- Reports hundred fast growing, revolutionary emerging giants in Asia Pacific

- Identified startups in 12 markets with valuation of up to US$500 million

A joint review by HSBC Bank and KPMG provides identified 10 companies that are poised to make a lasting impact on a global business landscape within the next decade.

A joint review by HSBC Bank and KPMG provides identified 10 companies that are poised to make a lasting impact on a global business landscape within the next decade.

Culled through the ‘Emerging Giants in Asia Pacific’ statement, the two companies required an in-depth take a look at 6, 472 technology-focused startups in 12 Asia Pacific markets with valuations of up to US$500 million (RM2. 2 billion).

In a declaration, the report furthermore identified 100 leading emerging giants in Asia Pacific which are fast- growing, influential, and innovative with ambitions to achieve unicorn status and ten leading emerging large companies in each market surveyed.

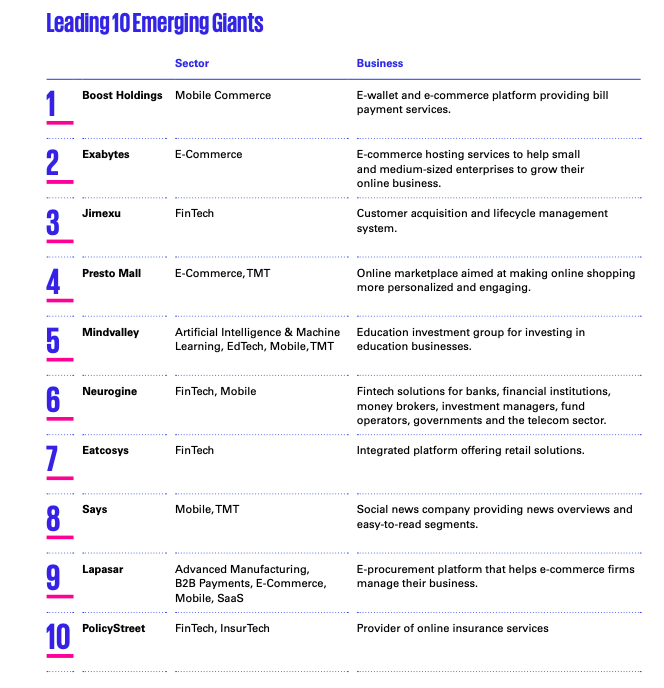

The list associated with ten emerging giants in Malaysia:

According to Karel Doshi, mind of commercial banking, HSBC Malaysia, “The listing of emerging giants in Malaysia excites us because it is evidence that our nation offers all the right ingredients for start-ups in order to flourish and be leaders that shape their particular industry.

According to Karel Doshi, mind of commercial banking, HSBC Malaysia, “The listing of emerging giants in Malaysia excites us because it is evidence that our nation offers all the right ingredients for start-ups in order to flourish and be leaders that shape their particular industry.

“Financial institutions should be committed to offering online companies the right support to allow them to scale beyond Malaysia to be an rising giant or even unicorn, ” said Doshi.

Guy Edwards (pic) , head of technologies, media and telecommunications, KPMG in Malaysia said, “  While startups are poised to continue actively playing a major role in the country’s development, some may struggle to gain the guidance and business support necessary to grow.

While startups are poised to continue actively playing a major role in the country’s development, some may struggle to gain the guidance and business support necessary to grow.

“Beyond government support, nurturing the right environment for our local startups requires adopting a regional outlook, plus encouraging strong collaboration by stakeholders in the space, ” mentioned Edwards.

The report indicated that while there is no specific formula to be a good ’emerging giant, ‘ the companies identified had been standout players within a wide variety of disciplines.

This consists of superior technology and technical knowledge, ‘hyper localised’ businesses, mastery of logistics channels and supply chain procedures, successful adaptations of their business model(s) depending on correct identification of market gaps and a winning culture that will attracts and keeps talent.

According to Securities Commission Malaysia, funding is usually starting to reach a significant level with overall committed venture capital funds hitting US$1. two billion (RM5. several billion) in 2021, up 20% within 2020, and almost five times over Malaysian startups raised in 2019.

[RM1 = US$0.239]

It also mentioned that there has been an increase in venture capital deals in the region, with record-breaking numbers in 2021.

Although 2022 looks unlikely to do it again the highs associated with 2021, Q1 2022 figures suggest that 2022 is on focus on to exceed both 2020 and 2019 funding levels intended for Asia Pacific as a whole, it said.

The report also features interviews with startup founders and executives over the 12 Asia Pacific cycles markets that offer understanding on the challenges plus opportunities that startups face.

Check this to download the copy of the statement.