As China, US meet for tariff talks, how will Art of the Deal match up against Art of War?

Who has the higher hand when top officials and business leaders board planes flying from Washington and Beijing to the Swiss negotiating table?

As US and Chinese officials meet in Switzerland this weekend for their first face-to-face business discussions since President Donald Trump’s sweeping new taxes go into effect, analysts said the imbalance in negotiating power is already obvious.

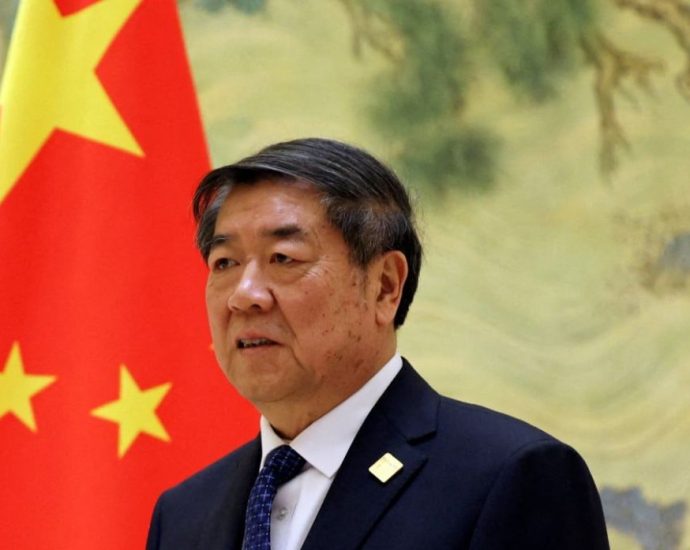

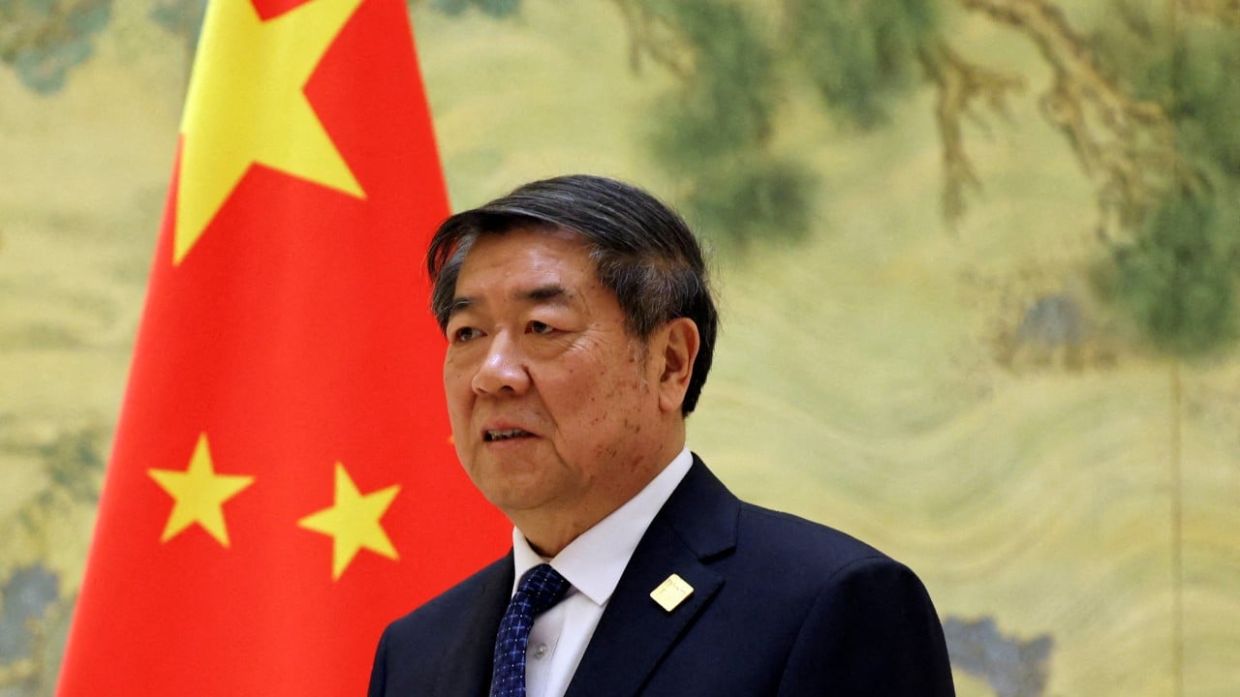

The meetings, which are scheduled for Saturday ( May 10 ) and Sunday, will be led by Trade Representative Jamieson Greer and US Treasury Secretary Scott Bessent. Vice Premier He Lifeng may lead the government on Beijing’s area.  ,

Despite its individual regional economic pressure, China enters the discussions with stronger requirements, a clear communication, and more corporate patience, according to observers. The United States, on the other hand, has downplayed the hopes of a package and balanced expectations.

Wang Dan, chairman of China at Eurasia Group, said that” China does have the upper hand because the US is reaching out.”

” The US’s domestic situation is primarily what caused the discussions,” the statement states. No one expected this level of volatility in the market, despite the fact that some folks had anticipated some difficulties.

According to Dexter Tiff Roberts, a foreign senior fellow at the Atlantic Council’s Global China Hub, both China and the US are “feeling true economic problems from these outrageously high taxes.”

While China struggles with a decline in export-related work, the US is threatened by empty store shelves and higher customer costs.

However, Roberts did point out that the Chinese have a higher tolerance for pain than other countries, with the Chinese saying” chin ku,” which means to “eat bitterness” or to experience pain.  ,