The US Treasury yields, which are the key drivers of international markets, lower property prices, increase the US dollar exchange rate, and pose a threat to US homebuilding and another rate-dependent economic activity. As rates rise, moreover, the US Treasury deficit – already above 6 % of GDP – will increase. The federal debt’s interest rate increased from$ 400 billion to$ 1 trillion in 2021, putting an additional$ 1.8 trillion requirement on top of the previous year’s$ 1.8 trillion.

Despite my calculations, foreign central banks have decreased their holdings of US government debt, putting pressure on yields by painfully 0.8 %, based on my analysis. Central bankers shifted out of money assets as a result of the arrest of Russian foreign exchange reserves in 2022. The US business was perhaps more harmed by the reserve arrest than Russia’s.

The Federal Reserve, to be sure, increased the rate at which banks are charged for overnight cash, which contributed to the majority of the price rise. However, a significant increase in the so-called real offer of Treasury bonds ( in this case, the interest rate on inflation-indexed Treasuries ( TIPS) is attributable to less foreign central banks purchasing of US loan. Reduced foreign central bank holdings of US government debt account for roughly 80 basis points ( 8/10ths of a percentage point ).

Foreign central banks, including those of China, India, Saudi Arabia, and Turkey, began shifting their foreign exchange reserves into gold and out of Treasuries after the US and its allies seized half of Russia’s$ 600 billion in foreign exchange reserves in early 2022, following Russia’s invasion of Ukraine.

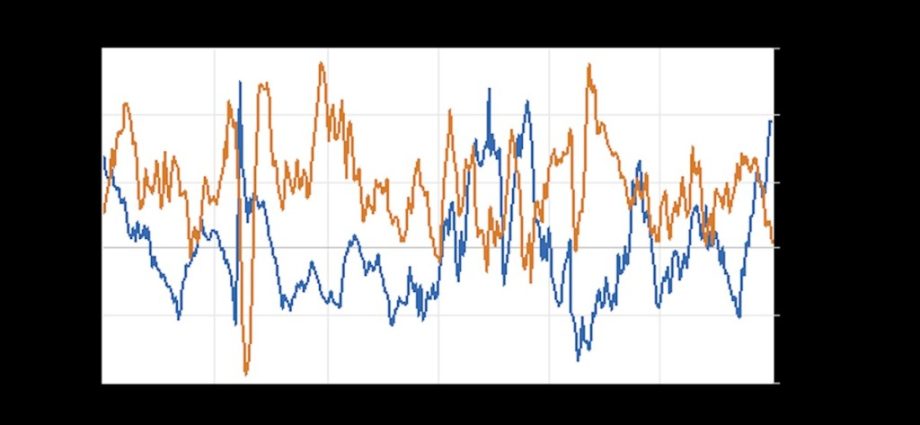

The influence of foreign central banks ‘ sales of US federal debt is illustrated in the table below.

The Fed’s report on the change in international central banks holdings of Treasuries for six weeks is shown in the red line. The offer of 10-year TIPS is depicted in the blue line, which is the nighttime rate that the Fed charges bankers. 10-year Ideas provides increased by 80 basis points as of January 1 ( the shift in the TIPS supply that is not explained by the federal funds rate is depicted in the blue line, once more ). At the 95 % trust level, statistical tests demonstrate that the relationship between the two elements is important.

While the US Treasury’s saving necessity has risen quickly, foreign central banks holdings of US Treasuries have declined. This contrasts starkly with the time period 2007-2012 ( including the World Financial Crisis ), when the Treasury intervened with an ( then ) unprecedented$ 800 billion bailout to support the banking system. Foreign central banks, notably including China, stepped in to support the Treasury, doubling their holdings of US government debt to$ 4 trillion from$ 2 trillion in 2007. During the Covid crisis of 2020, by contrast, foreign central banks ( notably including China ) reduced their holdings of Treasuries.

This has had a significant and palpable effect on US Treasury provides.

We are comparing leads and falls, which clearly demonstrate that adjustments in foreign central banks holdings of Treasuries are related to changes in the TIPS offer (once more, the changes are not those that the federal funds rate has predicted ). Each table in the table below displays the relationship between the two factors ‘ current and past lagged values at regular intervals. For instance, the lagged benefit of changes in international central banks holdings of Treasuries shows a -0.6 relationship with that weekend’s TIPS yield when compared to a 5-week slowdown. Changes in international central banks investments are consistent with the cross-correlogram, which is contrary to what the cross-correlogram suggests.

Additionally, it explains how the real yield on US Treasuries is decoupled from the golden value. For the 15 years 2007 to 2022, golden and TIPS provides were traded simultaneously. They provide a form of protection against unanticipated prices and dollar depreciation, and they both play a similar investment role. The difference is that Treasury assets may be seized by the US government, as in the case of Russia, while metal in a central bank’s tomb can’t.

After March 2022, metal rose sharply despite the surge in TIPS provides. The balance of the government’s debt is in question, and the value of golden as a wall against currency depreciation is rising as a result of all the major American economies’ running huge deficits.

Like additional sanctions against Russian business, Washington’s arrest of the Russian supply backfired. It destroyed confidence in the basic property of the US dollar supply system, particularly the debt of the US Treasury, and raised America’s borrowing cost just as the Treasury’s borrowing requirements exploded.