. Despite a strong labor market and historically low unemployment rates, there are beginning signs of softness, as evidenced by stuttering new job growth and slowing wage growth, which could point to a potential future moderation in consumer spending.

According to the research, domestic demand is anticipated to remain flat or even decline, as demonstrated by recent budget plans that intended nominal spending reductions. In addition, fuel subsidies are being reduced to reduce the deficit in order to increase the public debt-to-GDP ratio. Investment, particularly within the industrial sector, is likely to face constraints amid the prevailing uncertain external environment.  ,

Exports are expected to grow modestly in the external sector in 2024, despite a subdued global demand. Malaysian exports are anticipated to benefit from the anticipated bottoming out of the electronics cycle, but this impact may not be fully realized until the second half of the year as a result of the country’s position within global supply chains.

The significant discount of the Bank Negara Malaysia’s ( BNM) policy rate in relation to the US Federal Funds rate was a major contributor to the Malaysian ringgit’s struggles in Q1 2024. The currency’s weakness hinders BNM’s ability to ease policy, which has been hovering below 2 % for the past six months and showing little sign of significant increase. This issue persists until the US Federal Reserve starts making rate cuts, which are anticipated to occur in Q3, easing the ringgit’s pressure and potentially allowing policy rate adjustments.  ,

While Malaysia’s Q1 2024 GDP growth showcased resilience, primarily supported by robust electronics exports, the economic outlook remains cautious due to challenges in both domestic consumption and external demand. Although there are still questions about global economic conditions and domestic policy responses, Bank Negara Malaysia is confident that there are upside risks from greater spillover from the tech upcycle, more robust tourism activities, and faster implementation of existing and new investment projects. However, the Malaysian economy is expected to experience modest growth throughout 2024.

In summary

- Malaysia’s GDP grew by 4.2 % year- on- year in Q1 2024, supported by electronics exports.

- Due to challenges in domestic consumption and the state of the world economy, the outlook for sustained growth is still uncertain.

- Government decisions and supply-side constraints continue to have an impact on Malaysia’s economic dynamics.

, Other findings from the Economic Update Q2 2024 include:

Singapore: Trade- weighted economy will remain subdued

- Singapore’s GDP grew 2.7 % year- on- year in Q1 while seasonally adjusted Q1 GDP grew slightly by 0.1 % quarter- on- quarter.

- Singapore’s economic momentum is likely to be subdued, despite strong electronics exports.

- This year’s overall growth will likely remain slightly below the previous year’s trend, as evidenced by soft domestic demand.

Indonesia: Shift in monetary policy likely to be delayed

- Indonesia’s economy grew by 5.1 % year- on- year in Q1 2024, up from 5.0 % in Q4 2023.

- Domestic consumption, both in the private and public sectors, continues to drive resilience, with the latter likely bolstered by election- related spending.

- The external sector will be a drag, given soft global growth. Lowering external demand and sideways trade figures will also impact business investment.

- Bank Indonesia is anticipated to hold rates until Q4 2024, with a potential 25 basis point rate cut following the US Federal Reserve’s rate cut.

Vietnam: A soft 2024, but a bright medium- term outlook

- Vietnam’s real GDP grew by 5.6 % year- on- year in Q1 2024, down from 6.7 % in Q4 2023.

- Exports remained robust in early 2024, driven by electronics and agriculture.

- Poor sentiment, capital deployment, and consumption are expected to remain drags, with credit growth at its joint- slowest in 10 years as of March. Year- to- date credit growth, or the amount of loans from commercial banks, was only at 1.3 % year- on- year in March after two months of negative figures.

- As Vietnam benefits from the reshuffling of the structural supply chain from China, which will likely increase economic momentum gradually in H2 2024, it is likely to experience a gradual improvement in economic momentum, which will draw in foreign direct investment.