Donald Trump also leads in most elections, and betting industry give him , a better than perhaps chance , of winning the election this November. Therefore, it is crucial to consider what his true guidelines will be and how they will affect the outcomes that Americans are interested in.

Best now, the results Americans , definitely worry about most , is inflation. Therefore, we should consider how Trump’s laws will impact prices and getting ahead of the curve.

This is an inherently challenging workout. Trump is n’t wedded to a particular ideology and is often very open to persuasion – especially if you come , bearing large checks  , for him and his businesses.

It’s often difficult to predict whether he’ll carry out his policy promises in a strong and substantial method or whether he’ll create a symbolic sign and leave it that way. However, we must make our best guess if we are going to make an informed choice regarding who should be leader.

The simple story below is that , there are three major ways , Trump could raise prices in the US: taxes, imbalances, and pressuring the Fed to lower interest rates.

Taxes and inflation

A number of people are warning that Trump did increase prices by imposing high tariffs. For instance,  , how’s Matt Yglesias:

]T] ariffs have a distinct inflationary impact…]Consider ] a 10 % tax on imported olive oil. That makes imported olive oil more expensive… But it’s also going to raise the price of , domestic , olive oil, because price competition from foreigners has diminished …]N] ow imagine doing this across the economy. The cost of , everything , goes away.

Trump , has promised , a 10 % tariff on all imports from all countries, a 60 % tariff on all Chinese goods and , a 200 % tariff , on all cars made by Chinese- owned companies. Tariffs raise customer costs — in economics conditions, they represent a , damaging supply shock. Bad supply shocks reduce development, increase poverty, and push up inflation. So if you care about prices, it’s fair to worry about this.

There are lots of risks concerning , merely how much , taxes push up prices. To use just one example, it’s possible that tariffs would have a negative impact on the economy’s status as the country’s reserve currency, leading to a stronger dollar, which would allow Americans to purchase imported goods more expensively and may reduce some of the effects of the price.

It seems doubtful to me that Trump had take , the extraordinary, wrenching actions , needed to degrade the money, so currency appreciation is one force in the economy that would “push up” against the effects of tariffs. ( Of course, if Trump , did , actually go ahead and degrade the money, that would produce , yet higher prices. )

In fact,  , dollar appreciation , in 2018 might be one reason why Trump’s tariffs in his first term did n’t push up consumer prices much for Americans — only by , 0.2 % total, according to one study.

Because of these difficulties, distinct versions arrive at different inferences for how much Trump’s proposed tariffs would raise inflation.

For example, Bloomberg’s economics team forecasts , a total increase of 2.5 % in consumer prices , from , all , of Trump’s proposed tariffs, while Robinson and Thierfelder ( 2022 )  , predict an increase of 6.7 % , from just the 10 % global tariff alone.

This would be a one- day price increase, hardly a long- term rise in the inflation rate. Even a frenzied burst of inflation may cause voters to be uneasy for a while, as we saw in 2021-22, and a 6.7 % increase in consumer prices is nothing to begrudge.

So the risk of price- driven inflation is genuine, but the effect may be temporary, and there’s a real possibility that it would be modest in size. Another potential Trump policies, but, could have bigger and longer- profound effects.

Imbalances and prices

Because it was reduced during his first term, we tend not to connect Trump with inflation. But that does n’t mean his policies did n’t contribute to the inflation of 2021- 22.

The , US$ 2.2 trillion CARES Act , and its ,$ 0.9 trillion follow- up , in December 2020 handed out large amounts of money to American families – even more than Joe Biden handed out in 2021.

Americans first saved the majority of that money before using it up, but in 2021 they started using the money that had already been saved up. Most economics think that this investing binge , contributed tremendously to inflation , in 2021 and early 2022.

In my opinion,  , Trump did the right thing around, because making sure that Americans were n’t economically ruined by Covid, and that the US economy recovered immediately, were more crucial than keeping prices low. However, Trump’s pandemic saving does show two points:

- Governmental paying has a significant impact on demand-side prices.

- Trump does n’t have much of an instinct for austerity

In reality, Trump’s disdain for poverty and lack of concern about imbalances predates the pandemic. Thanks largely to Trump’s tax cuts,  , the federal deficit increased , from 3.4 % in 2017 to 4.6 % of GDP in 2019.

And populist leaders generally do n’t tend to use austerity to distribute short-term goodies to maintain their popularity, even if this causes more pain for the citizens in the long run.

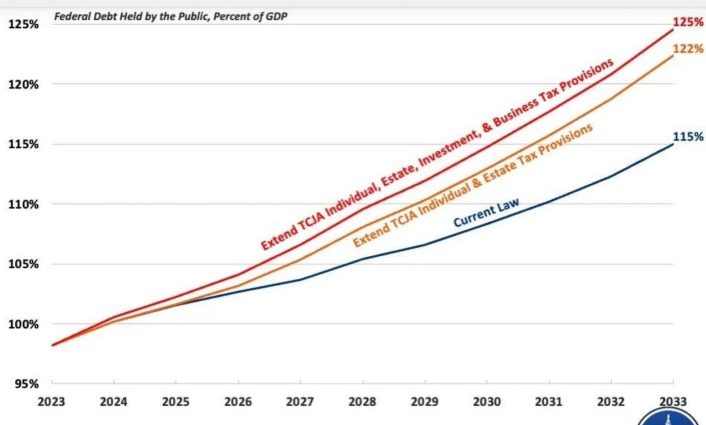

What did Trump’s gap policies look like after serving in office? In his blog, Yglesias flags , an analysis , by the Committee for a Responsible Federal Budget, which shows how extending the tax breaks from Trump’s first word would increase the regional loan:

Now, that’s not a huge increase, and the blue line for” current law” shows that Biden is already doing quite a lot of deficit spending. But it’s likely that Biden’s deficits are  , already , contributing to stubbornly above- target inflation.

As I wrote in , a post back in April, macroeconomics theory tends to think that government budget deficits are inflationary:

It’s theoretically possible that deficits can be inflationary. In fact, this is , how a typical New Keynesian macro model works. It’s also implied by a theory called , the Fiscal Theory of the Price Level. Therefore, it is possible that the US government’s large deficits are causing inflation to stay stubbornly above target.

Now as I noted in that post, macroeconomic theory is n’t always a great guide to reality. Governments have accumulated sizable debts in some cases, like Japan, without causing inflation. However, it’s unquestionably important to note that higher deficits under Trump would increase inflation.

And this problem is getting worse, because of rising interest costs. As the US government continues to roll over more and more of its legacy low-interest debt from before the pandemic at the new, higher interest rates, it is required to pay more and more every month to pay off the debt in order to service the debt. We are borrowing to pay the interest on our own borrowing, which is causing deficits to rise.

The only way to solve that issue is through austerity. Although it’s still up for debate whether Biden and Congress will continue to support austerity after this election, Trump’s record and his general populist leadership style suggest he wo n’t be willing to deal with the issue.

Instead, I anticipate that Trump will attempt to control rising interest rates by putting pressure on the Federal Reserve to lower interest rates.

Monetary interference and inflation

The Fed is supposed to be independent in theory; it is supposed to control interest rates in order to strike a balance between high employment and low inflation.

This implies that the Fed is supposed to do the dirty, pointless job of raising interest rates to combat inflation when inflation rises. In the short run, increasing interest rates can lead to a lot of short-term economic pain, as evidenced by Paul Volcker’s early 1980s increase in rates, which resulted in two painful but brief-lived recessions.

In other words, the Fed has the responsibility to act as the “bad cop” in the economy, and we give it some autonomy to protect it from the inevitable political repercussions when tough choices are required.

During his first term in office, Trump , repeatedly attacked , the Fed,  , demanding , that the Fed cut interest rates even more from their already low levels. Many people thought Trump was attempting to stifle the independence of the Fed by putting political pressure on them for political gain in the interim.

Now, Trump’s allies are preparing an even more aggressive , attack on Fed independence, according to WSJ:

In the middle of a deepening rift among his advisers over how aggressively to challenge the central bank’s authority, Donald Trump’s allies are quietly drafting proposals that would attempt to erode the Federal Reserve’s independence if the former president wins a second term.

Former Trump administration officials and other supporters of the presumed Republican nominee have spoken in recent months about a range of ideas, from incremental policy changes to a long-shot claim that the president should himself play a role in setting interest rates.

The group of Trump allies advocates for his consultation on interest-rate decisions, and the draft document suggests that the White House be more forcefully using the Treasury Department to review Fed regulations and using the Treasury Department as a central bank check. The group also asserts that Trump would have the authority to remove Jerome Powell from the Fed chair before his four-year term expires in 2026, according to people with knowledge of the situation.

In fact, Trump seems to , love nothing more , than feuding with, and establishing dominance over, American institutions, this is simply one more example.

Trump would remain in office for the duration of his term by forcibly forcing the Fed to lower interest rates, even in the face of rising inflation. It would also push down the government’s interest costs, delaying the need for austerity. However, higher inflation would be the cost of those low interest rates.

In addition, inflation expectations increased as US businesses, investors, and households realized that the Fed had been permanently compromised and politicized, putting an end to Volcker and his successors ‘ efforts to persuade Americans that the Fed is inherently hawkish.

A combination of tariffs, high and rising deficits, and monetary interference could push inflation back to 1970s levels. Larry Summers, who correctly predicted the inflation of 2021, is , right to worry:

Summers sees the same danger. ” It is difficult to predict the timing and the precise dynamics”, he told me,” but it is hard to imagine a policy package more likely to create stagflation” than measures that directly raise prices ( through tariffs ), undermine competition, enlarge deficits, and excessively expand the money supply. He predicted that as inflation expectations and long-term interest rates rise, there was a real risk that mortgage rates would rise above 10 % again during Trump’s presidency.

In Trump’s first term, he got lucky. Underlying inflationary pressures in the US were still fairly weak, deficits crept up but stayed under control, Trump’s early tariffs had only a minor impact, and the Fed managed to resist Trump’s initial attack on its independence. In a second term, he might get even luckier, but I would n’t bet the farm on it.

And then there’s the possibility that a second Trump term will bring about an actual economic catastrophe as well as painful and persistent inflation.

Could Trump cause hyperinflation?

No one really knows what causes some nations to experience extremely high inflation rates. But , economists  , have  , a guess.

Basically, the idea is that when the government becomes committed to running big permanent deficits,  , and , the central bank becomes committed to permanently supporting that borrowing with money creation, everyone basically abandons the country’s currency and its value collapses.

Some people believe that this only occurs when nations engage in wars or experience some other form of geopolitical instability. But in many hyperinflations in developing countries, there ‘s , no war or revolution involved , — instead, the combination of infinite deficits and infinite deficit- supporting money creation is due to a country’s own internal politics.

In reality, this typically refers to a nation getting a populist leader who is determined to maintain power by providing fiscal aid to supporters and/or cronies and who manages to compel the monetary authority to back this strategy.

Could Trump follow this pattern? It’s not likely. It would take a heck of a lot of macroeconomic meddling for America to become Argentina or Venezuela because it is such a big rich country and the dollar is such an important currency.

But it’s not entirely out of the question, either. And the consequences of hyperinflation are so dire — Venezuelans were literally reduced to , premodern living conditions , in the 2010s — that it’s worth worrying about even if the chance is small.

Now, this might sound silly to some people who lived through Trump’s first term. Why would we anticipate super-high inflation if Trump came back to power if there was no inflation under Trump the first time? But it’s worth noting that in most episodes of hyperinflation, it , takes a number of years , under the fiscally irresponsible ruling regime for inflation to explode. Things look OK for a while, and then , bam.

For example, take Hugo Chavez and his successor, Nicolas Maduro. Chavez, who presided over Venezuela in 2002, passed away in 2013. It’s pretty clear, in hindsight, that it was Chavez’ , failed economic policies , — continued by Maduro— that eventually resulted in Venezuela’s disastrous hyperinflation. However, until just before Chavez’s death, Venezuelan inflation appeared to be more or less in control.

Or consider Recep Tayyip Erdogan, a populist leader who has been in office since 2014 and served as prime minister for 11 years.  ,

Erdogan’s policy , of constantly forcing the central bank to lower interest rates caused the currency to , collapse , and inflation to go to over 60 % — not technically hyperinflation, but more than six times as high as US inflation in 2021- 22. Economic growth halted for a few years, and only a , timely reversal , of the low interest rate policy in 2023 managed to stabilize the situation.

However, Turkey’s inflation had been comparatively stable and low since 2004. It was four years into Erdogan’s term as president, and more than a decade since he became prime minister, before his policies made inflation explode.

When it comes to Trump and inflation, this is the main concern I have. Trump’s first term may provide a strong, peaceful macroeconomic environment that will persuade him to be a responsible steward of the macroeconomy, giving him the opportunity to commit macroeconomic arson in a second term.

Trump might have a corrosive impact on American macroeconomics, like Chavez and Erdogan, other populist leaders who have fought with their own institutions.

This , article , was first published on Noah Smith’s Noahpinion , Substack and is republished with kind permission. Read the , original , and become a Noahopinion , subscriber , here.