SHANGHAI IN CHINA: China is expected to maintain lending benchmarks unchanged this week, an election of market participants showed, with government bodies seen holding away monetary easing in the short-term to avoid a lot more depreciation pressure to the currency.

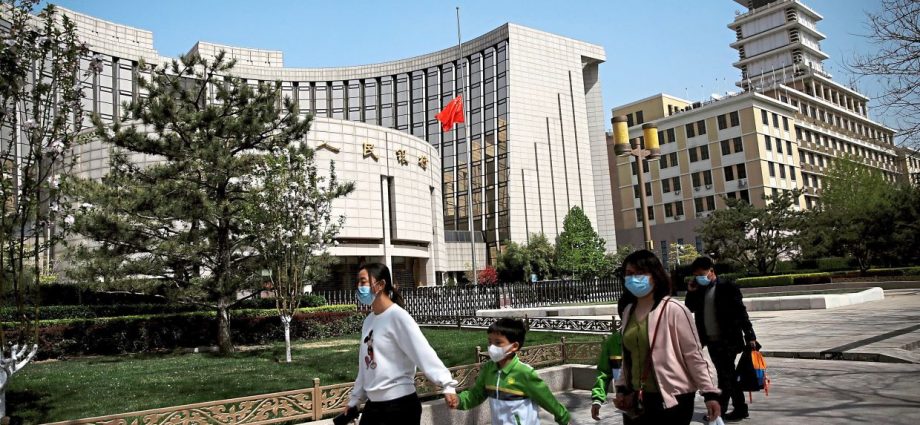

The particular loan prime rate (LPR), which banking institutions normally charge their best clients, is set simply by 18 designated commercial banks who publish proposed rates towards the People’s Bank associated with China (PBOC).

Twenty-one out of twenty-eight respondents, or 75% of all participants, in the Reuters snap vote predicted no alter to either one-year LPR or the five-year tenor at the repairing on Tuesday.

Among the remaining seven respondents, six expected a five-basis-point cut to the five-year LPR to stimulate the home sector, while the various other respondent projected minor cuts to each rates.

Many new and exceptional loans in China are based on the one-year LPR, which right now stands at 3 or more. 65%. The five-year rate influences the particular pricing of house mortgages and is now at 4. 30%.

Both rates were lowered within August to revive credit demand and support the flagging economy.

Expectations for a steady LPR repairing come as extending divergence between the monetary policies of China and most other main economies weighs the particular yuan down, limiting the scope to get more policy easing.

China, along with Japan, has been a major outlier amid a global operate of interest rate outdoor hikes to tame pumpiing with Beijing focused on reviving an economic climate hurt by COVID-19 shocks.

The PBOC partially rolled over maturing medium-term policy loans last week, while keeping the interest rate unchanged.

The borrowing cost of the medium-term financing facility (MLF) is a guide to the LPR, and markets generally use the medium-term plan rate as a precursor to any changes to the lending benchmarks.

“Although it is not a good infallible signal — the LPR had been lowered without an MLF reduction last Dec – it makes an LPR cut unlikely, ” economists on Capital Economics mentioned in a note.

“We do anticipate further rate slashes at some point given the particular still gloomy financial outlook. But that will depends on pressure within the renminbi easing. The PBOC won’t draw the trigger upon rate cuts until it does. ”

The yuan has lost about 4% to the dollar given that mid-August and is on course for its biggest annual loss given that 1994, when Tiongkok unified official and market exchange rates.

Separately, 5 of China’s biggest banks announced slashes to personal deposit rates last week, a move that could relieve pressure on margins after recent financing rate cuts to revive the economy.

“The cut might allow a bit more space for cutting the particular LPR, ” mentioned Ting Lu, main China economist in Nomura.

“However, there appears to be restricted space for further cuts to LPR rates, and these moderate modifications to benchmark rates will likely have a limited economic impact. ” – Reuters