That loud sputtering sound emanating from China is increasing in volume as factory activity contracts for a fourth straight month.

China’s official manufacturing purchasing managers’ index (PMI) dropped to 49.1 in August from 49.4 in July. Since April 2023, this key barometer has been below the 50-mark separating expansion and contraction for all but three months.

It suggests that Beijing’s efforts to revive Asia’s biggest economy care gaining less traction than hoped.

“We believe more fiscal easing is necessary to help secure the around 5% full-year growth target,” says Yuting Yang, an economist at Goldman Sachs Group.

At the moment, trade tensions with the West and debt troubles weighing on local governments are limiting Beijing’s ability to boost consumer spending.

Add in great uncertainty about who might be leading the US economy five months from now – and the magnitude of new tariffs on China-made goods – and Xi Jinping’s government is under increasing pressure to spur growth at home.

Xi’s “fridges-not-bridges” pivot, as some economists call it, aims to put household spending in the driver’s seat.

After the slowdowns of recent history — like the 2008 Lehman Brothers crisis — Beijing switched on the infrastructure engine.

This time, though, with local government finances in distress and overcapacity sweeping the nation, Team Xi is looking to ignite a domestic demand-led growth boom.

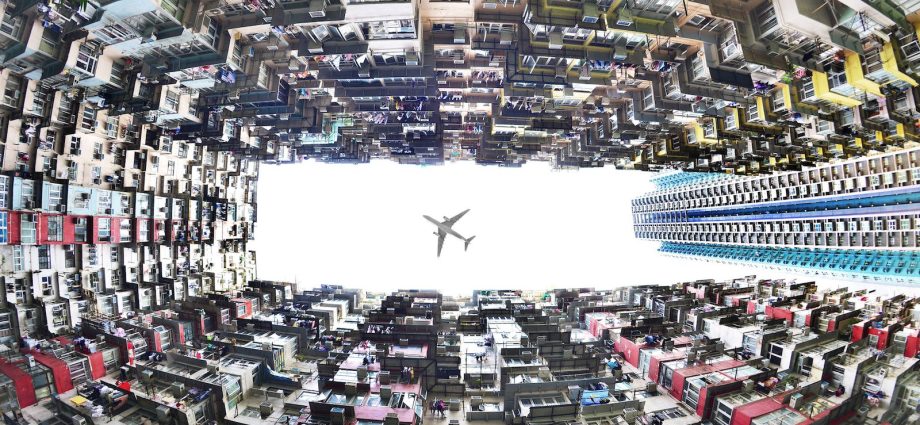

The economic payoff for all those massive skyscrapers, six-lane highways, international airports and hotels, white-elephant stadiums, sprawling shopping districts and amusement parks has become less and less over time. And the bill is now coming due.

Pulling off this transition is easier said than done in the post-Covid-19 era. A deepening property crisis has average consumers bracing for further drops in home prices, which is complicating efforts to cushion the downturn. So are deflationary trends spooking global investors.

The resulting blow to confidence is weighing on China’s US$17 trillion economy and triggering capital outflows that are sending mainland stocks lower. All this is making it harder for Xi’s inner circle to turn things around.

“Unfortunately, our year-old negative forecast for China appears to be playing out,” says economist Richard Martin at advisory firm IMA Asia. He adds that “the rest of Asia will need to prepare for the spillover from China’s slump, including the risk of a surge in dumped products.”

Ditto for worries about how Chinese overcapacity will collide with geopolitical currents.

Among them are Western efforts to slow China’s ability to increase global market share. Last week, Canada announced new tariffs on Chinese-made electric vehicles, aluminum and steel.

Ottawa’s 100% levies on EVs and 25% taxes on steel and aluminum put it in protectionist league with Washington and Brussels.

Such moves are adding to Xi’s headaches as a uniquely chaotic US election cycle heats up. Though a Donald Trump 2.0 presidency might be tougher on Beijing, a Kamala Harris-led White House would almost surely also tighten the screws on Xi’s economy.

That might add to the argument for greater Chinese fiscal stimulus. For Xi, who earlier this year began his third term as Communist Party leader, the stakes are high at home and abroad.

The party’s legitimacy with China’s 1.4 billion people rests on rapid economic growth and increasing per-capita income. The same goes for Xi’s ambitions both among the BRICS — Brazil, Russia, India and China — and the broader constellation of Global South nations.

A major narrative surrounding the BRICS and the Global South is of emerging-market economies coming into their own and picking up the slack as the US and Europe mature and grow less rapidly.

For now, China’s overcapacity troubles are putting the nation in global headlines for all the wrong reasons. Many argue, of course, that China isn’t exporting deflation so much as rising mainland productivity and efficiency and thus making the economy more competitive.

“As China is some 55% of regional GDP and the main trading partner for most neighbors, the outlook for China policy is critical,” Martin says. “So far, economic policy has been poorly aligned with the problems undermining China’s growth.”

The good news is that signals from Xi and Premier Li Qiang suggest reforms are being implemented. Key among them: getting bad assets off property developers’ balance sheets, strengthening local government finances across the nation and supporting private sector development.

For many, though, the perceived slow pace of action raises concerns about China’s economic trajectory into 2025.

Once again, says economist Carlos Casanova at Union Bancaire Privée, China’s manufacturing PMI is “highlighting ongoing challenges in the sector, driven by a downturn in housing and sluggish domestic demand. Most components showed a sequential decline, indicating widespread weakness.”

Notably, he adds, producer price and input price subcomponents experienced “significant easing” for different reasons.

“The producer price subcomponent, closely tied to the broader producer price index,” Casanova says, “suggests that overcapacity continued to exert downside pressure on factory prices in August.”

The bottom line, Casanova says, is that “economic growth is uneven, primarily fueled by service consumption, exports and substantial investment in core technology.”

All this, he says, “suggests that the government will need to implement counter-cyclical measures to stimulate domestic demand.”

This could entail additional interest rate cuts by the People’s Bank of China, though that might put downward pressure on the yuan.

“We believe China’s reluctance to pursue RMB appreciation in August may buy exporters time to offload their dollar holdings without incurring significant currency losses,” says Tommy Xie, an economist at OCBC Bank. It also suggests the PBOC might be reluctant to ease more.

Martin at IMA notes that “our view is that policy will be forced into better alignment as you can’t let a house burn for too long before turning on the hose.”

Two big steps are needed and anticipated, Martin notes. First, allowing market clearing by freeing prices and letting firms go bankrupt.

“Beijing has just allowed that in residential property, which means a big real estate and construction shake-out and a rise in unemployment and consumer distress,” he says.

“The rest of Asia needs to be ready for an increase in China’s export dumping in 2025. Second, the national government needs to use its balance sheet to drive up growth as all other balance sheets are too weak. No change yet but we are waiting.”

A major challenge is making good on Xi’s pledge to encourage households to spend more and save less. Along with faster, more balanced economic growth, that means building bigger social safety nets.

As Xi and Li realize, investment-led growth has peaked in China, as the financial system can no longer generate the same pace of credit expansion as in the past decade, says Logan Wright, director of China markets research at Rhodium Group.

“China’s economy is slowing once again, and weaker household consumption is the primary cause,” Wright notes. Household borrowing, he explains, “remains under pressure from low levels of consumer confidence and the flagging property market.”

As a result, the imbalances between domestic and external demand have widened, with China producing persistently large trade surpluses, now reaching $858 billion over the past year, or around 4.8% of GDP.

Because of this “slowdown” in household consumption, Wright says, “calls for structural reform to rebalance China’s economy are multiplying.”

“In the absence of significant fiscal reforms, long-term household consumption growth is likely to slow to around 3% to 4% per year in real terms over the next five to ten years,” Wright says.

At most, he adds, “household consumption will contribute around 1.5 percentage points of GDP growth per year, which is likely to limit overall long-term GDP growth to around 3%, given the known headwinds to faster investment growth.”

The good news is that Xi and Li claim to be on the case, devising ways to recalibrate China’s growth engines. The bad news is that official data continue to paint a picture among investors that Beijing isn’t moving fast enough to turn things around.

Follow William Pesek on X at @WilliamPesek