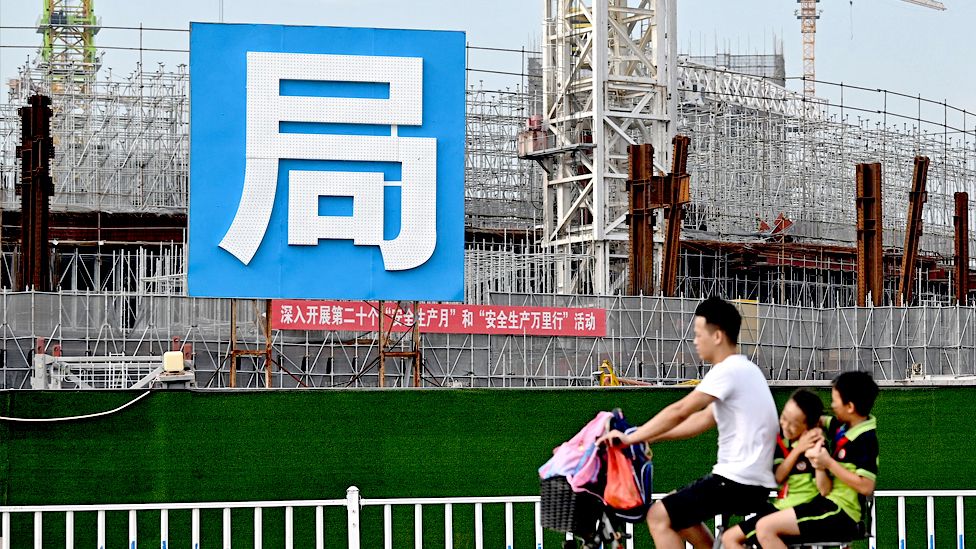

Country Garden, the largest private estate developer in China, is thought to be the most recent real estate juggernaut to default on its international loan.

A default would be one of the largest corporate debt restructurings in the nation, with the company owing$ 11 billion(£ 9 billion ) in debt and another$ 6 billion in onshore loans.

Its potential definition raises questions about China’s ability to recover from the pandemic.

China’s real estate market, which makes up a fourth of the business, is experiencing significant problems.

According to the most recent statistics, the nation’s economy expanded 4.9 % in the three months between July and September. Compared to the 6.3 % growth in the second quarter, that is slower.

Despite Beijing’s efforts to increase cover need, the number of home sales is also lower than it was last year.

According to the most recent data, the nation’s real estate investment decreased by 9.1 % during the first nine months of the year.

According to Raymond Cheng, Standard Chartered’s North Asia main purchase officer,” This will spark our worries about the housing market in China.”

In order to regain confidence and trust in the market, markets will probably seek a more coordinated policy approach, Mr. Cheng continued.

When new regulations to regulate the amount of money that large real estate firms may acquire were implemented in 2020, China’s housing market was rocked.

With a number of other developers defaulting on their debts and abandoning empty construction projects across the nation, the government’s property industry has been affected by its economic issues.

China is also dealing with different issues, such as slow economic growth, rising regional government debts, and record-high youth unemployment.

More information about this tale

-

-

29 September

-