Restrictions on the economy and finances frequently have negative effects. The dollar’s use of force against Russia is the most significant example. The estimate has sparked a global action to de-dollarize, the reverse of the disciplinary move’s proper intent.

Despite the legendary error, US Senator Marco Rubio of Florida was able to introduce a bill into Congress to chastise de-dollarized nations. The bill aims to outlaw economic organizations that devalue the world’s currency.

The Sanctions Evasion Prevention and Mitigation Act, a ominous acronym for Rubio’s costs, may involve US president to impose sanctions on financial institutions that use Russia’s SPFS financial messaging services, China’s CIPS payment system, and other solutions to the dollar-centric SWIFT program.

Rubio is not alone in targeting places selling to de-dollarize. Donald Trump’s financial advisors are weighing ways to chastise nations that are constantly devaluing the money.

The Trump administration has proposed to” sanction both supporters and opponents who seek effective means of bilateral trade in assets other than the dollar.” Violators may be subjected to import restrictions, tariffs and” dollar manipulation charges”.

Awakening BRICS

Initial de-dollarization was criticized by US policymakers and economic media critics. They argued the money is used in some 80 % of all international financial dealings. No other money perhaps approaches.

But economic sanctions against Russia, imposed after Russia’s military action in Ukraine’s Donbas region in 2022, became a turning point. De-dollarization has accelerated, and it is now probably unsustainable.

The Association of Southeast Asian Nations ( ASEAN ) made the announcement in May of its intention to stop transnational trade and instead use local currencies. Although the statement made little stories in the world, ASEAN is a significant trading bloc made up of ten nations and 600 million people in total.

Bartering contracts are another way to get around the dollar program. While Pakistan has authorized bartering with Iran, Afghanistan, and Russia, Iran and Thailand are trading foods for fuel. China is building a state-of-the-art aircraft in Iran, to get paid for in oil.

Additionally, using cryptocurrencies to defy the dollar system and prevent being scrutinized by American courts. Beyond the traditional banking system, cryptography, such as Bitcoin, enables users to send and receive money anywhere in the world in a secure manner.

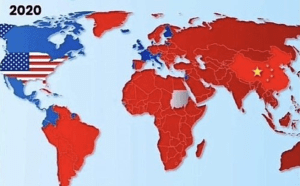

The BRICS, which are quickly emerging as the largest economic bloc in the world, have large priorities regarding de-dollarization.

Aside from a shared desire to build a counterpoint to the G7, the BRICS had some clearly defined goals as of 2022. However, the group’s strong new focus and purpose were facilitated by the dollar system’s weaponization and the melting of US$ 300 billion in Soviet reserves held in Western banks.

BRICS started as an improbable partnership. The five foundation families have different cultures, political systems, and financial systems, with locations on three different continents. However, they are both eager to create a unipolar earth.

The BRICS has no intellectual program and is driven by economics. It concentrates mainly on cooperation and socioeconomic development. Its philosophy is based on consensus and cooperation.

China is the BRICS’s financial statement because it is the largest trading partner of the majority of nations. As China steadily de-dollarizes, its investing partners are likely to adopt in different degrees.

The consists

The US government’s influence over the world monetary system dates back to 1974, when it persuaded Saudi Arabia to simply buy its oil in bucks. The deal came after the US declared its intention to leave the gold standard in 1971. The’gold window’, in which money could be exchanged for real gold, was closed by President Richard Nixon.

The US was fighting two wars at the same time – the war in Vietnam and the war on poverty – and the government issued more dollars and debt than could be backed by gold. The consists assured continued global demand global for dollars.

All oil-importing nations were required to keep money reserves, according to the deal. Oil-exporting nations invested their money surpluses in US Treasury and Bonds, providing ongoing funding for the country’s debts.

US bill issues

The US has a significant advantage over other nations because it has power over the country’s reserve currency. It has the authority to acquiesce to any nation it sees as an economic or political interlocutor, and it has the ability to sanitize it.

Also, the government can issue loans to overseas countries in its own money. Countries that require imports of essential commodities like fuel, meal, and medicine but lack the funds can use the International Monetary Fund to obtain loans.

The beginning of the business, privatizing people companies, and liberalizing financial markets are typical neo-liberal conditions that countries are subject to when lending to them. The outcomes were not ideal.

IMF customers include Pakistan, Argentina, and Egypt, which demonstrate how frequently nations struggle to pay off debts. In April this year, Pakistan received its latest aid package of$ 3 billion, its 23rd IMF loan since 1958.

The consists made it easier for the US to finance its debt and led to profligate spending by the US government. In 1985, just ten years after the petrodollar agreement, the US became the biggest debtor in the world.

In 1974, the US national debt was$ 485 billion, or 31 % of GDP. This year, the national debt surpassed$ 35 trillion, representing 120 % of GDP.

This year, the federal debt’s interest payments will surpass$ 8 billion, making it the most important budget item forward of defense and social security. In a few years, discretionary spending will surpass all other types of investing without a significant course adjustment.

The debt crises reinforces rising US concerns about de-dollarization. Less money buyers of US bill mean less money is spent on them.

US securities have long been viewed as a safe haven for buyers. Bonds provide a predictable transfer, and the government guarantees payment. But in the past few years, buyer desire for long-term US loan has come under stress. A obvious sign of trouble: the money and golden, which for years had traded in a small speed, started to vary.

The problem of buyers is based on simple arithmetic. If the US problems more dollars/debt than socioeconomic development justifies, it causes inflation. When bond yields are 4 % and inflation is 8 %, bonds are a loss-making investment, which is not good for pension funds and other investors with long-term commitments.

The US bond market is valued at$ 50 trillion, a substantial amount by most measures. The minimum value of the world’s dollar system, which is essentially unimaginable but has more than a quarter of a billion dollars, is a pale figure.  ,  ,

- The off-shore shadow banks is estimated at$ 65 trillion

- The generic business is valued at$ 800 trillion

- The off-shore dark banking sector is$ 65 trillion

- The eurodollar market is$ 5 trillion to$ 13 trillion

De-dollarization results in the gradual return of some trillions of dollars to their original owners. The need for money will only decrease as a result of countries ‘ transition to multicurrency trading.

The US’s ability to attract more foreigners may be diminished as a result of US dollar flow. Fewer buyers means higher interest payment, which leads to higher debts.

Gold versus Bitcoin

To minimize US debt, which is thought to be about 70 % of GDP, several measures have been suggested by academics and politicians. Socially, however, the necessary drastic spending cuts and higher fees are in order.

A second option for addressing the debt-death circular has been suggested by a number of officials and economists: strengthening the US stability sheet by adding Bitcoin to the country’s resources.

More than 200, 000 Bitcoins have already been seized and declared a debt by the US government. Donald Trump, the US government’s nominee for president, has pledged to keep Bitcoins on the balance sheet.

Bitcoin is also inexpensive, claim Bitcoin’s proponents. They predict its price may reach six images, up from$ 60, 000 in recent months. Cyber bull contrast a sizable order of Bitcoin with the Louisiana Purchase in the 19th century, when the US purchased almost a third of France’s territory for$ 15 million.

Robert F. Kennedy Jr., the president’s nominee, has gone one step further and suggested that the US government purchase Bitcoin in exchange for the country’s recent golden resources.  ,

A portion of the US government’s$ 615 billion in silver is now held by the government, which is a fraction of its$ 35 trillion loan. The government would need to purchase more than 9 million Bitcoins at present prices to suit the value of its golden reserves.

Importantly, Kennedy Jr wants the authorities to up the money with a combination of resources like gold, gold and platinum, in addition to Bitcoin. A “basket” of these assets may be a new group of US ties.

Ironic, let Bitcoin save the money. The crypto was designed to avoid, if not destroy, the dollar and the stablecoins money system.

Similarly humorous, Bitcoin is generally denominated and valued in cash. That is, whatever happens to the money will affect the dollar-denominated Bitcoin. Silver, on the other hand, is in a course of its own.

If the money or Bitcoins goes to zero, the owner is left with nothing. If silver goes to zero, the owner still has the metal.

The next supply money

Kennedy Jr. is probably correct to assume that all painful assets will be used to support the money. The Argentine peso and Zimbabwe’s dollar could change their currencies if that is the case. Both nations almost eliminated their currency depreciation. In order to enforce governmental control on the government, Zimbabwe suddenly turned to gold-backed money.

The Bretton Woods Agreement, which set the gold-backed money as the standard for all other currencies, has been the first de-dollarization challenge to the penny since 1944. Given the political pressure between BRICS and G7 countries, a Bretton Woods II is very unlikely.

Otherwise, there will be more multicurrency agreements being created, and perhaps a BRICS exchanging currency will be introduced. The BRICS money unit will only be online, with asset-backed backing. No paper money or coins may be distributed.

The global financial system is therefore likely to fragment into three sections: the dollar-led stablecoins system, multicurrency contracts and a BRICS-led investing money. The money will be the world’s next reserve money in addition to the other two, but the dollar is most likely to be the last one.

Reserve currencies are a ( neo)colonial remnant. They mainly benefit rich people and corporations. Countries will generally benefit from a multicurrency system because it will reclaim their financial and financial autonomy and make them accountable for their own future.