- Great depth of detail of all irregularities and alleged wrongdoings

- Suspicious transactions to V-Circle, Convedge for ‘development costs’

Despite it being the Christmas/year-end period when many corporate leaders take a break, tech CEOs, some as far away as in Chile, bombarded me with questions when Malaysian business weekly, The Edge, broke the story on 22 Dec 2023 that leading Japanese tech company Hitachi Ltd, had filed a motion in the Malaysia High Court to wind up its wholly owned FusioTech Holdings Sdn Bhd and 12 of its wholly-owned subsidiaries in Malaysia, all part of the Fusionex Group.

It was not just the motion to wind up, but the news that Ivan and many of his leadership team quit their jobs abruptly without serving due notice and did not execute their professional and fiduciary duties with a proper handover of access and documents.

A Hitachi Japan spokesperson told DNA that that Hitachi had no choice but to close the business down, describing it as the “most cautious course of action to proactively manage and minimise the impact to everyone involved. The senior management departed the company abruptly, leaving Hitachi without a formal handover of management and operations. This departure included a lack of sharing information regarding the continuity of Fusionex’s operation and business during their exit.”

“How is this possible?” “Is this for real?” “What is the real story?” posed ecosystem leaders.

Many expressed shock and disbelief that not just Ivan, but members of his leadership team could behave in such an unprofessional, unethical and irresponsible manner. “If this is true, and I honestly find it hard to believe, then they have opened themselves to legal action from Hitachi and even possible censure from the professional bodies they are members of,” said one tech ecosystem leader with a strong corporate background.

One CEO said, “Ivan is so well respected. How could this happen?”

The Ivan is question is Ivan Teh, a highly respected 47-year-old, soft spoken, polite entrepreneur with an intense work ethic who founded Fusionex in Malaysia in 2009 and grew it into one of Southeast-Asia’s top analytics and AI companies.

Hitachi, which bought his company in April 2020 even declared Fusionex as, “A market leader in providing state-of-the-art, innovative, data-driven platforms.” A company with, “a customer base of more than 11,000 SMEs in Asia.” This was a company that Hitachi had pinned big hopes on, targeting to acquire more than 60,000 SME customers in Southeast Asia by FY23.

Instead, with the court already appointing interim liquidators from Deloitte Restructuring Services PLT on 27 Dec, agreeing with Hitachi’s argument that the dire situation Fusionex faces demands urgency, the fear is that Fusionex will cease to exist, with the only remnants being its billboards around the Klang Valley, waiting to be taken down as well. The winding up petition against the Fusionex Group of companies are still pending before the court and with the Court hearing the petition in May 2024.

A stunning fall, without parallel in Malaysia’s tech history

It is a stunning fall, without parallel in Malaysia’s tech history. More so, as Ivan is the closest thing to being the golden boy for Malaysian tech, building a company to compete in the enterprise tech space against global tech players.

In fact, everyone in the Malaysian tech ecosystem is still shocked that Hitachi, which acquired Fusionex in April 2020 for RM545 million (according to its audited filings) would want to kill a profitable company with audited revenues of RM533 million for FY21, RM647 million for FY22 and RM833 million in FY23. Fusionex’s financial year ends March 31, in sync with Hitachi’s.

Such was Hitachi’s confidence in Ivan that it left him and his management team fully in control of running FusioTech Holdings, the new company established post its acquisition. Hitachi placed five of its executives as non-executive directors on the board with Ivan and his CFO, Chen Chiang as executive directors.

But a clear picture emerges from the unusually detailed winding up petition filed by Hitachi, viewed by DNA, where Hitachi chronologically lists a series of actions by Ivan and his leadership team over a 15-month period that is sweeping and breathtaking in scope, outlining flimsy excuses, non transparency and non-cooperation with Hitachi.

According to an experienced lawyer familiar with liquidation matters, “Hitachi, as the sole shareholder, could have kept its winding up petition at a basic and superficial level. Instead, Hitachi went to great lengths in its court papers to update the court with great depth of detail of all the irregularities and alleged wrongdoings that happened.”

This could be setting up for future action it aims to take against Ivan, said another lawyer.

Asked by DNA if Hitachi was preparing to seek legal action against the directors and management team of Fusionex for failing to carry out their fiduciary duties, a Hitachi Japan spokesperson said, “Following standard legal procedures, if the winding up order is granted by the Court, a liquidator will be appointed to take over operations during the winding down process. Any potential legal action would have to be considered by the appointed liquidator.”

Actions ‘which indicate unethical and irresponsible business conduct’

The petition contains a chronological order of astonishing events where Hitachi accuses Ivan and members of his senior leadership team of, “refusal to provide clear financial disclosures, the unexplained resignation of key personnel, and the lack of any records of customers, suppliers, and employees which indicate unethical and irresponsible business conduct.”

Btw, this non-cooperation also included a senior secretary who refused to provide the new CEO, Hiroyuki Kumazaki, with the mobile numbers of all the senior leadership team and who initially refused to hand over her company laptop to him. And when she did, it was found to have been wiped clean (reformatted to erase all previous data.)

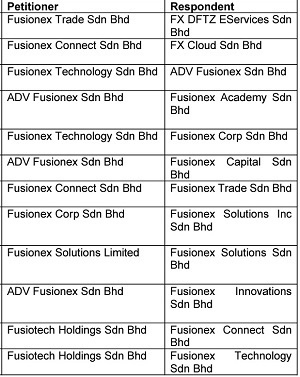

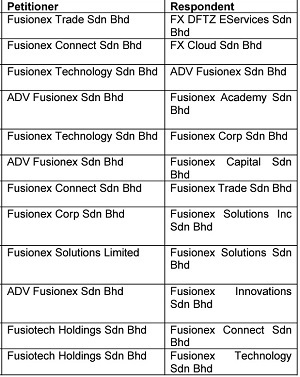

Hitachi also cites “an apparent breach of section 245 of Companies Act 2016 as the accounting and other records to sufficiently explain the transactions and financial position of each Respondent (ie each of the 12 companies it intends to wind up. See table.) and to enable a true and fair assessment of the profit and loss accounts and balance sheets.”

intends to wind up. See table.) and to enable a true and fair assessment of the profit and loss accounts and balance sheets.”

Incredibly, Hitachi said cabinets in the finance department “appeared to have been emptied out” with the financial records and management accounts of the Fusionex Group and Fusiotech Holdings nowhere to be found, except for the balance sheet and consolidated statement of financial position as at 30.9.2023.

Astoundingly, there was also no complete list of staff emails, which Kumazaki asked for so he could explain matters to the staff. Kumazaki and the new leadership team who came in had to compile a list manually. A senior HR executive was also accused of being uncooperative.

Hitachi discovered, to their shock, that from Sept to Nov, at least 110 staff had either resigned or been retrenched. The directors were not informed of this meaningful situation.

Suspicious transactions pertaining to V-Circle and Convedge for ‘software development costs’ and/or ‘technology fees’

Amidst the paucity of data available to it however, a set of finance ledgers relating to the Fusionex Group (dated 05.07.2023) were also found. According to Hitachi, “the ledgers showed a number of suspiciously voluminous transactions pertaining to V-Circle’s and Convedge’s ‘software development costs’ and/or ‘technology fees’. A substantial number of these transfers were done through the Fusionex Group’s Singapore and Macau-incorporated entities.

Convedge is a bid gata company launched in 2010 while V-Circle MY Sdn Bhd was incorporated in July 2022 and describes itself as AI-powered, managed SaaS platform primarily serving B2B customers across various communities using IR4.0 technology, is said to be staffed with some executives who left Fusionex and where Fusionex engineers also worked on V-Circle projects.

There is market talk that Ivan has an interest in the company although his name does not appear as a shareholder or director and a person familiar with V-Circle tells DNA that Ivan has no interest in the company.

Meanwhile DNA has learnt that a former Fusionex project manager for a major government account has reached out to the government agency to reassure them that their Fusionex built and run platform would be maintained and kept running smoothly post Fusionex. An executive from the agency tells DNA, “We want to wait for more clarity on what really happened at Fusionex before making any decisions of support.”

It is believed that other ex-Fusionex executives have also been reaching out to key government and private sector clients as well, assuring them of support though it is not clear through which company.

It is also not known if Hitachi has reached out to any customers to support them, though such efforts are clearly handicapped by it not knowing who Fusionex’s customers even are beyond the large ones where the contract wins were accompanied by media releases.

The internal audit request which triggered Ivan’s fall

The catalyst for the current situation started when Hitachi, as part of its risk management and corporate governance where it conducts an internal audit of its subsidiaries every three years, gave Ivan notice in Aug 2022 that it intended to do an audit on Fusionex Group and Fusiotech Holdings in March 2023.

This started a series of back and forth between Ivan and Hitachi, outlined in its petition, in which Hitachi wanted to exercise its legal rights as owners of Fusionex and with Ivan and his leadership team giving various reasons to obstruct this, chief of which was a purported ‘government directive’ that prevented Ivan from sharing sensitive data with foreign parties.

According to its winding up petition, Hitachi said it was alerted by Ivan in Sept 2023 that the company had suffered a sharp drop in revenue followed by a shocking revelation from Ivan at a meeting on 27 Oct 2023 that it would need to cut costs, including immediate retrenchments, without which it may not be able to meet its financial obligations by Nov/Dec and that the retrenchments would require large compensation.

In the meeting, attended by Jacob Isaac, the Managing Director and Chen Chaing, the CFO, a second option was presented which entailed an immediate shareholder capital injection of between US$100 million to US$150 million (by mid Nov) to stabilize the group, prevent further erosion of confidence and loss of customers.

As stated in its winding up petition, the news came as a “rude shock” to Hitachi which was unaware of the dire financial situation of Fusionex Group. On 13 Nov 2023, Ivan and Jacob were in Japan to present a recovery plan to Hitachi executives.

This time they said the Fusionex Group needed the US$100 million to US$150 million funding to strengthen its R&D. No mention was made of needing the money to stabilise the group.

In a written response handed to Ivan on the day of the meeting, Hitachi expressed grave concern over the lack of communications and transparency by Ivan and his leadership team over the actual nature of the financial situation of Fusionex.

But, aiming to help resolve the issue, Hitachi set out some pre-conditions for Ivan to obtain funding from it, which included:

- Information to be provided by Ivan and his management team (including bank balance data);

- The appointment of Hitachi’s nominees as directors in other entities of Fusionex Group; and

- All bank transactions of Fusionex Group to be jointly approved by a finance team designated by Hitachi.

But this request by the owners of the company and its appointed directors and audit committee was denied by Ivan, all on the pretext of some “government directive” that prevented him from sharing financial information sought by Hitachi in a company they owned, 100%.

Hitachi’s lawyers were also not given a copy of the directive and were only allowed to view it without taking any notes during a meeting between the two sides in KL on 23 Nov.

Still, this was enough for Hitachi’s lawyers to realise that the ‘Government Directive’ was merely a general letter reminding the recipients to exercise caution and avoid breaching any laws in relation to the disclosure of data to third parties and foreigners.

A few days later the inhouse legal counsel for Fusionex showed Hitachi’s lawyers a copy of another ‘government directive’ dated 27 Nov which purported to prohibit Fusionex from sharing any data with the audit committee. Once again, Hitachi’s legal team were refused a copy of the ‘Government Directive’ and only allowed to look at it visually without taking any notes.

The next day, Fusionex called for a meeting with Hitachi where it suspended any further discussions based on the newly received government directive, including not allowing the Audit Committee to meet with Fusionex auditors EY.

Hitachi described this as “shocking” as the members of the Audit Committee were also directors of Fusiotech and should have unrestricted access to its financial records.

An ecosystem leader familiar with the contents of Hitachi’s winding up petition did not mince his opinion of the alleged behaviour by Ivan and his leadership team.

“If this is confirmed to be true, then I am truly astounded by the actions of the management team in dealing with their own Board and shareholder. Hitachi is the sole shareholder of the company and they, and the Board they appointed, have full authority and power to access all and any company document they desire. The management team and the CEO owe a fiduciary duty to the Board and cannot withhold any information requested by the Board,” he said.

He went on to add, “It is absolutely nonsensical to state that there is a so called government directive to withhold information from foreign nationals and that this applies to foreigners who are on the board. There is no such thing and it is merely an excuse to withhold information from the Board.”

The ecosystem leader goes on to say, “The Petition is highly damaging to the management team who have a responsibility to explain themselves. I am concerned that the actions of the Fusiotech management team may have deeper repercussions for the ecosystem especially foreign investors and prospective acquirers of Malaysian startups.”

‘Give Ivan some space…’

Prior to my having access to the Hitachi winding up petition papers, I had spent almost two weeks asking industry players, current and past Fusionex staff about what could have gone wrong but with very little light on what could have caused this drastic decision by Hitachi. This included a conversation with a former senior executive who tried to convince me not to write about the matter.

“There are truths, half truths and some untruths of the various opinions and speculations out there. I would say that we give Ivan some space and when the dust settles, we will know more,” said the executive.

But the dust is not about to settle on this story as Ivan and his senior execs who left suddenly are hoping for. Not when the answer to Hitachi’s drastic winding up application is laid bare in the detailed court submission.

It remains to be seen if Ivan will come out and defend himself and his reputation against the damaging contents of Hitachi’s petition. Any future he hopes to have of still being a key part of Malaysia’s tech ecosystem will depend on this. The Court has also tasked the interim liquidators of the Fusionex Group of companies to issue a report on the status of the business and financial affairs of the companies. It is hoped that such a report will also shed some light on the state of Fusionex.

As of publishing of this article, Ivan has not responded to DNA queries to get his side of the story.