China’s exports grew 10.7 % year-on-year in December, outpacing November’s 6.7 % gain and beating analyst forecast of 7.3 % growth. The main driver of Chinese exports remains the Global South, particularly to nations where China is building system, but restocking in anticipation of taxes accounted for a small portion of the gain. In 2023, China’s export to the Global South outpaced its supplies to all developed markets, and the trend toward developing countries is still there.

Exports to the US now comprise just 15 % of China’s total shipments, down from 20 % in 2018. In December, China sold$ 137 billion in goods to the Global South, compared with just$ 108 billion to all developed markets.

The biggest year-on-year get in December came from Indonesia, whose payments from China were off 50 % on the past December. In Southeast Asia’s largest nation, China is building high-speed road and telecom equipment.

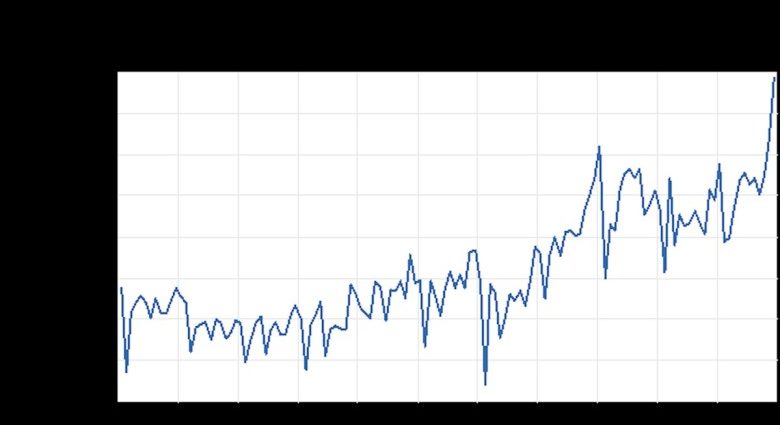

The shift in full exports for 2024 compared to overall exports for 2023 is shown in the above chart. Brazil and Indonesia, which together have almost half a billion people, both rose by 18 % over the period, along with Vietnam. Kazakhstan, the largest market in Central Asia, also increased its payments from China by nearly 20 %. By contrast, increases in export to the US and Europe were little, and Japan showed a tiny drop.

The US in December took only 15 % of China’s exports, down from a peak of 20 % in 2018.

With China’s business shifting to the Global South, Washington has lost the ability to impose tariffs or other trade restrictions on the country.

Indonesia is a striking in China’s trade page. In the last four decades, China’s payments have increased by$ 9 billion per month, or$ 108 billion annually. The Carnegie Endowment wrote in December 2023,” Over the past century, China has made , large investments , in Indonesia through Belt and Road, spanning various , sectors , such as equipment and mine. The Public framework has solidified China’s status as one of Indonesia’s largest buying partners…. Chinese opportunities have the potential to boost Indonesia’s economic development, especially when directed toward system development”.

Chinese investments in Indonesia include the Jakarta-Bandung high frequency railroad, a nationwide 5G wifi networking, box ports and integrated warehouses. With a 5 % growth in GDP over the years, it was among the highest in the area.

China’s Belt and Road Initiative’s long-term practicality and the hopes for its trade deal with the Global South depend on whether its dealing colleagues can use exports to fuel future progress. There are any number of failures in the Belt and Road investment, but Indonesia appears to be succeeding.