- Pickup of revenue, great performance from OpCos, likely to exceed Heading KPIs

- Looks to finalising 5G commercial details with DNB therefore customers will advantage

Axiata Group Bhd documented strong operational functionality for the first 1 / 2 of the year ended June 30, 2022 (1H22) reflecting the solid fundamentals of its Working Companies (OpCos) towards a backdrop associated with inflationary pressures, higher interest rates, and foreign exchange losses stemming in the strengthening US buck.

Axiata Chairman Shahril Ridza Ridzuan said, “For the first half of 2022, the Board can be encouraged by the continued discipline and determination of the operating businesses in executing the Group’s plans. ”

On track to exceed Heading KPIs for 2022, the Group has also set out on proactive actions to withstand immediate problems from macroeconomic risks by recalibrating its operations for enhanced resilience and environmentally friendly long-term growth.

On a reported basis, the Group’s Year-to-Date (YTD) revenue and Earnings Just before Interest, Tax, Devaluation and Amortisation (EBITDA) increased by five. 8% and 7. 4% respectively, primarily contributed by every OpCos except Dialog4 and Ncell5.

Profit After Tax and Minority Interest (PATAMI) slipped into a loss of US$33. 35 million (RM149 million) largely because of unrealised forex losses from Dialog plus Axiata due to the strengthening US dollar, higher taxes in the form of one off Cukai Makmur in Malaysian organizations and surcharge taxes in Dialog plus net finance cost.

With an underlying basis, income excluding device (ex-device) grew by 7. 9%, whilst EBITDA grew 8. 1% correspondingly, offset by higher taxes plus net finance cost. EBITDA margin enhanced to 44. 9% while EBIT expanded by 34. 0%, trickling down to Underlying PATAMI which continuously grew by thirty seven. 5%.

The higher EBITDA contribution by all OpCos except Dialog plus Ncell was also buoyed by the absence of accelerated depreciation of 3G assets in 2022, offsetting higher fees and net financing cost.

Within the quarter, Axiata achieved cost superiority through capital expenses and operational expenditure savings of US$86. 84 million (RM388 million) and RM257 million, totaling RM645 million in financial savings.

[RM1 = US$0.224]

The Group’s stability sheet reflected its growth-fueled activities, having a Gross debt/EBIDTA of 3. 03x, net debt/EBITDA of 2 . 48x and money balance of RM6. 6 billion.

Digital celcos performance

Celcom managed its year-on-year development momentum with income ex-device up by 4. 2% YTD driven by prepaid revenue and good contribution from new acquisitions in Celcom’s B2B business unit. EBITDA grew by 13. 0% for the back of reduce opex and financial debt recovery. EBIT plus PATAMI improved > 100% with PATAMI rising to RM542 million flowing via from higher EBIT, offset by higher taxes from Cukai Makmur.

XL’s revenue ex-device increased by almost eight. 5% benefitting from reopening during Lebaran and positive energy from price improvements. EBITDA lagged income growth due to increased opex to drive revenue, and consequently EBIT margin slid to eleven. 6% compounded by higher D& The. PATAMI dropped by 14. 1% on account of lower one-off benefits and higher internet finance cost.

Robi’s revenue ex-device rose by 3. 2% within tandem with higher data subscribers plus usage. EBITDA and EBIT outpaced topline at 9. 1% and 12. 1% respectively. However , PATAMI dropped by sixty-five. 8% as a result of foreign exchange losses on USD-denominated loans and higher net finance cost.

Towards a challenging socioeconomic climate, Dialog’s long lasting topline was negated by forex deficits due to depreciation of the Sri Lankan Rupee (LKR) against the dollar. Revenue ex-device improved by 20. 3% YTD attributed to increased contributions across just about all segments. PATAMI fallen to a loss of LKR28. 3 billion significantly impacted by forex deficits, without which, PATAMI would have been LKR6. 0 billion.

Ncell’s income ex-device slipped simply by 4. 4% powered by lower core posting of 1. 9% and due to lower domestic interconnect price whereby voice got dropped 11. 3% while data moderated the downturn having a growth of 17. 6%. The producing EBIT and PATAMI had declined simply by 18. 8% plus 24. 1% respectively.

Smart continued its upward momentum as revenue ex-device rose simply by 6. 5% YTD on the back of strong data growth of 11. 7% from increased information subscribers and utilization. EBITDA increased by 5. 3% that was moderated by increased direct cost. Meanwhile, PATAMI increased simply by 14. 2% because of one-off investment impairment of financial services in the past financial calendar year.

Digital Businesses

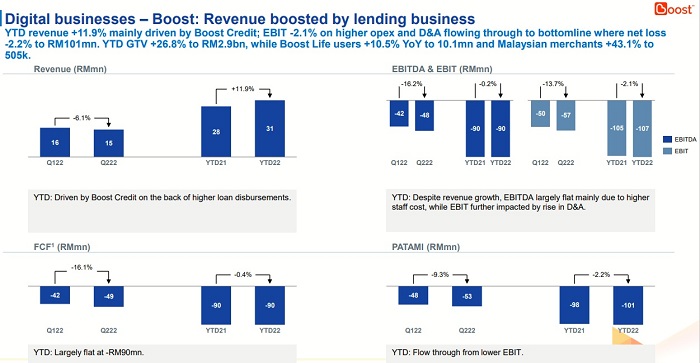

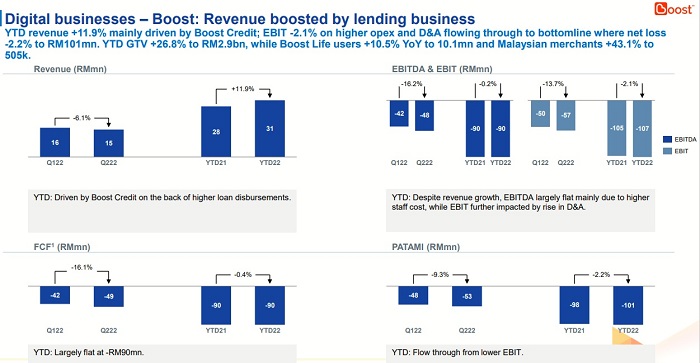

Boost’s revenue increased simply by 11. 9% YTD mainly attributed to Boost Credit. EBIT and PATAMI narrowed simply by 2 . 1% plus 2 . 2% respectively. Despite this, operational metrics continued to be strong, as YTD gross transactional value grew simply by 26. 8% to RM2. 9 billion, while Boost Life users grew simply by 10. 5% year-on-year and Malaysian retailer touchpoints grew by 43. 1% in order to 505, 000.

ADA10 suffered its revenue enlargement with a 14. 9% growth YTD, primarily driven by Consumer Engagement, and eCommerce solutions which was bolstered by the acquisitions of Awake Asia in 2021 and SingPost’s eCommerce unit in May 2022. EBITDA plus PATAMI slid simply by 4. 8% and 17. 6% correspondingly due to higher opex and taxes.

Infrastructure

edotco’s revenue rose by 23. 7% YTD benefitting from the inorganic acquisition of Touch Mindscape in Malaysia and organic contribution, particularly in Bangladesh. Inorganic growth along with natural B2S rollout and colocation were similarly reflected in YTD EBITDA growth of 32. 5% plus YTD EBIT development of 37. 4%. PATAMI slid marginally by 7. 8%, mainly caused by unrealised forex translation reduction, higher net financing cost and taxes expense from Cukai Makmur.

If excluding forex trading impact, PATAMI increased by 35. 6% YTD.

Overview of the 1H22 by the Board plus Executives

Chairman Shahril said, “For the first half of 2022, the Board is prompted by the continued discipline and perseverance of the operating companies within executing the Group’s plans. I am very happy to report that Axiata’s future-proofing efforts take track, including the Celcom-Digi merger, completion of Hyperlink Net acquisition and expansion of edotco’s tower portfolio. The particular Board has also been operating closely with the leadership team to get around the current environment in order to anchor the Group’s businesses against macroeconomic uncertainties and market developments. ”

“On 5G in Malaysia, we are closer to having a common alignment between the different stakeholders in the spirit of developing a sustainable ecosystem. Axiata looks forward to finalising access and industrial details with Electronic Nasional Bhd therefore consumers and businesses will benefit from next generation solutions as the country accelerates digitally. ”

“Axiata’s ESG commitments recorded further traction using the formalisation of its Board Sustainability Committee within April 2022 to strengthen and supervise ESG matters within the Group. Axiata’s Diversity, Equity and Inclusion (DEI) Framework covering four areas of Gender, Abilities, Generations and Ethnicities, was also released during the quarter, ” Shahril added.

Meanwhile Axiatas joint acting CEO Vivek Sood stated, “With COVID-19 affects clearly behind us, a majority of our working companies have shipped solid operational leads to the first half of 2022, mostly outperforming within their markets. With the improved operational performance, we are likely to exceed the particular headline KPIs for that year both in conditions of revenue not including device as well as EBIT growth. ”

“Forex influence and macro headwinds especially in Sri Lanka, Bangladesh and Nepal experienced adversely impacted Group earnings. To come the tide, our immediate focus is going to be directed towards integrating new acquisitions, controlling USD liquidity plus inflation especially in frontier markets and easing out the balance sheet stretch. ”

Joint Acting CEO Dr Hans Wijayasuriya added, “In the medium-term, we have been cognisant of dangers such as increased energy costs, global chip supply shortages plus higher interest rates. We have been also keeping an in depth watch on the influence of M& The transactions specifically the particular timing of completion, impact to gross debt/EBITDA and shipping of synergies. ”

“Moving forward, we are assured of the learnings that may be applied group wide from Project Resilience – a Collective Brain initiative becoming piloted to stable Dialog against extreme headwinds and macroeconomic pressures. ”

Aiming to strongly adopt technology and analytics to enhance item, network and the service experience, Dr Hans stressed that ultimately, the goal is to enhance resilience and drive long-term value creation group-wide in order to benefit the customers and communities Axiata is a regional digital champion.